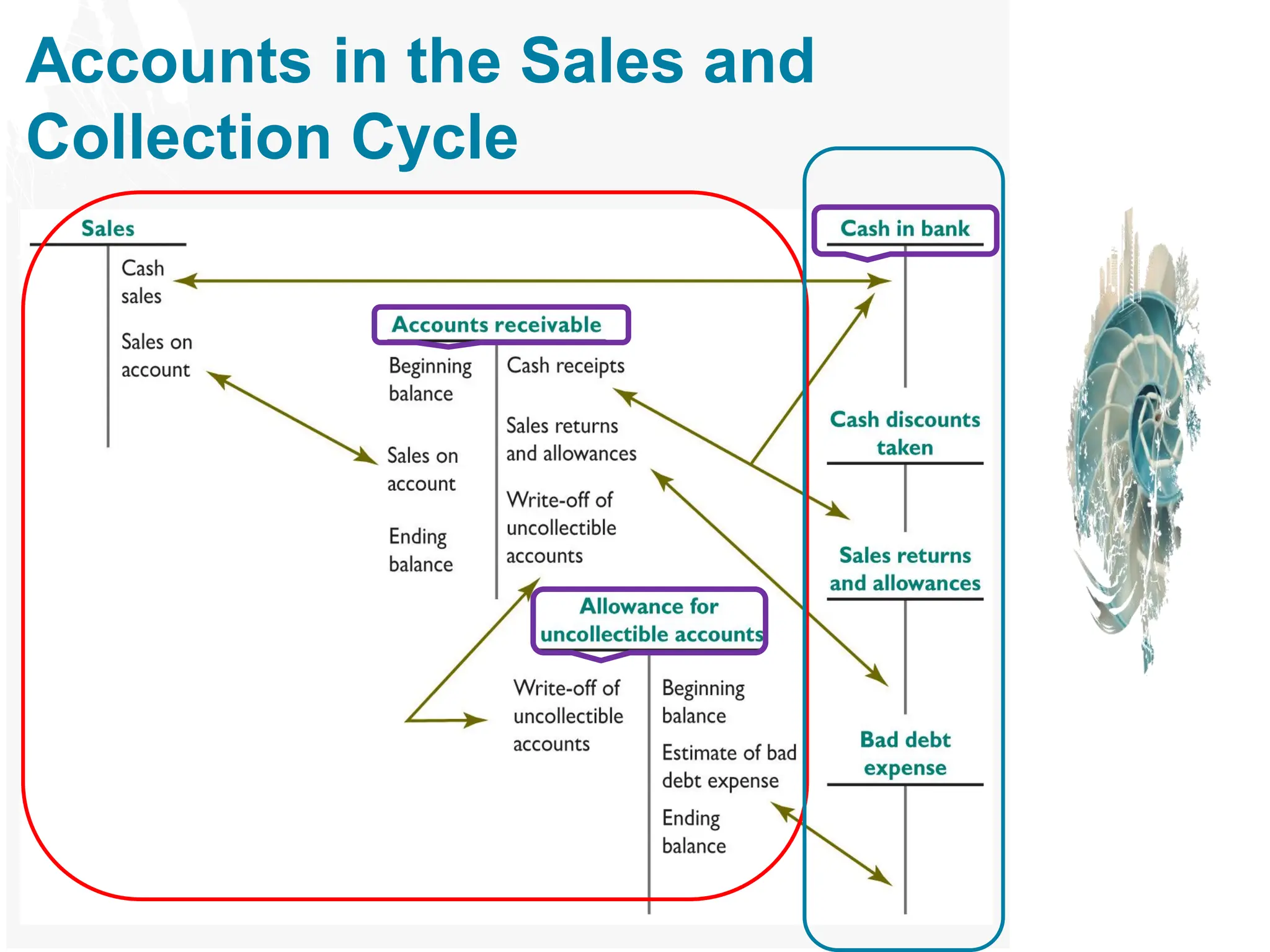

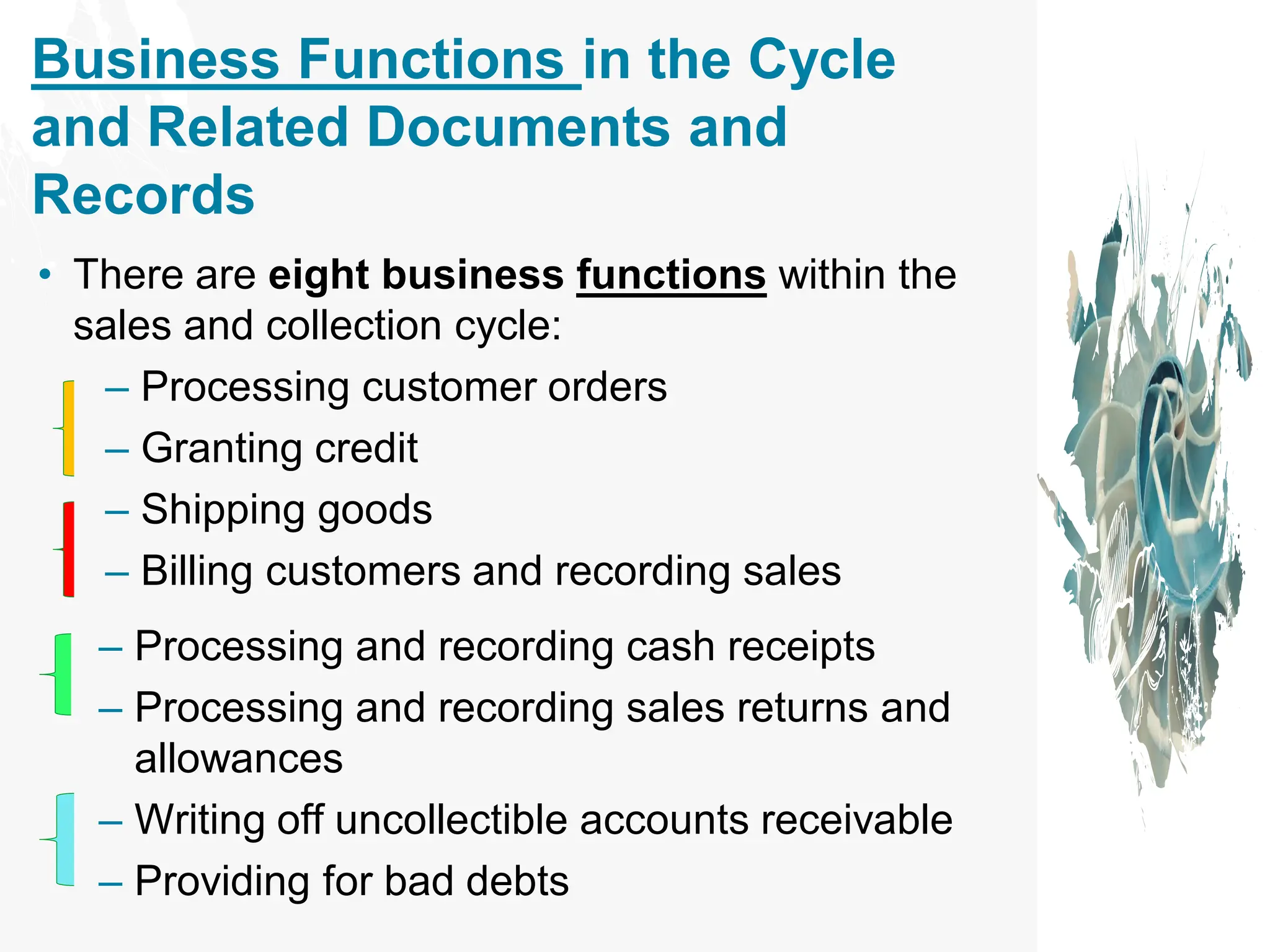

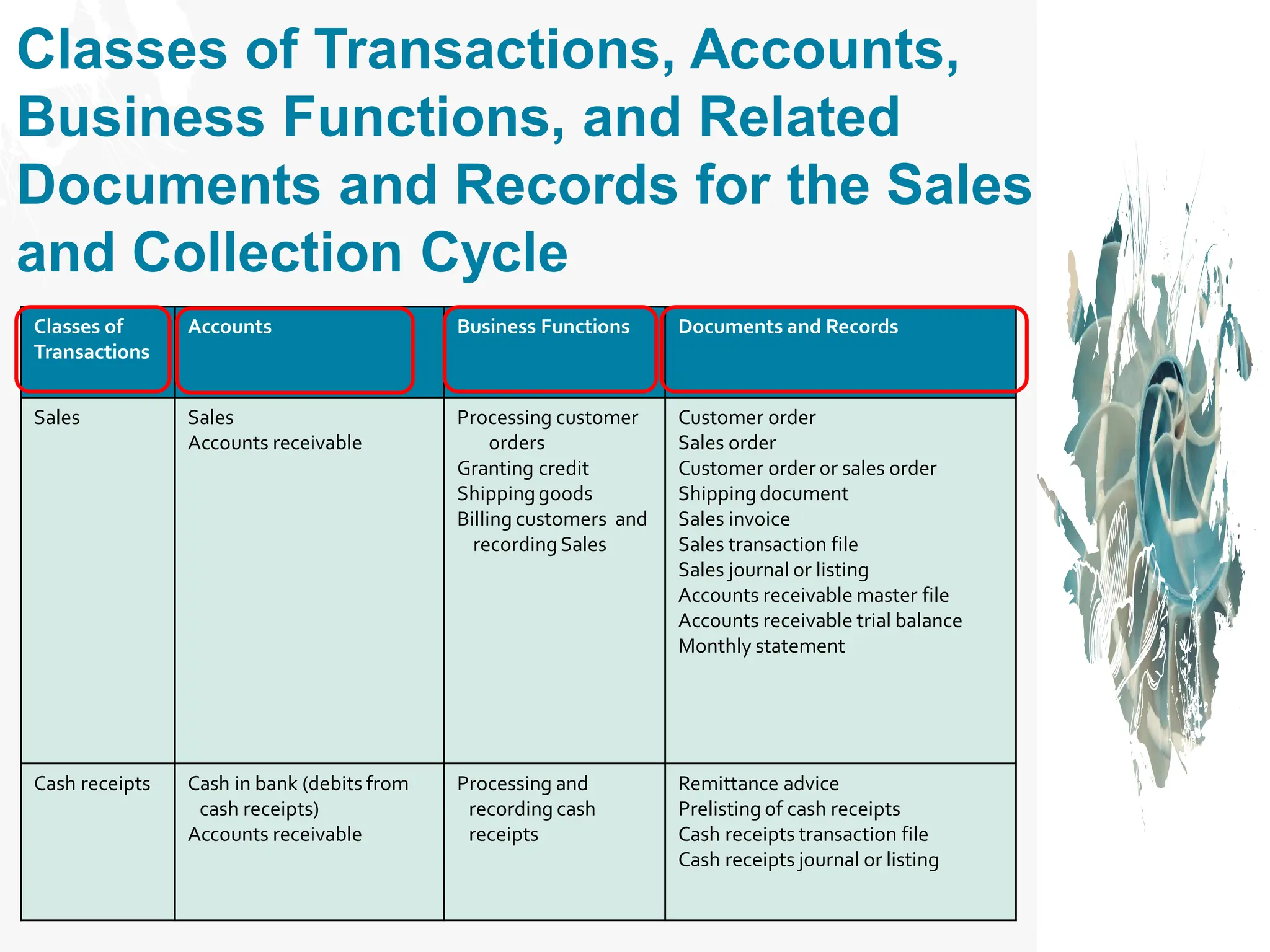

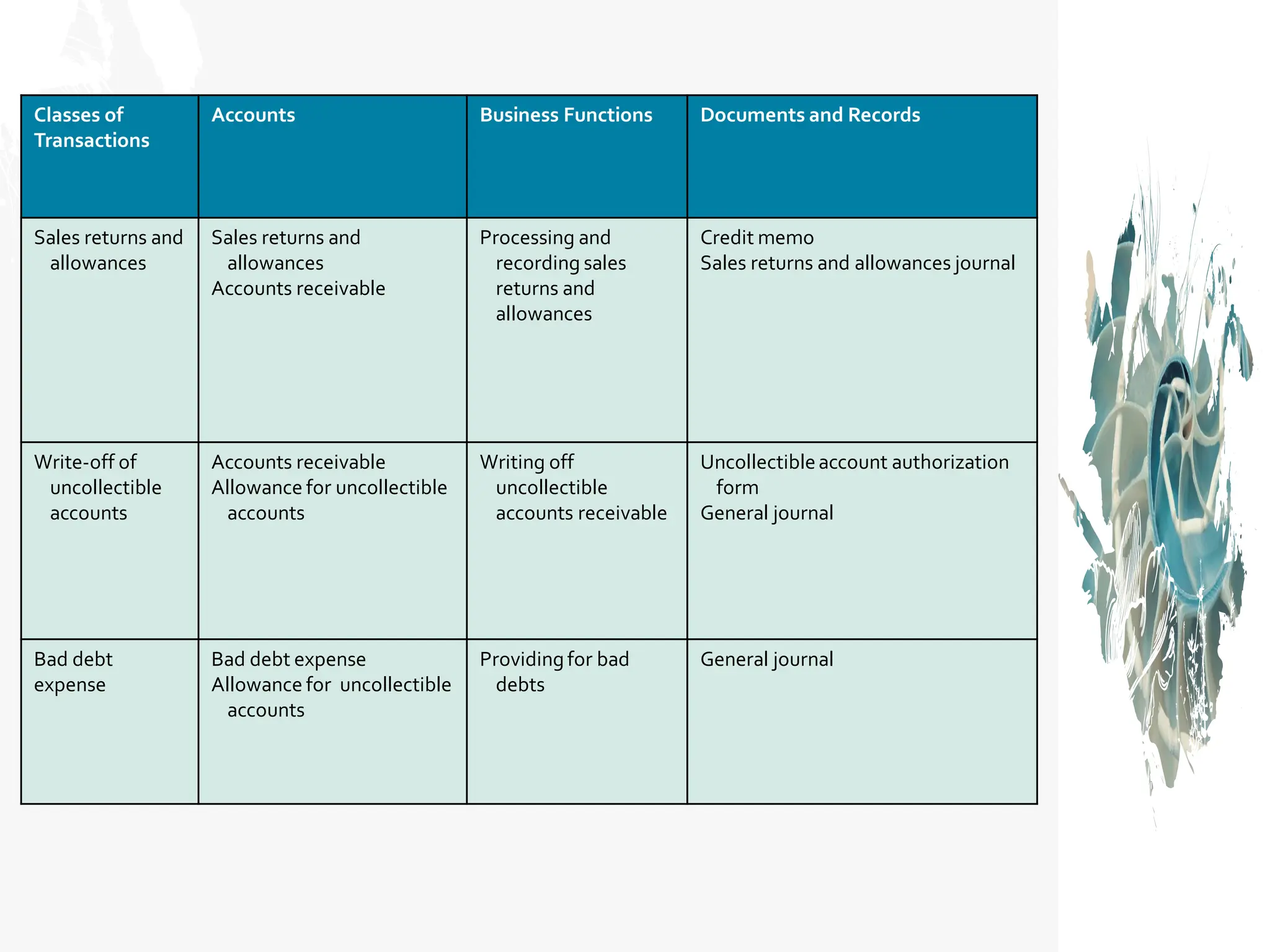

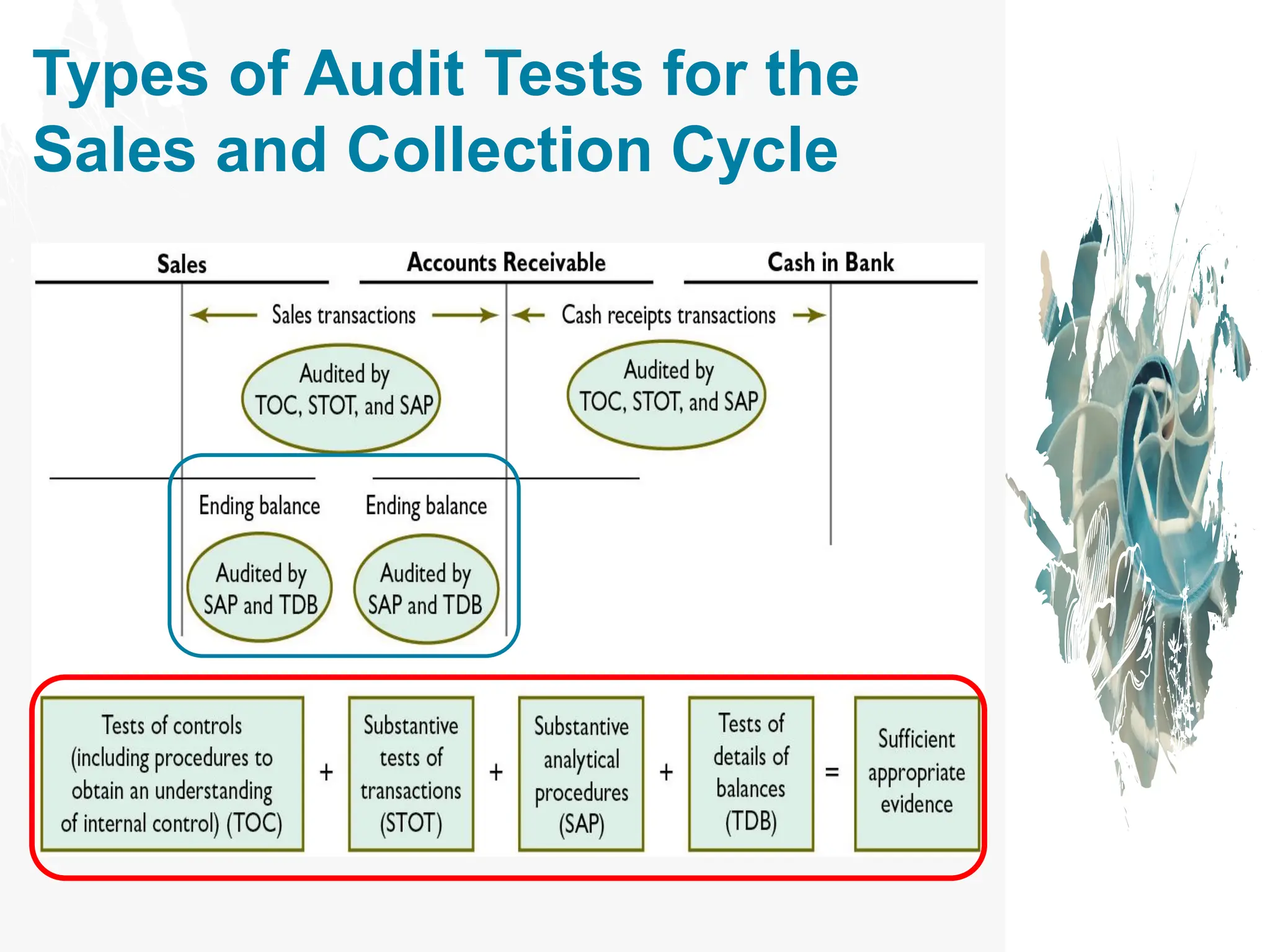

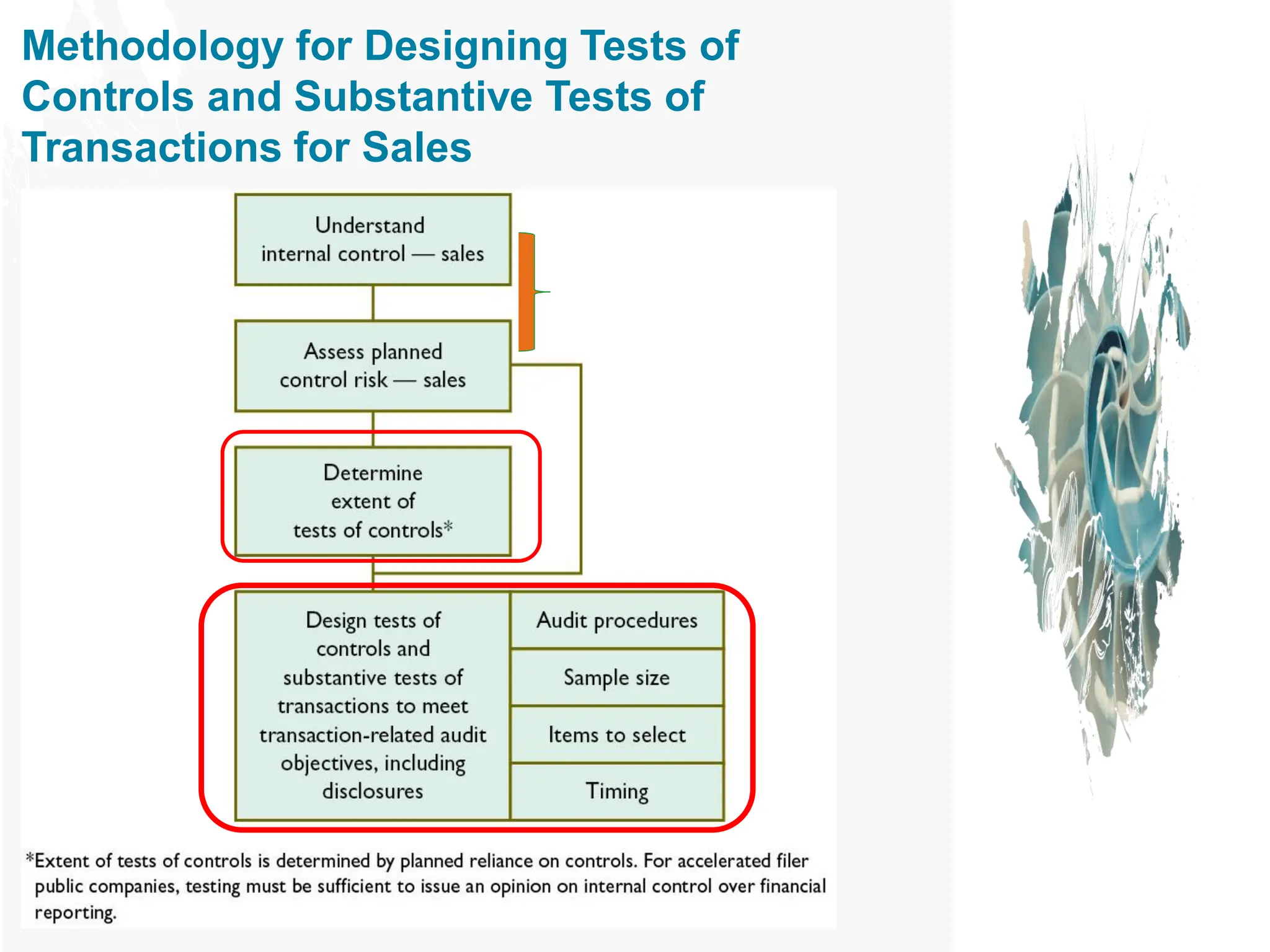

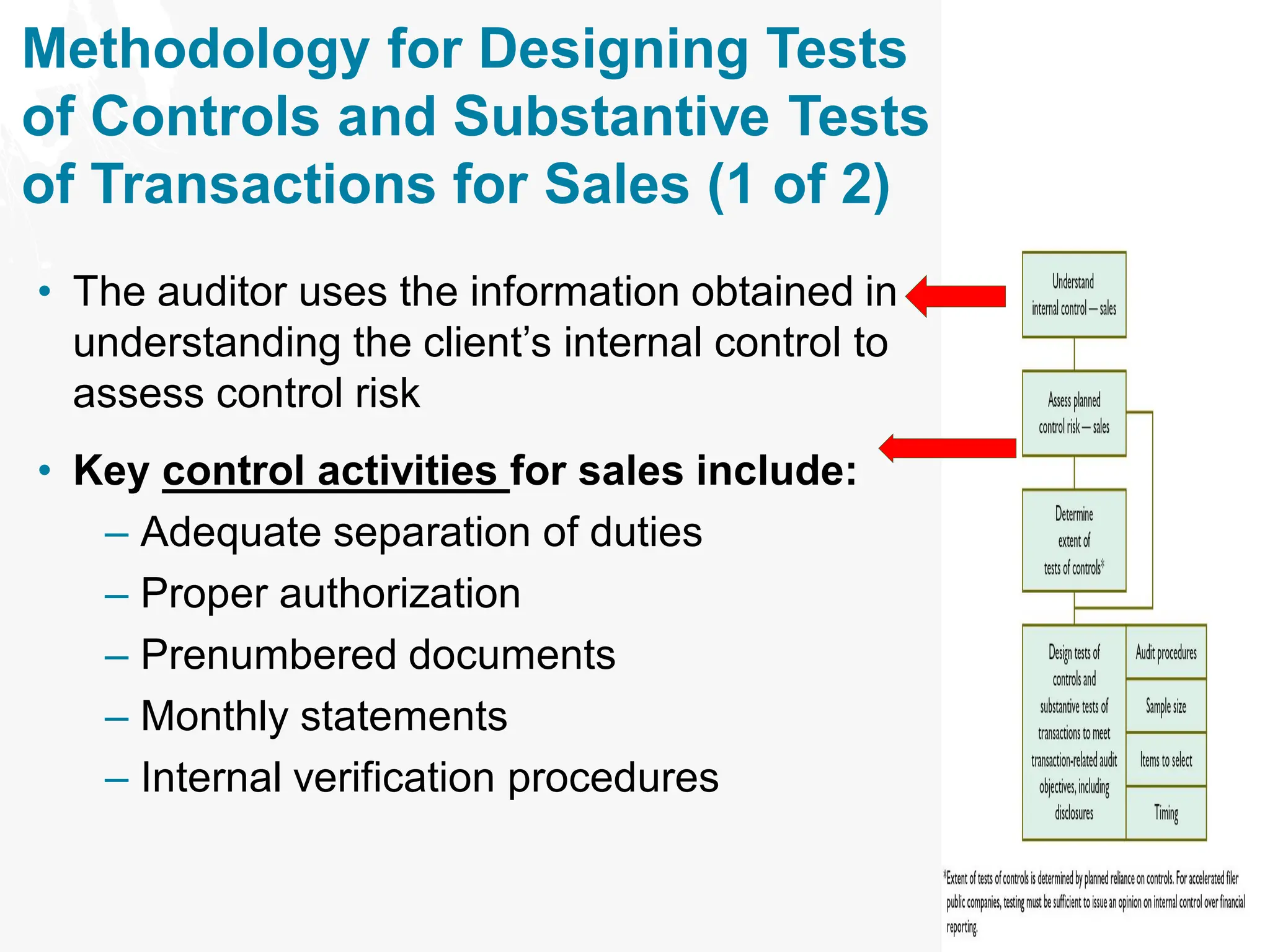

