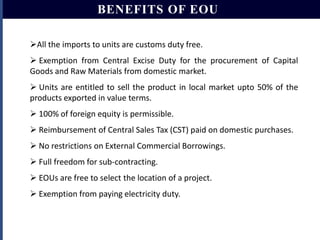

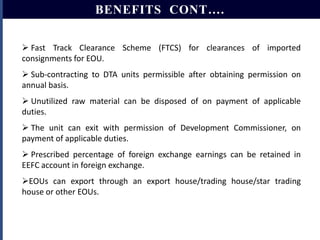

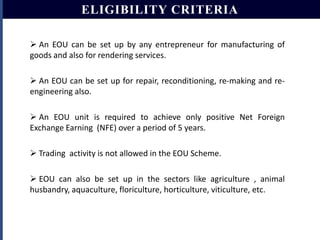

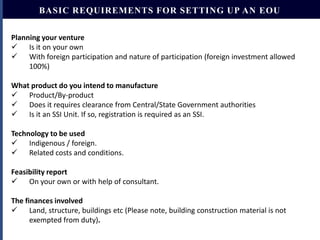

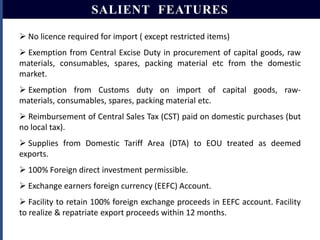

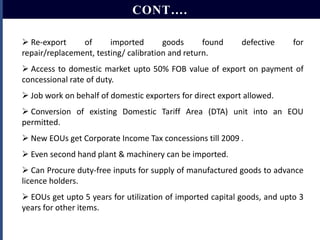

This document provides an overview of Export Oriented Units (EOUs) in India. EOUs were established to boost exports by enabling additional production capacity with minimum value addition. Their key objectives are to transfer latest technologies and stimulate direct foreign investment. EOUs are required to achieve a positive net foreign exchange over 5 years and maintain input/output norms. In return, EOUs receive benefits like duty-free imports, excise and sales tax exemptions, ability to sell in the local market, and 100% foreign ownership. Major sectors for EOUs include food processing and coffee.