Market outlook 20 05-10

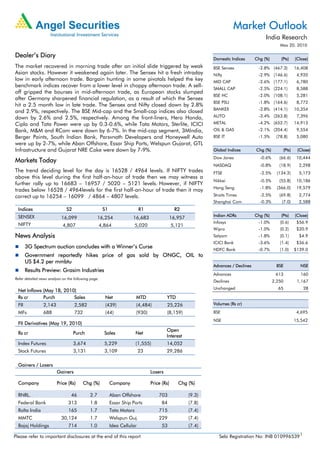

- 1. Market Outlook India Research May 20, 2010 Dealer’s Diary Domestic Indices Chg (%) (Pts) (Close) The market recovered in morning trade after an initial slide triggered by weak BSE Sensex -2.8% (467.3) 16,408 Asian stocks. However it weakened again later. The Sensex hit a fresh intraday Nifty -2.9% (146.6) 4,920 low in early afternoon trade. Bargain hunting in some pivotals helped the key MID CAP -2.6% (177.1) 6,780 benchmark indices recover from a lower level in choppy afternoon trade. A sell- SMALL CAP -2.5% (224.1) 8,588 off gripped the bourses in mid-afternoon trade, as European stocks slumped BSE HC -2.0% (108.1) 5,281 after Germany sharpened financial regulation, as a result of which the Sensex BSE PSU -1.8% (164.6) 8,772 hit a 2.5 month low in late trade. The Sensex and Nifty closed down by 2.8% BANKEX -3.8% (414.1) 10,354 and 2.9%, respectively. The BSE Mid-cap and the Small-cap indices also closed down by 2.6% and 2.5%, respectively. Among the front-liners, Hero Honda, AUTO -3.4% (263.8) 7,396 Cipla and Tata Power were up by 0.3-0.6%, while Tata Motors, Sterlite, ICICI METAL -4.2% (652.7) 14,913 Bank, M&M and RCom were down by 6-7%. In the mid-cap segment, 3MIndia, OIL & GAS -2.1% (204.4) 9,554 Berger Paints, South Indian Bank, Parsvnath Developers and Honeywell Auto BSE IT -1.5% (78.8) 5,080 were up by 2-7%, while Aban Offshore, Essar Ship Ports, Welspun Gujarat, GTL Infrastructure and Gujarat NRE Coke were down by 7-9%. Global Indices Chg (%) (Pts) (Close) Dow Jones -0.6% (66.6) 10,444 Markets Today NASDAQ -0.8% (18.9) 2,298 The trend deciding level for the day is 16528 / 4964 levels. If NIFTY trades FTSE -2.5% (134.2) 5,173 above this level during the first half-an-hour of trade then we may witness a Nikkei -0.5% (55.8) 10,186 further rally up to 16683 – 16957 / 5020 – 5121 levels. However, if NIFTY Hang Seng -1.8% (366.0) 19,579 trades below 16528 / 4964levels for the first half-an-hour of trade then it may correct up to 16254 – 16099 / 4864 – 4807 levels. Straits Times -2.5% (69.8) 2,774 Shanghai Com -0.3% (7.0) 2,588 Indices S2 S1 R1 R2 SENSEX Indian ADRs Chg (%) (Pts) (Close) 16,099 16,254 16,683 16,957 Infosys -1.0% (0.6) $56.9 NIFTY 4,807 4,864 5,020 5,121 Wipro -1.0% (0.2) $20.9 News Analysis Satyam -1.8% (0.1) $4.9 ICICI Bank -3.6% (1.4) $36.6 3G Spectrum auction concludes with a Winner’s Curse HDFC Bank -0.7% (1.0) $139.0 Government reportedly hikes price of gas sold by ONGC, OIL to US $4.2 per mmbtu Advances / Declines BSE NSE Results Preview: Grasim Industries Advances 613 160 Refer detailed news analysis on the following page. Declines 2,250 1,167 Unchanged 65 28 Net Inflows (May 18, 2010) Rs cr Purch Sales Net MTD YTD FII 2,143 2,582 (439) (4,484) 25,226 Volumes (Rs cr) MFs 688 732 (44) (930) (8,159) BSE 4,695 NSE 15,542 FII Derivatives (May 19, 2010) Open Rs cr Purch Sales Net Interest Index Futures 3,674 5,229 (1,555) 14,052 Stock Futures 3,131 3,109 23 29,286 Gainers / Losers Gainers Losers Company Price (Rs) Chg (%) Company Price (Rs) Chg (%) RNRL. 46 2.7 Aban Offshore 703 (9.3) Federal Bank 313 1.8 Essar Ship Ports 84 (7.8) Rolta India 165 1.7 Tata Motors 715 (7.4) MMTC 30,124 1.7 Welspun Guj. 229 (7.4) Bajaj Holdings 714 1.0 Idea Cellular 53 (7.4) Please refer to important disclosures at the end of this report Sebi Registration No: INB 0109965391

