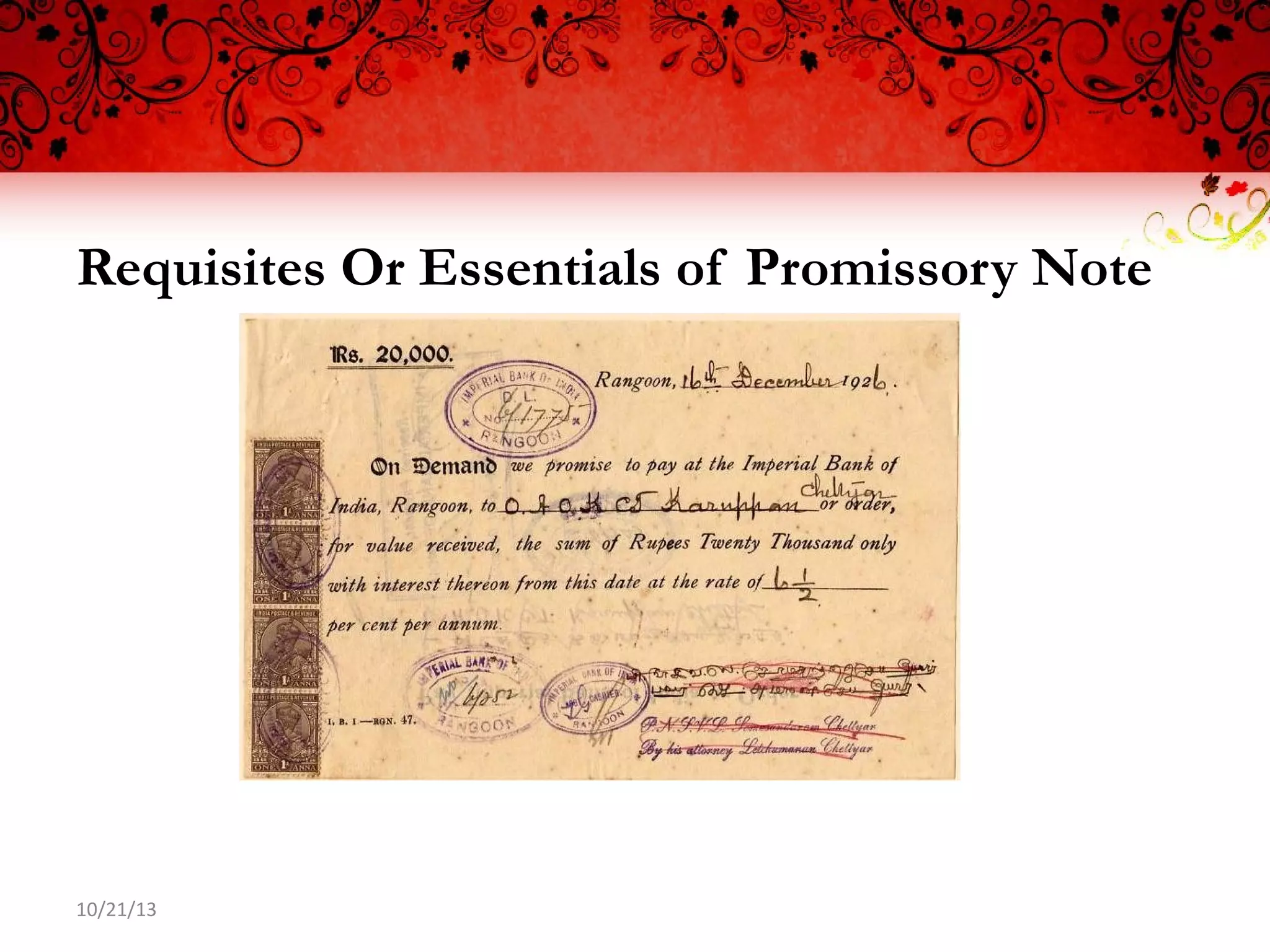

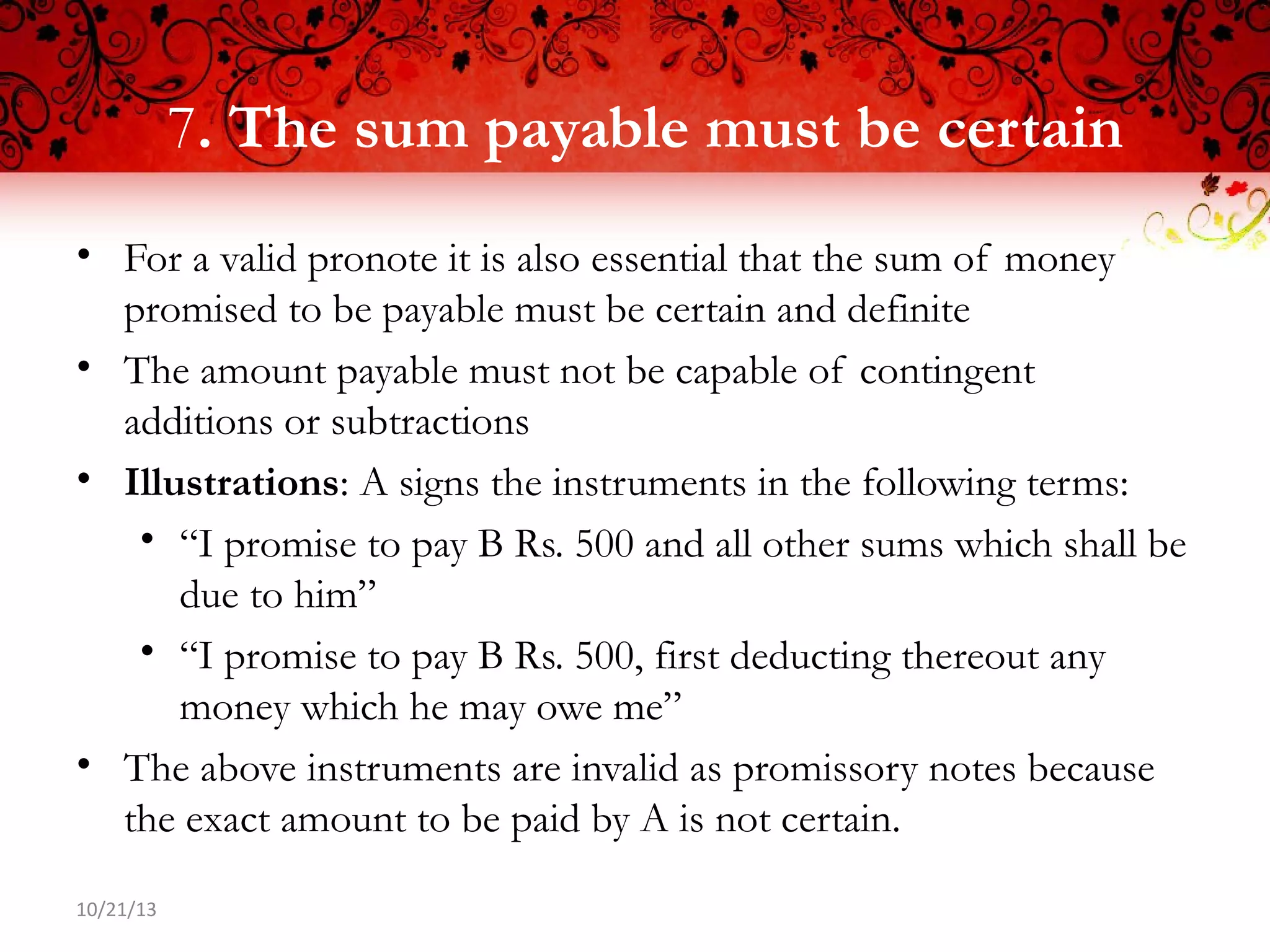

A promissory note is a written instrument containing an unconditional promise by the maker to pay a certain sum of money to a specified individual or bearer. To be valid, it must include certain essentials such as being in writing, containing a clear promise to pay, being signed by a specific maker, and ensuring the sum payable is definite and in legal tender. Examples of invalid promissory notes include those with conditional promises or uncertain payees and amounts.