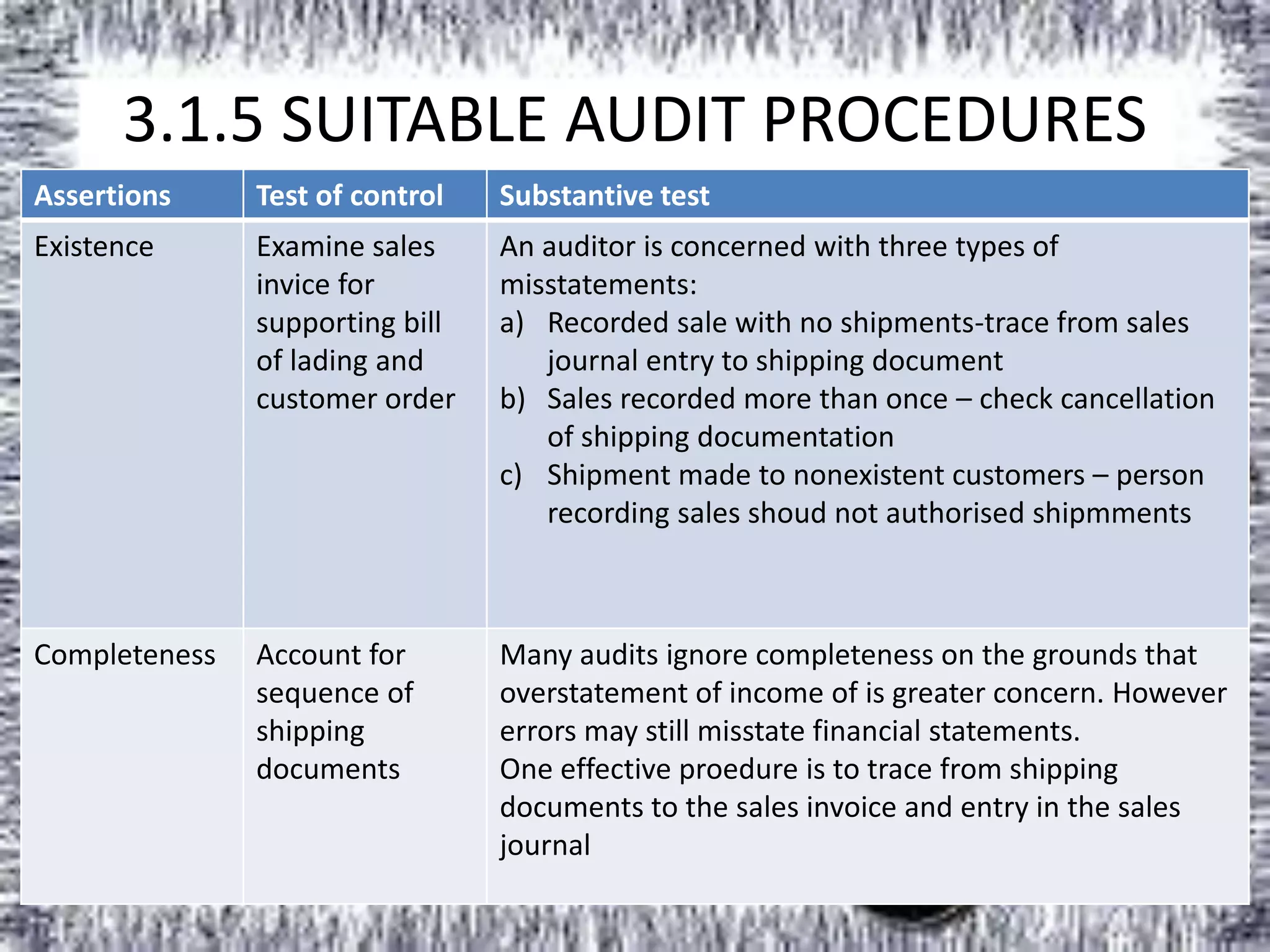

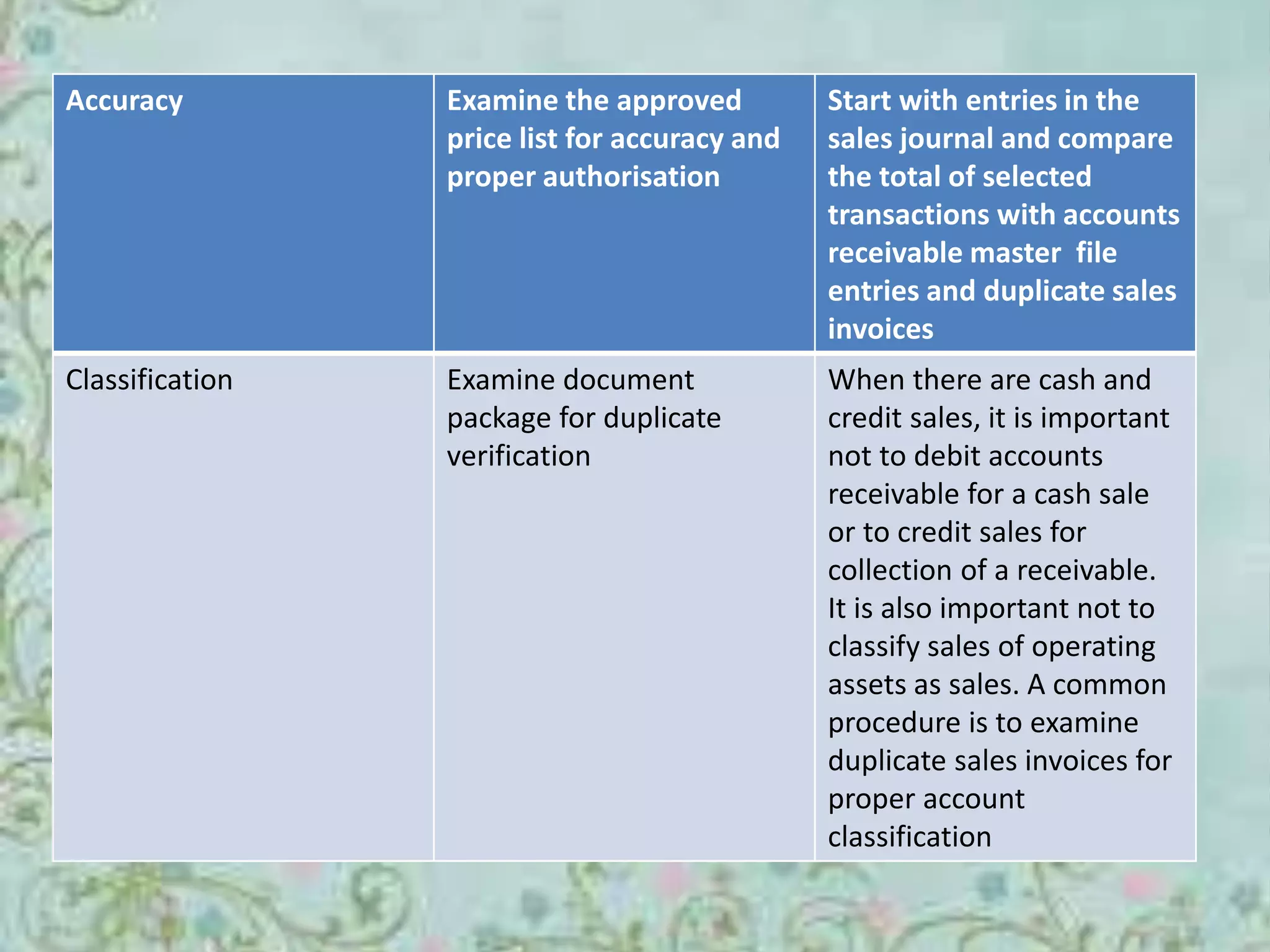

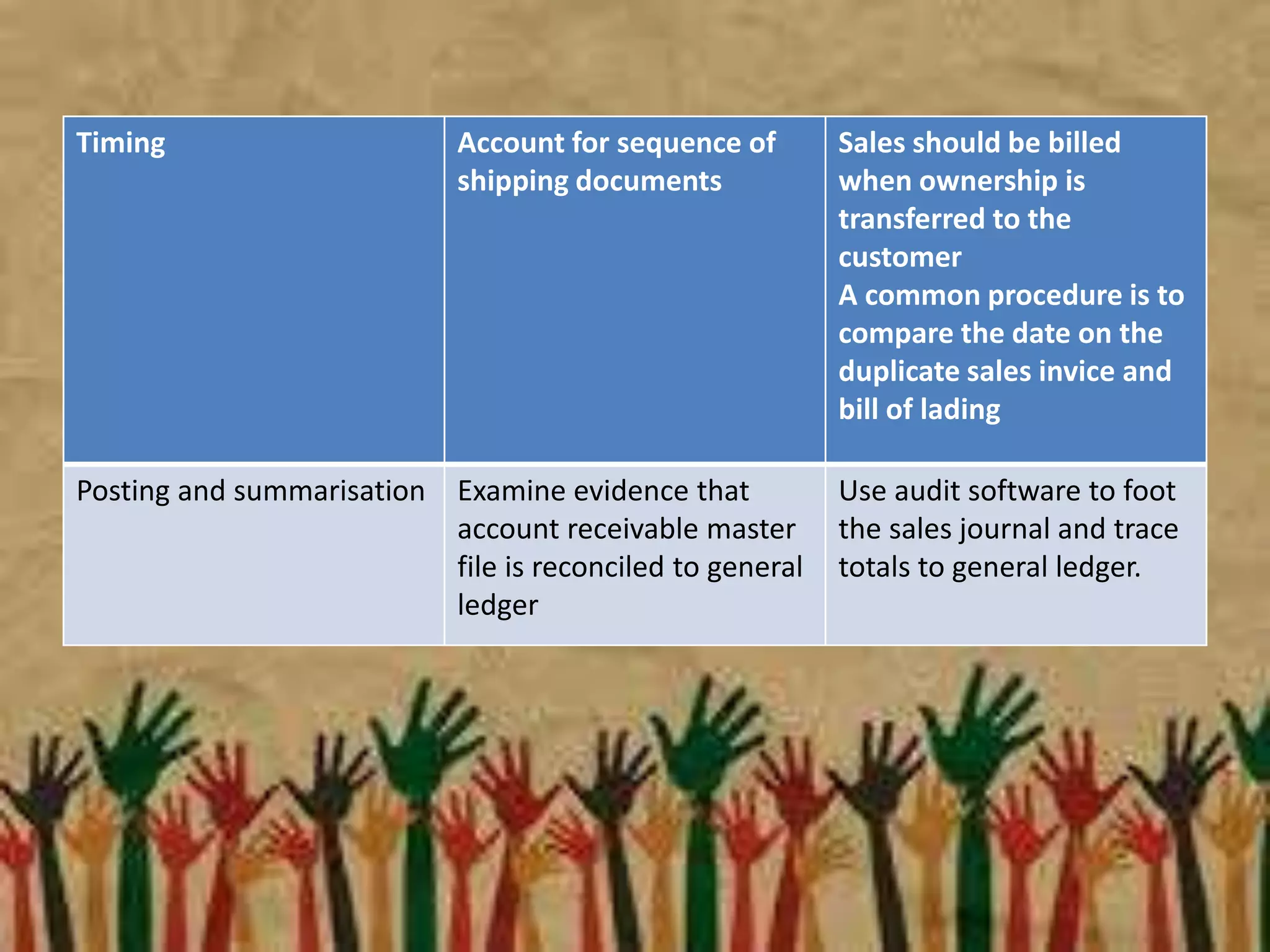

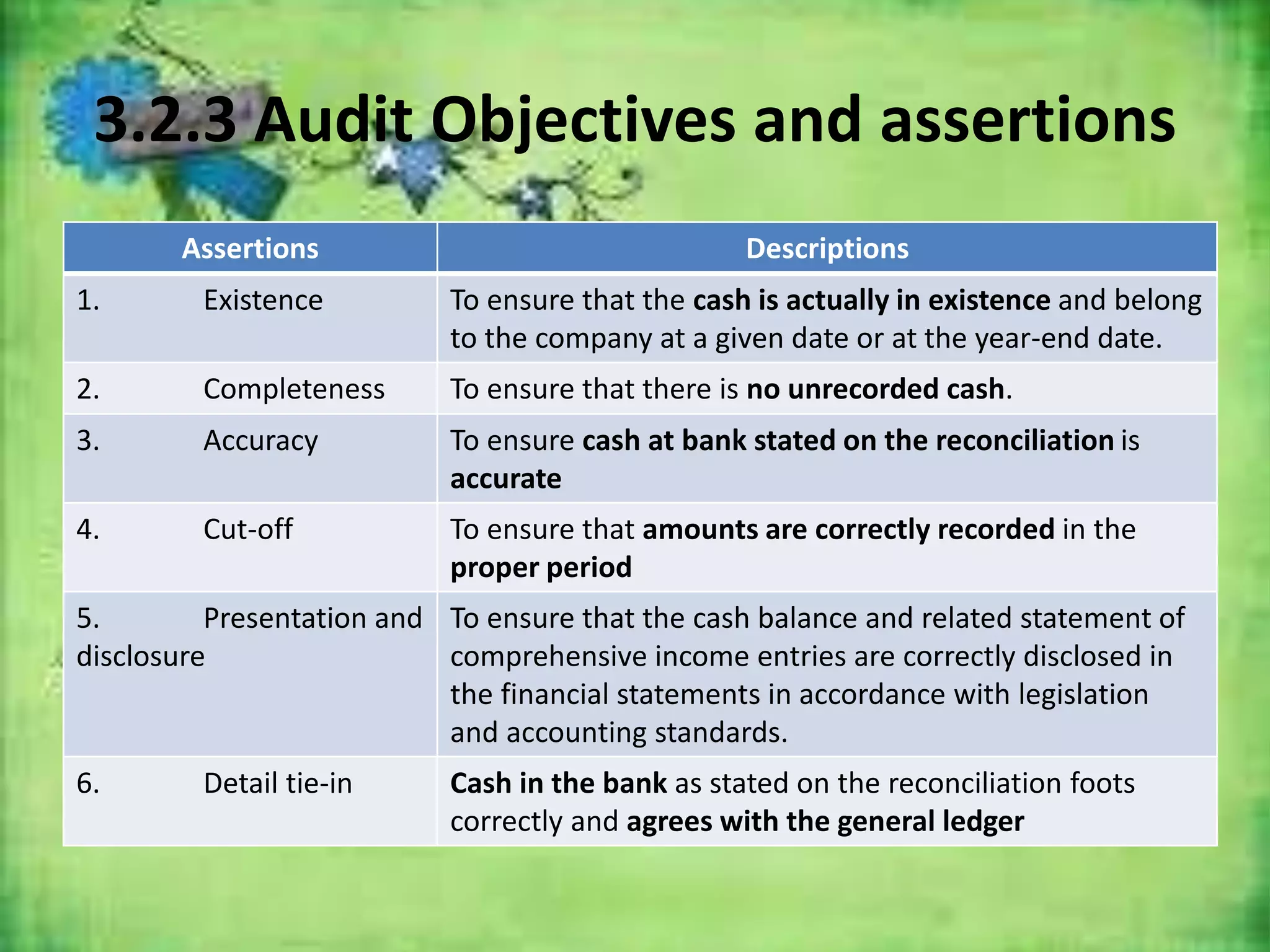

