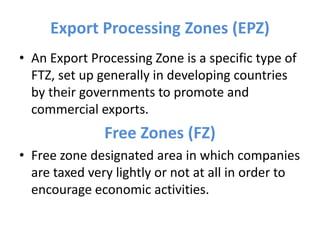

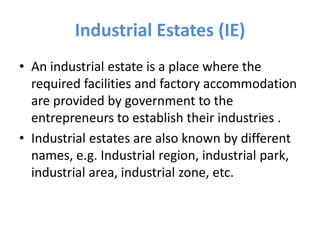

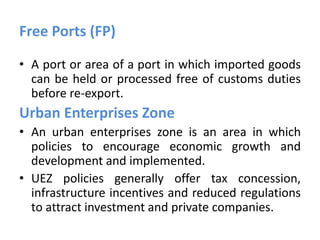

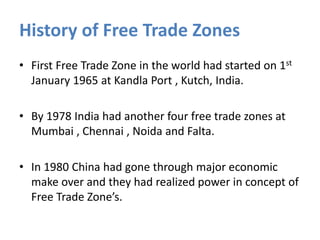

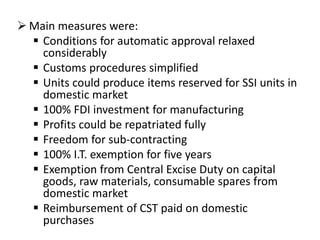

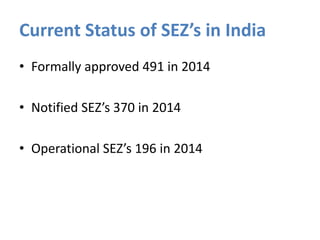

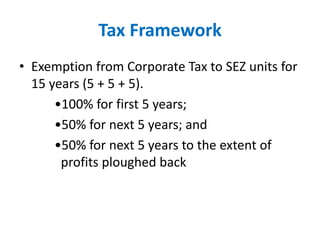

Special Economic Zones (SEZs) are designated areas within countries that have special economic regulations to encourage business activity. SEZs offer tax reliefs and opportunities for lower taxation. India's first SEZ was established in 1965 and the 2000 policy expanded incentives for private sector SEZs. SEZs are intended to promote economic growth, attract foreign investment, and increase exports and GDP. While SEZs create jobs, they have also been criticized for displacing farmers and reducing long-term tax revenue through corporate tax holidays. As of 2014, India had 491 approved SEZs, with 196 operational zones accounting for 38% of the country's exports.