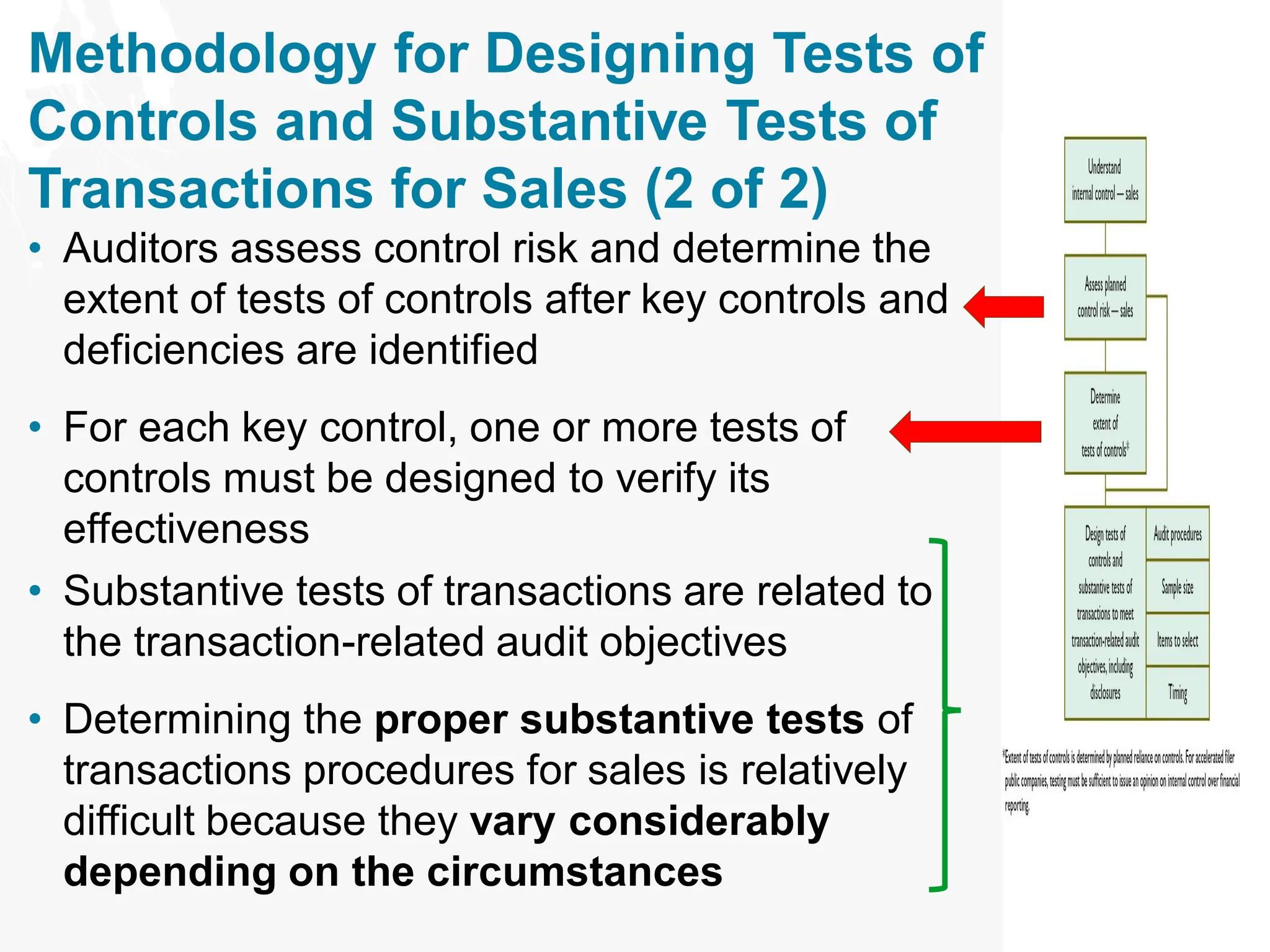

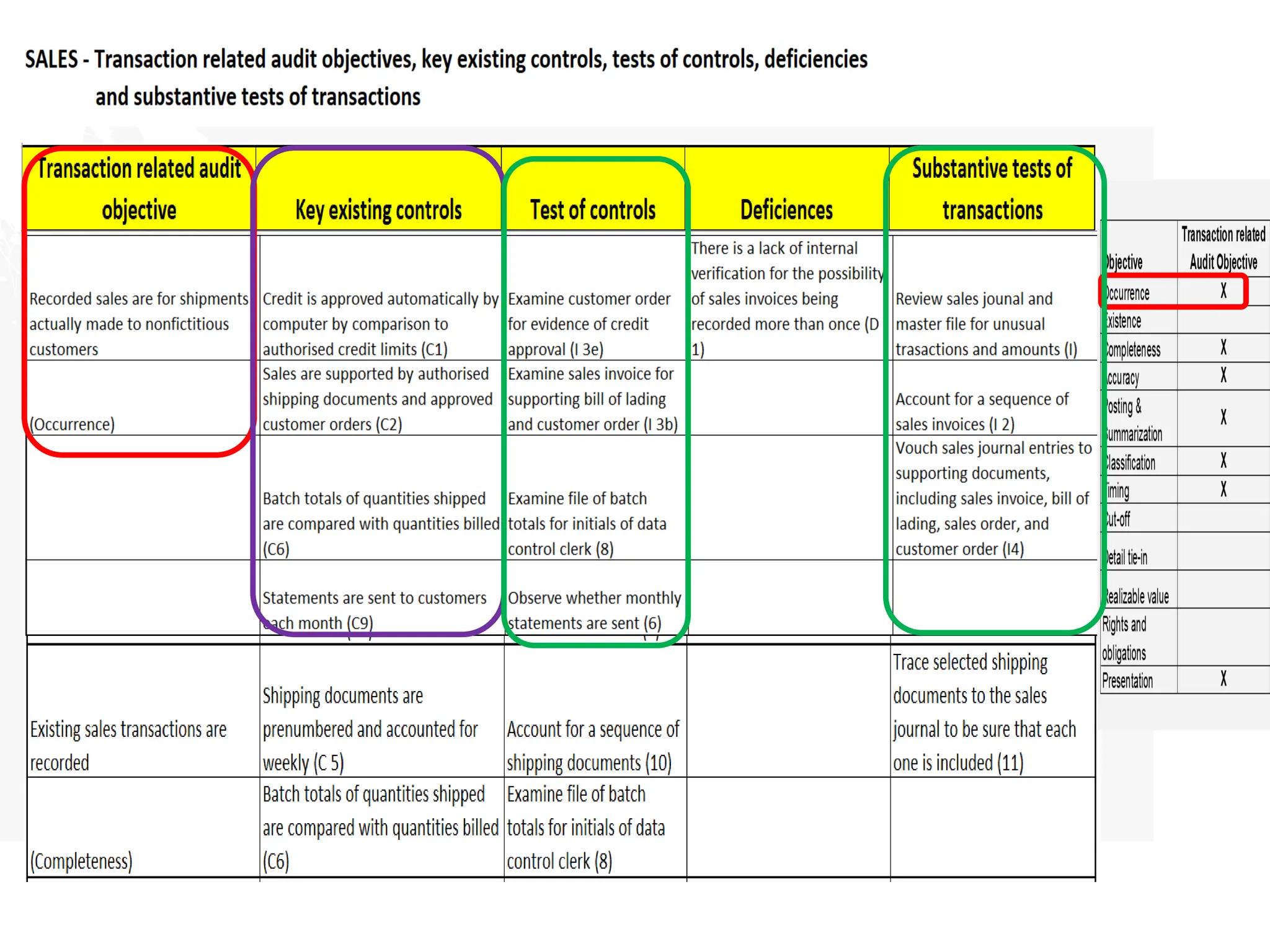

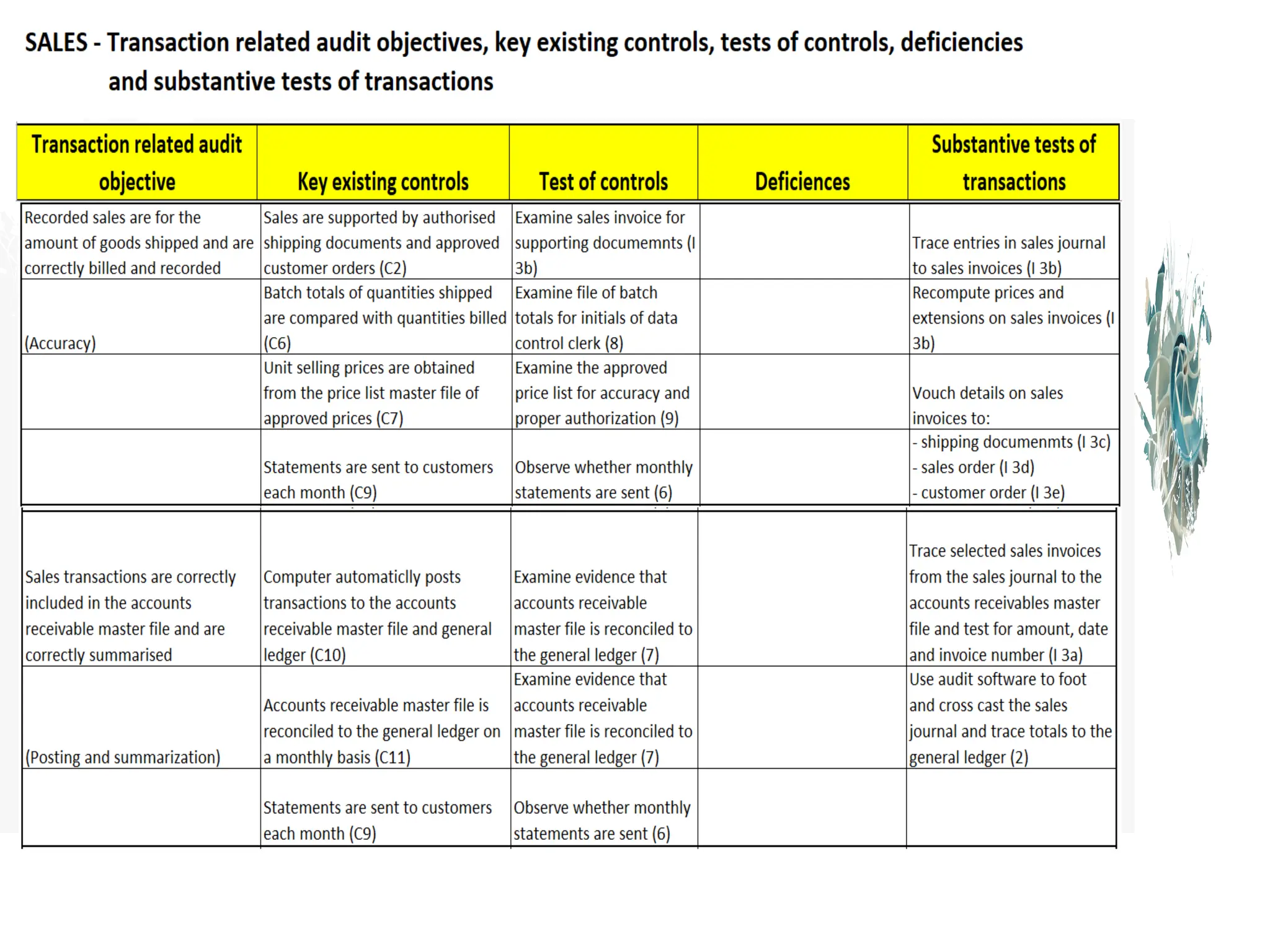

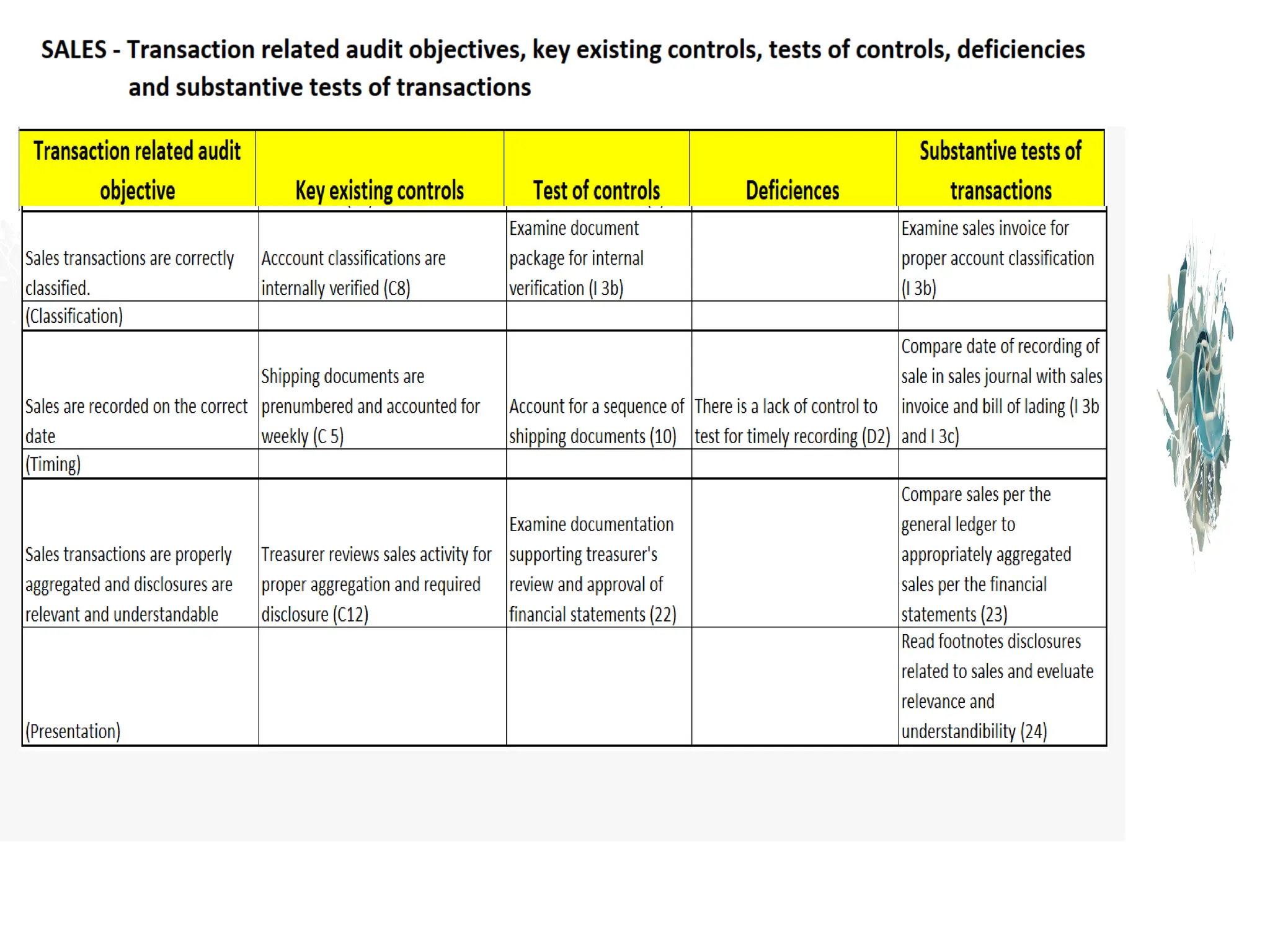

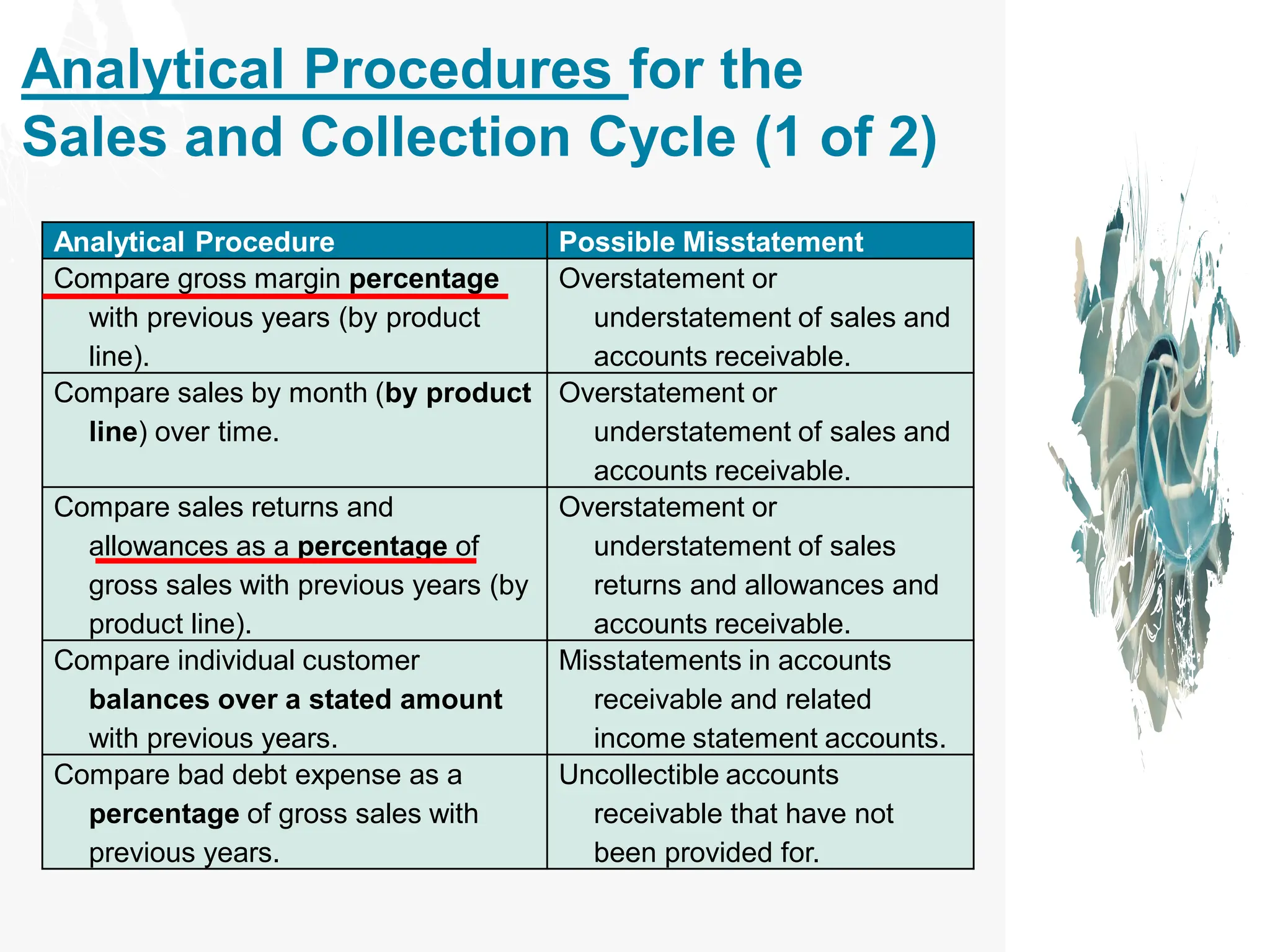

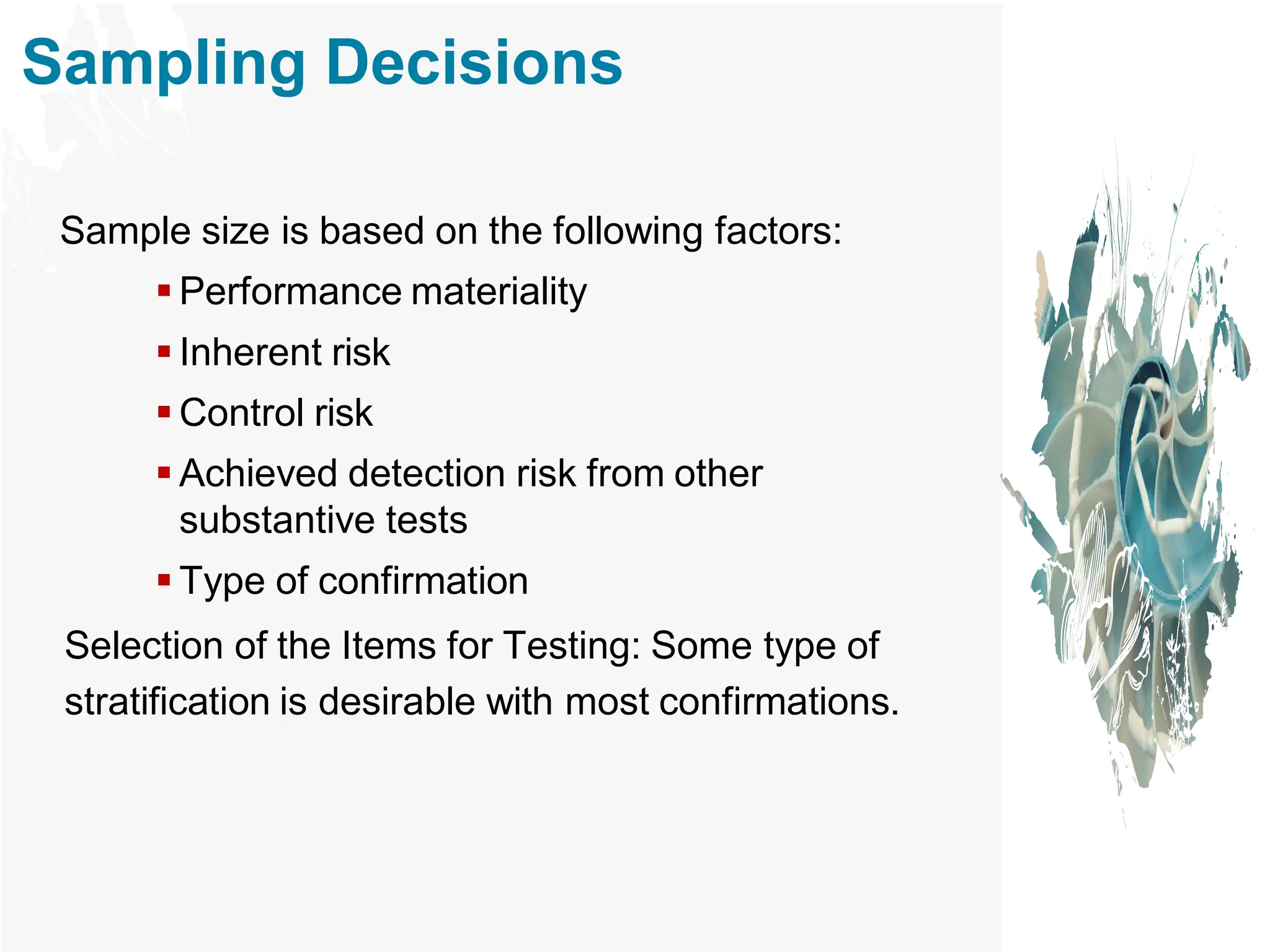

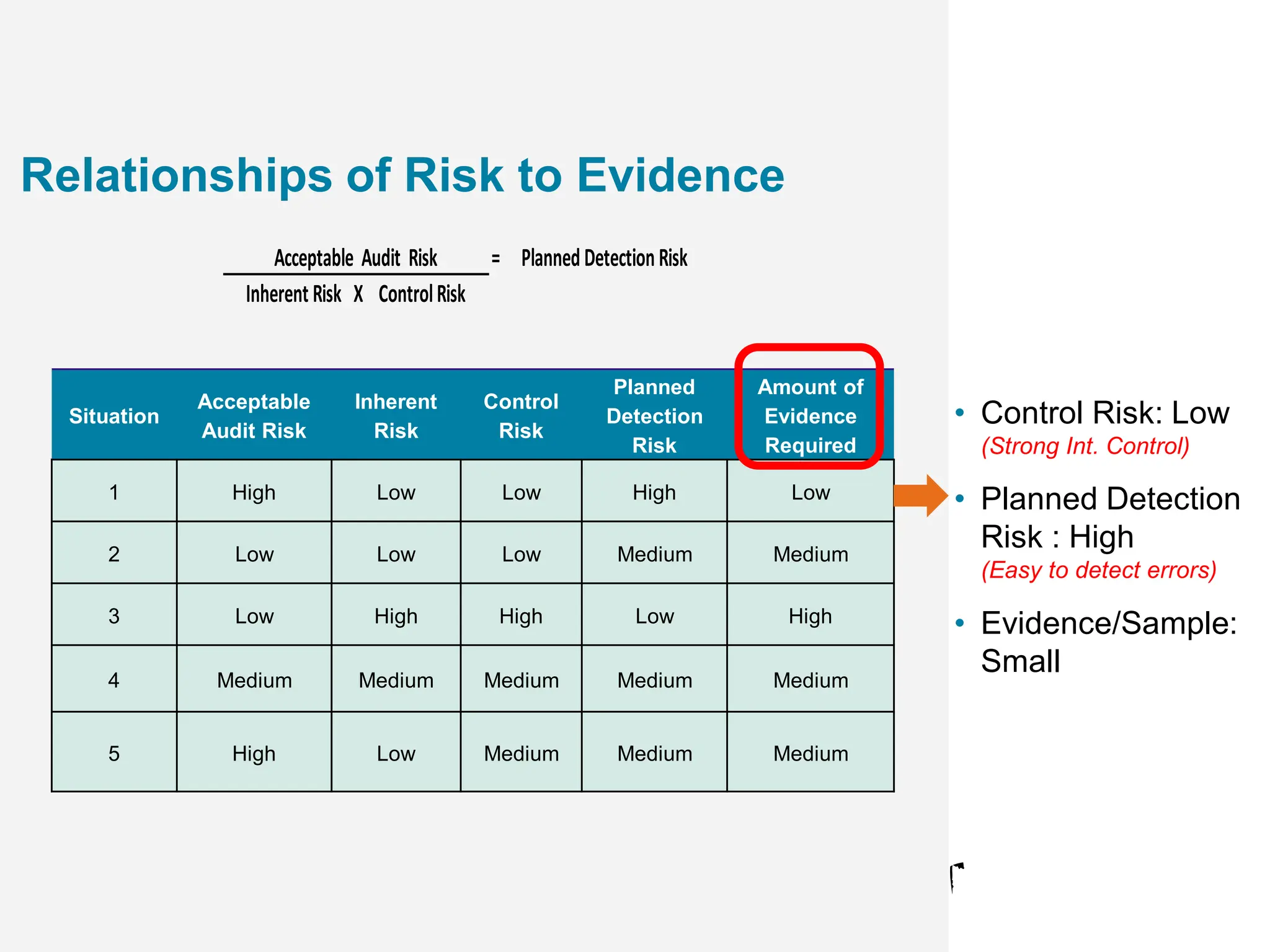

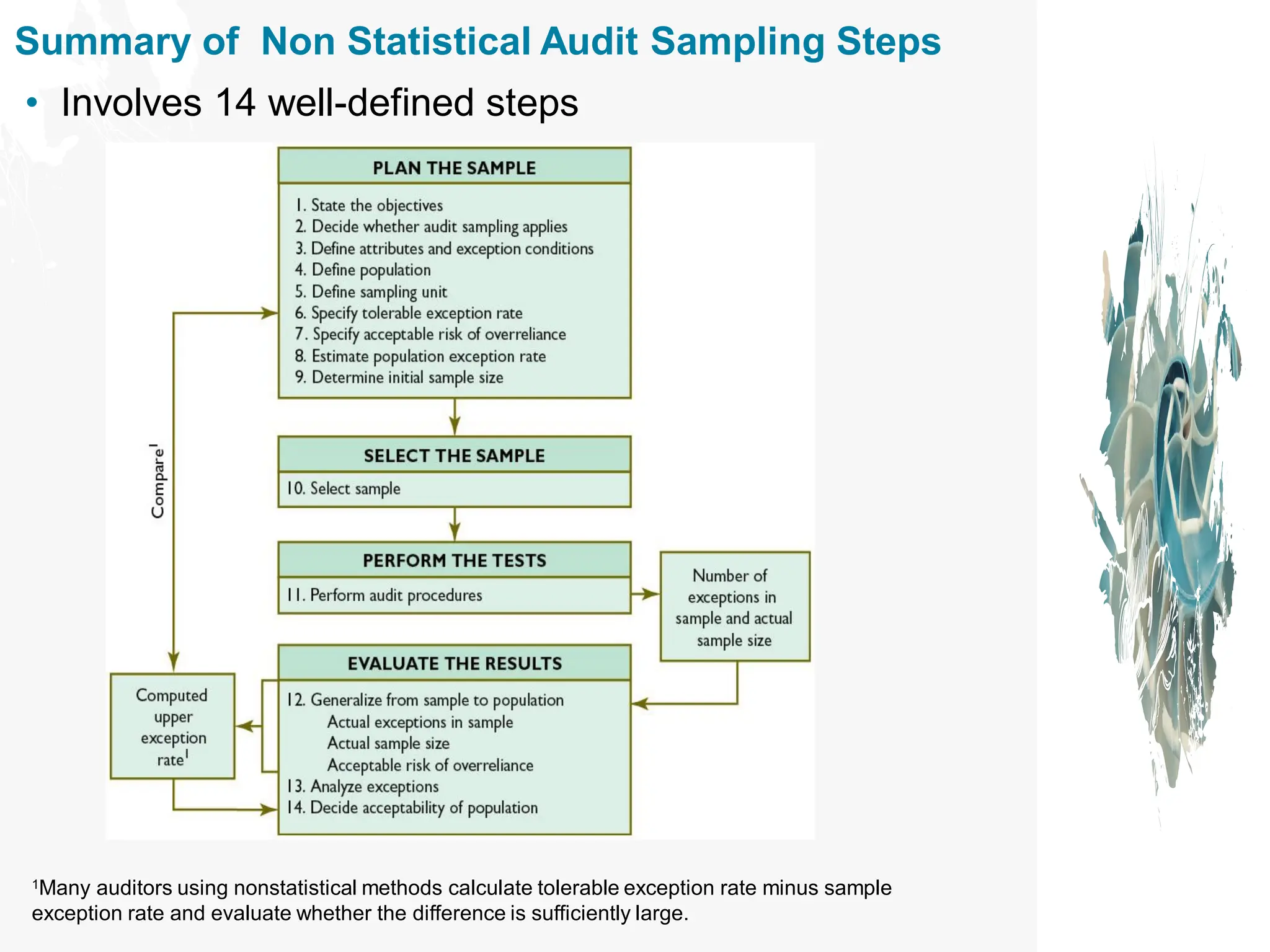

