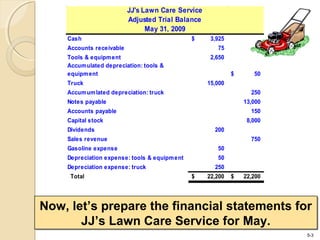

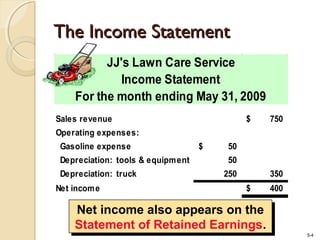

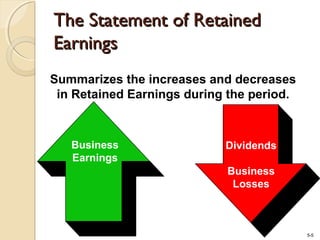

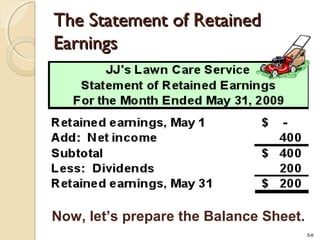

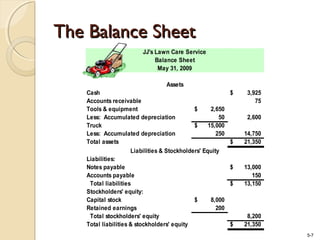

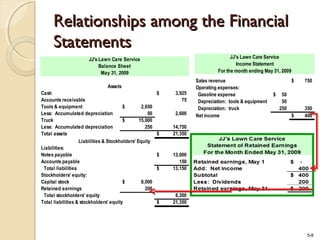

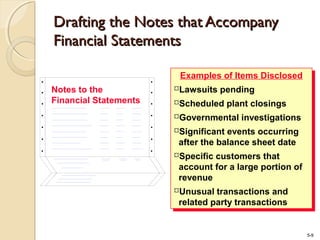

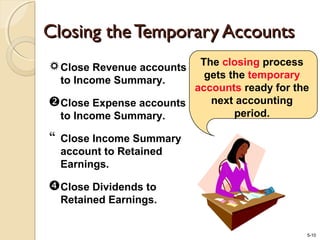

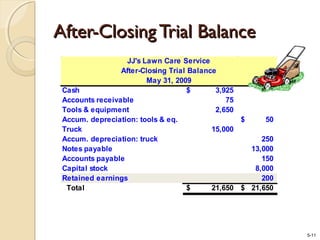

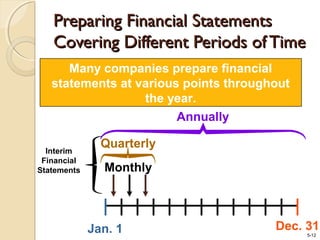

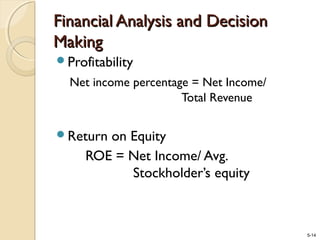

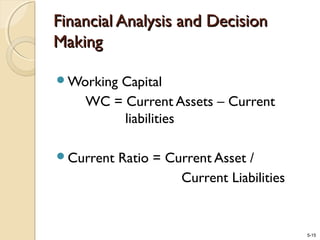

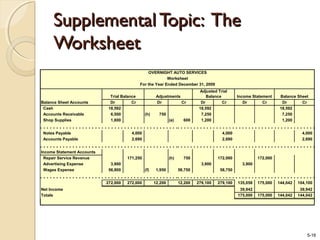

The document discusses the accounting cycle, specifically focusing on the preparation and reporting of financial statements for publicly owned companies. It provides detailed examples of financial statements, including income statements, balance sheets, and the closing processes for temporary accounts. Additionally, it outlines the significance of financial analysis for decision-making and includes self-testing questions at the end.