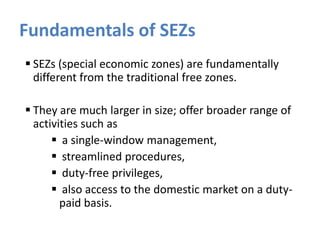

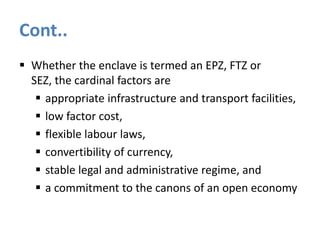

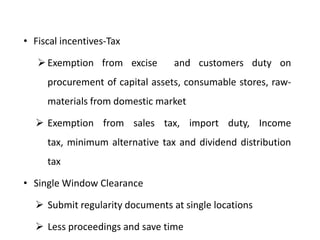

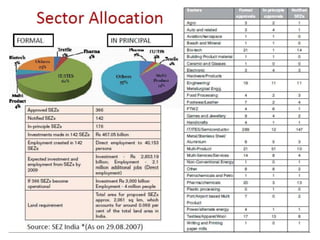

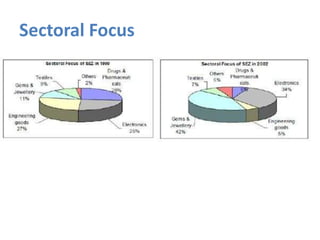

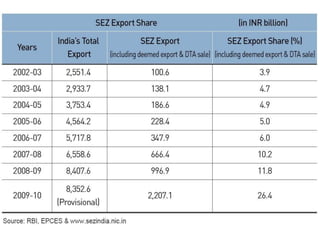

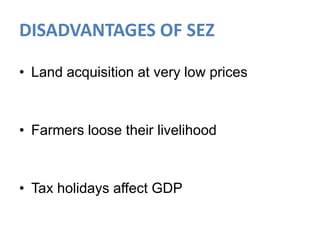

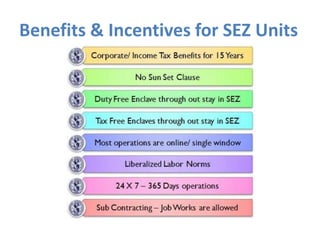

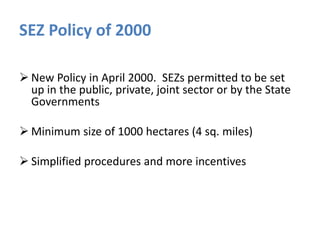

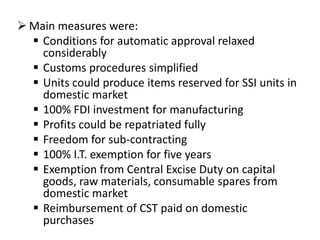

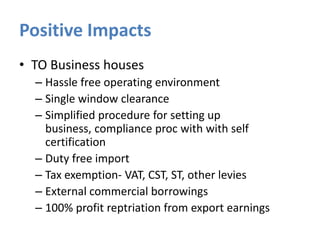

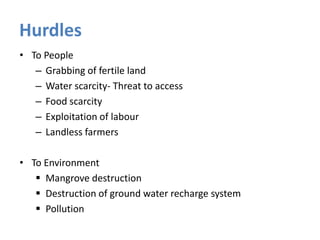

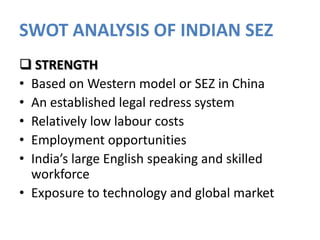

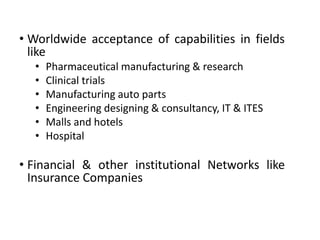

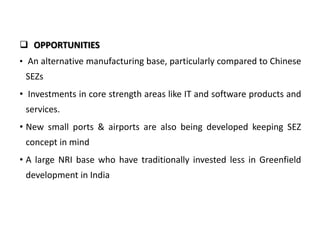

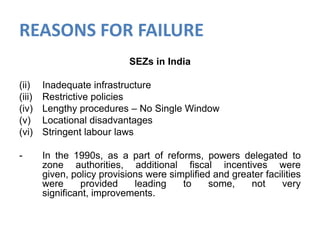

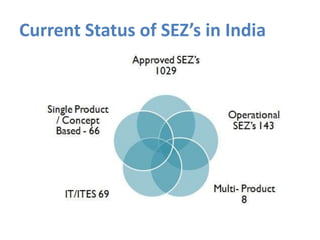

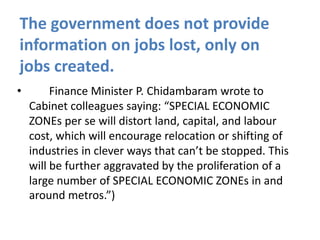

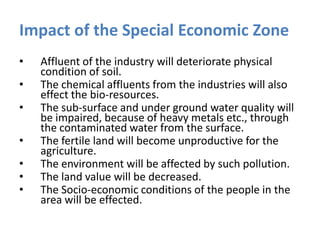

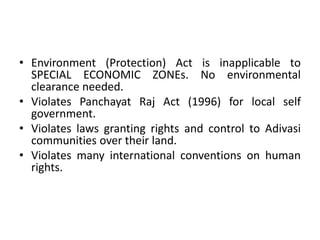

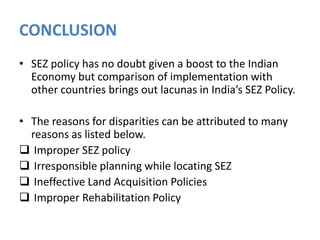

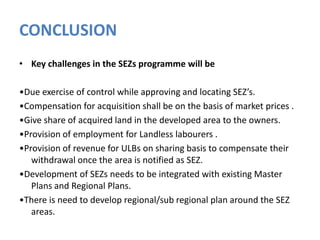

Special economic zones (SEZs) are specifically delineated duty-free enclaves meant to be foreign territories for trade operations. SEZs aim to generate economic activity, promote exports and investment, and create jobs. They offer tax exemptions and simplified compliance procedures. However, SEZs have also faced criticism for distorting land and labor markets and displacing people. While SEZs have contributed to India's exports and FDI, their implementation has faced challenges around planning, land acquisition policies, and inadequate infrastructure and support. Overall, SEZs can boost the economy but India must ensure proper control, compensation for land, and employment opportunities to maximize benefits and minimize disadvantages.