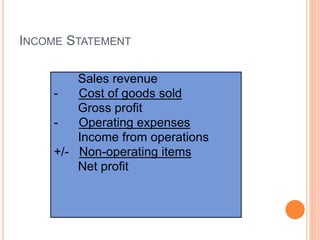

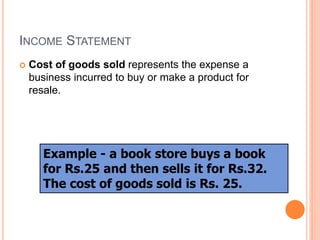

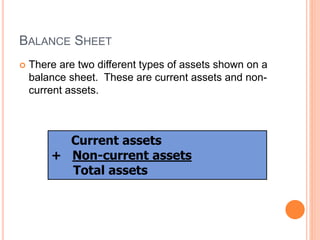

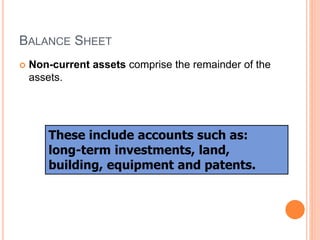

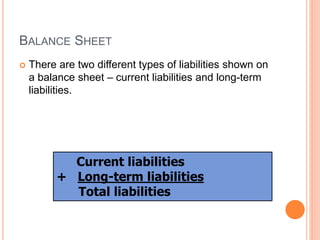

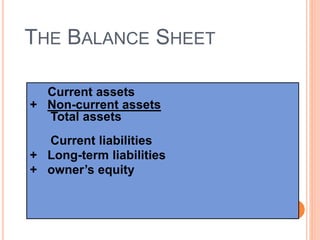

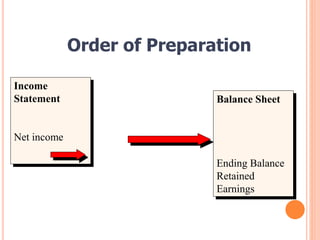

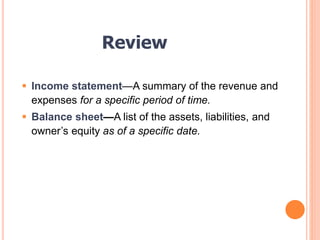

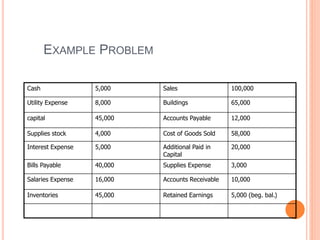

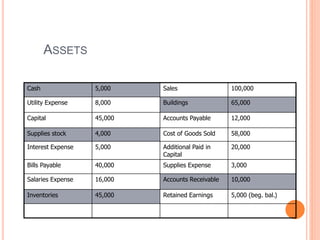

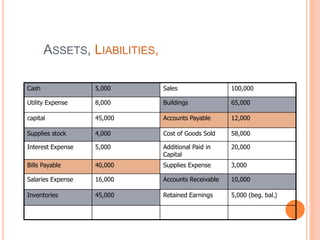

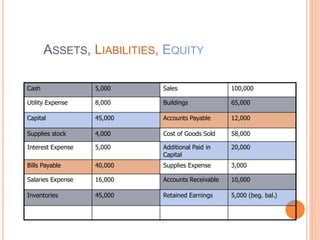

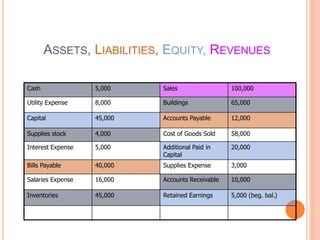

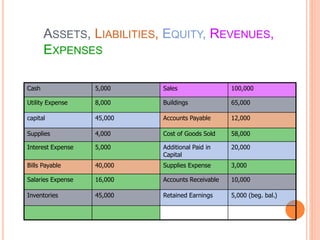

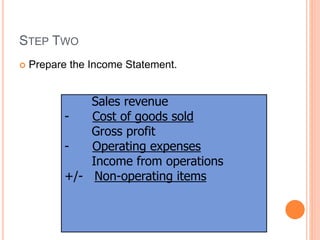

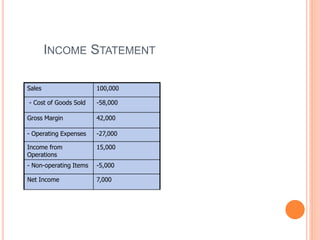

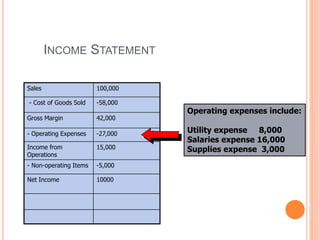

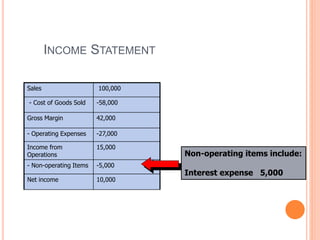

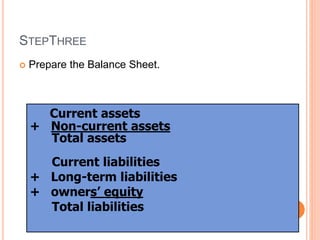

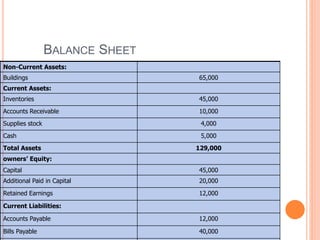

This document provides an overview of how to prepare three key financial statements: the income statement, balance sheet, and cash flow statement. It discusses the basic formats and components of each statement. The income statement reports a company's revenues, expenses and net income over a period of time. The balance sheet outlines a company's assets, liabilities and equity at a point in time. It categorizes assets as current and non-current and liabilities as current and long-term. The purpose is to analyze a company's financial position and performance.