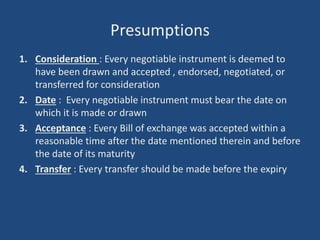

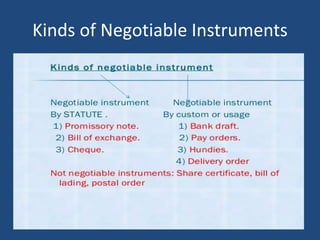

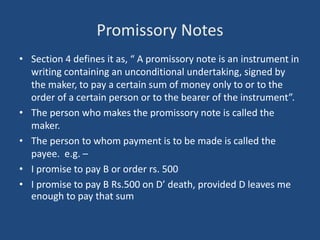

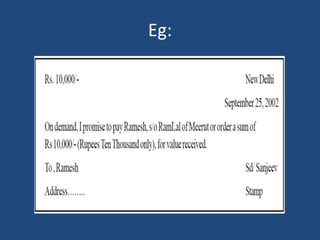

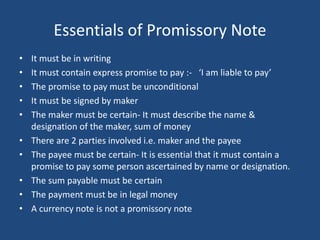

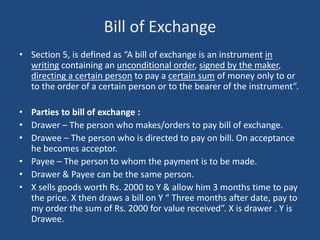

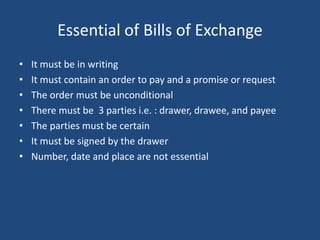

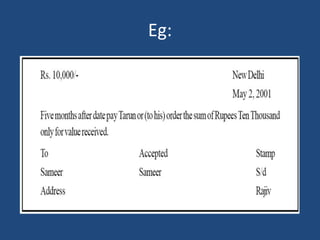

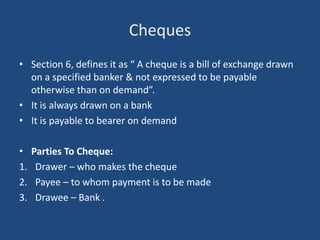

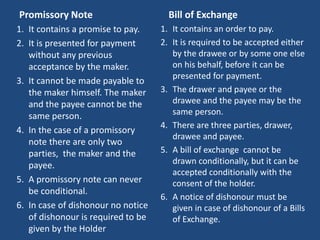

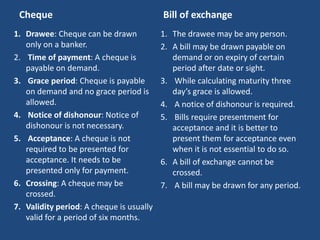

The document discusses negotiable instruments under Indian law. It defines negotiable instruments as written and signed documents that entitle the holder to a specified sum of money and are freely transferable. The three main types of negotiable instruments are promissory notes, bills of exchange, and cheques. Promissory notes contain an unconditional promise to pay, bills of exchange contain an order to pay, and cheques are drawn on a bank and payable on demand. Key characteristics include being in writing, containing an unconditional obligation, and specifying a certain sum payable. Negotiable instruments can be transferred between parties either through negotiation (delivery or endorsement) or assignment.