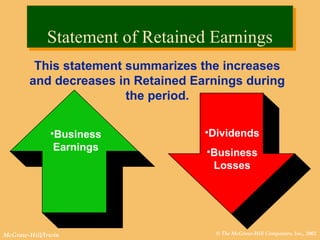

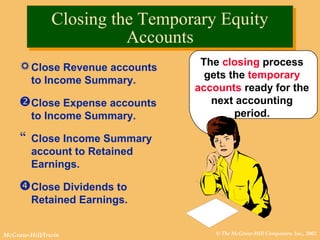

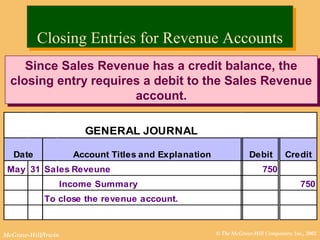

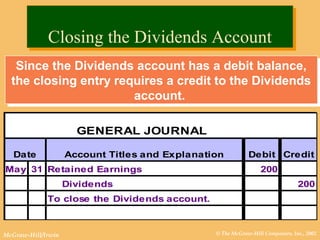

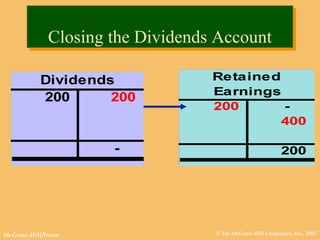

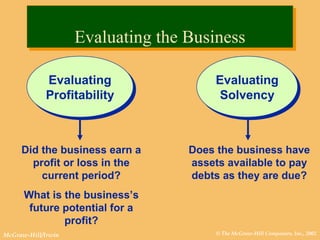

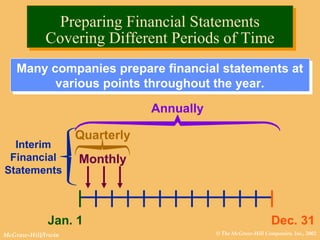

This document discusses the accounting cycle and preparing financial statements. It provides an example of JJ's Lawn Care Service adjusting trial balance, income statement, statement of retained earnings, balance sheet, and statement of cash flows for May. It then discusses closing entries, evaluating the business using financial statements, and preparing interim financial statements at different points in the year.