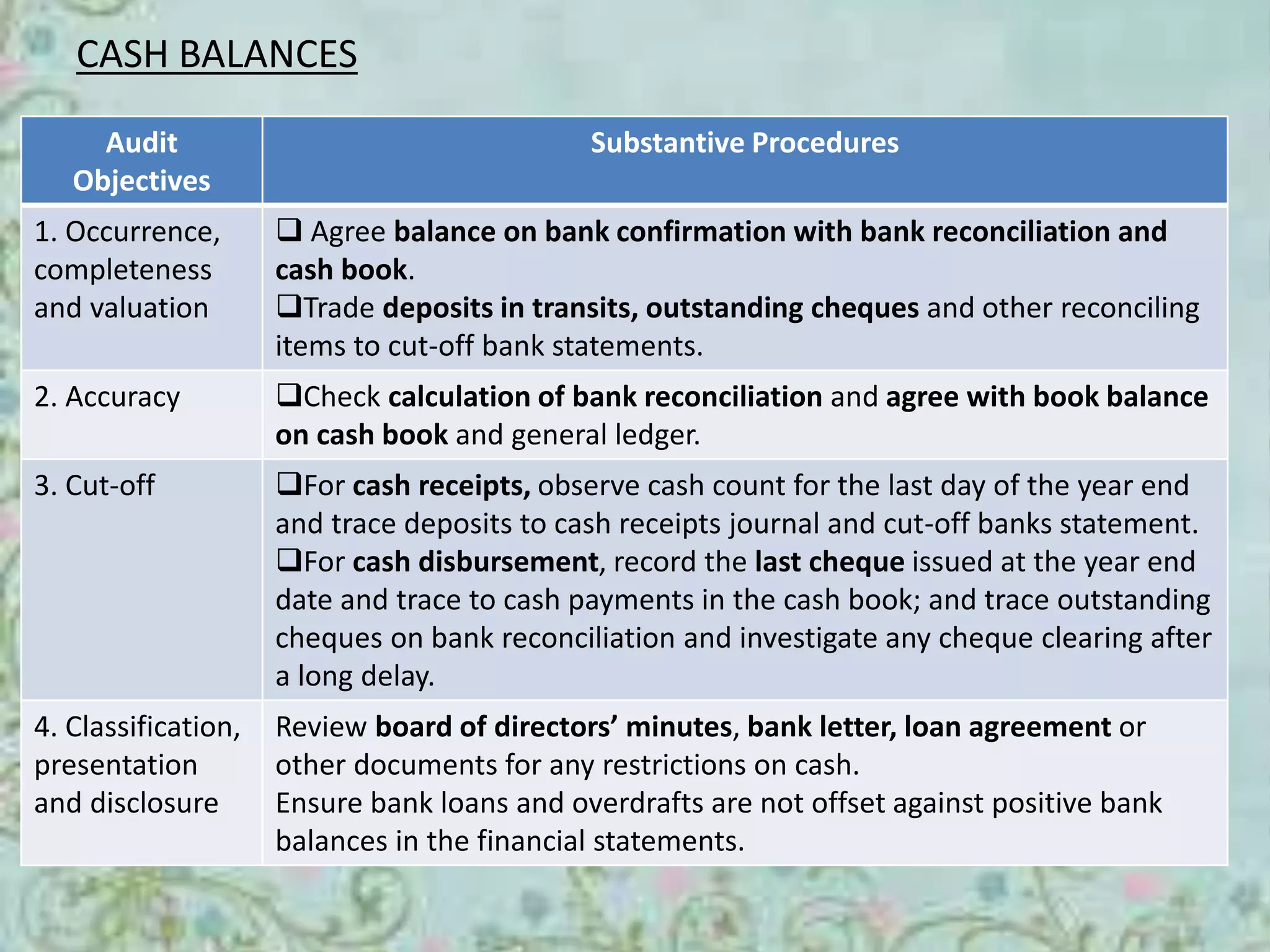

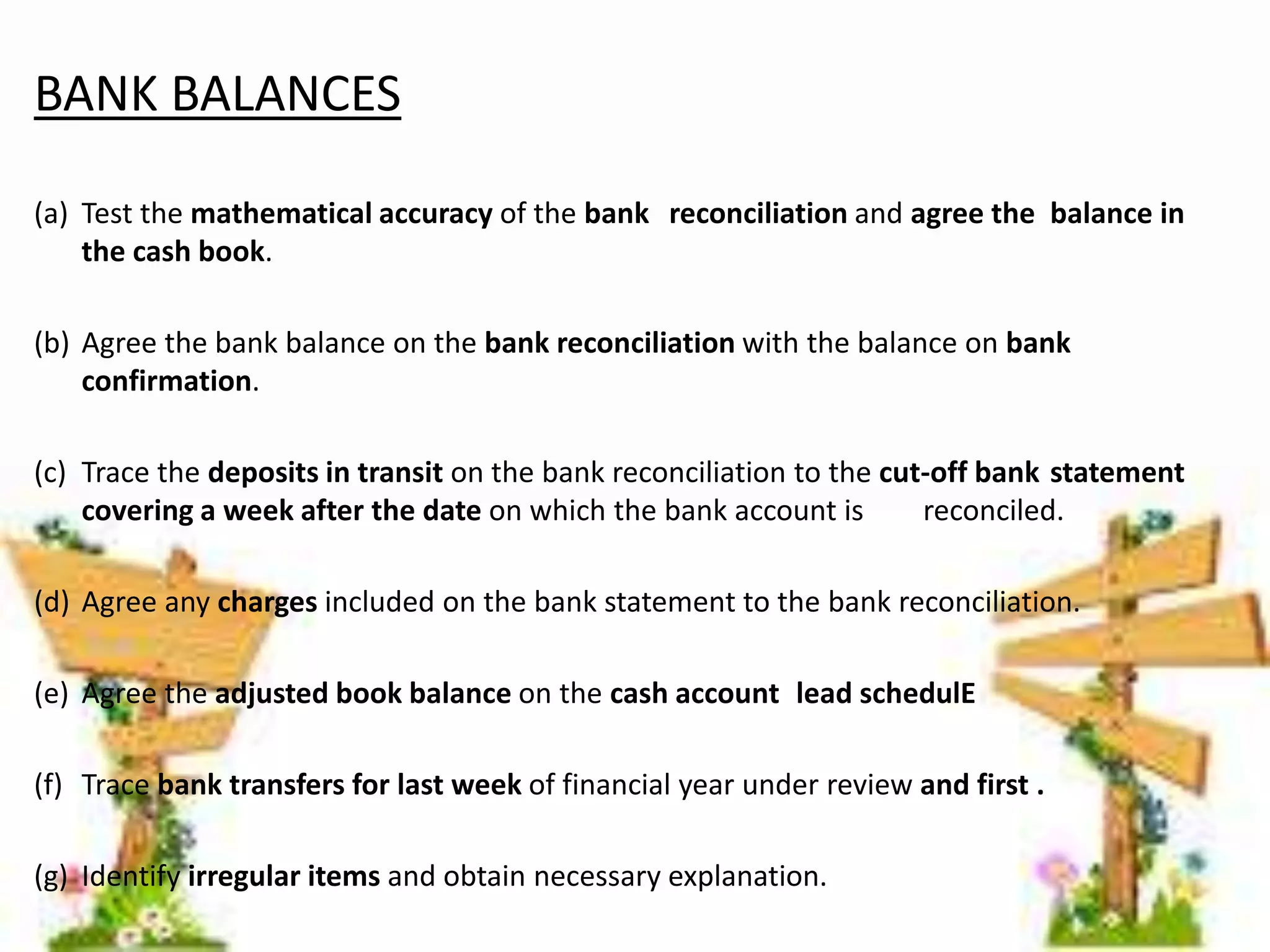

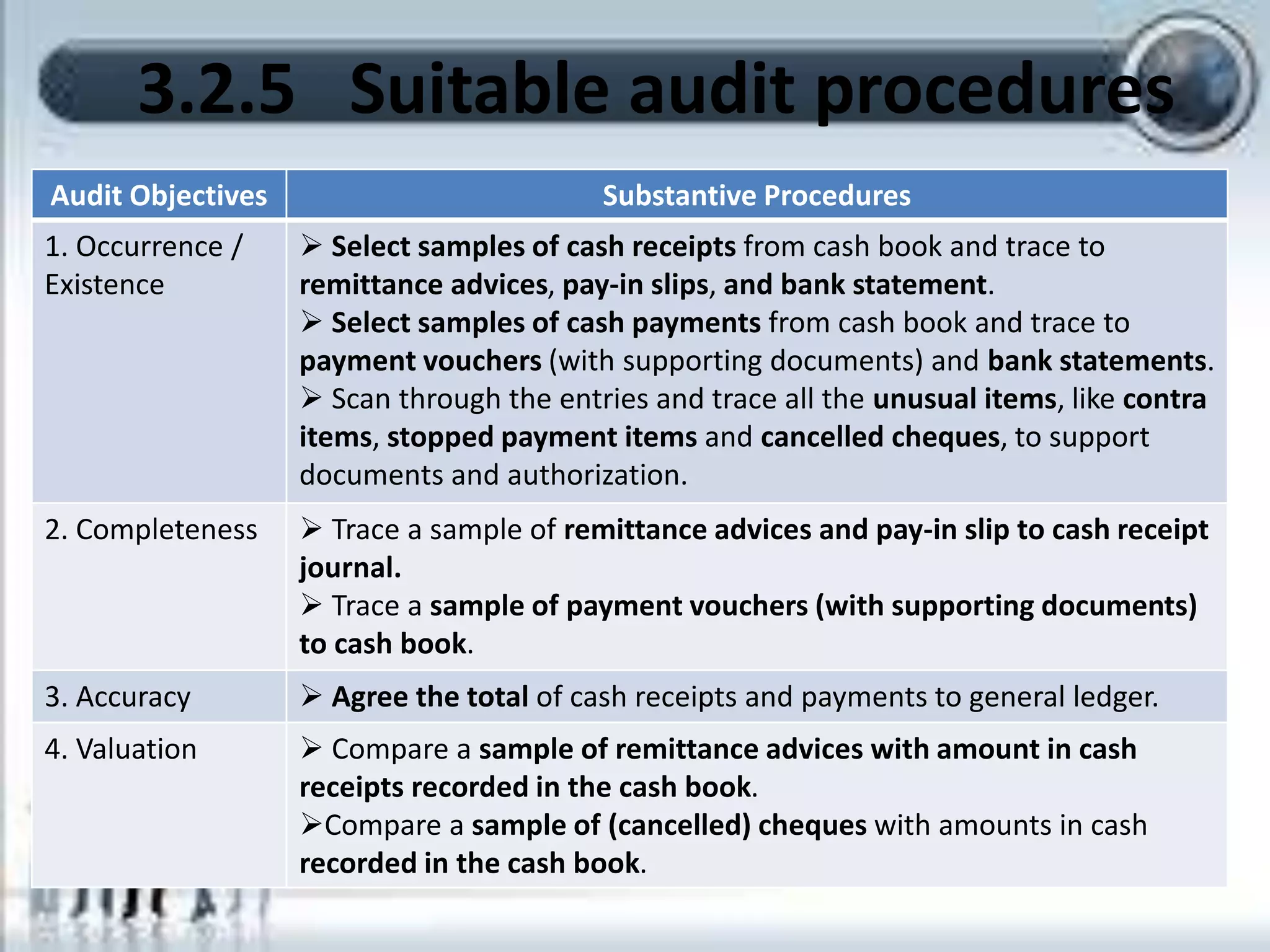

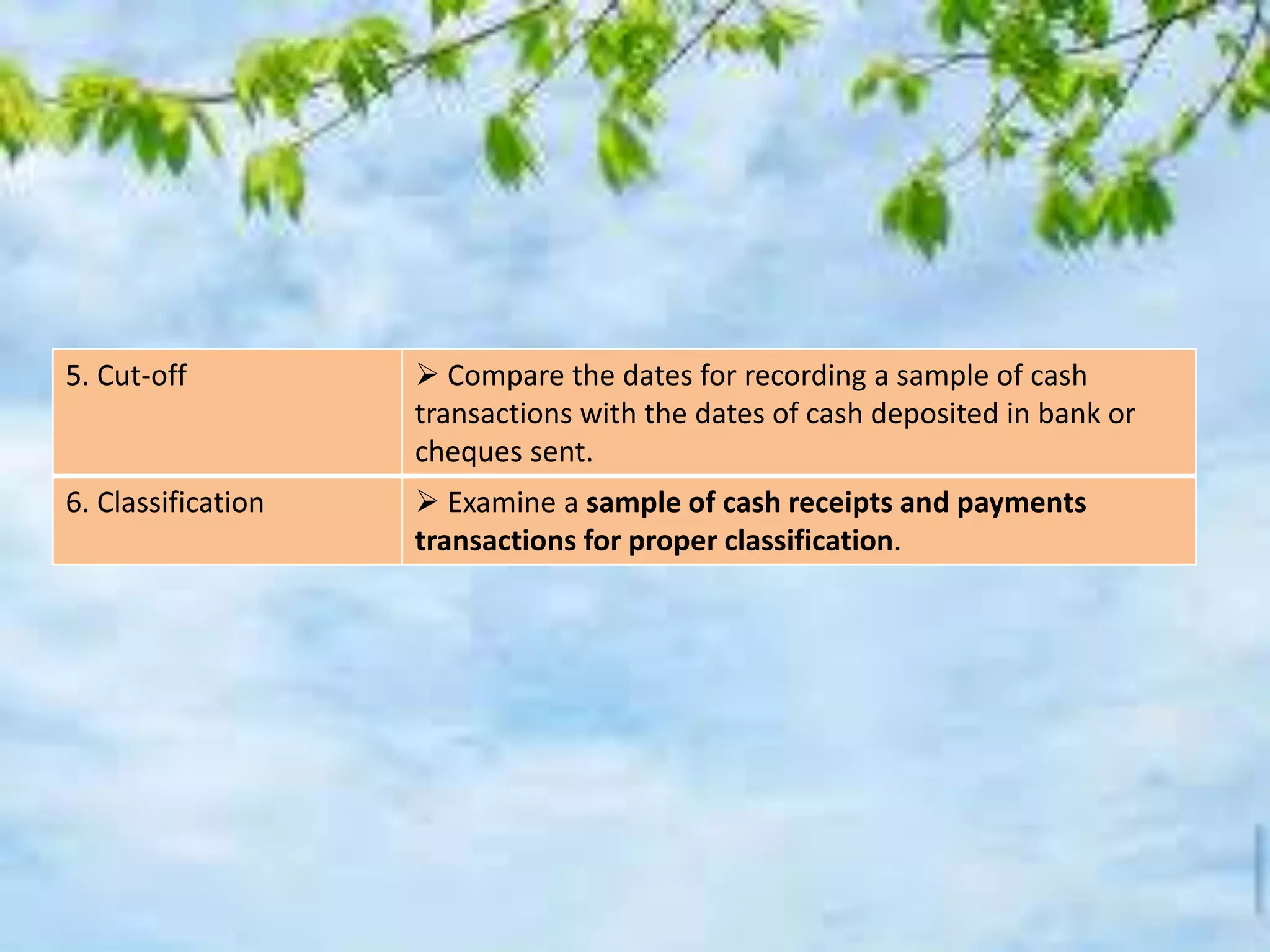

