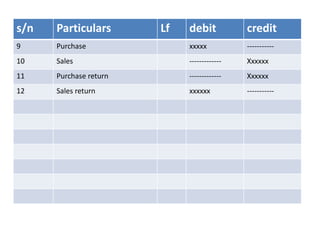

A trial balance is a statement that lists the debit and credit balances of all accounts in the ledger. It is prepared to check the arithmetic accuracy of the books, ensure the double entry of transactions, and provide a list of balances to help prepare the final accounts of profit and loss and balance sheet. Some advantages are that it connects the ledger to final accounts, helps find and correct errors, and serves as the basis for final accounts. Limitations include only applying to double entry systems and being costly for small businesses. The trial balance format lists account titles, debit balances, and credit balances.