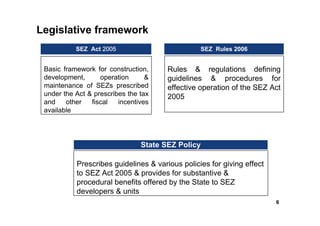

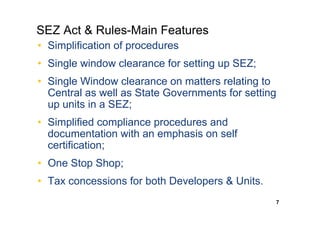

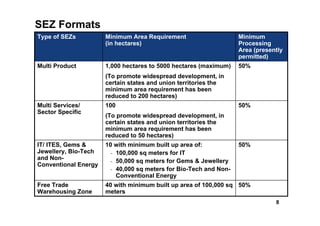

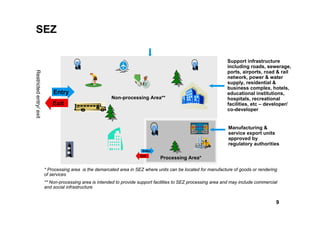

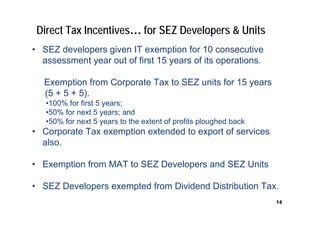

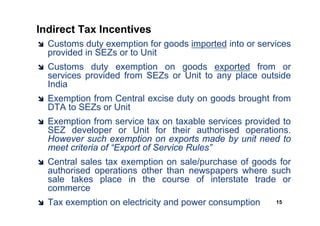

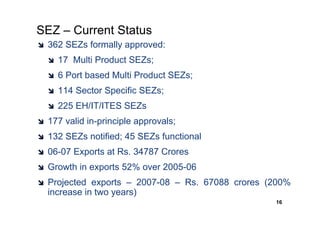

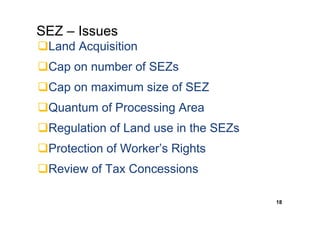

1) SEZs are intended to generate jobs and exports by providing world-class infrastructure and tax incentives. 2) The SEZ Act of 2005 and Rules of 2006 provide the legislative framework for SEZ development. SEZs have various formats depending on size and type. 3) SEZs offer direct tax exemptions for developers and units, as well as indirect tax exemptions on imports/exports. 4) While SEZs have led to increased investment and exports, issues around land acquisition and regulation remain.

![SEZ ground realities

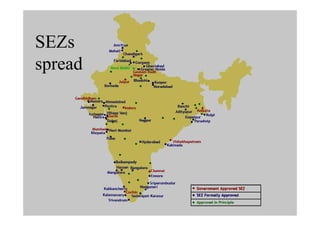

Total Land Area 2973190 sq km

Agricultural area 54.5% 1620388 sq km

Non Agricultural area 1352802 sq km

SEZs formally approved (362) 487 sq km

In-principal approvals (177) 1571 sq km

[Area for SEZs so far notified amounts to

only 177 sq km]

Total Area proposed for SEZ 2058 sq km

As % of total land area 0.069%

As % of Agri land 0.13%

Chinese SEZs

Xiamen : 131 sq. km

Shenzen : 327 sq. km

Hainan : 34000 sq. km

19](https://image.slidesharecdn.com/sez-100405094938-phpapp01/85/Special-Economic-Zone-19-320.jpg)