- 2. Market Outlook | India Research 3G Spectrum auction concludes with a Winner’s Curse The 3G Spectrum auctions concluded on Day 34, raising about Rs70,000cr for the Government, two times the budgeted estimate. Among the major bidders, Bharti won 13 circles (outlay of Rs12,295cr), RCOM won 13 circles (outlay of Rs8,585cr), Idea won 12 circles (outlay of Rs5,972cr), Tata Tele won 9 circles (outlay of Rs5,864cr), Vodafone won 9 circles (outlay of Rs11,618cr) and Aircel won 12 circles (Outlay of Rs6,296cr). The successful bidders would be allocated the airwaves by the end of September 2010, after the spectrum is vacated by the Defense Department. The operators would have to pay the amount in the next 15 days. Bharti Airtel won 13 circles, including the two key circles of Mumbai and Delhi, with an estimated outlay of Rs12,295cr. The company would see increased capex for the year as compared to its guidance of Rs8,000cr, and would be able to amortize the same over the next 20 years. The 13 circles where it won account for 63% of its total subscriber base; thus, this would support a large part of its potential future opportunities. RCom strategically added 13 circles, with an outlay of Rs8,585cr, despite its GSM operations having sufficient spare capacity; thus, this would meet its requirement for the next couple of years. Idea won 12 circles, shelling out Rs5,972cr, covering about 72% of its existing subscriber zone, and adding incremental spectrum in its large covered base. We believe that the aggressive bidding would lead to increased capex spends, straining the leverage position of the companies in the coming period. However, we believe that Bharti, Idea and RCom have managed to corner crucial and scarce spectrum in their required respective circles. Government reportedly hikes price of gas sold by ONGC, OIL to US $4.2 per mmbtu According to news reports, the government has more than doubled the price of natural gas produced by state-owned ONGC and Oil India Ltd. (OIL) to US $4.20/mmbtu, at par with the rate at which RIL sells its gas. The Cabinet approved an oil ministry proposal to raise the rate of gas sold to power and fertilizer firms, from US $1.79/mmbtu to US $4.20/mmbtu (i.e. Rs6,818 per thousand cubic meters). APM gas price were last revised in 2005 to Rs3,200 per thousand cubic meters (US $1.79/mmbtu). ONGC and OIL will get US $3.82/mmbtu price for the gas they produce from fields given to them on nomination basis and after adding 10% royalty, the fuel will cost US $4.20/mmbtu for consumers. On top of the US $4.20/mmbtu, GAIL India would be allowed to charge 11.2 cents/mmbtu as a marketing margin (thus, GAIL will benefit as it was earlier not allowed to charge marketing margin on APM gas). Above this would be taxes, pipeline transportation charges and other levies. While the move will help state-run firm’s break-even in the gas business, it would result in a hike in electricity generation tariffs and fertiliser production costs. ONGC in FY2009 had lost Rs4,745cr in revenues on selling 17.71bcm of gas at the government’s fixed rate. We expect ONGC’s EPS to rise by Rs16/share for FY2012E on account of the proposed move. On account of the same, we upgrade ONGC from Neutral to Buy with a Target price of Rs1,233/share. GAIL is also likely to gain on account of the same, as its EPS is likely to rise by around Rs1.9/share for FY2012E. Given the implied P/E multiple of 16.6x to our target price, there could be a further upside of Rs32/share to our current target price of Rs553/share. May 20, 2010 2