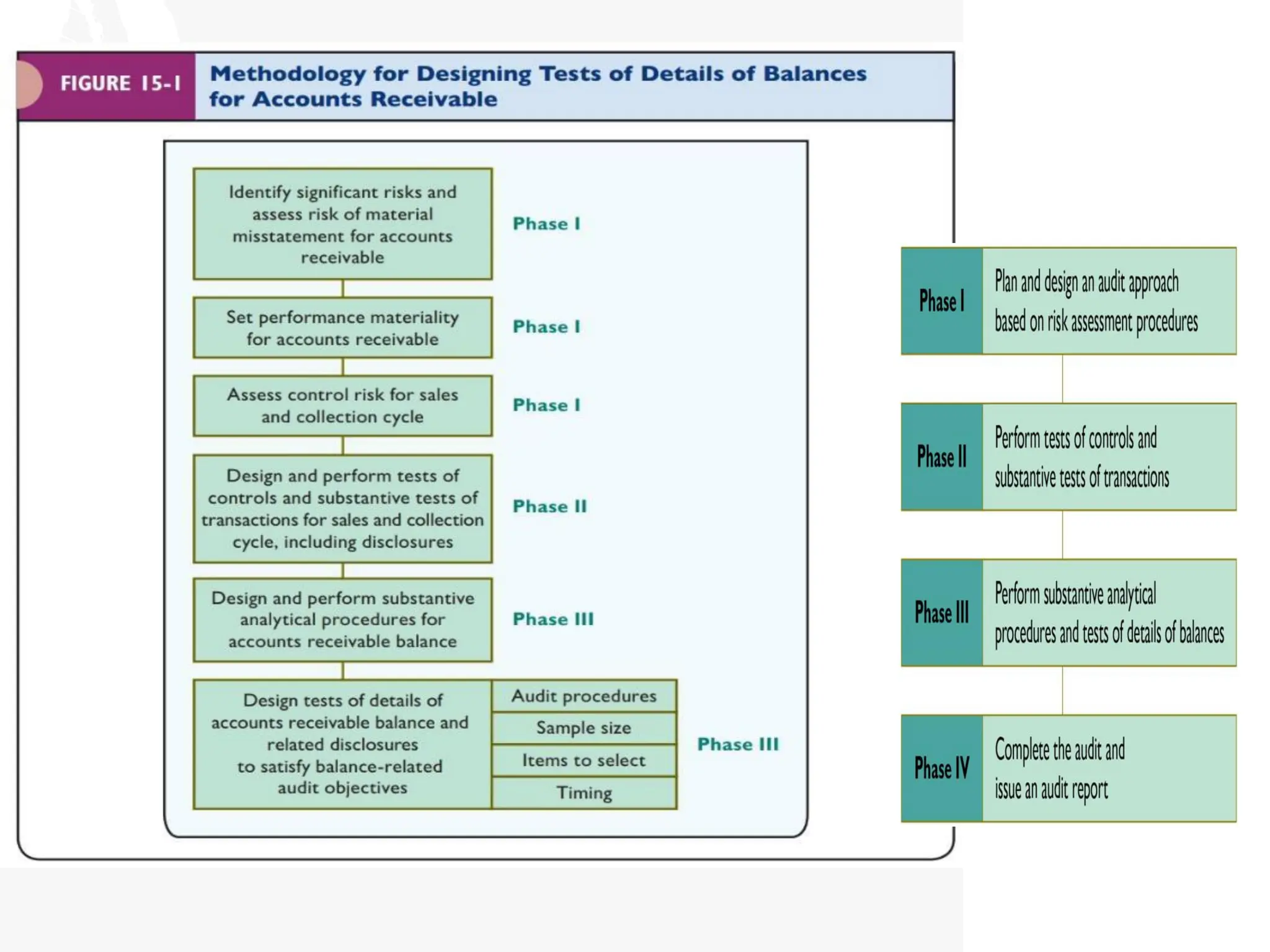

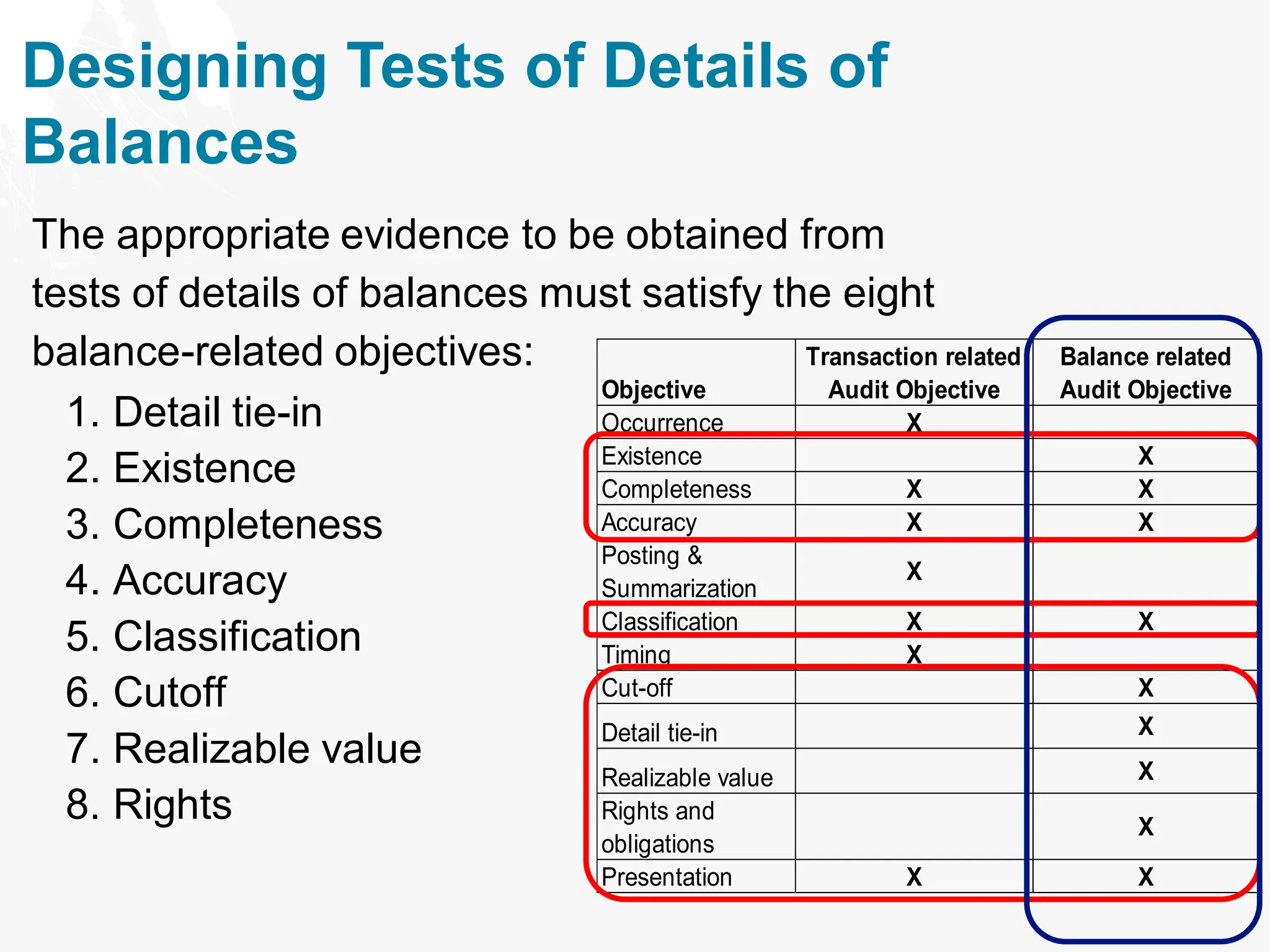

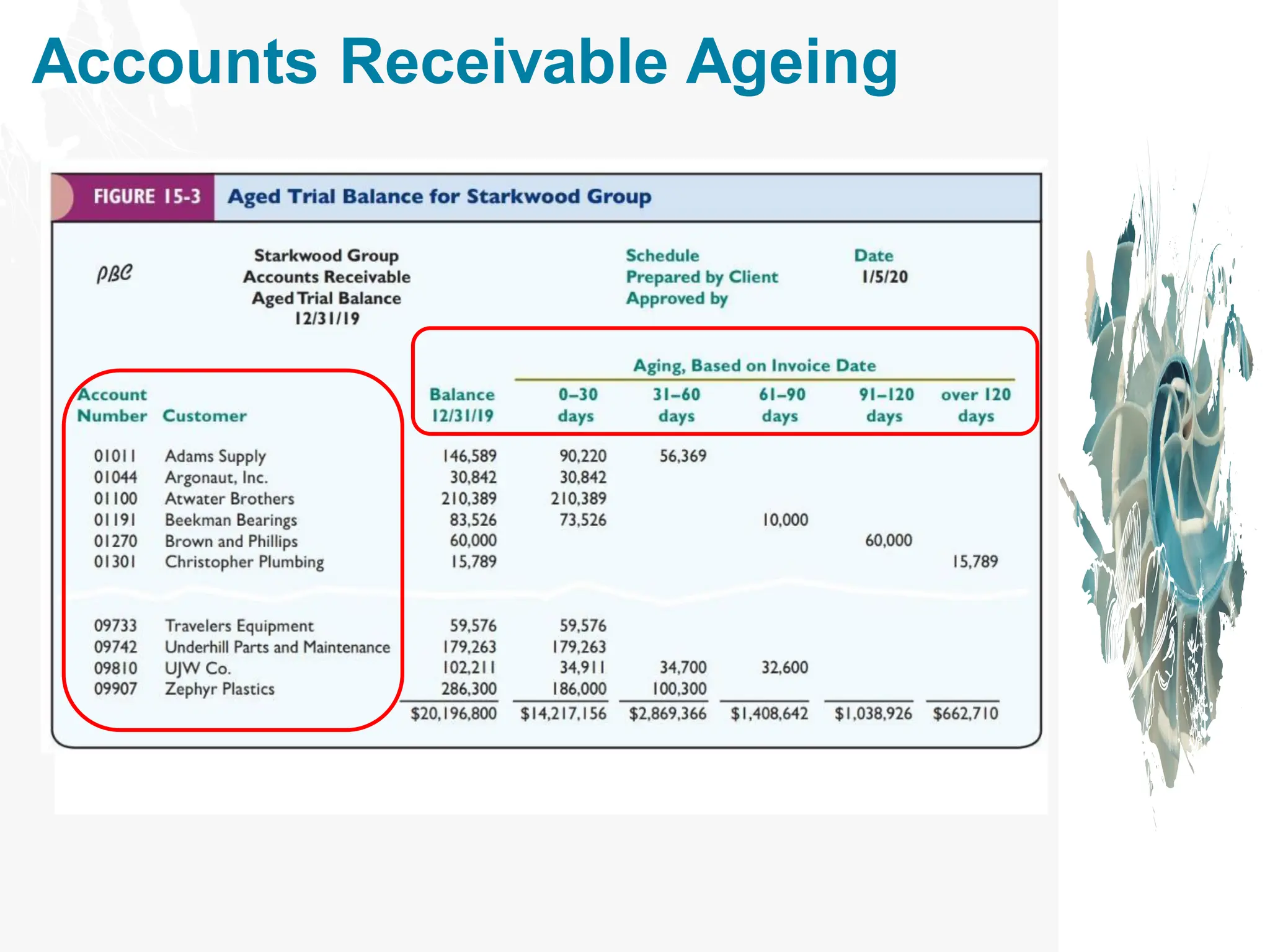

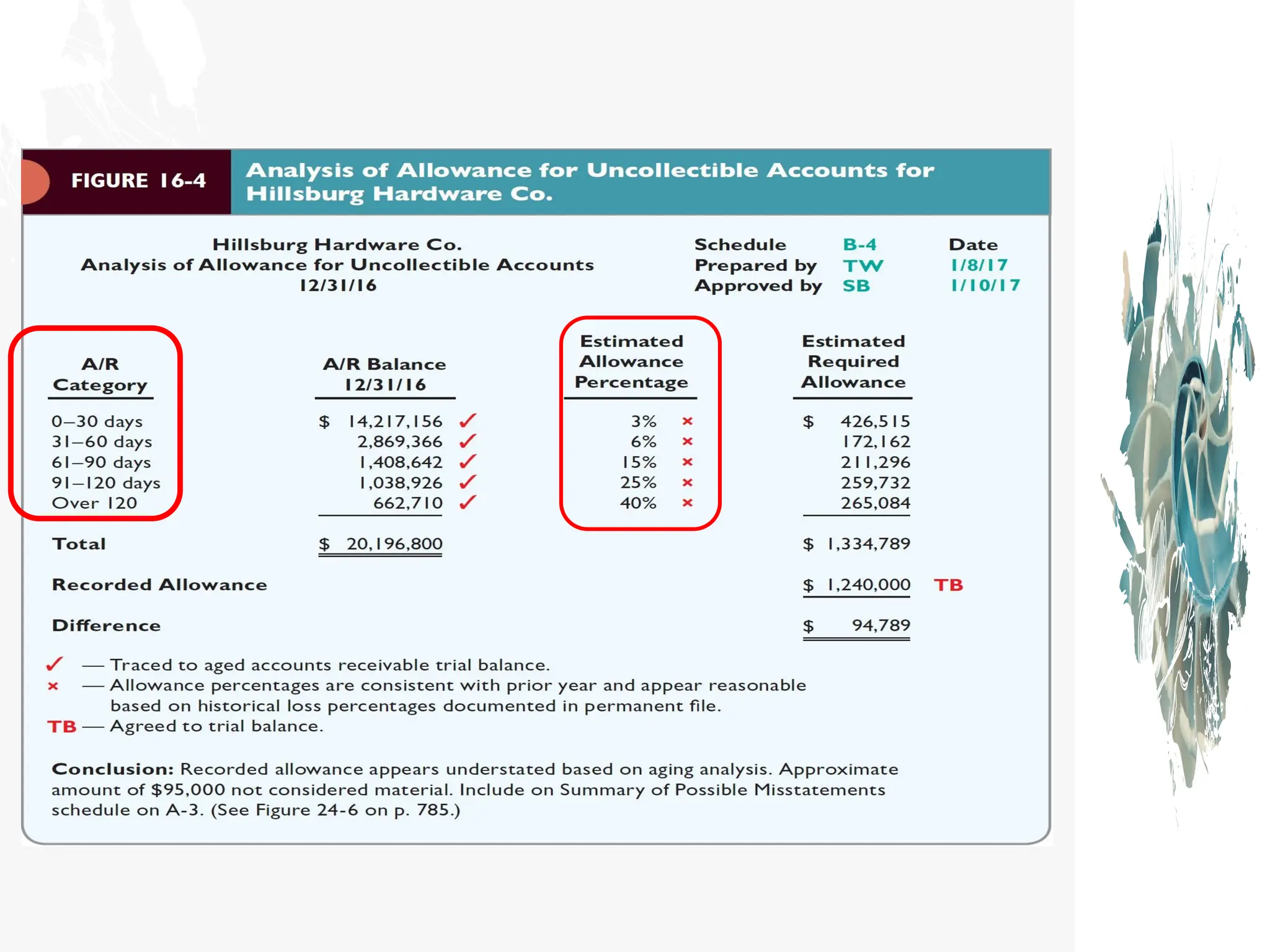

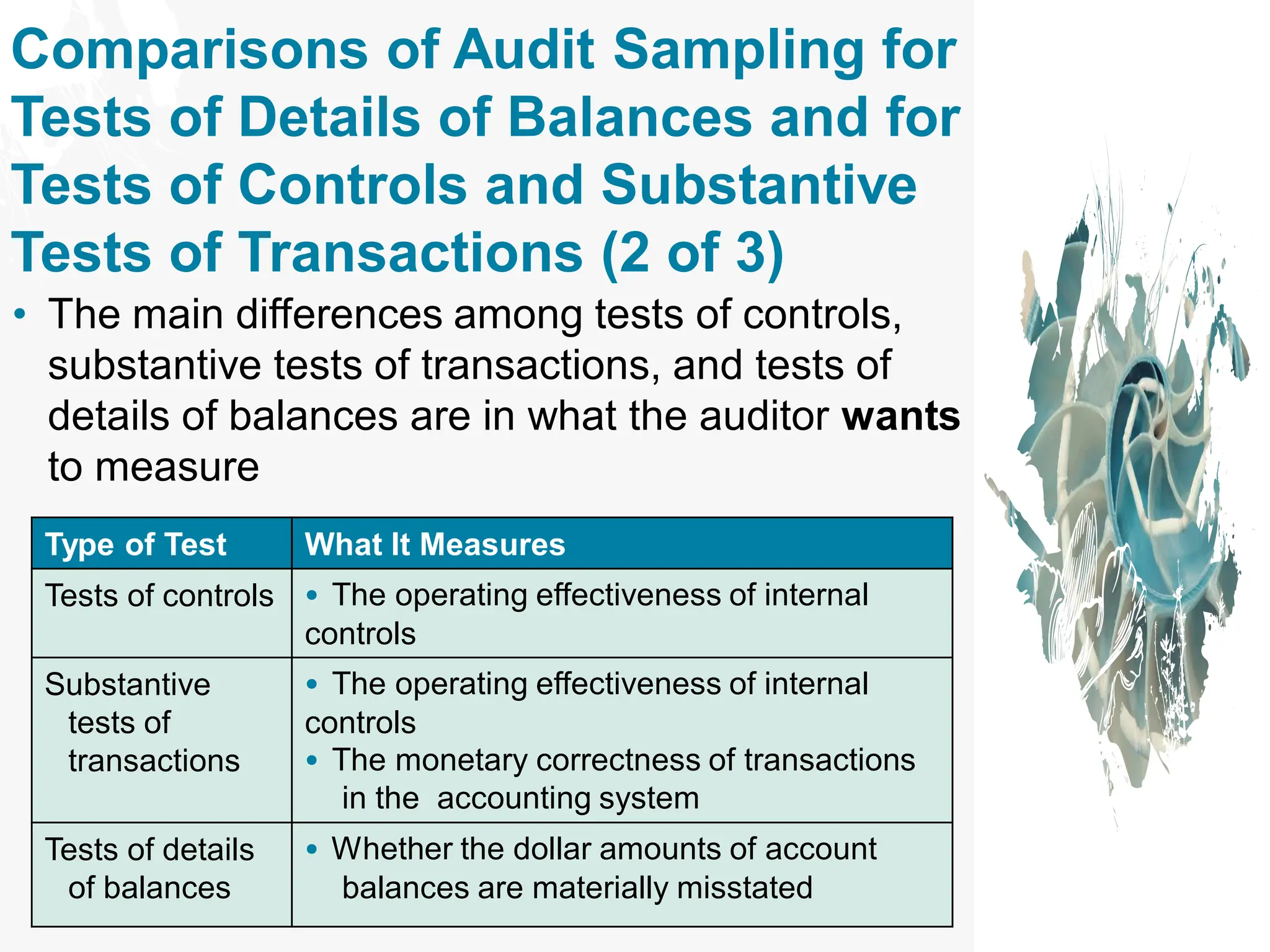

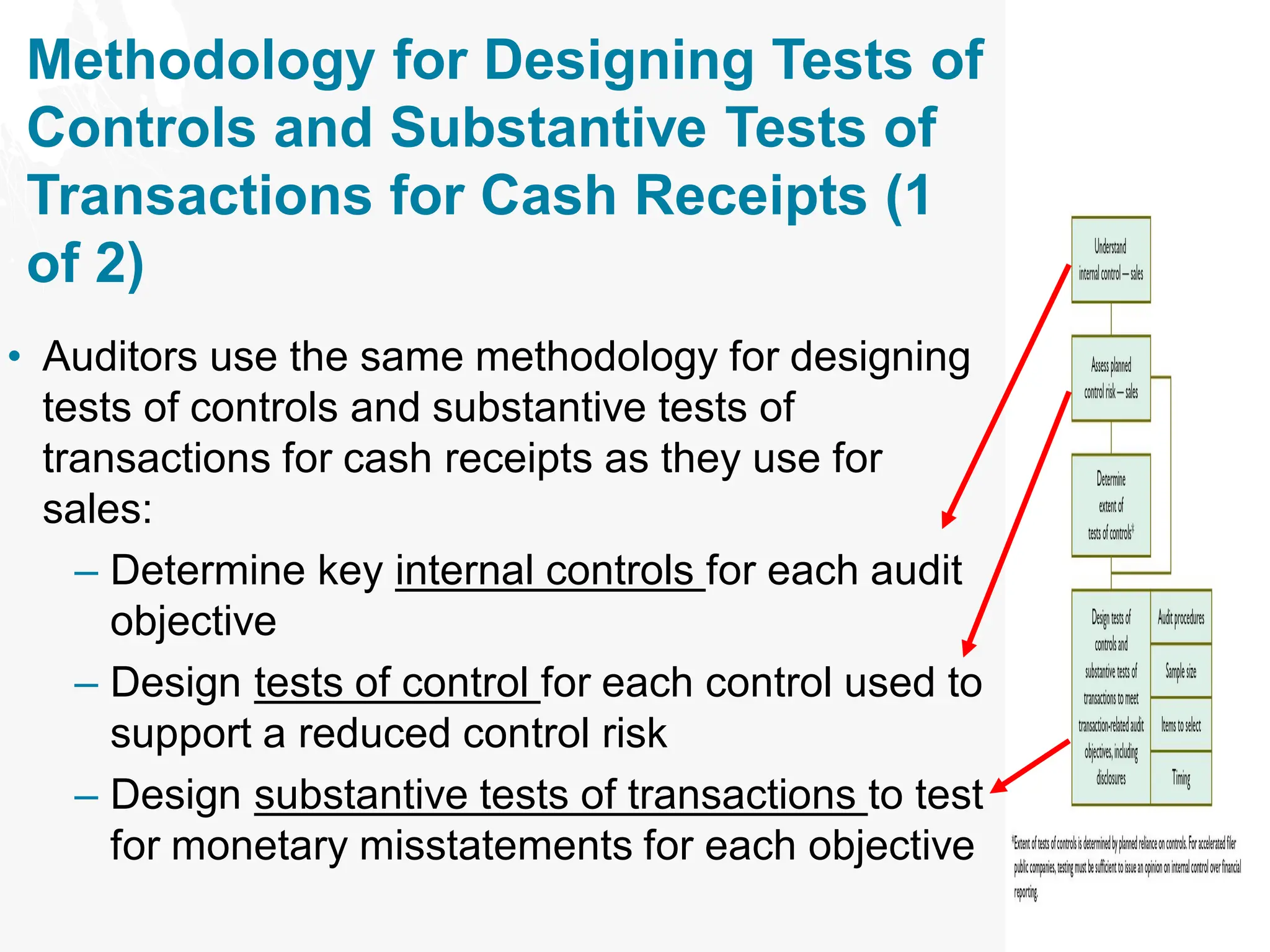

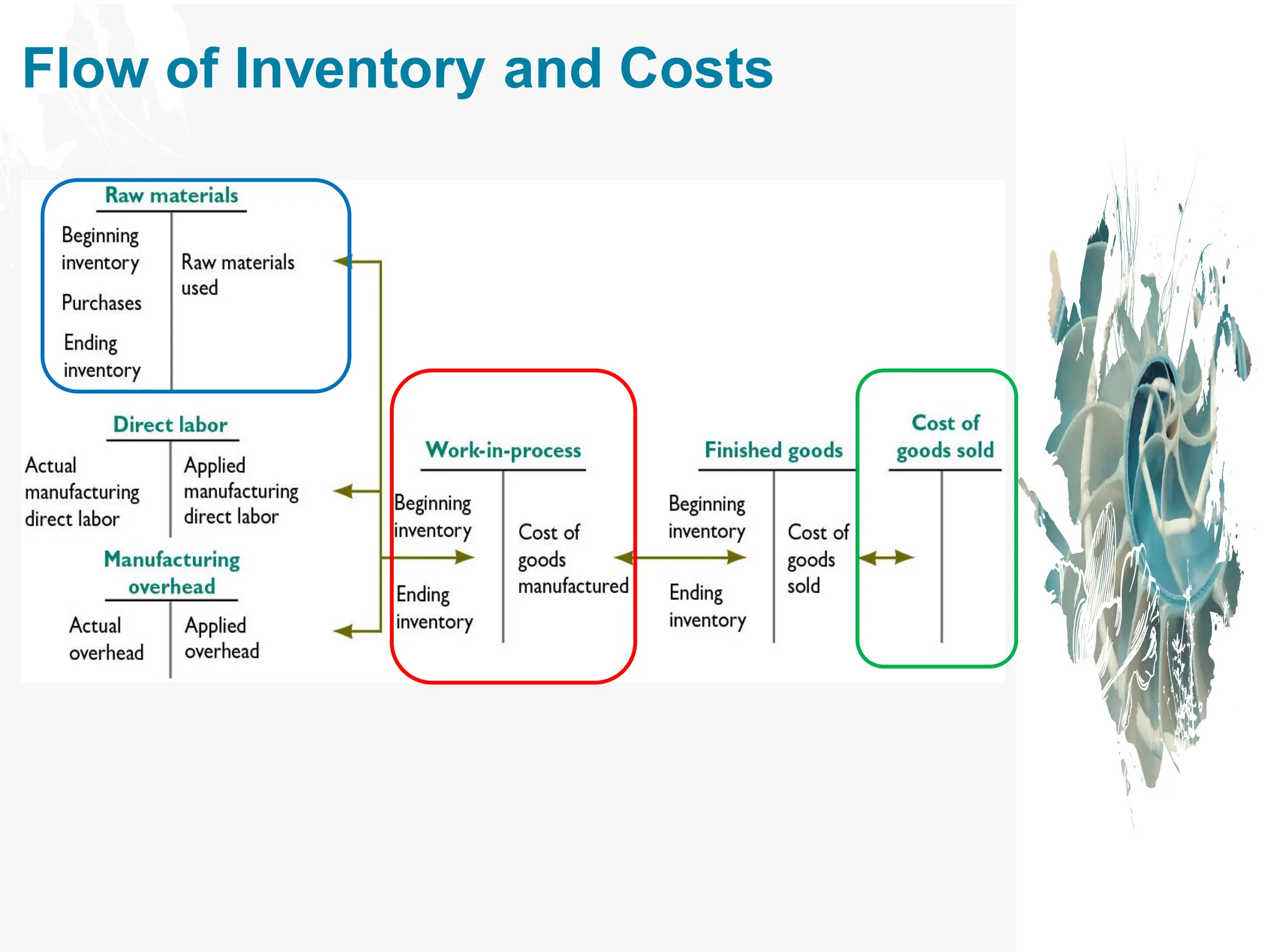

