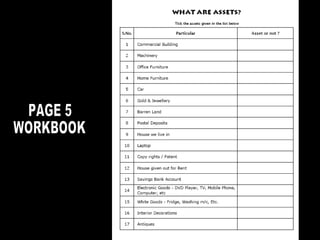

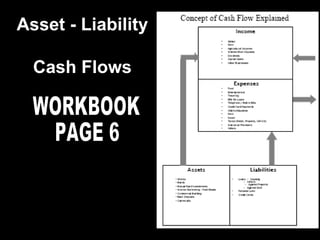

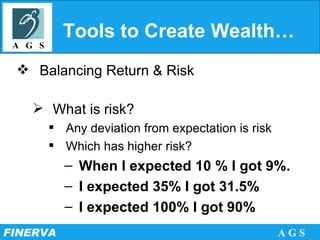

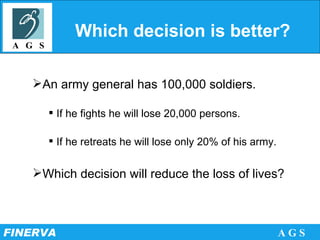

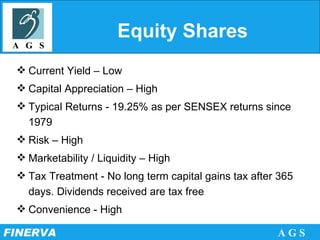

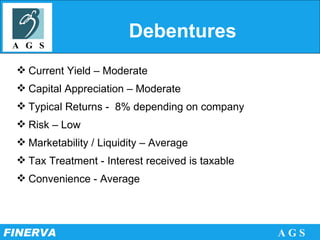

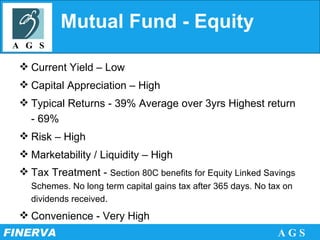

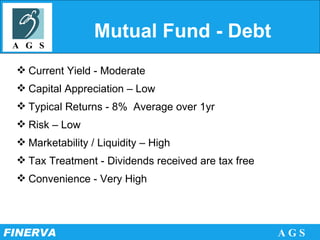

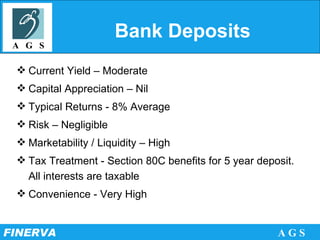

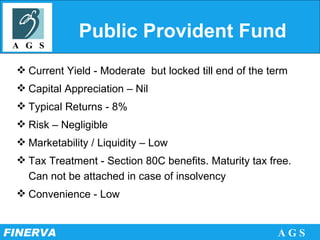

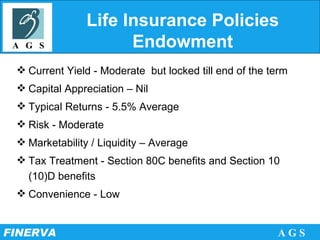

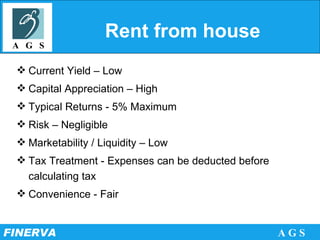

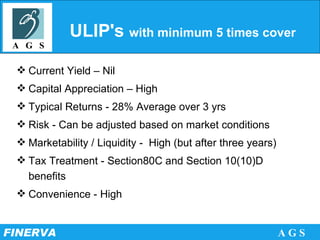

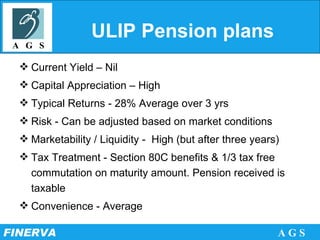

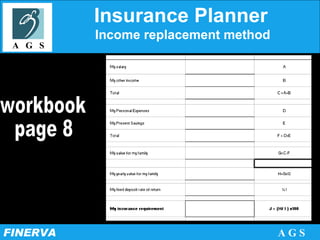

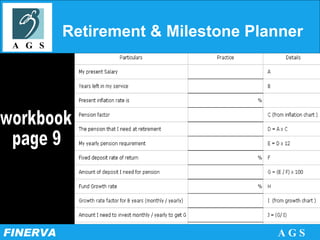

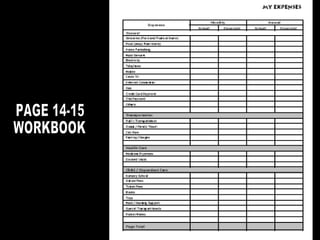

This document summarizes the agenda and content of a personal finance workshop. The workshop covers tools for creating wealth such as cash flow analysis and balancing risks and returns in investments. It also discusses budgeting myths and creating a budget to have surplus funds for goals. Various investment options like equity, debt funds, bank deposits, real estate, etc. are compared in terms of returns, risks, tax treatment and other factors. Retirement and insurance planning tools are also introduced.