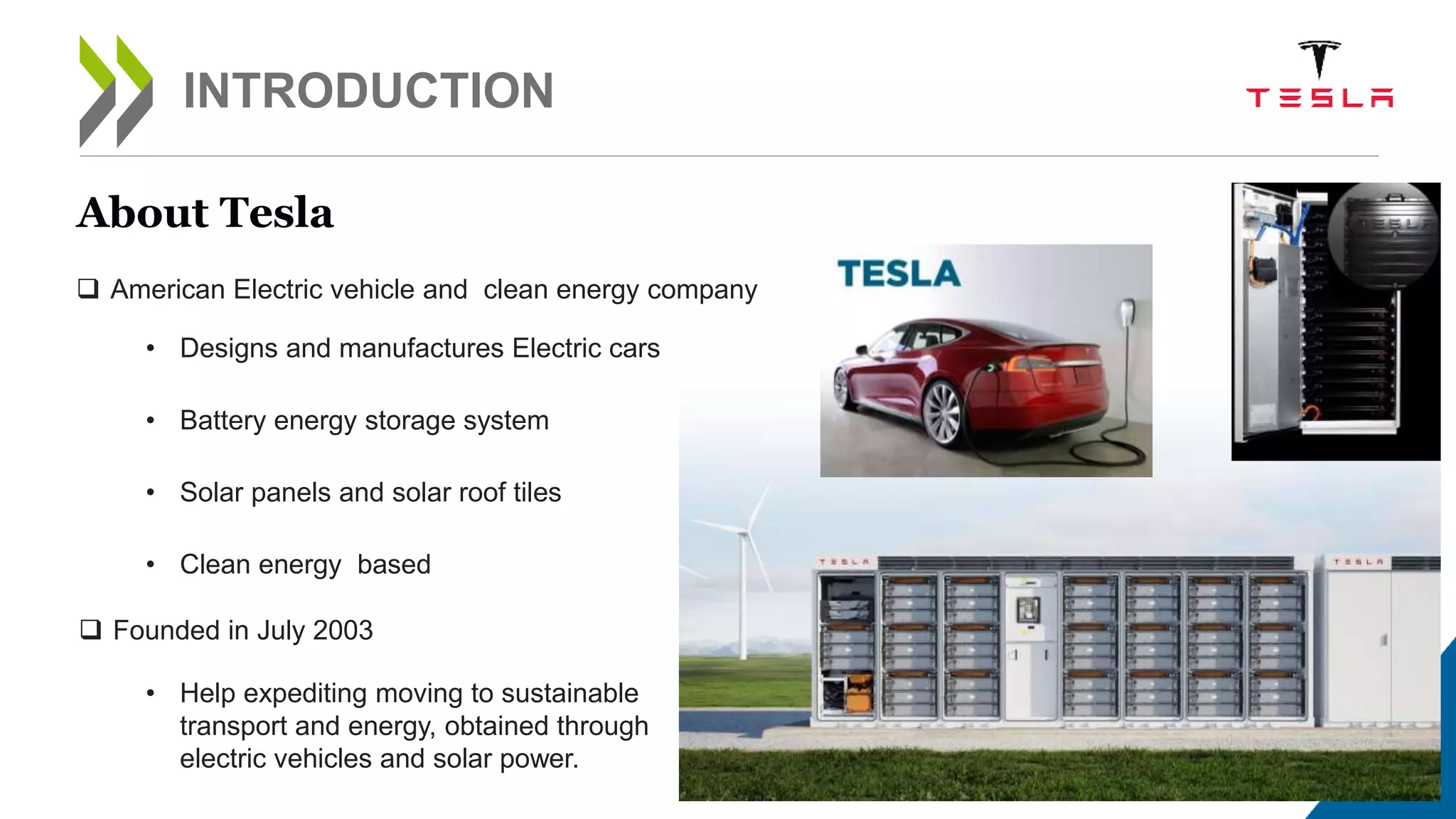

