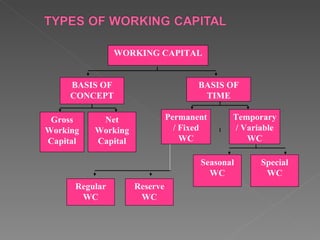

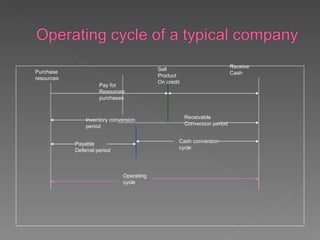

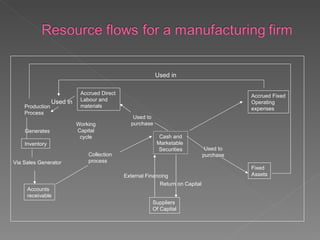

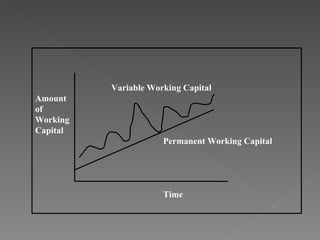

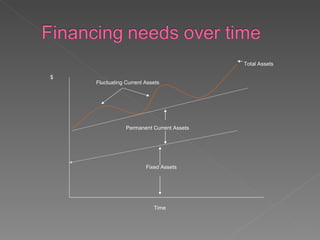

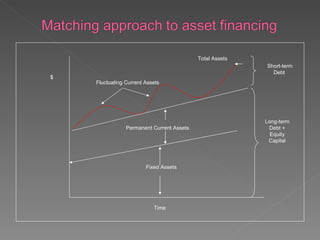

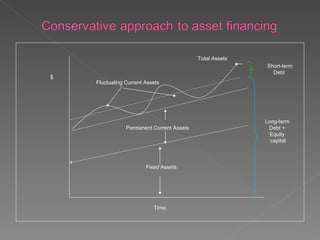

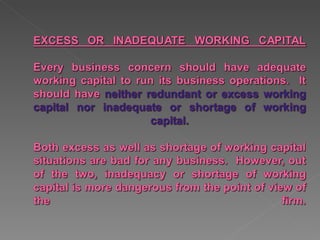

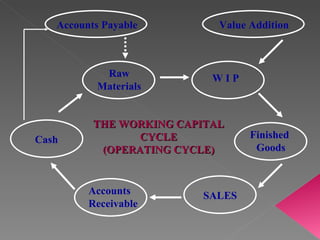

Working capital refers to a company's short-term assets such as cash, inventory, and receivables that are used to fund day-to-day operations, and there are two main concepts for defining it - the balance sheet approach looks at current assets minus current liabilities, while the operating cycle concept focuses on the time required to convert resources into cash from purchasing, producing, and selling goods. Proper management of working capital is important for companies to ensure they have sufficient cash flow and liquidity to pay debts and support daily operations.