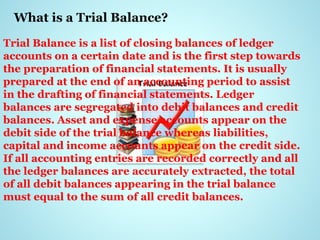

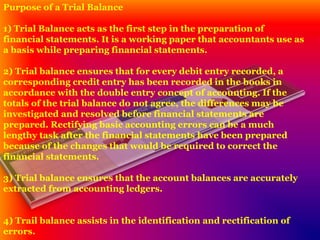

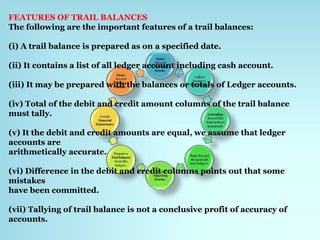

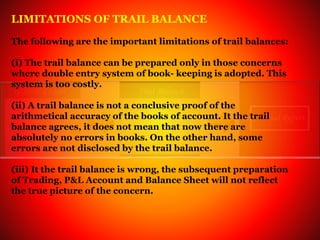

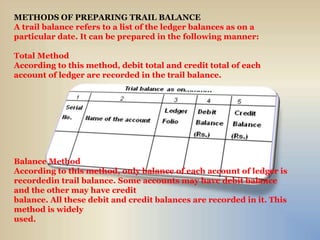

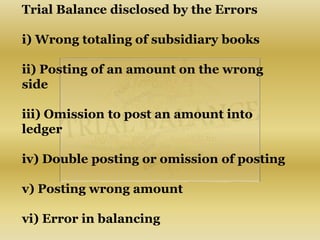

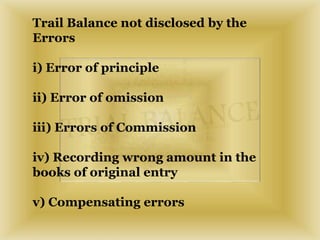

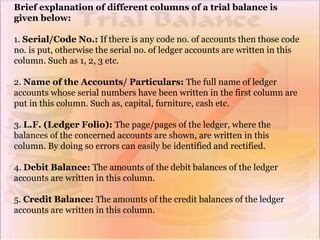

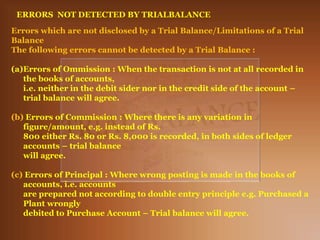

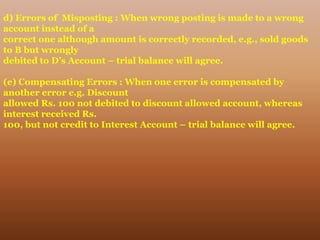

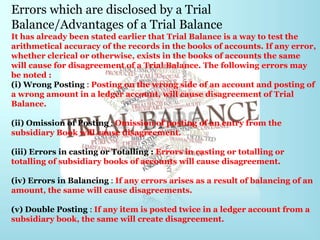

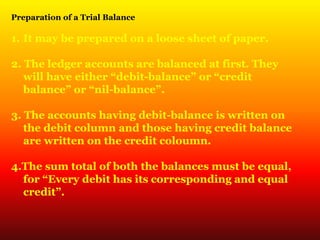

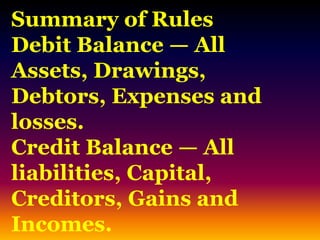

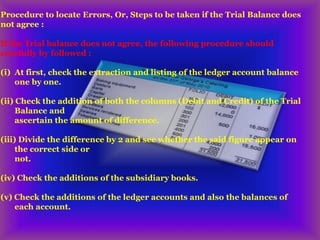

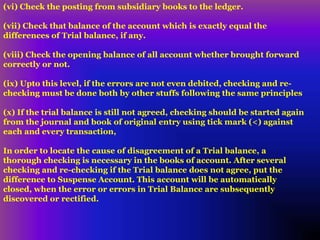

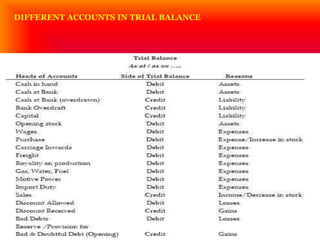

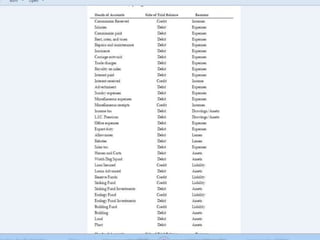

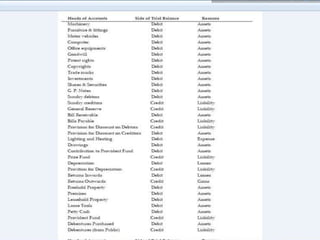

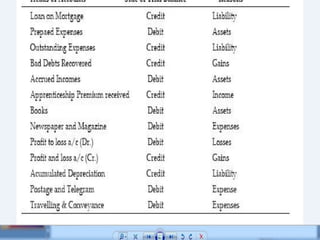

A trial balance is a list of closing ledger account balances that helps in preparing financial statements, ensuring that total debit balances equal total credit balances. It acts as a working paper for accountants and aids in identifying errors, although it does not guarantee the complete accuracy of accounts and has its limitations, such as being unable to detect certain types of errors. The document also outlines methods for preparing a trial balance, features, and procedures for locating discrepancies.

![9

This presentation is owned by

ABUL KALAM AZAD PATWARY

“for class 9-10[accounting]”](https://image.slidesharecdn.com/accounting-chapter-9-150209050322-conversion-gate01/85/Accounting-chapter-9-2-320.jpg)