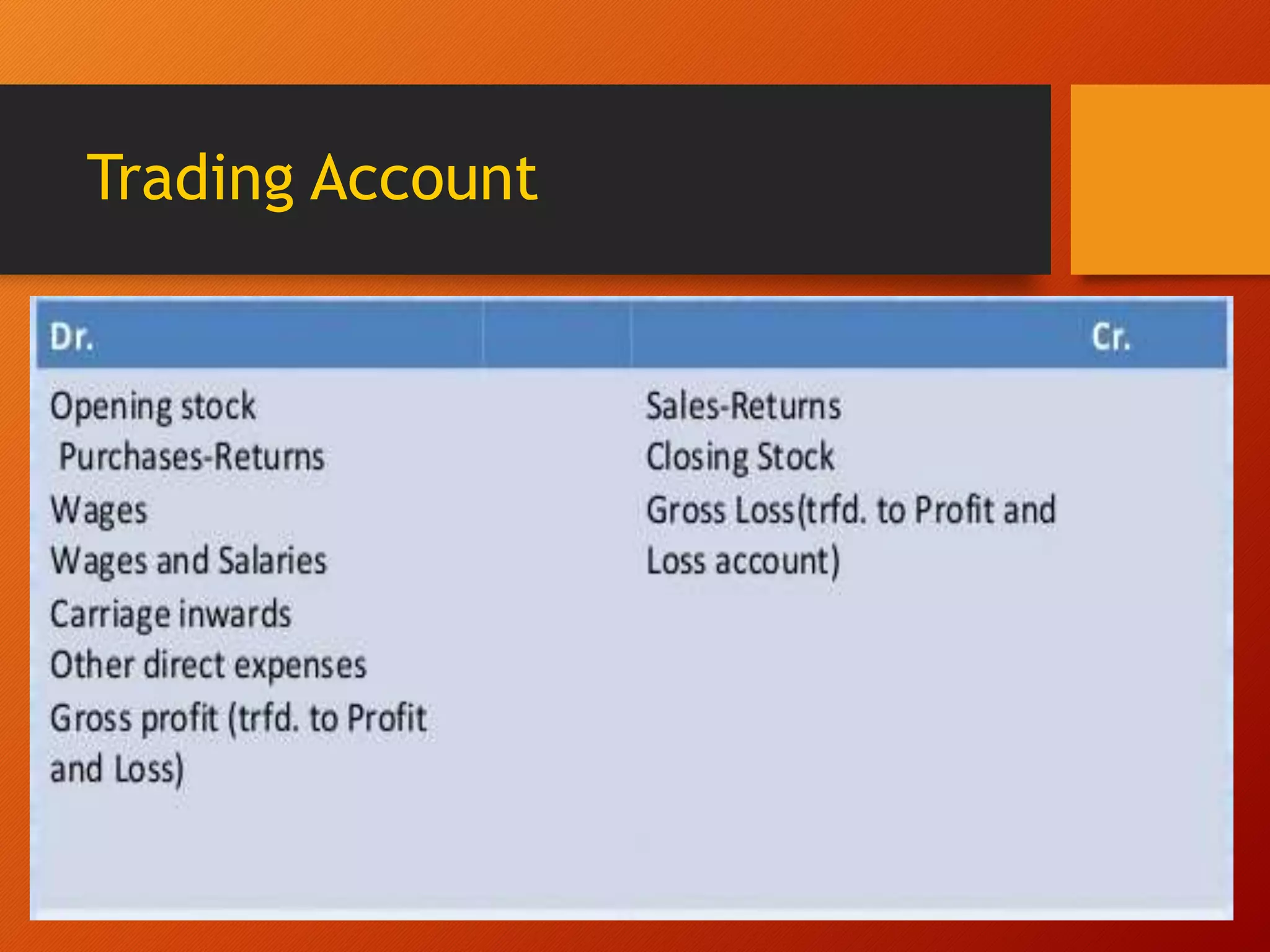

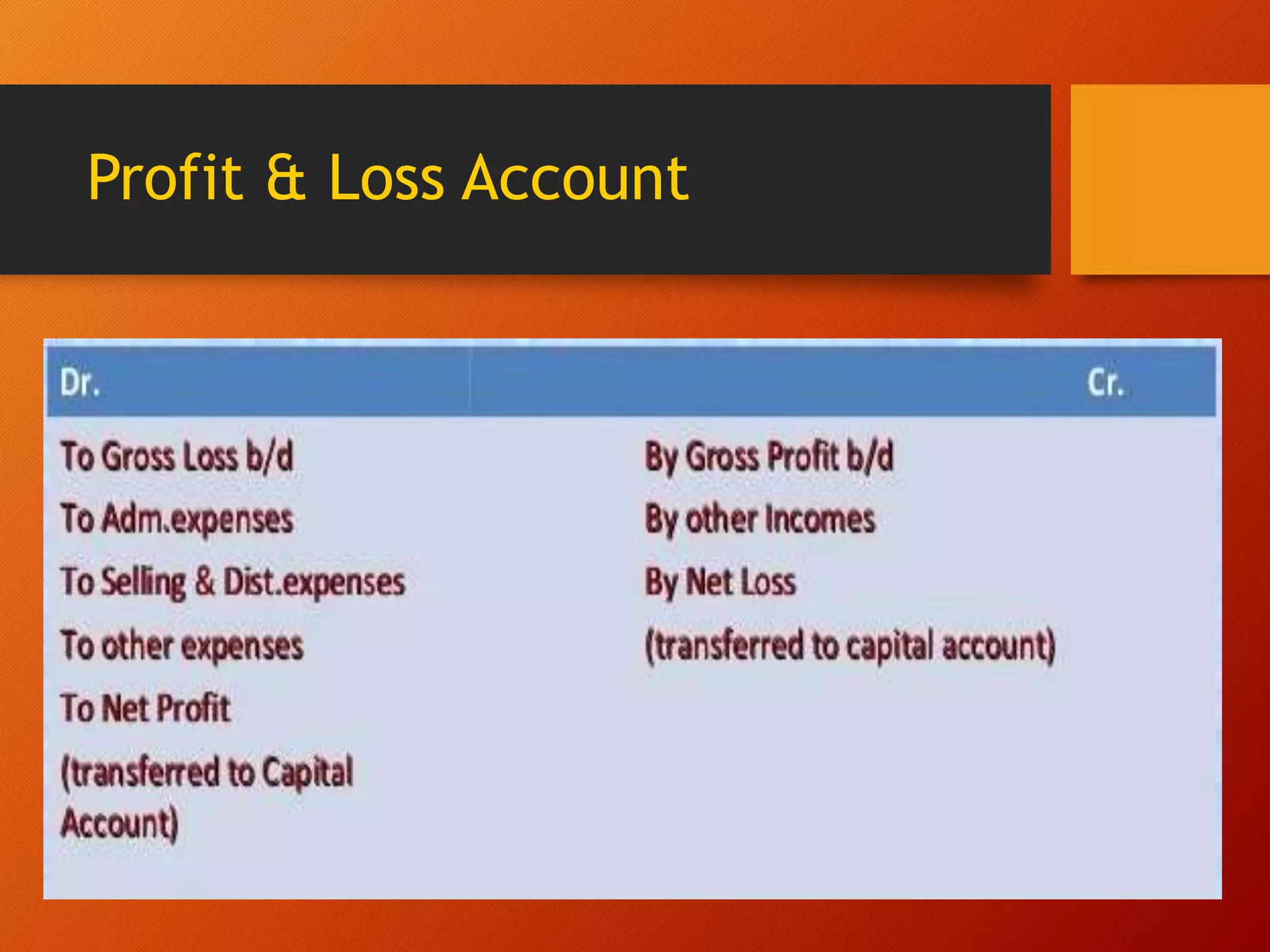

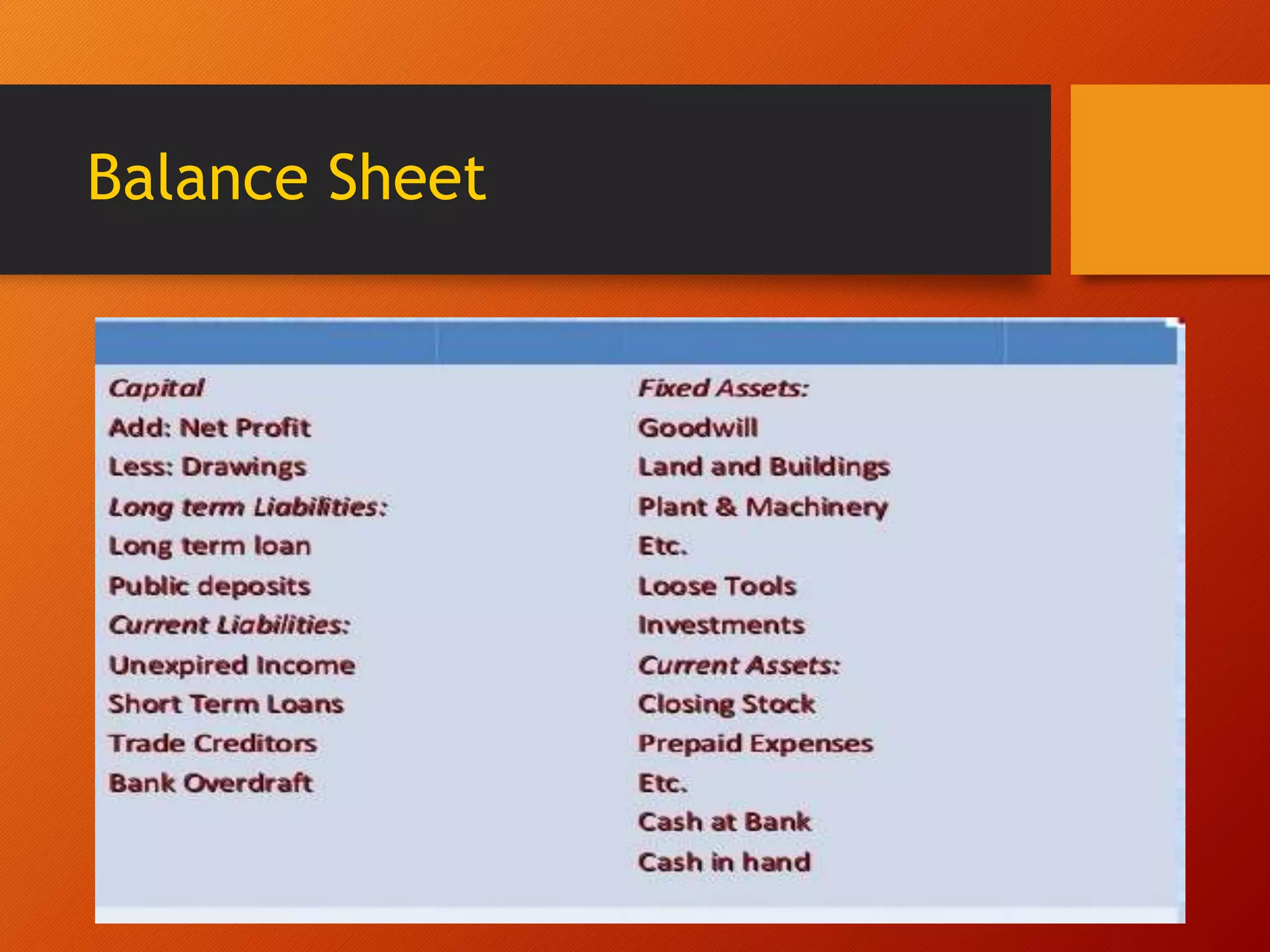

