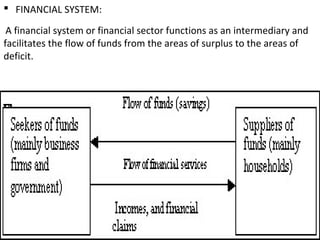

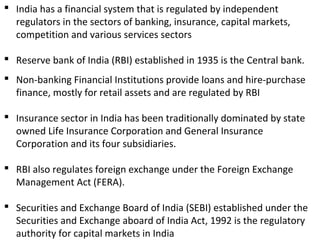

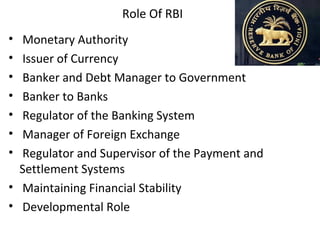

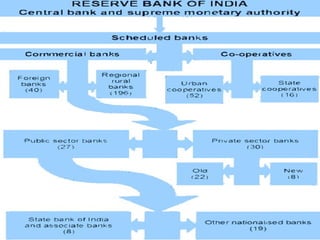

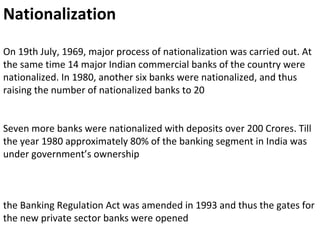

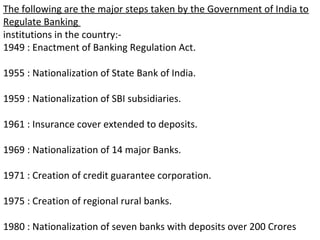

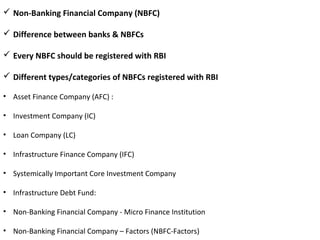

The document summarizes the financial system in India. It discusses the various components of the Indian financial system including banking, insurance, capital markets, and regulatory authorities. It notes that the Reserve Bank of India acts as the central bank and regulates the banking sector, foreign exchange, and payment systems. It also discusses the roles and functions of financial institutions and markets in facilitating the flow of funds from surplus to deficit areas. The reforms of the financial system in the 1990s aimed to make the system more competitive, transparent, and resilient by increasing privatization, deregulation, and improving regulations.