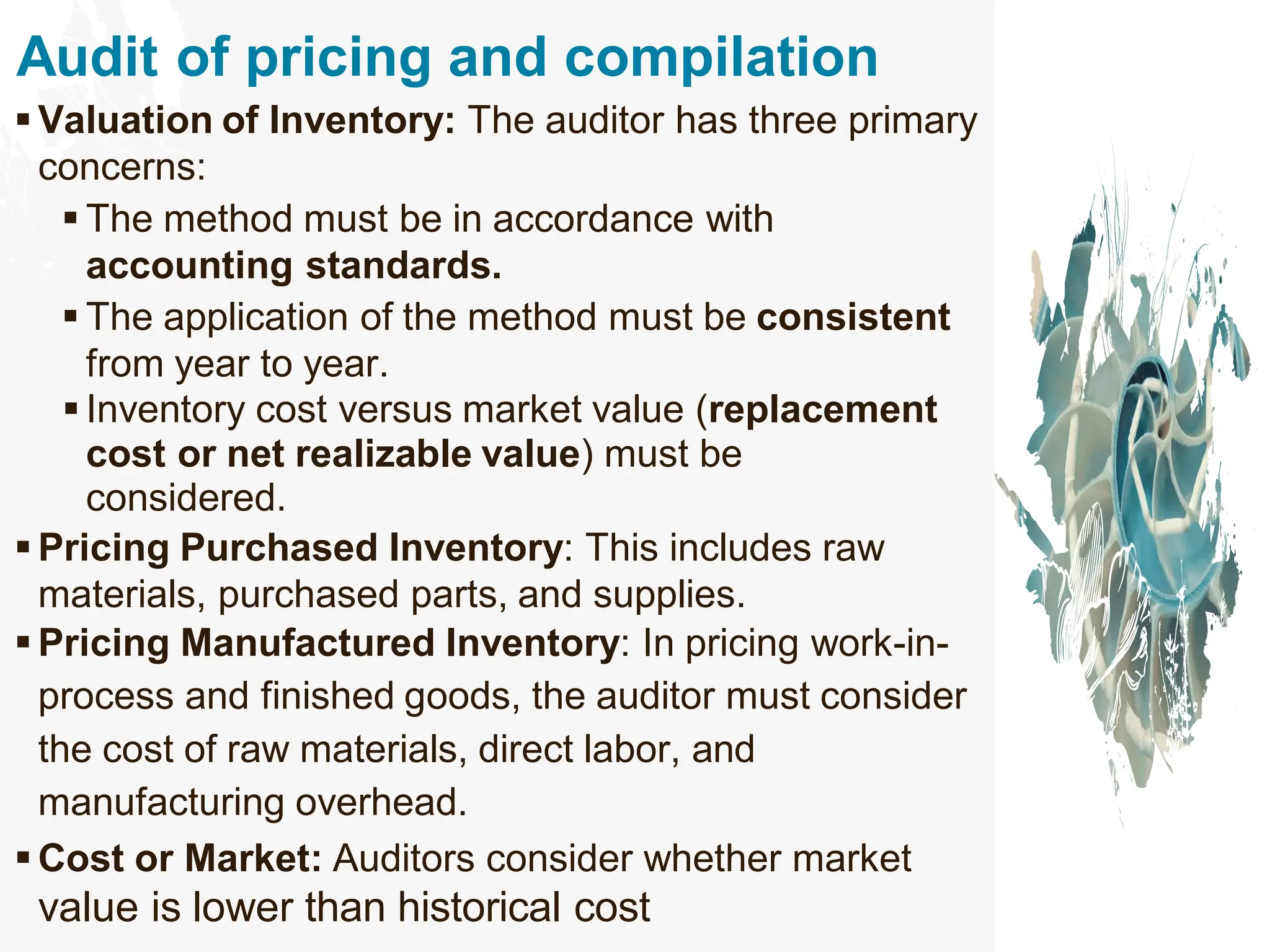

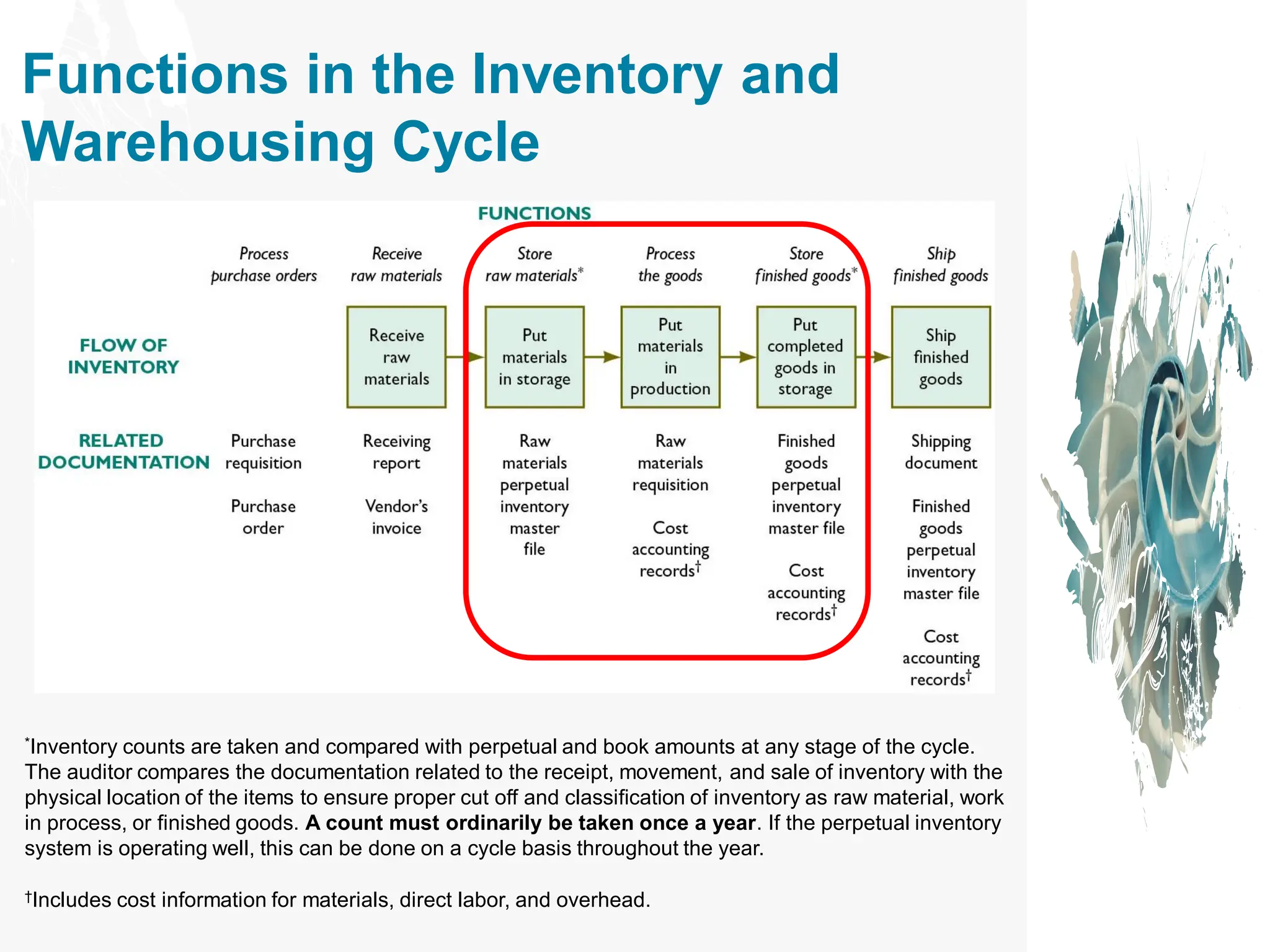

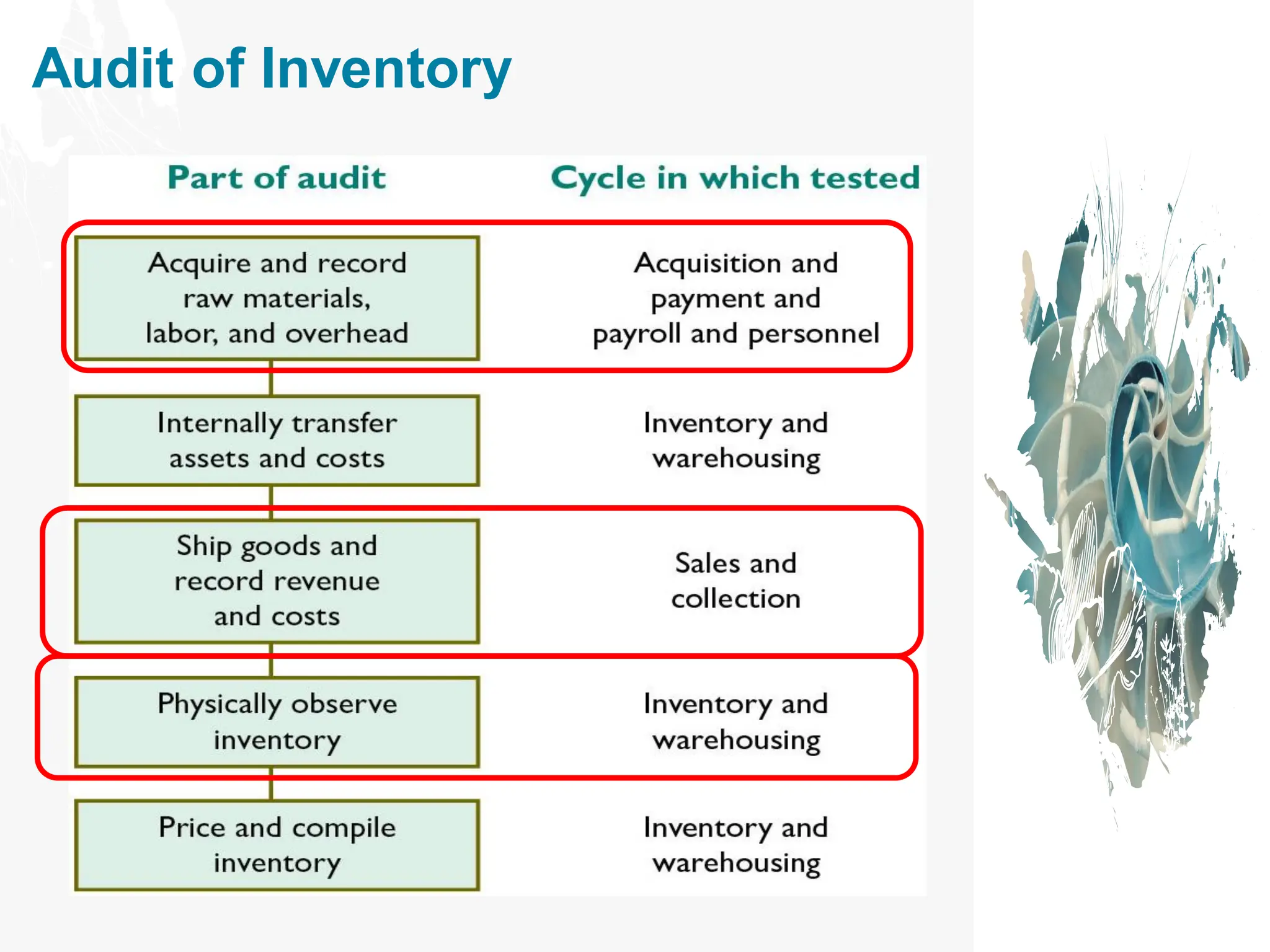

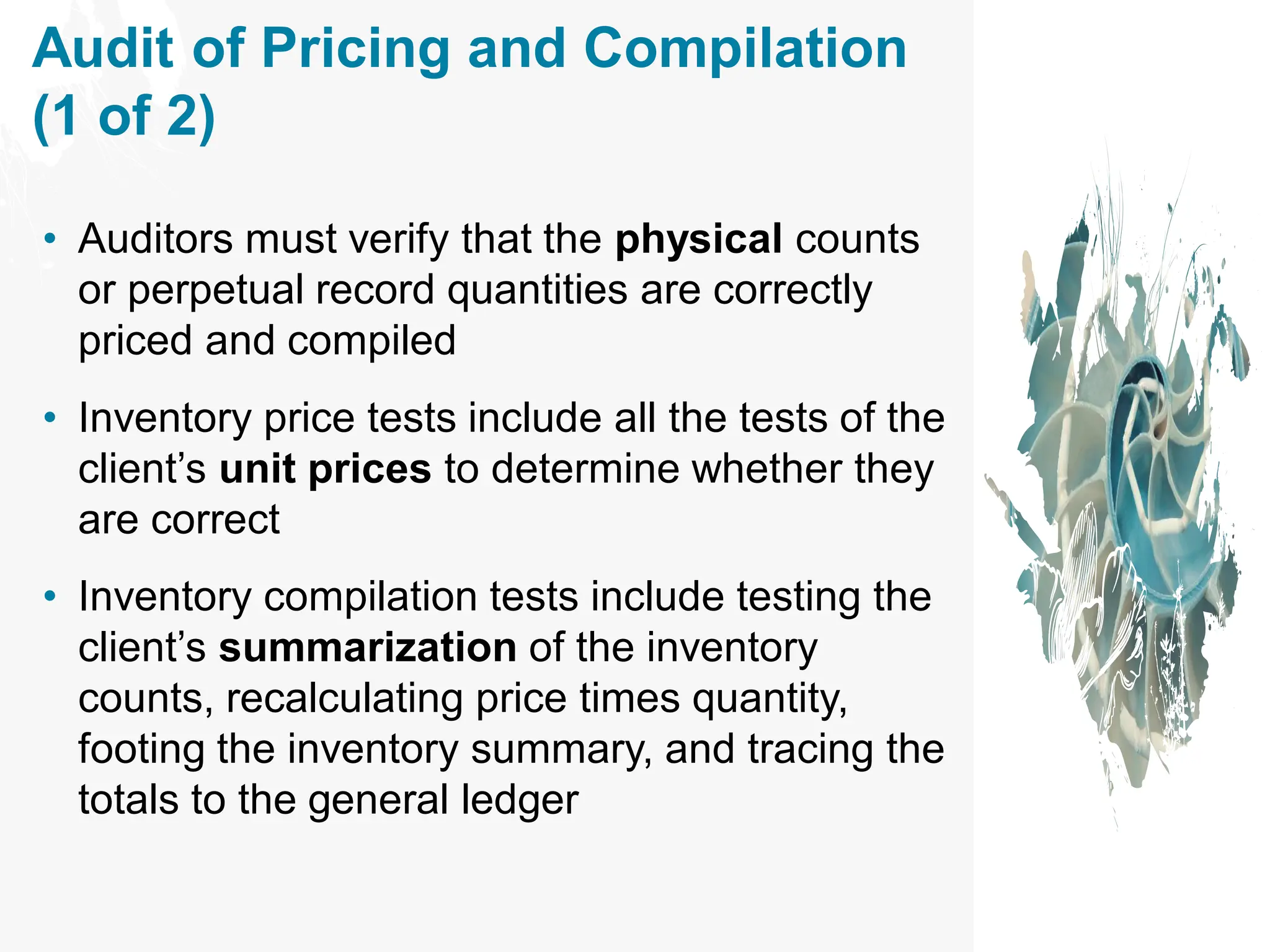

The document discusses the audit processes for the sales cycle, including accounts receivable, sampling decisions, and inventory management. It