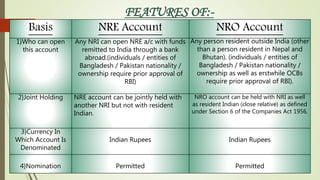

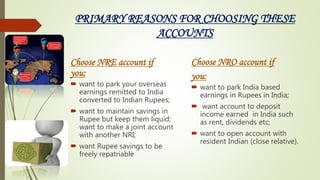

This document provides information about different bank accounts available to Non-Resident Indians (NRIs), including Non-Resident Ordinary (NRO) accounts and Non-Resident External (NRE) accounts. It discusses the key differences between these two account types, such as NRE accounts allowing funds to be freely repatriated outside India while only interest earned on NRO accounts can be repatriated. The document also provides details on eligibility requirements, interest rates, tax treatment, and features of NRO and NRE accounts offered by several Indian banks.