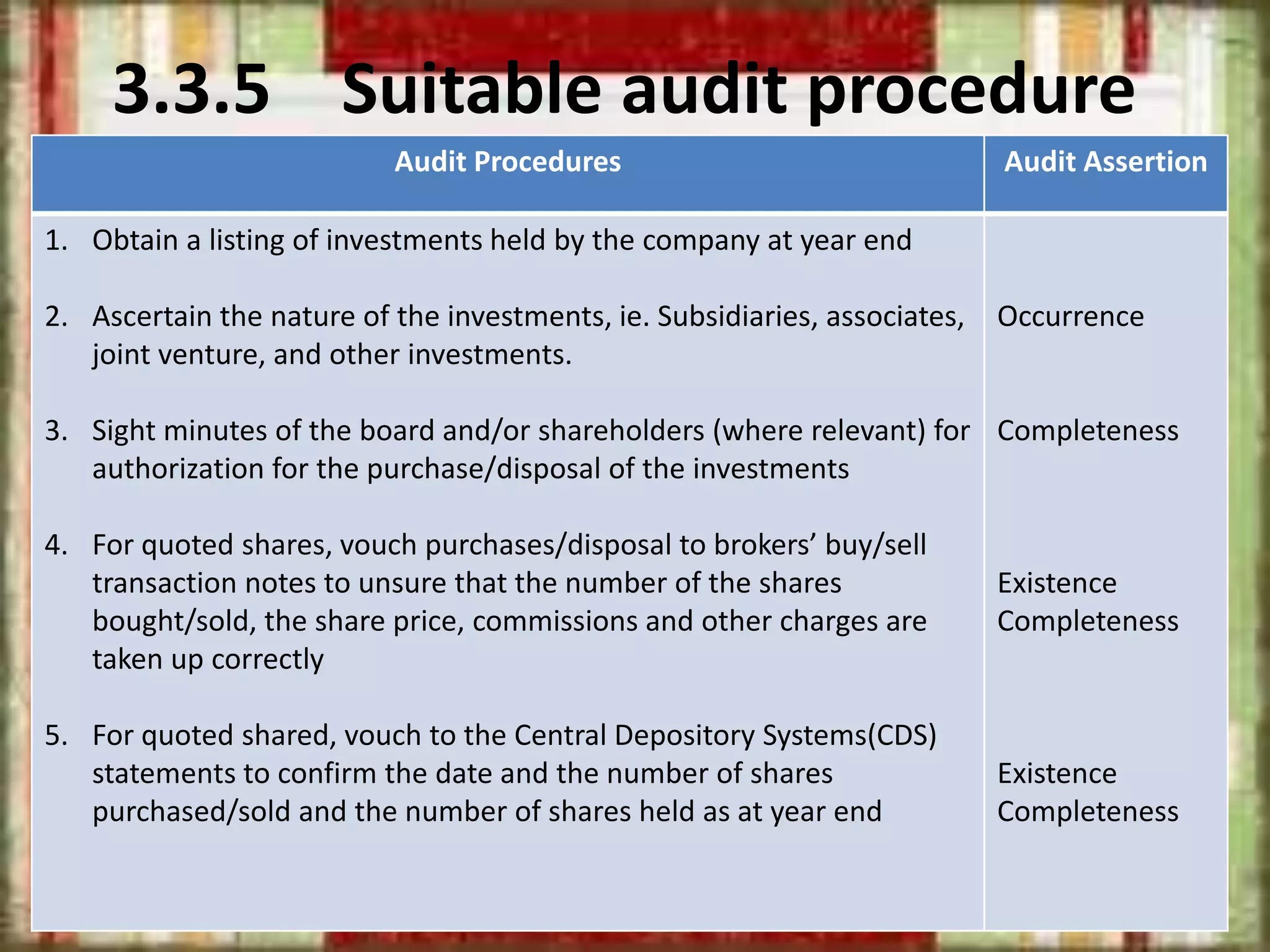

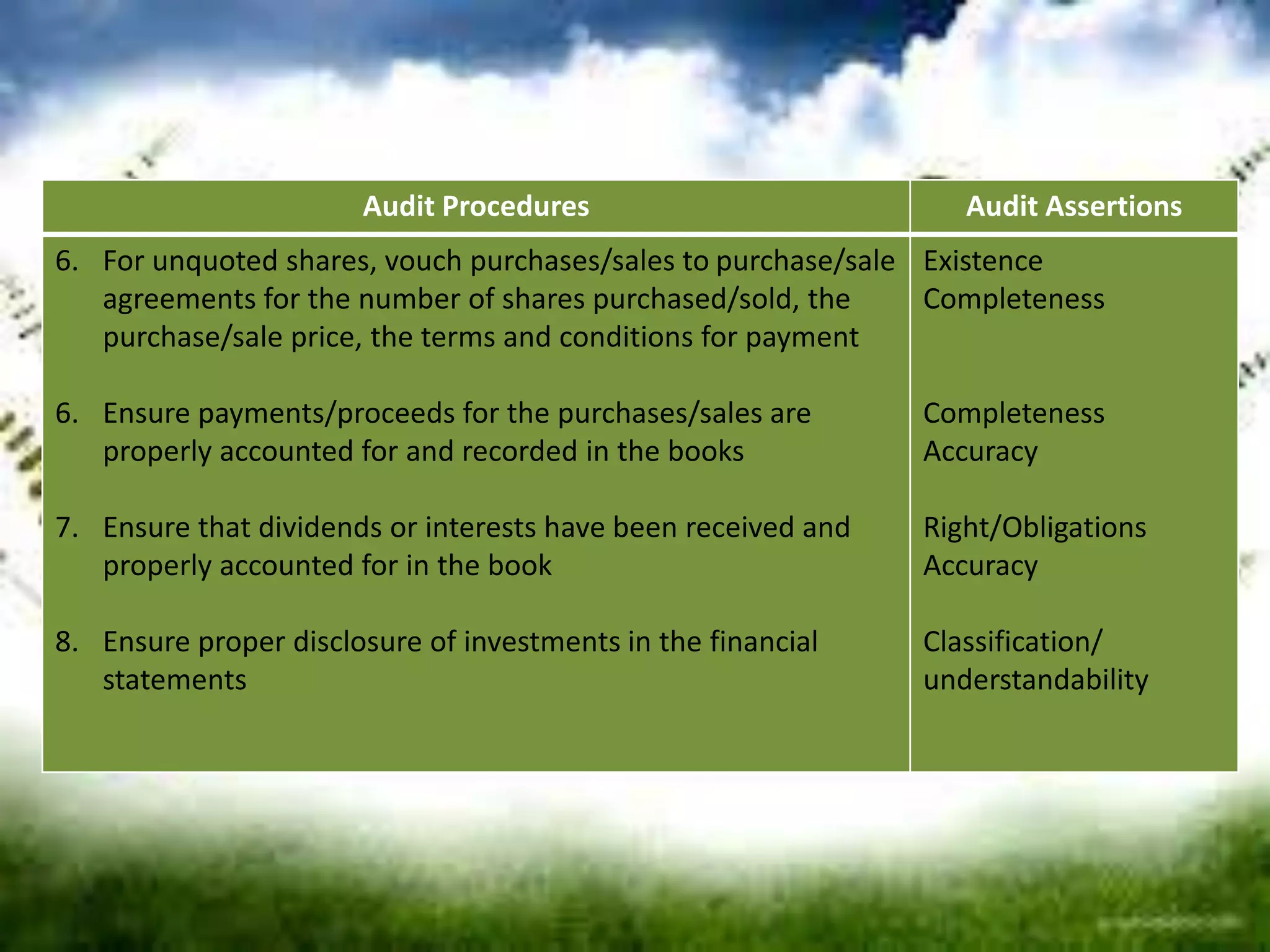

This document discusses auditing procedures for investments, cash and bank balances, and revenue and expenditures. It provides the purpose, evidence, suitable audit objectives and assertions, and audit procedures for each area. For investments, the objectives are to ensure proper authorization, recording, valuation and disclosure of investments. Suitable procedures include verifying purchase and sale documentation, payments, dividends received, and financial statement disclosure. For cash and bank balances, the objectives are around existence, completeness, accuracy, cut-off and classification. Recommended procedures include bank confirmation, reconciliation checks, and sampling transactions. The revenue and expenditures section outlines audit tests around authorization, completeness, accuracy and other assertions through examining documentation and tracing samples.