- 3. Market Outlook | India Research Grasim Industries - 4QFY2010 Result Preview Grasim Industries (Grasim) is slated to announce its 4QFY2010 results today. We expect the company’s consolidated net sales to decline by 1% yoy to Rs4,908cr due to de-growth in the Top-line of cement division. However, we expect the VSF business to post a 31.6% yoy growth in its Top-line during 4QFY2010 to Rs1,020cr. The company’s OPM’s are set to improve by 458bp yoy to 29.2%, primarily on account of better operating performance from the VSF business. We expect the net profit to grow by 28.6% yoy to Rs731cr. We maintain an Accumulate on the stock, with a Target Price of Rs2,861. Economic and Political News India's imports jump 43.3% in April 24 foreign investment proposals worth Rs1,412cr approved India may slap taxes, quotas to limit iron ore exports Corporate News Bombay Dyeing sells Mumbai property to Axis Bank Ranbaxy recalls some batches of 3 drugs in Europe Reliance April crude imports up 42% Tata Power challenges Maharashtra Govt. directive Source: Economic Times, Business Standard, Business Line, Financial Express, Mint Events for the day Grasim Industries Dividend, Results Jet Air India Results Shree Cement Dividend, Results Wockhardt Results May 20, 2010 3

- 4. Market Outlook | India Research Research Team Tel: 022-4040 3800 E-mail: research@angeltrade.com Website: www.angeltrade.com DISCLAIMER This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment decision. Nothing in this document should be construed as investment or financial advice. Each recipient of this document should make such investigations as they deem necessary to arrive at an independent evaluation of an investment in the securities of the companies referred to in this document (including the merits and risks involved), and should consult their own advisors to determine the merits and risks of such an investment. Angel Securities Limited, its affiliates, directors, its proprietary trading and investment businesses may, from time to time, make investment decisions that are inconsistent with or contradictory to the recommendations expressed herein. The views contained in this document are those of the analyst, and the company may or may not subscribe to all the views expressed within. Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and trading volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's fundamentals. The information in this document has been printed on the basis of publicly available information, internal data and other reliable sources believed to be true, and is for general guidance only. Angel Securities Limited has not independently verified all the information contained within this document. Accordingly, we cannot testify, nor make any representation or warranty, express or implied, to the accuracy, contents or data contained within this document. While Angel Securities Limited endeavours to update on a reasonable basis the information discussed in this material, there may be regulatory, compliance, or other reasons that prevent us from doing so. This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced, redistributed or passed on, directly or indirectly. Angel Securities Limited and its affiliates may seek to provide or have engaged in providing corporate finance, investment banking or other advisory services in a merger or specific transaction to the companies referred to in this report, as on the date of this report or in the past. Neither Angel Securities Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may arise from or in connection with the use of this information. Note: Please refer to the important `Stock Holding Disclosure' report on the Angel website (Research Section). Address: Acme Plaza, ‘A’ Wing, 3rd Floor, M.V. Road, Opp. Sangam Cinema, Andheri (E), Mumbai - 400 059. Tel : (022) 3952 4568 / 4040 3800 Angel Broking Ltd: BSE Sebi Regn No : INB 010996539 / CDSL Regn No: IN - DP - CDSL - 234 - 2004 / PMS Regn Code: PM/INP000001546 Angel Securities Ltd:BSE: INB010994639/INF010994639 NSE: INB230994635/INF230994635 Membership numbers: BSE 028/NSE:09946 Angel Capital & Debt Market Ltd: INB 231279838 / NSE FNO: INF 231279838 / NSE Member code -12798 Angel Commodities Broking (P) Ltd: MCX Member ID: 12685 / FMC Regn No: MCX / TCM / CORP / 0037 NCDEX : Member ID 00220 / FMC Regn No: NCDEX / TCM / CORP / 0302 May 20, 2010 4