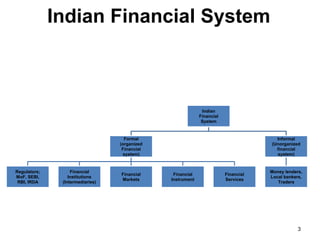

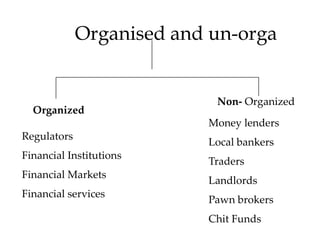

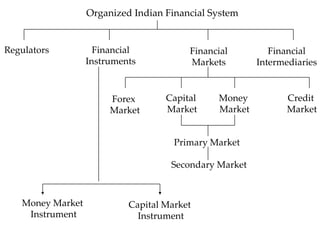

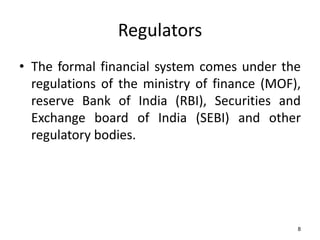

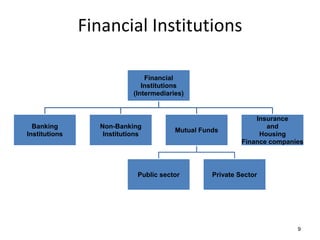

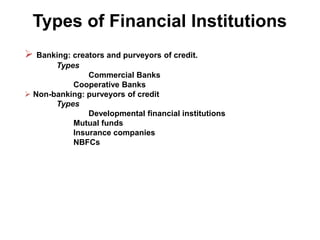

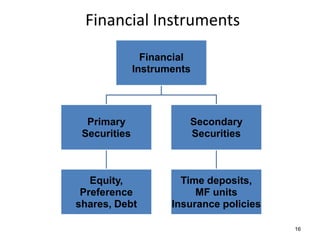

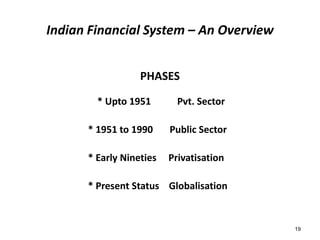

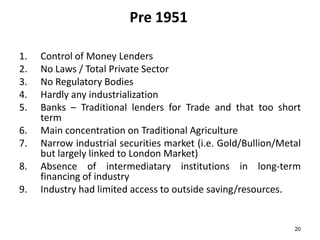

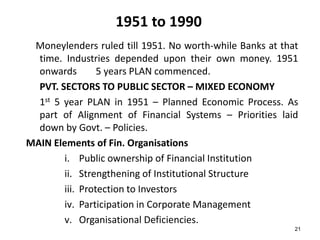

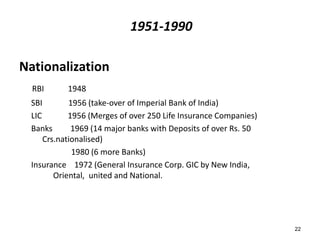

The document provides an overview of the Indian financial system. It discusses that the Indian financial system comprises formal (organized) and informal (unorganized) sectors. The formal sector is regulated and includes various financial institutions, markets, instruments and services. It also discusses the evolution of the Indian financial system from the pre-1951 era dominated by money lenders and traders, to the post-1951 period which saw the development of public sector banks and institutions, and later privatization and globalization in the financial system from the early 1990s onward. Key components of the formal financial system like regulators, financial institutions, markets, instruments and services are also explained.