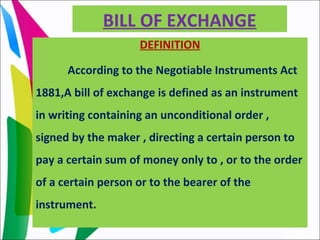

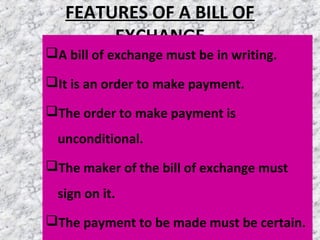

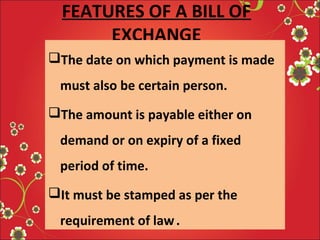

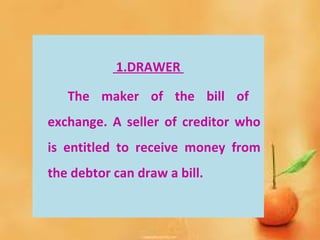

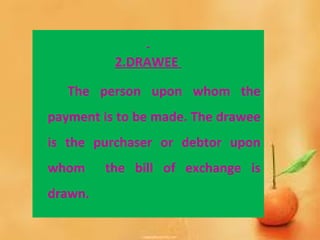

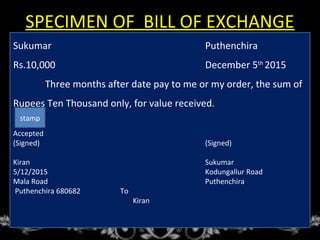

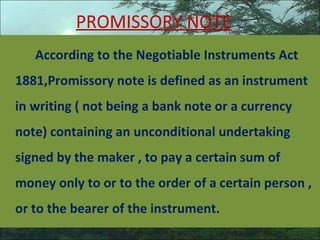

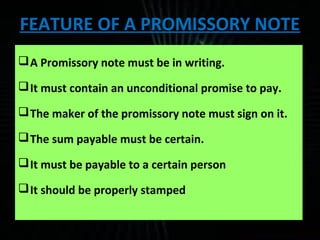

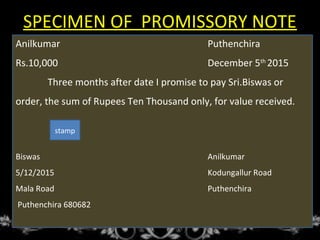

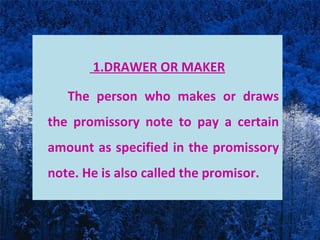

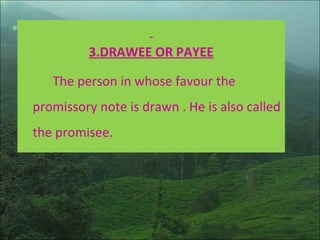

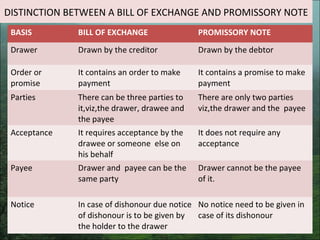

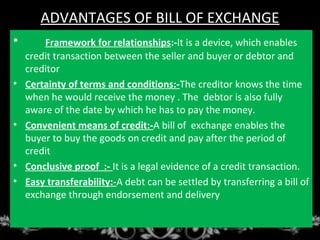

The document discusses bills of exchange and promissory notes under Indian law. It defines bills of exchange and promissory notes, lists their key features and parties involved. A bill of exchange contains an unconditional order to pay, while a promissory note contains an unconditional promise to pay. The document also provides sample formats and distinguishes between bills of exchange and promissory notes. It outlines the advantages of bills of exchange as a means for facilitating credit transactions.