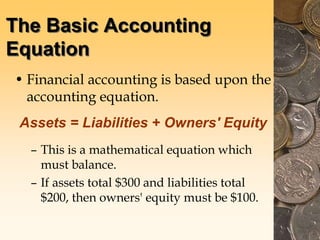

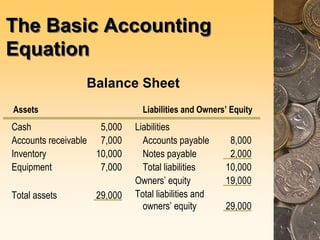

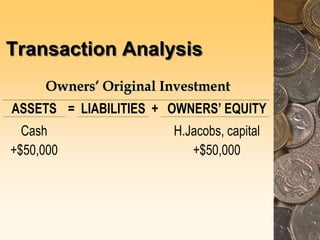

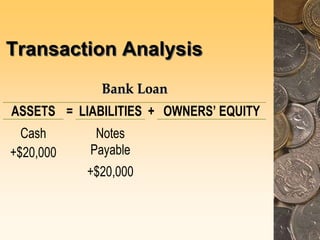

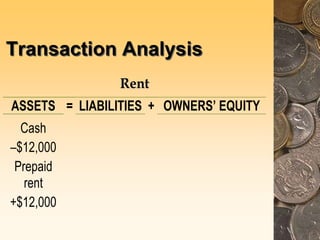

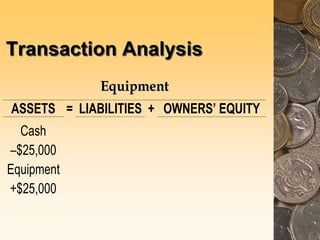

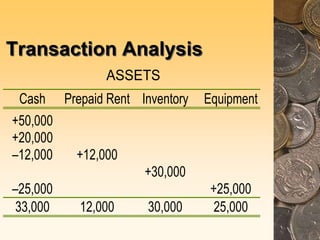

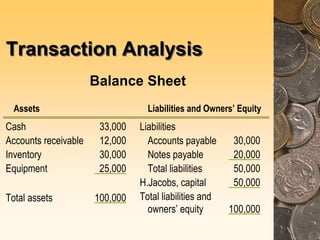

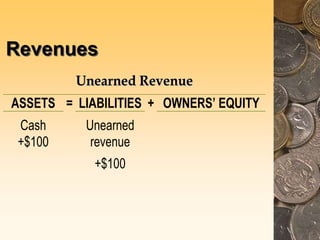

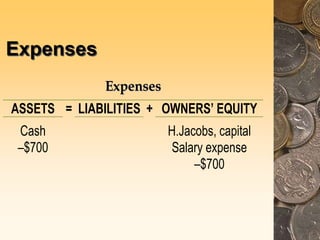

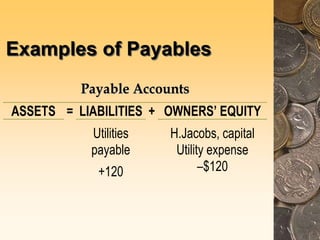

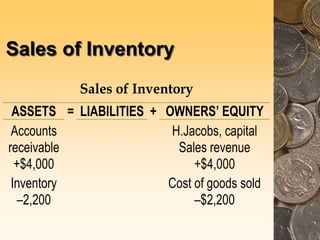

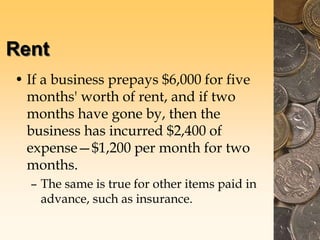

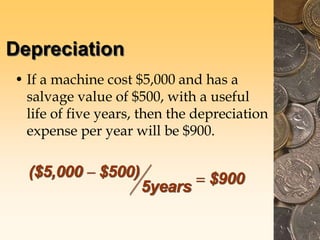

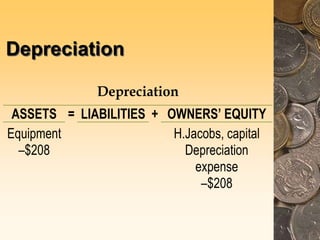

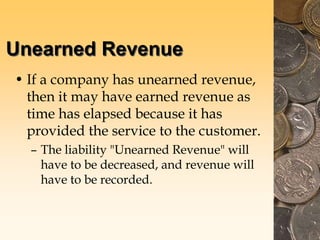

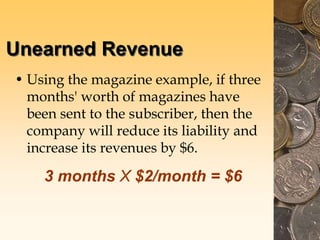

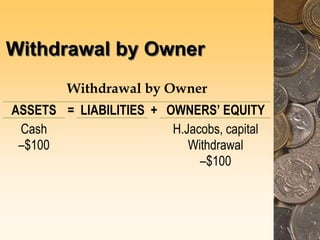

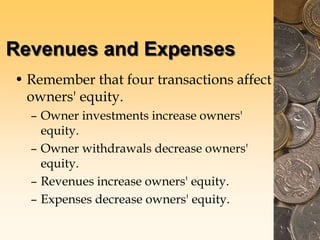

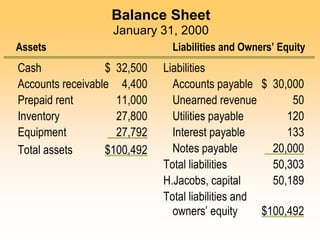

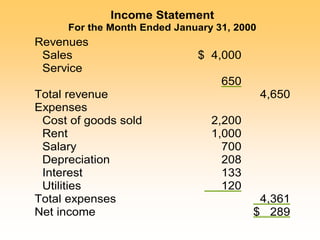

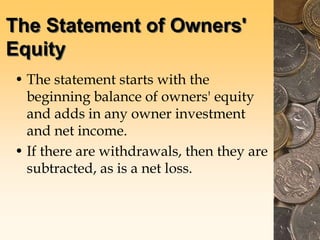

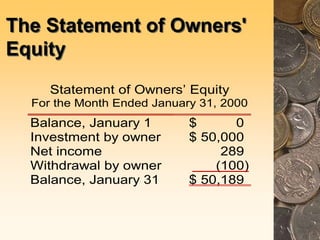

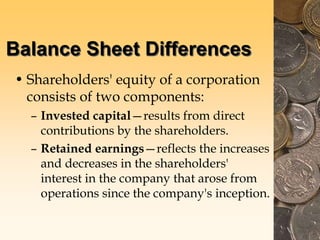

The document discusses key concepts in financial accounting including the accounting equation, assets, liabilities, owners' equity, revenues, expenses, and transactions. It explains that the accounting equation is Assets = Liabilities + Owners' Equity and must always balance. Transactions are analyzed to determine their impact on accounts to maintain the balance of the equation. Revenues increase owners' equity while expenses decrease owners' equity.