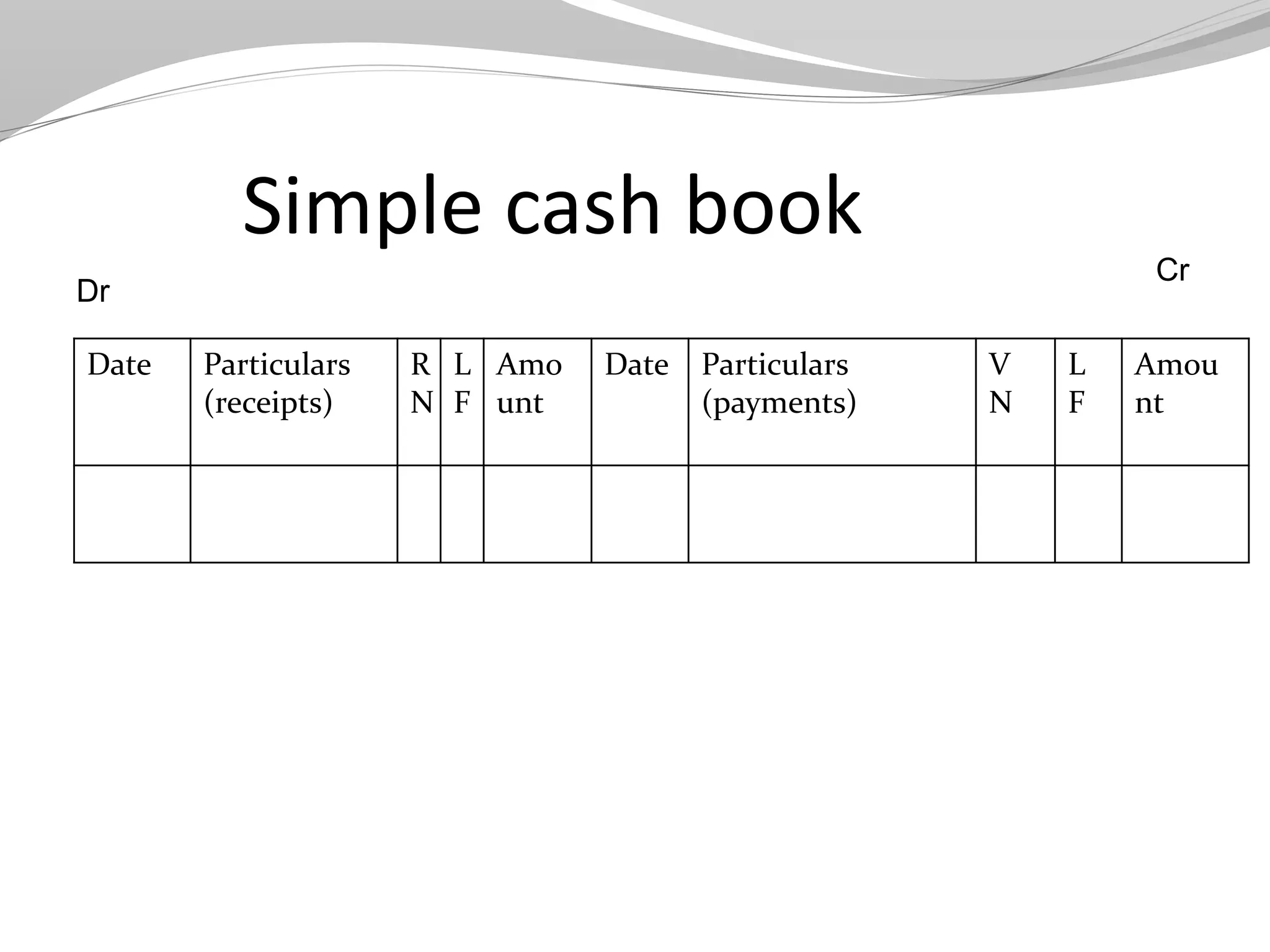

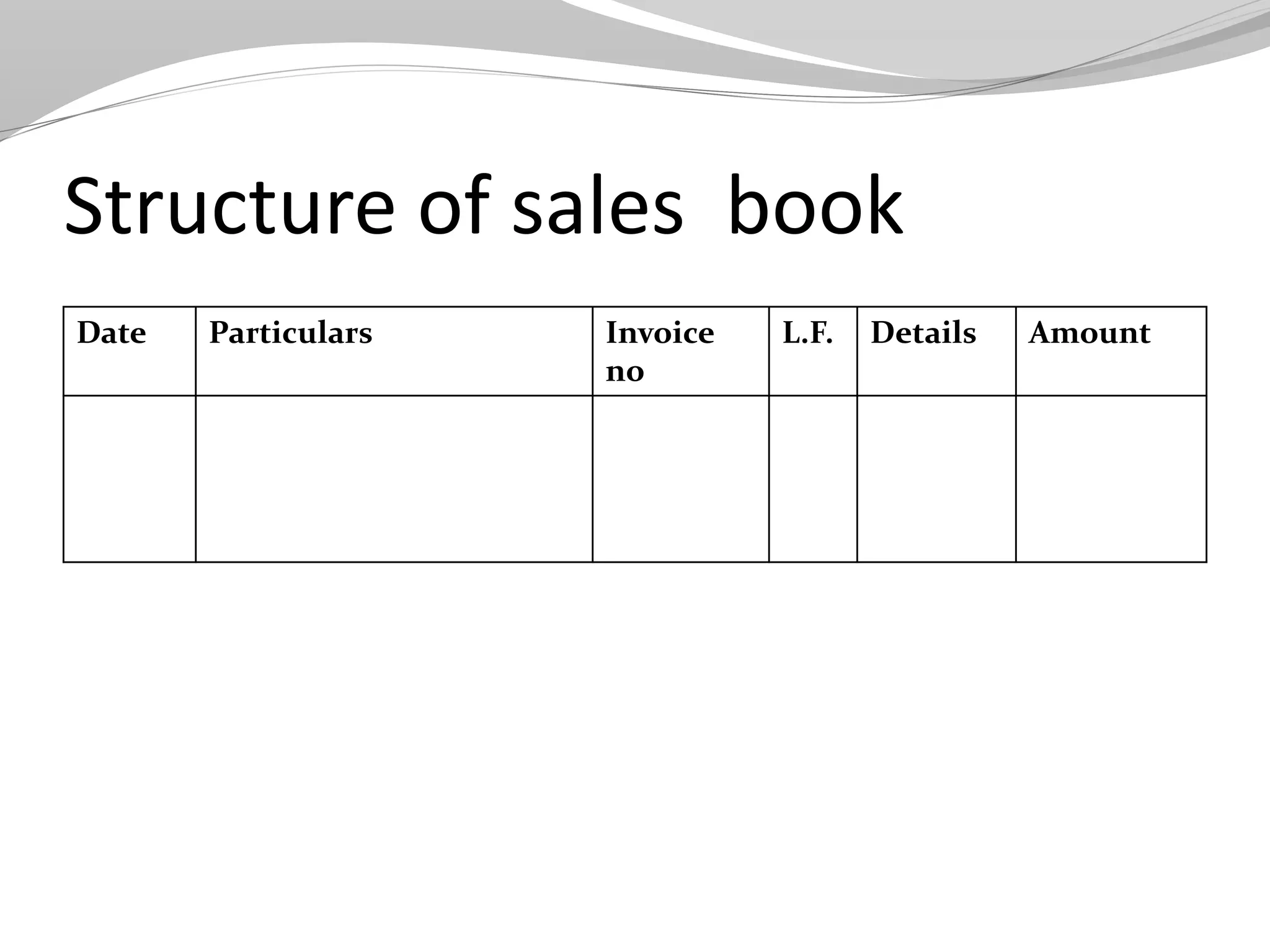

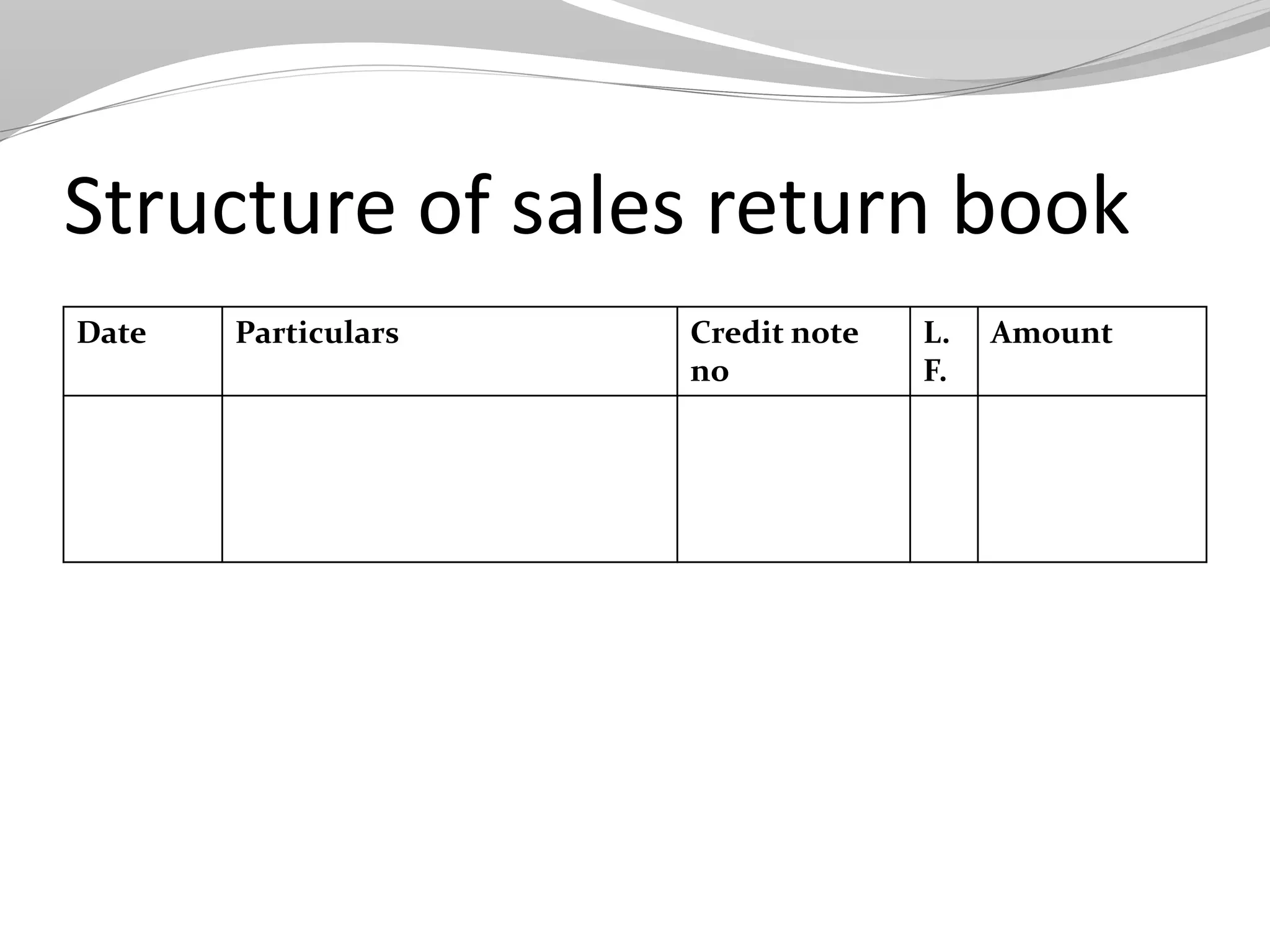

