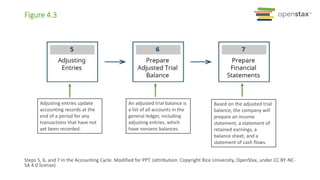

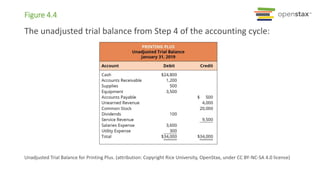

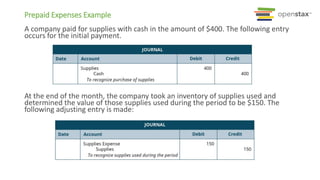

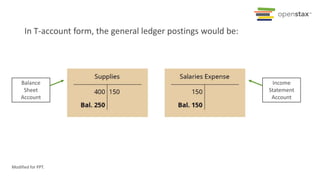

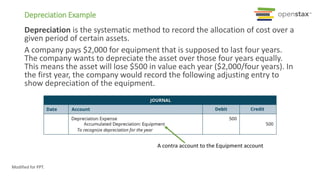

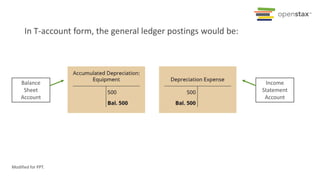

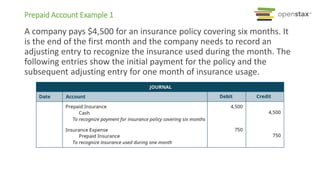

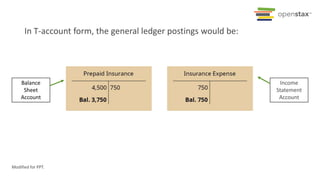

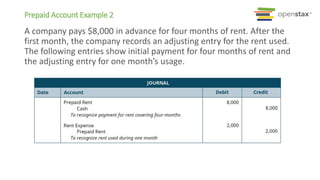

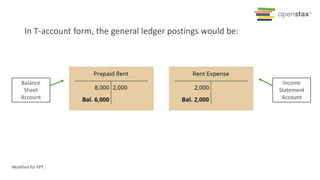

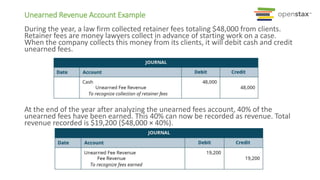

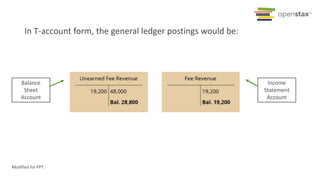

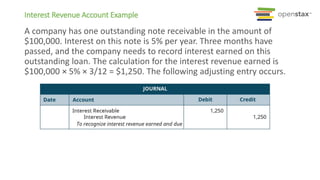

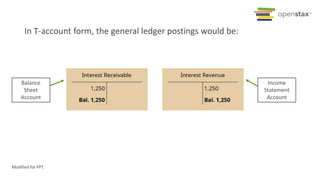

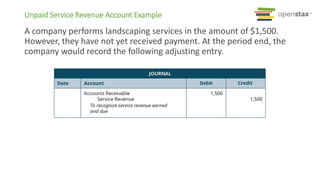

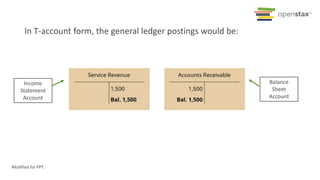

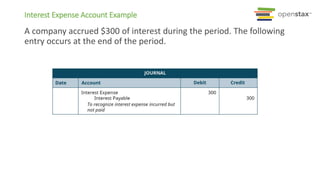

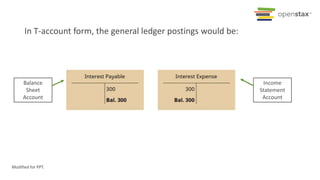

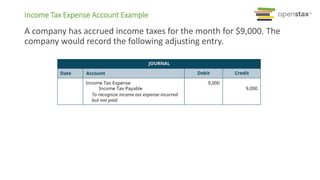

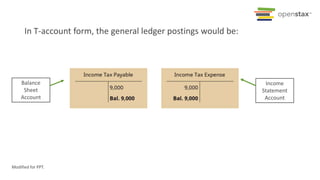

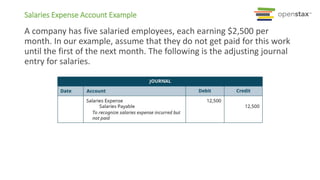

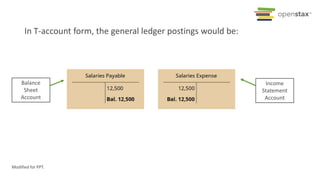

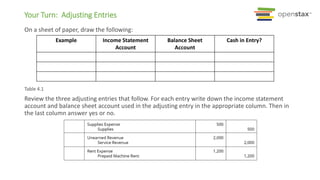

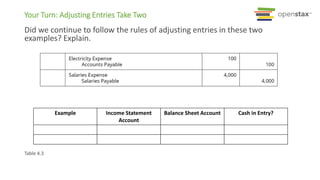

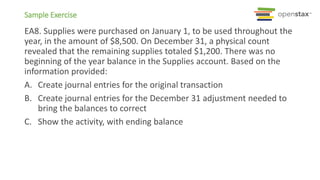

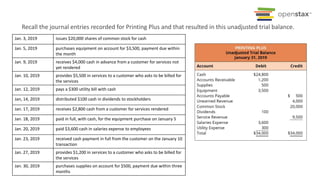

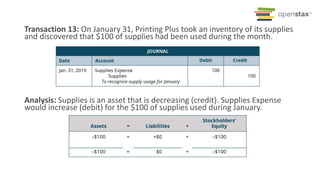

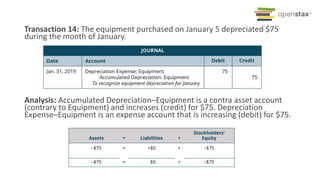

