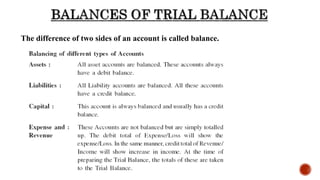

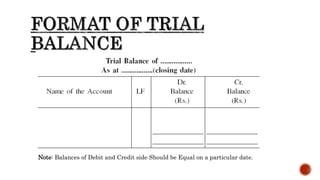

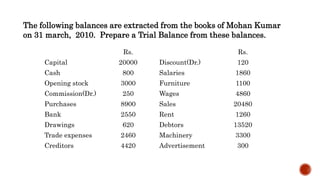

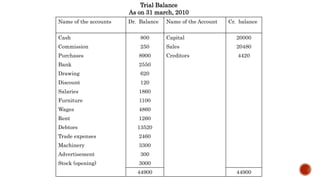

The document discusses a trial balance, which is a list of ledger account balances on a given date arranged in debit and credit columns. A trial balance can help detect certain errors and is used to prepare financial statements. It summarizes balances extracted from the books of Mohan Kumar on March 31, 2010, including assets, expenses, revenues, and equity accounts. The balances are arranged in a trial balance with equal totals of Rs. 44,900 on both sides.