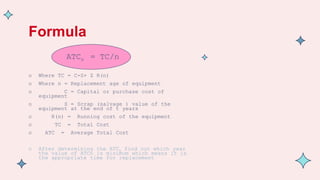

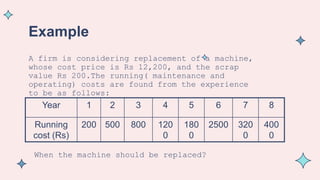

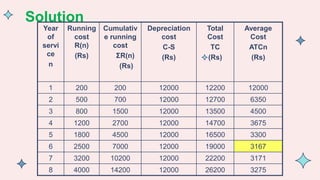

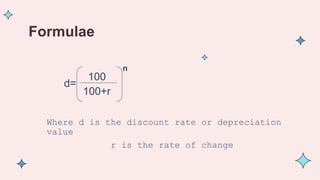

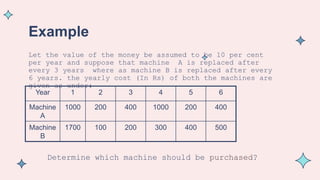

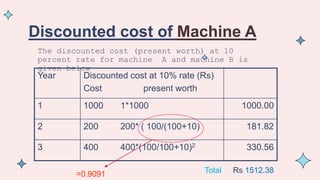

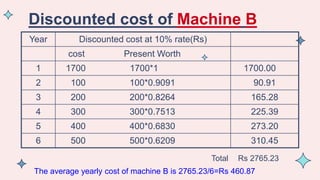

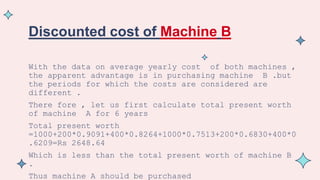

This document discusses replacement theory and models for replacing equipment. It presents two types of equipment failure: gradual failure and sudden failure. It then describes six replacement models: 1) constant-interval replacement policy, 2) age-based replacement policy, 3) time-based replacement policy, 4) inspection replacement policy, 5) modified-age replacement policy, and 6) block replacement policy. It also provides examples of Model 1, which considers running costs that increase over time when the value of money is constant, and Model 2, which accounts for both increasing running costs and a changing value of money over time. The examples calculate the discounted costs of options to determine the most cost-effective replacement time or equipment.