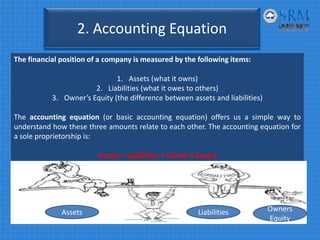

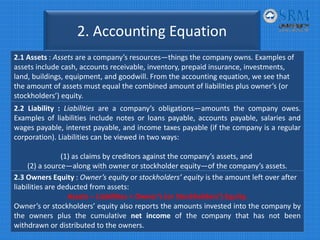

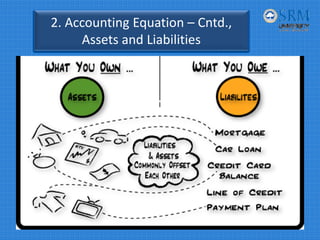

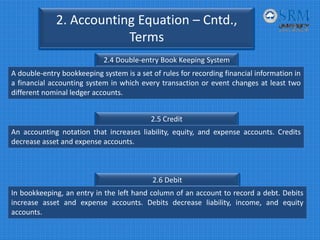

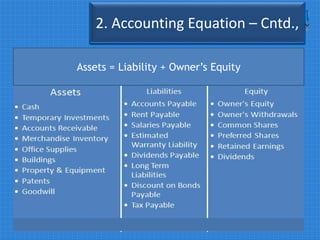

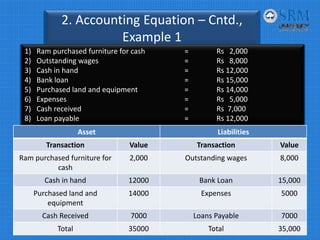

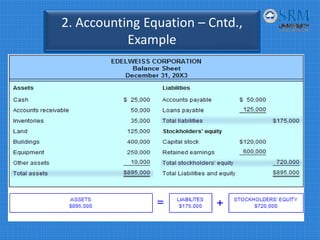

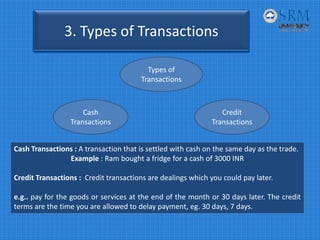

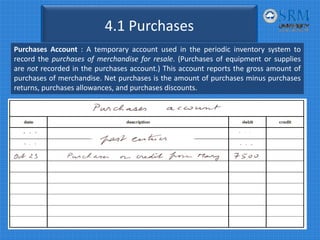

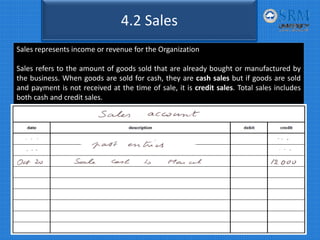

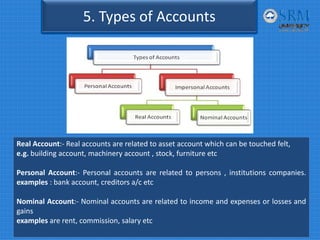

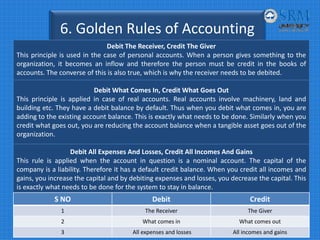

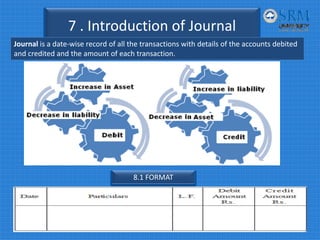

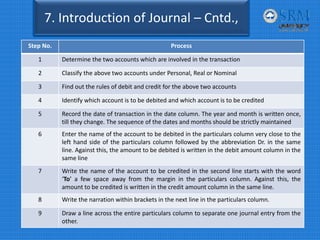

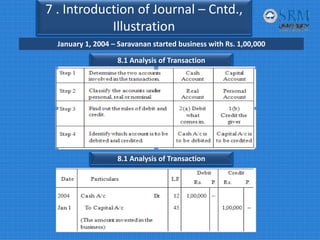

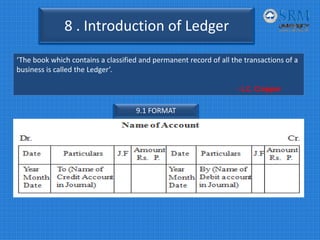

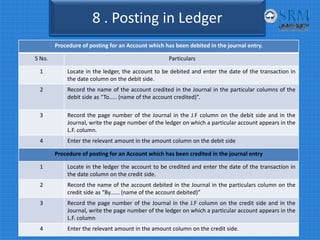

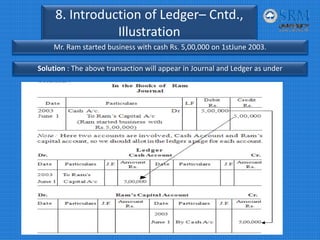

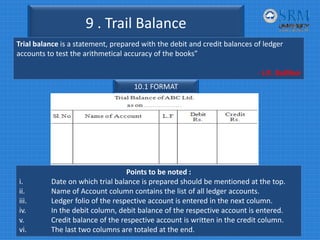

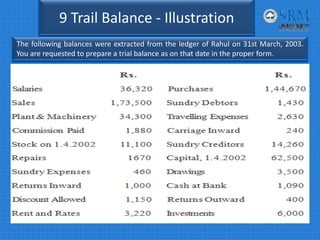

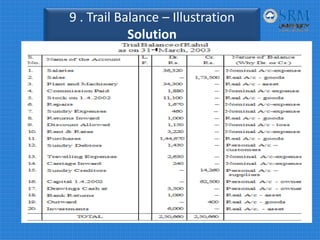

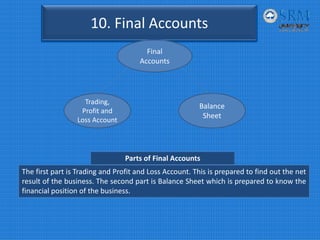