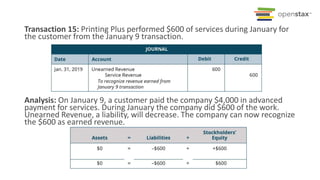

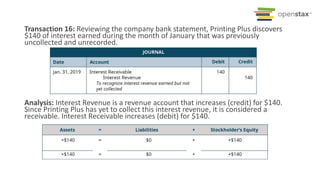

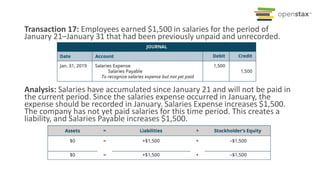

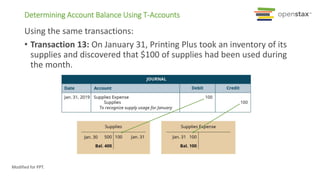

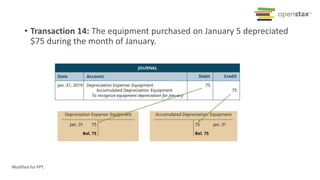

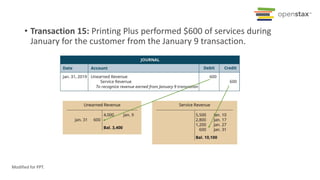

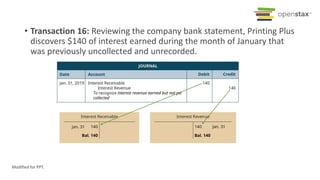

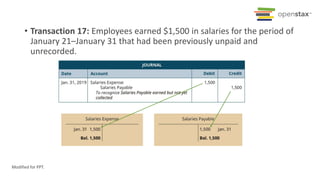

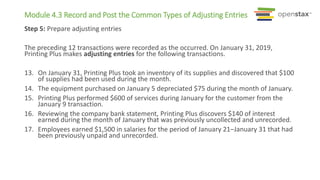

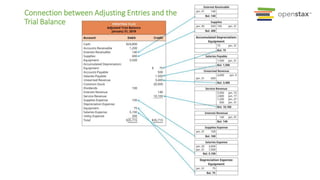

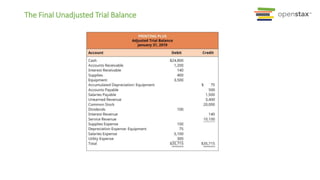

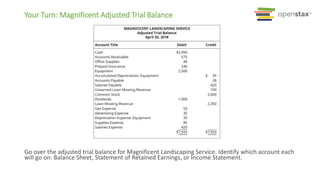

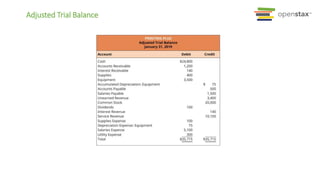

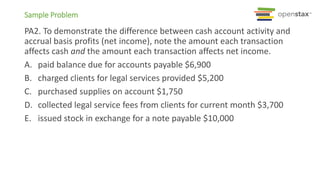

This document discusses adjusting entries in accounting. It explains that adjusting entries are necessary at the end of an accounting period to update accounts for transactions that have occurred but not yet been recorded. There are two main types of adjusting entries - deferrals and accruals. Deferrals relate to prepaid expenses and unearned revenue, while accruals accumulate revenues and expenses that were incurred in a period but not yet recorded. The document provides examples of prepaid expenses, depreciation, and interest earned to illustrate the adjusting entry process.