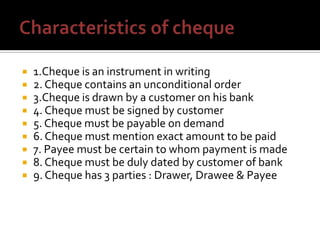

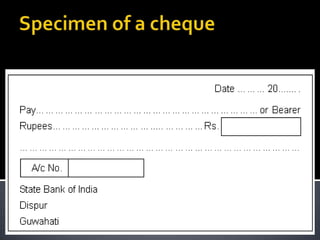

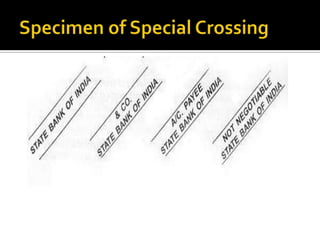

A cheque is a written order from a customer to their bank to pay a specified sum of money to a payee. It has three key parties - the drawer (customer), drawee (bank), and payee (recipient of funds). There are different types of cheques including bearer, open, crossed, generally crossed, specially crossed, not negotiable, and restrictively crossed ("account payee") cheques. Crossed cheques provide more security than open cheques by requiring payment through a bank instead of in cash over the counter.