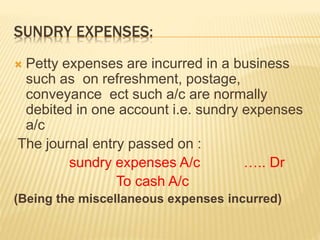

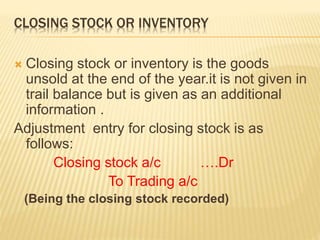

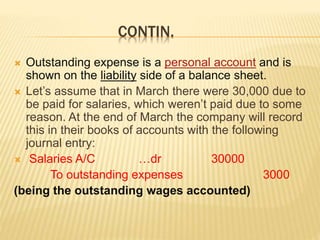

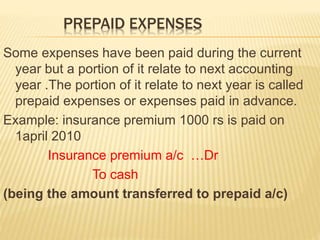

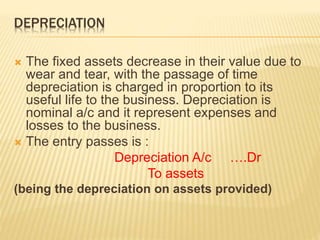

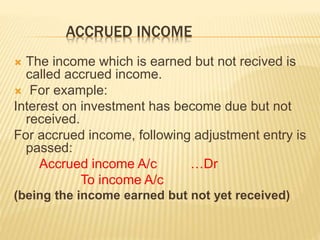

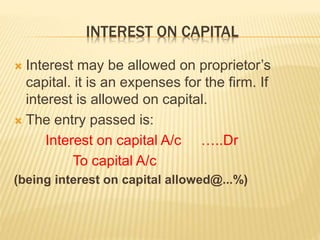

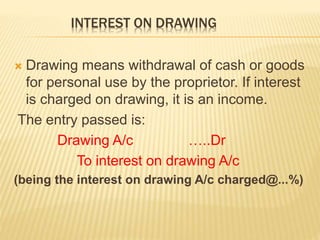

The document discusses various types of journal entries including entries for sundry expenses, closing stock, outstanding expenses, prepaid expenses, depreciation, accrued income, interest on capital, and interest on drawings. It provides examples of each type of journal entry, explaining the purpose and accounting treatment for each type of transaction.