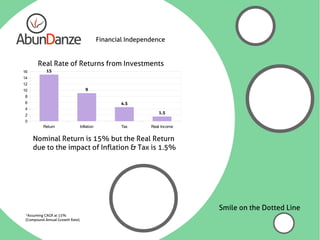

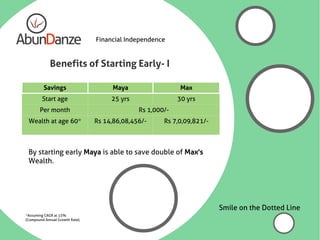

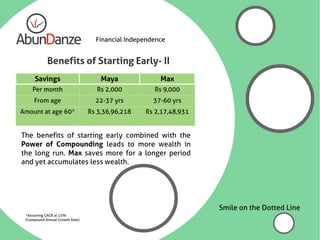

The document emphasizes the importance of starting early on the path to financial independence by establishing clear investment objectives and employing effective strategies. It highlights the impact of inflation on real income and the benefits of compound interest, illustrating that starting savings at a younger age can lead to significantly greater wealth accumulation. The overall message is to plan in advance and make informed investment choices to achieve financial goals.