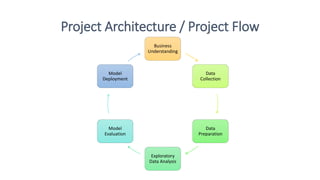

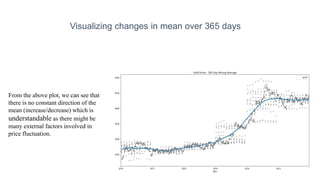

The document outlines a project aimed at forecasting gold prices over the next 30 days using data from 2016 to 2021, with the objective of assisting gold exporting and importing companies in anticipating price movements. It covers various aspects such as data collection, exploratory data analysis, modeling techniques like ARIMA and SARIMA, and the challenges the team faced during development. Ultimately, the project emphasizes the significance of understanding gold price trends and fluctuations for better revenue management.