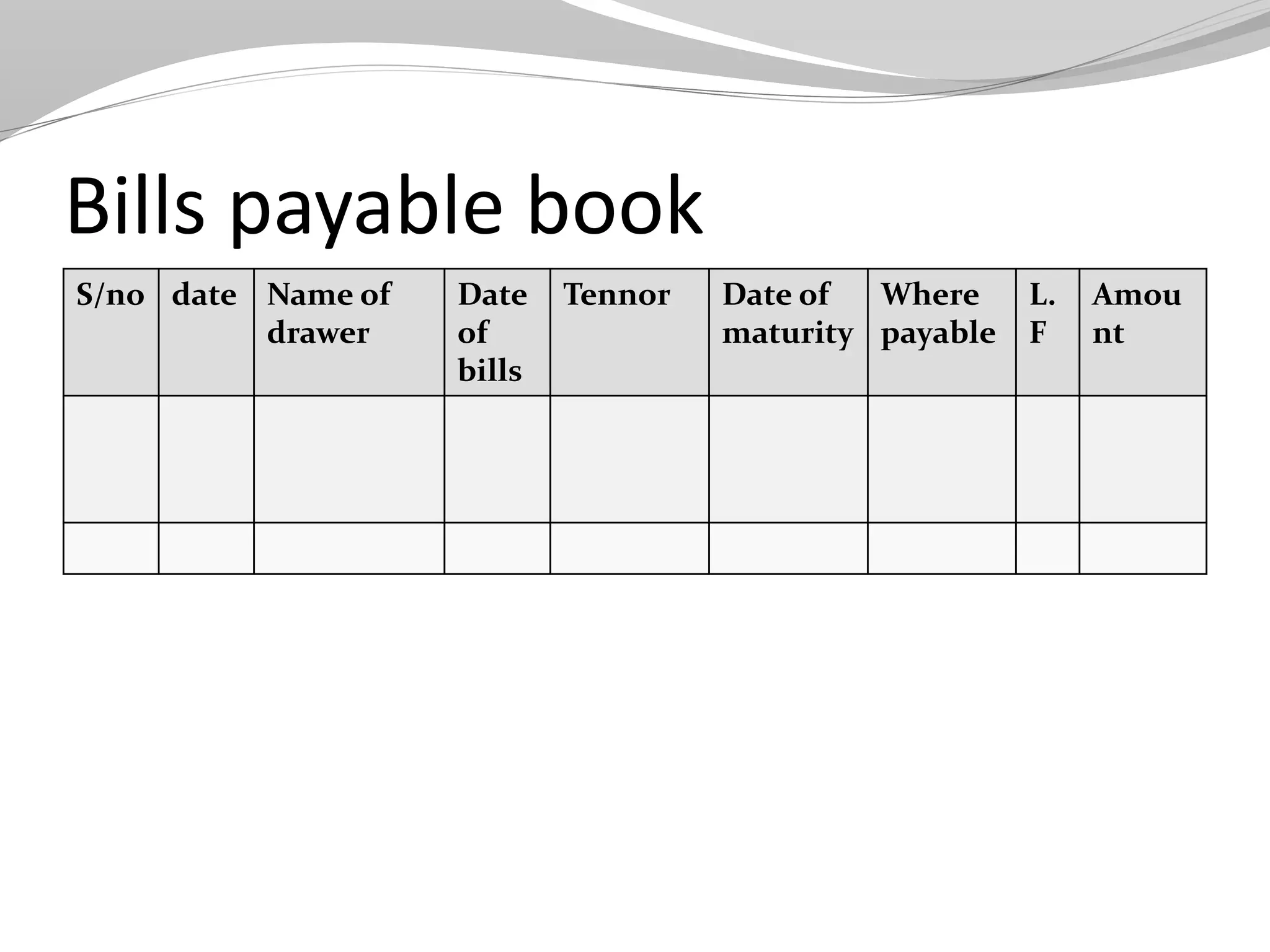

This document discusses various subsidiary books used in accounting. It describes 8 main subsidiary books: cash book, purchase book, sales book, purchase return book, sales return book, bills receivable book, bills payable book, and journal proper. It provides details on the purpose and structure of each book for recording transactions in a specialized and organized manner before posting to the ledger.