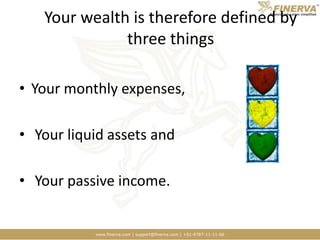

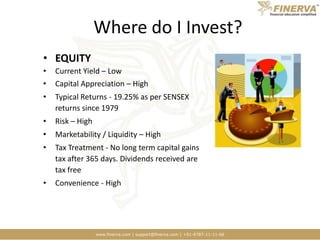

This document provides strategies for wealth creation and management. It discusses key concepts like assets, liabilities, growth, risk, and definitions of wealth. Specific investment options are outlined like equity, bank deposits, and mutual funds. The mantra emphasized is to start investing and taking advantage of compounding returns early. Wealth is defined as being able to sustain one's lifestyle without working through liquid assets and passive income exceeding monthly expenses.