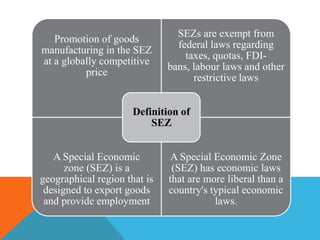

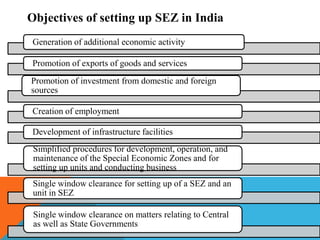

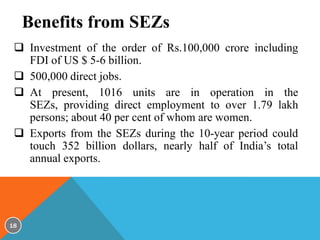

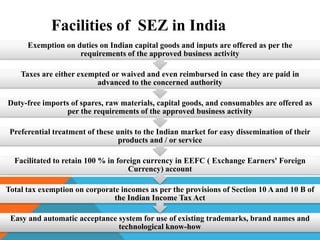

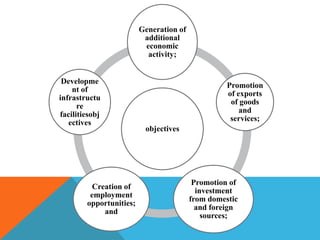

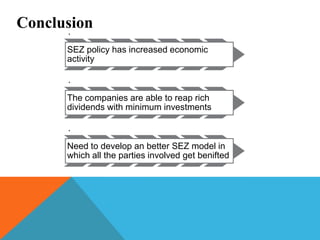

Special Economic Zones (SEZs) are geographic regions that have economic laws more liberal than typical economic laws. SEZs aim to generate economic activity and promote exports by providing tax exemptions, single window clearances, and other incentives.

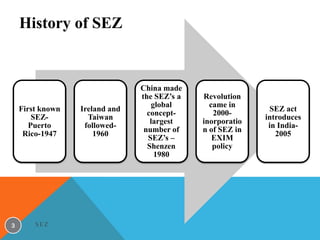

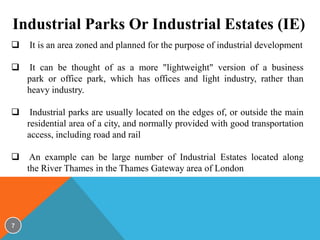

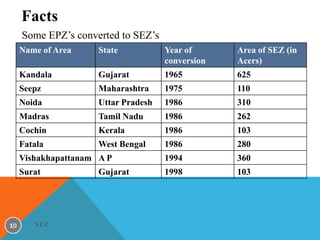

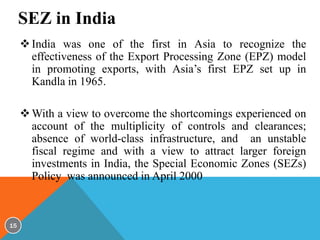

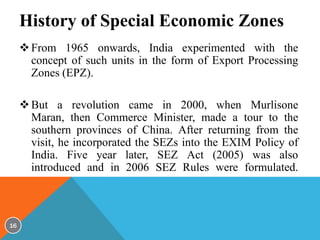

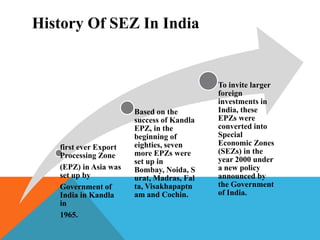

The document discusses the history and categories of SEZs. It notes that the concept originated with Puerto Rico in 1947 and was later adopted by countries like Ireland, Taiwan, and notably China, which established large numbers of SEZs. The main categories of SEZs include free trade zones, free zones, industrial parks, free economic zones, and urban enterprise zones.

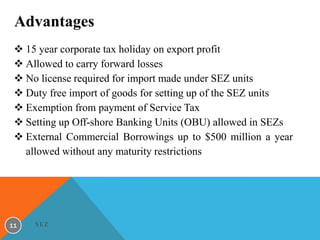

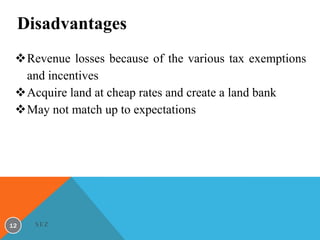

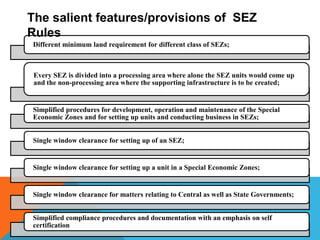

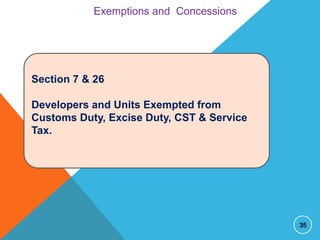

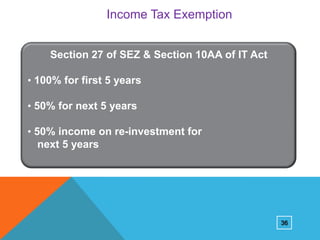

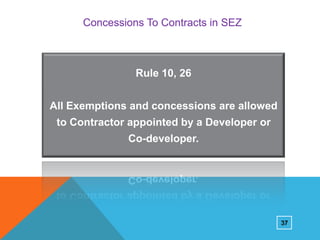

The key advantages of SEZs in India include tax holidays, duty exemptions, simplified procedures