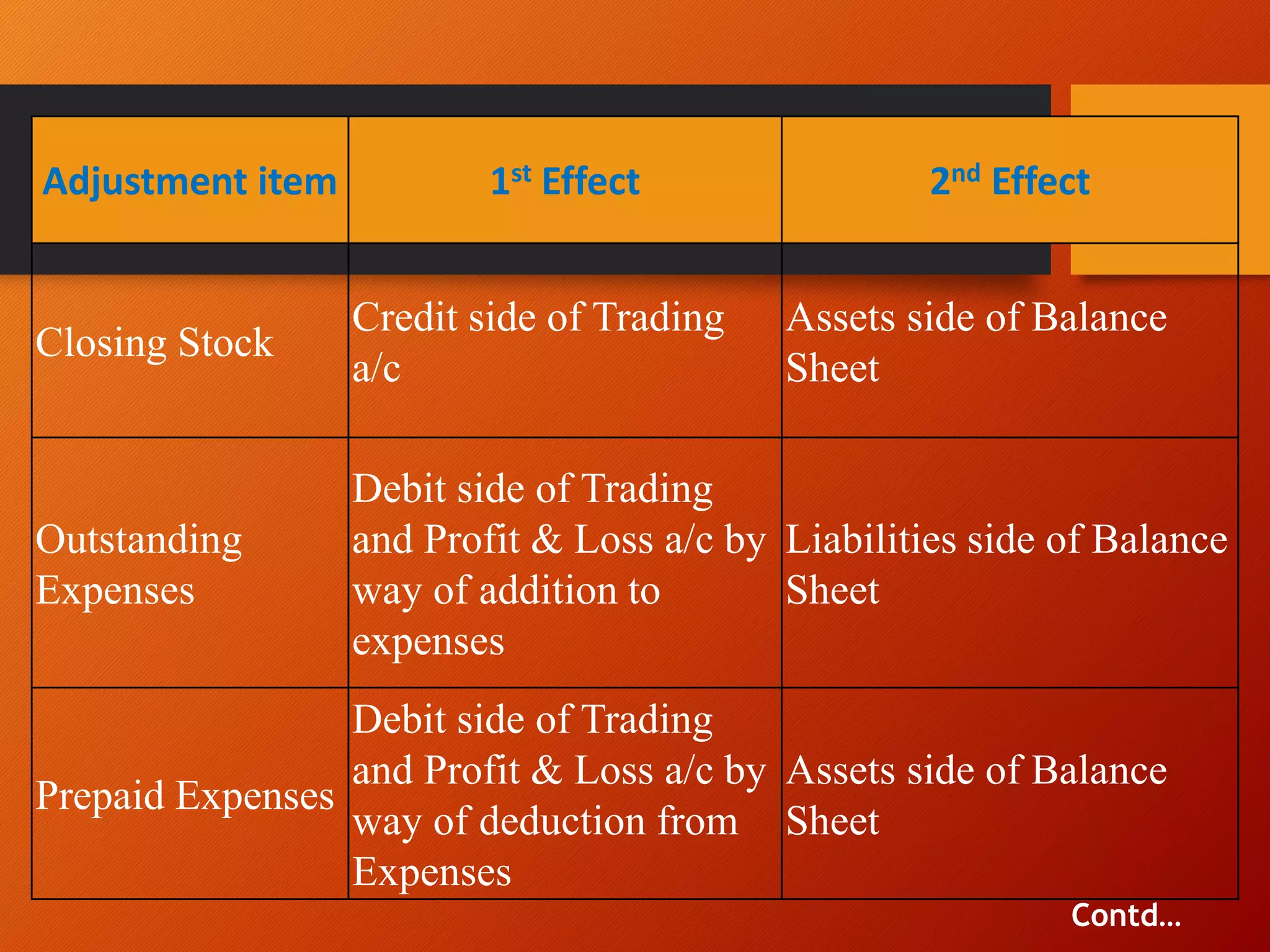

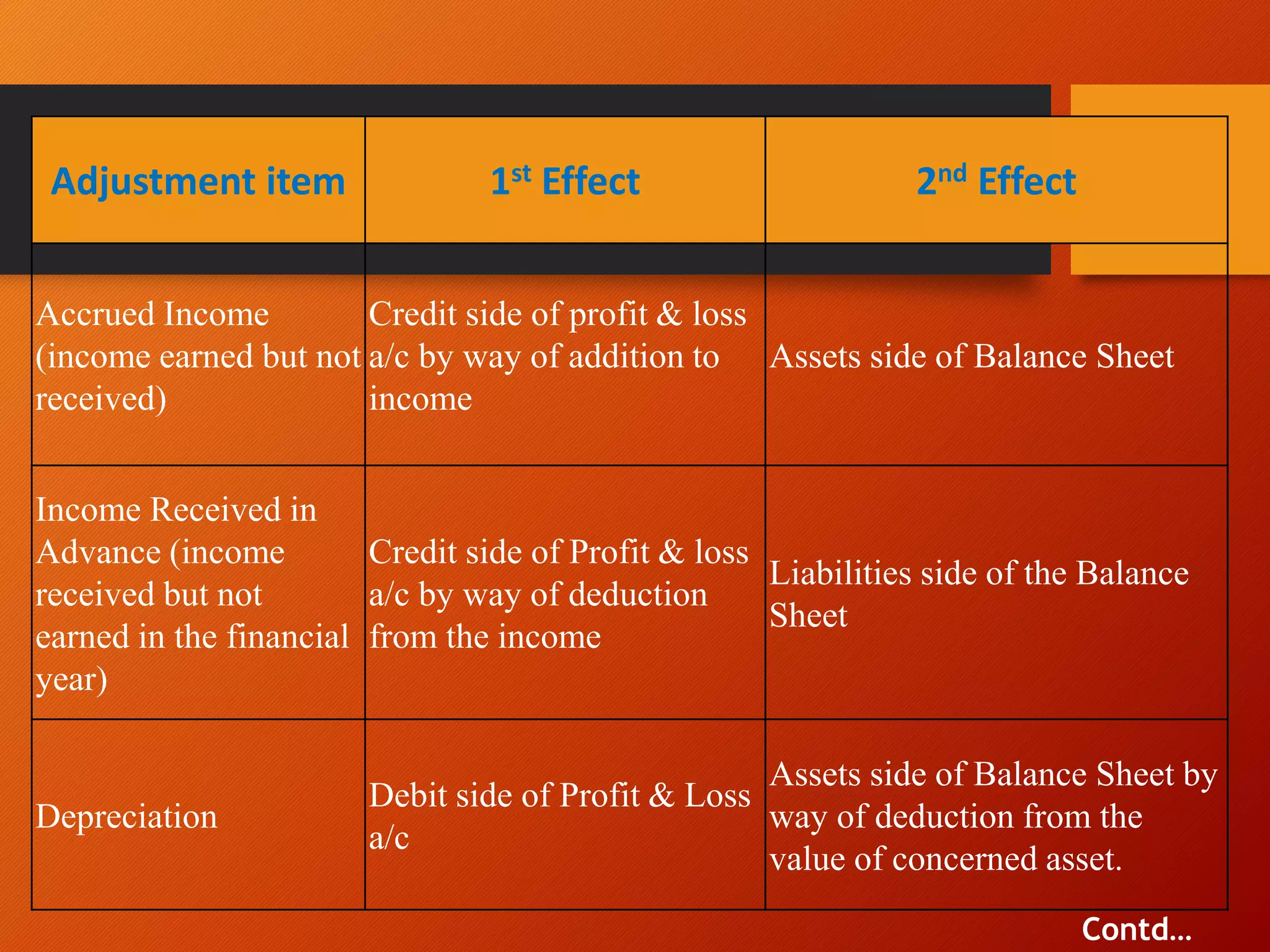

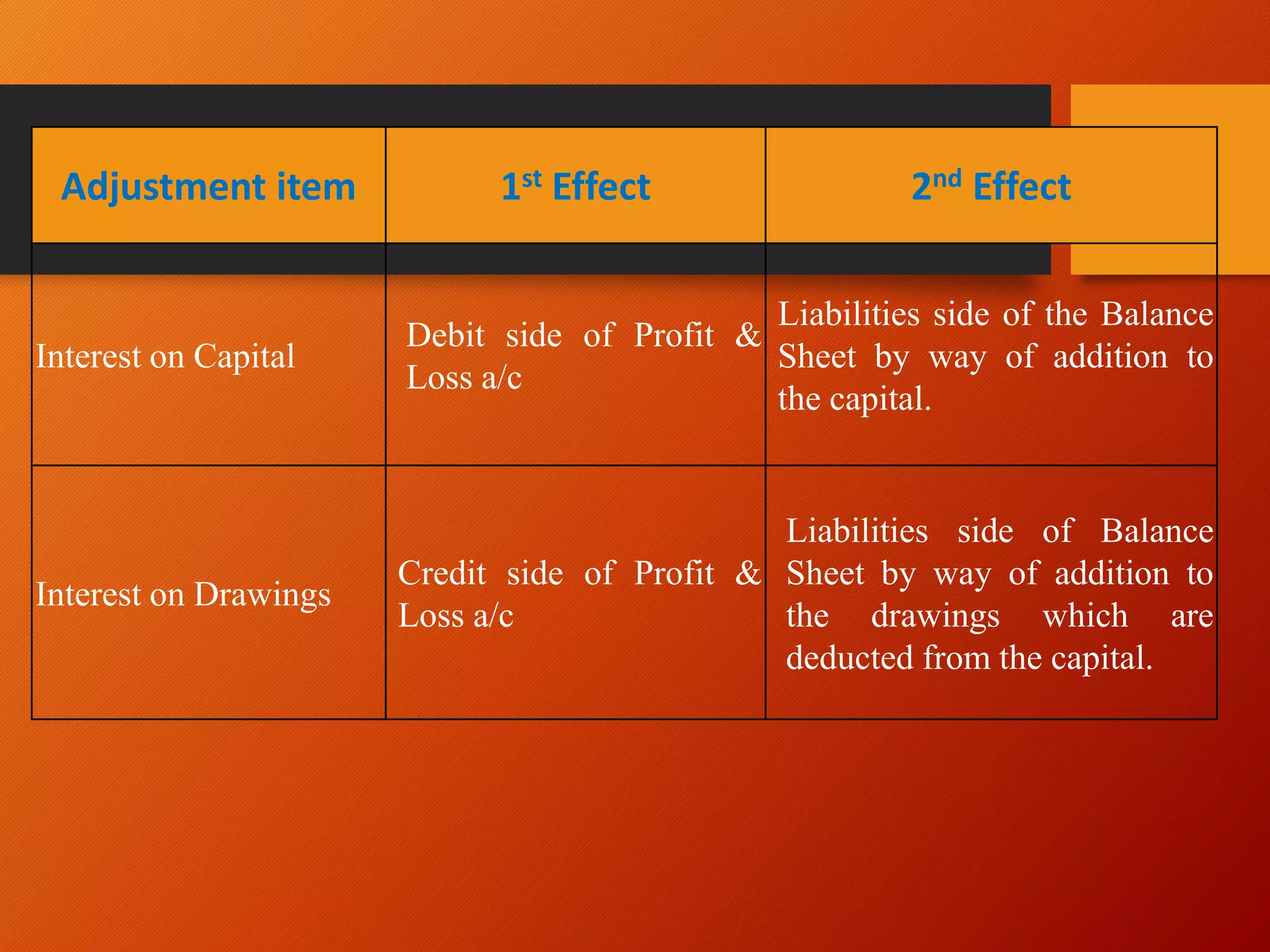

The document provides an overview of final accounts preparation, including trading accounts, profit and loss accounts, and balance sheets, detailing their components and adjustments necessary for accurate financial reporting. Key objectives include determining profit or loss from business operations and understanding the financial position at year-end. Adjustments such as closing stock, outstanding expenses, and depreciation are discussed to illustrate their impacts on the final accounts.