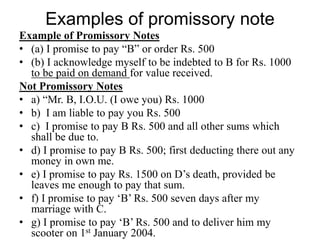

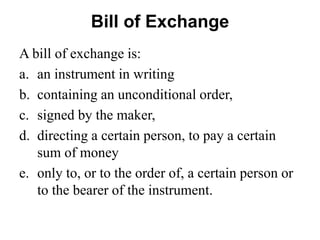

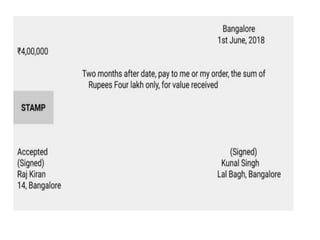

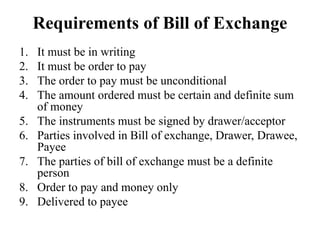

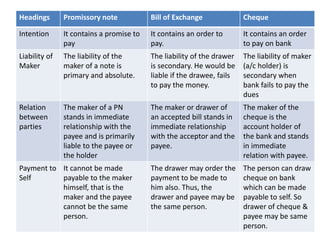

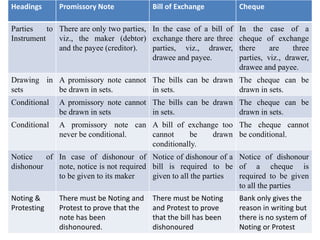

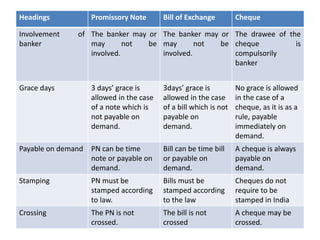

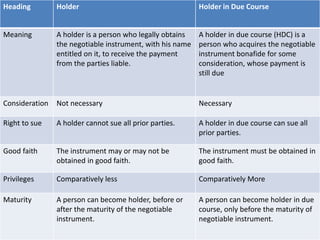

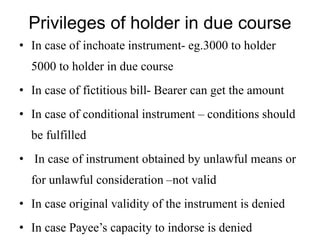

The Negotiable Instruments Act 1881 evolved over many years through several drafts to address objections from the mercantile community regarding deviations from English law. The Act was originally drafted in 1866 but faced issues being passed. It was redrafted in 1877 and again in 1880 on the recommendation of a new law commission. The fourth draft introduced in 1881 became the Negotiable Instruments Act 1881 that is still in force today. The Act governs negotiable instruments like promissory notes, bills of exchange, and cheques by establishing definitions, rights, and liabilities of parties involved.