This document contains advice from Robert Kiyosaki's book "Rich Dad Poor Dad" on building wealth and financial intelligence. Some of the key points include:

- Proper exercise increases health and proper mental exercise increases wealth

- The difference between being broke and being poor is that broke is temporary while poor is eternal

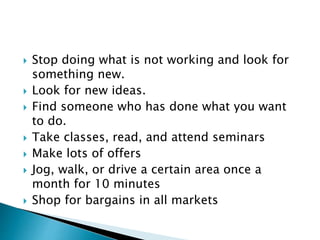

- True learning requires energy, passion and a burning desire to overcome obstacles like fear and ignorance

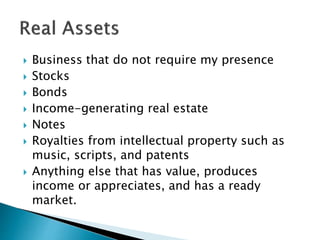

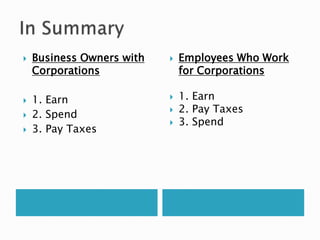

- The poor and middle class work for money while the rich have money work for them through assets

- Financial intelligence is recognizing opportunities and acquiring assets that generate income rather than liabilities that cost money