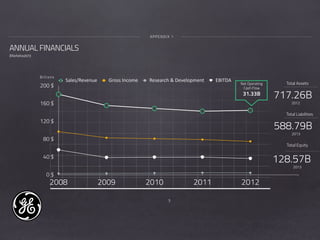

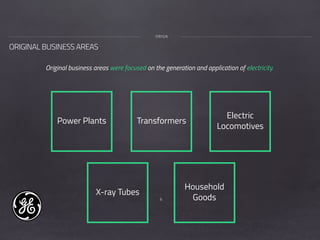

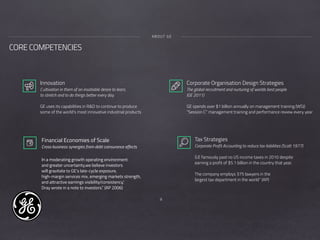

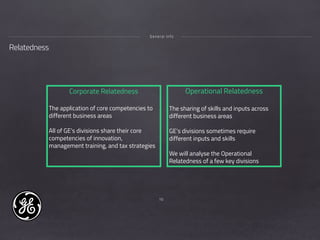

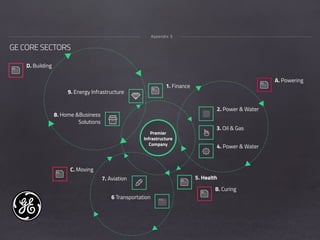

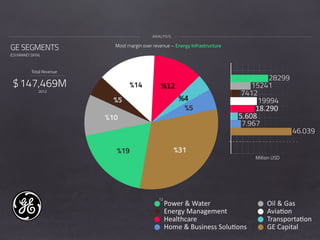

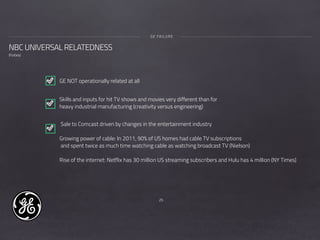

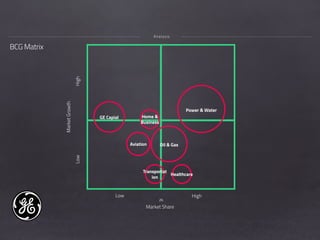

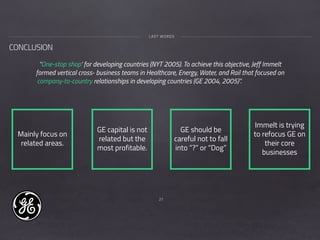

General Electric has historically diversified into many industries, both related and unrelated to its original focus on electricity generation. In recent decades, GE has refocused on industries related to its core competencies of innovation, management training, and tax strategies. GE's aviation, healthcare, oil & gas, power & water, and transportation divisions are considered operationally related, while GE Capital is viewed as unrelated. The presentation analyzes the operational relatedness of key GE divisions and concludes GE should focus on related areas while being careful not to fall into question marks or dogs in the BCG matrix.