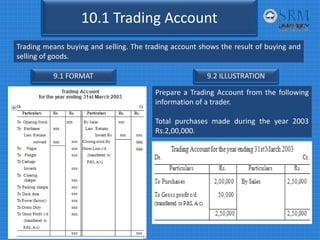

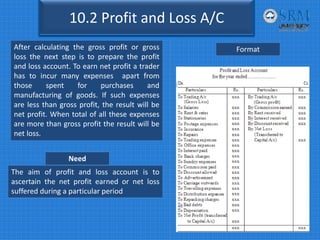

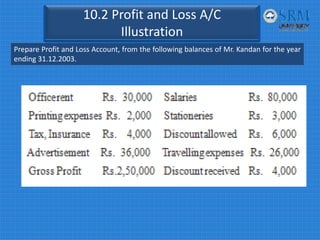

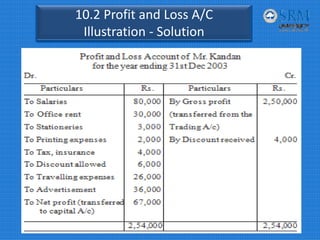

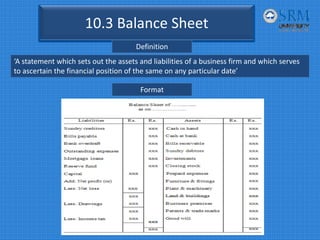

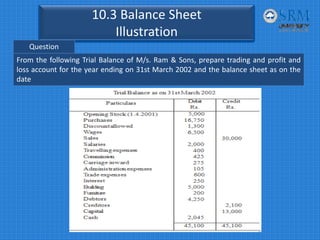

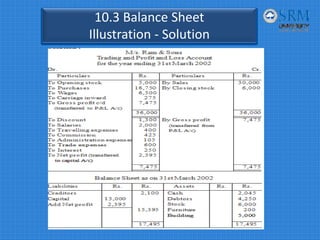

Accounting Basics provides an overview of key accounting concepts for first year MBA students. It defines accounting as identifying, measuring, and communicating economic information to allow for informed judgment and decision making. The document discusses the accounting equation, which shows that assets must equal liabilities plus owner's equity. It also explains debits and credits, the different types of accounts, and the steps for recording transactions in journals and ledgers. Trial balances and final accounts such as trading, profit and loss, and balance sheets are introduced to assess business performance and financial position.