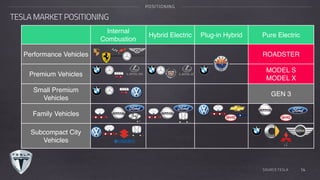

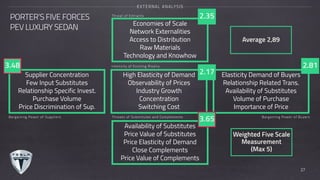

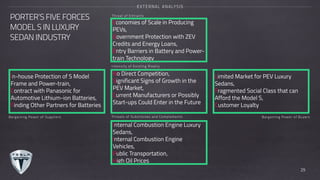

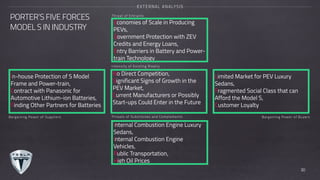

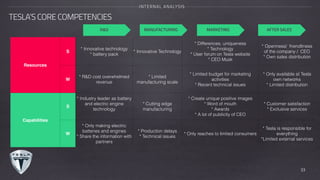

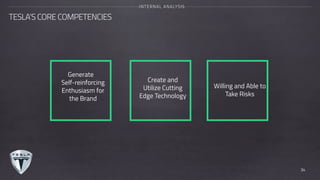

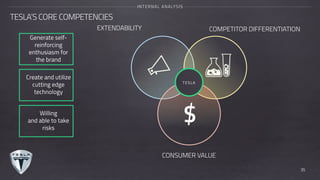

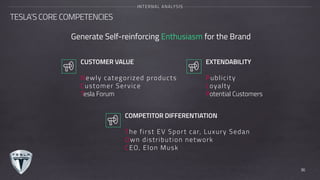

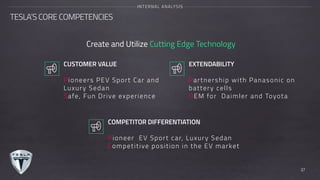

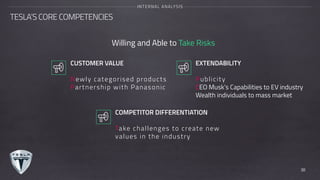

Tesla Motors aims to accelerate sustainable transport by bringing compelling electric cars to mass markets. It was founded in 2003 and currently produces the Roadster sports car and Model S luxury sedan. Tesla's core competencies include generating enthusiasm for its brand, utilizing cutting-edge technology, and a willingness to take risks. These competencies help Tesla differentiate itself from competitors and create value for customers. However, Tesla faces future challenges as larger automakers adapt and resistance emerges to Tesla's sales model as it aims to reach broader markets.