outlines various business functions, classes of transactions, and key controls for effective audits, emphasizing the importance of designing substantive tests of transactions and internal controls. Additionally, it covers audit sampling methods, including statistical and nonstatistical sampling, and provides detailed steps for tests of details of balances related to accounts receivable.

![WHY?

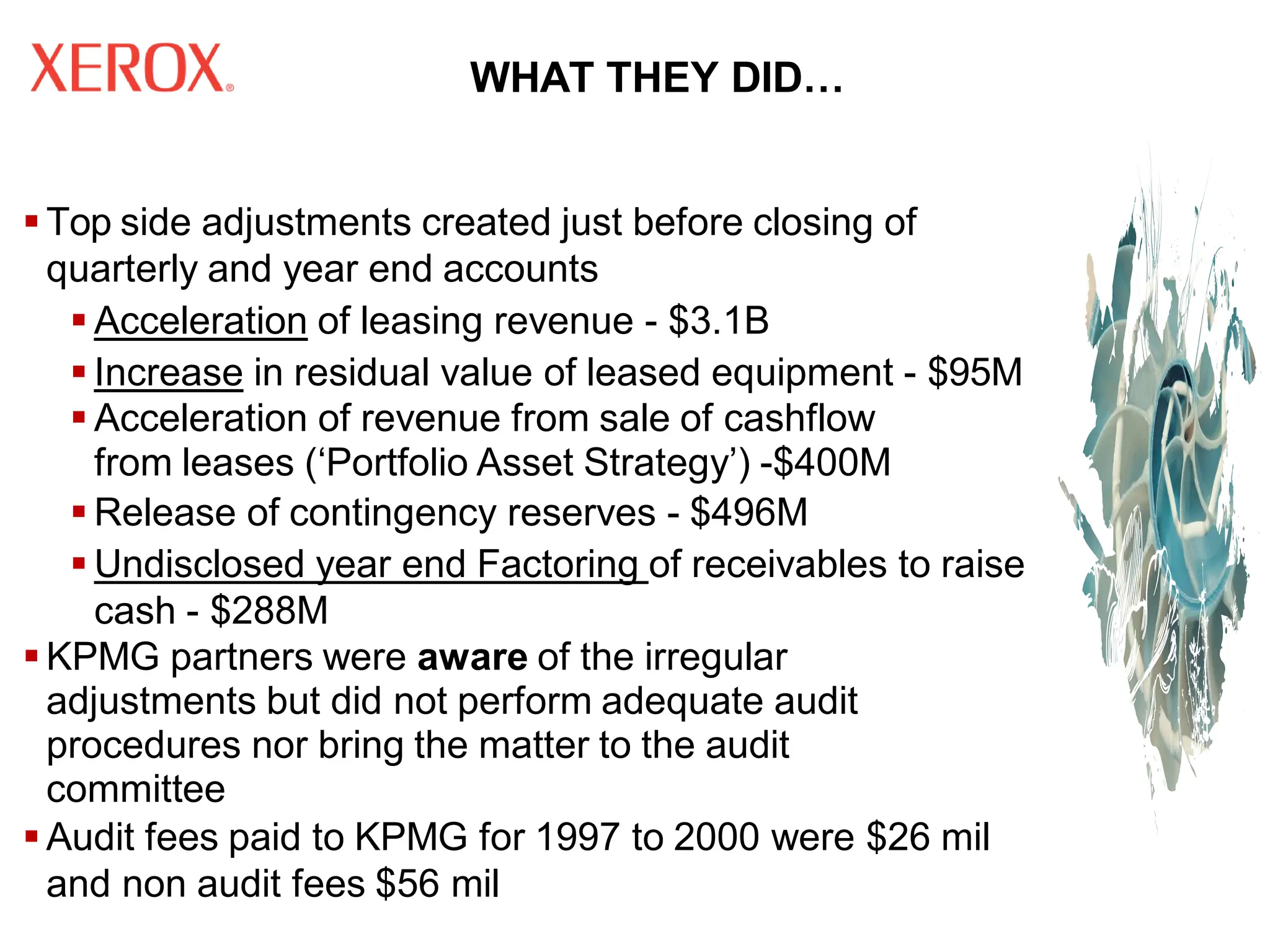

▪ This was necessary because corporations are under

enormous pressure from Wall Street investors to keep up

short-term earnings.

▪ Otherwise, their share values will drop, which not only

threatens companies heavily reliant on share values to

finance debt, but also has financial consequences for top

executives, whose huge incomes are bound up with

stock options.

▪ The SEC investigation noted that “compensation of Xerox

senior management depended significantly on their ability

to meet [earnings] targets.”

▪ Because of the accounting manipulations, top Xerox

executives were able to cash in on stock options valued

at an estimated $35 million.](https://image.slidesharecdn.com/week6salesandcollectioncycle-241118020159-7eb65dc3/75/Week-6_Sales-Cyle-and-Collection-Cycle-pdf-115-2048.jpg)