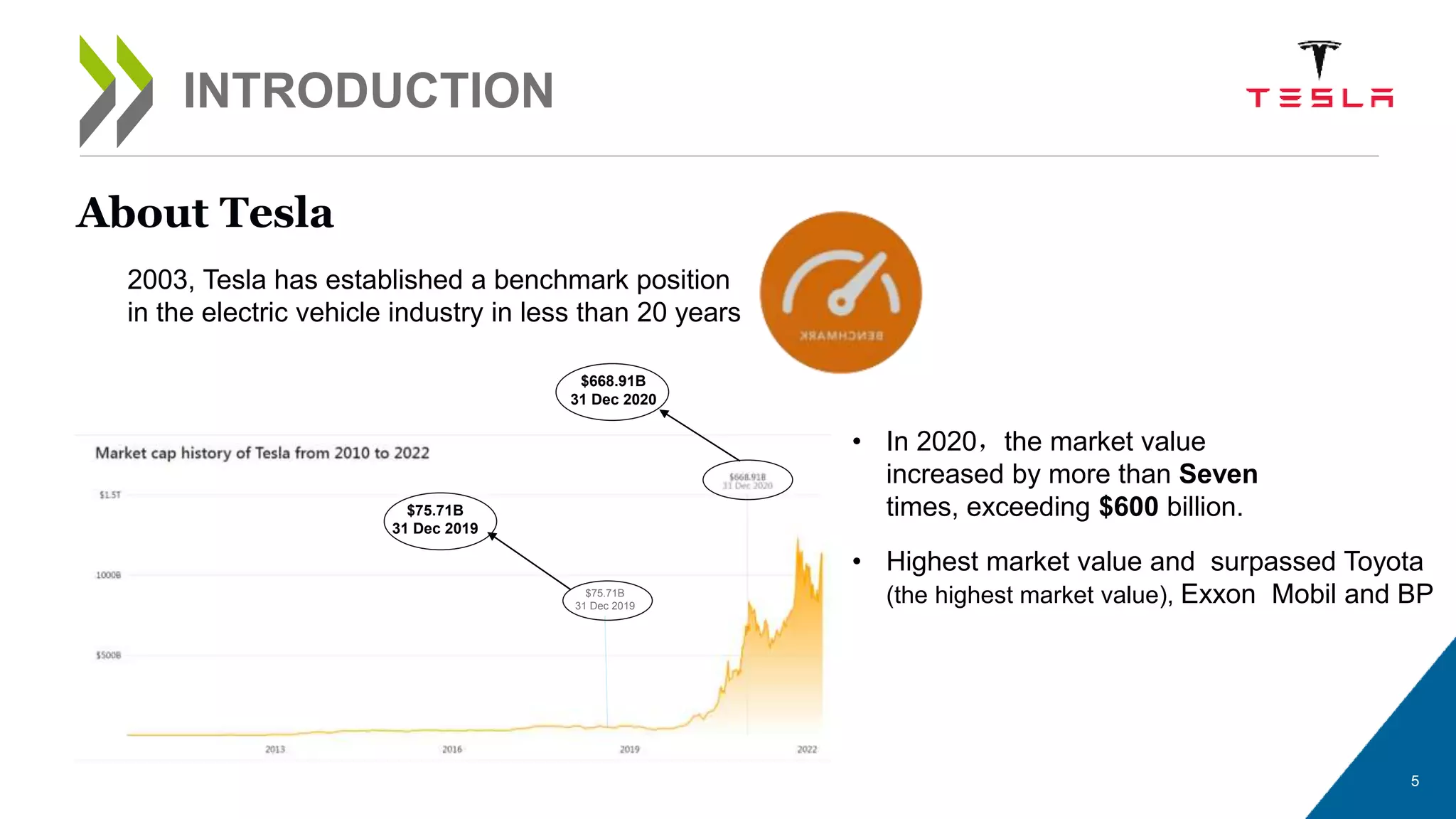

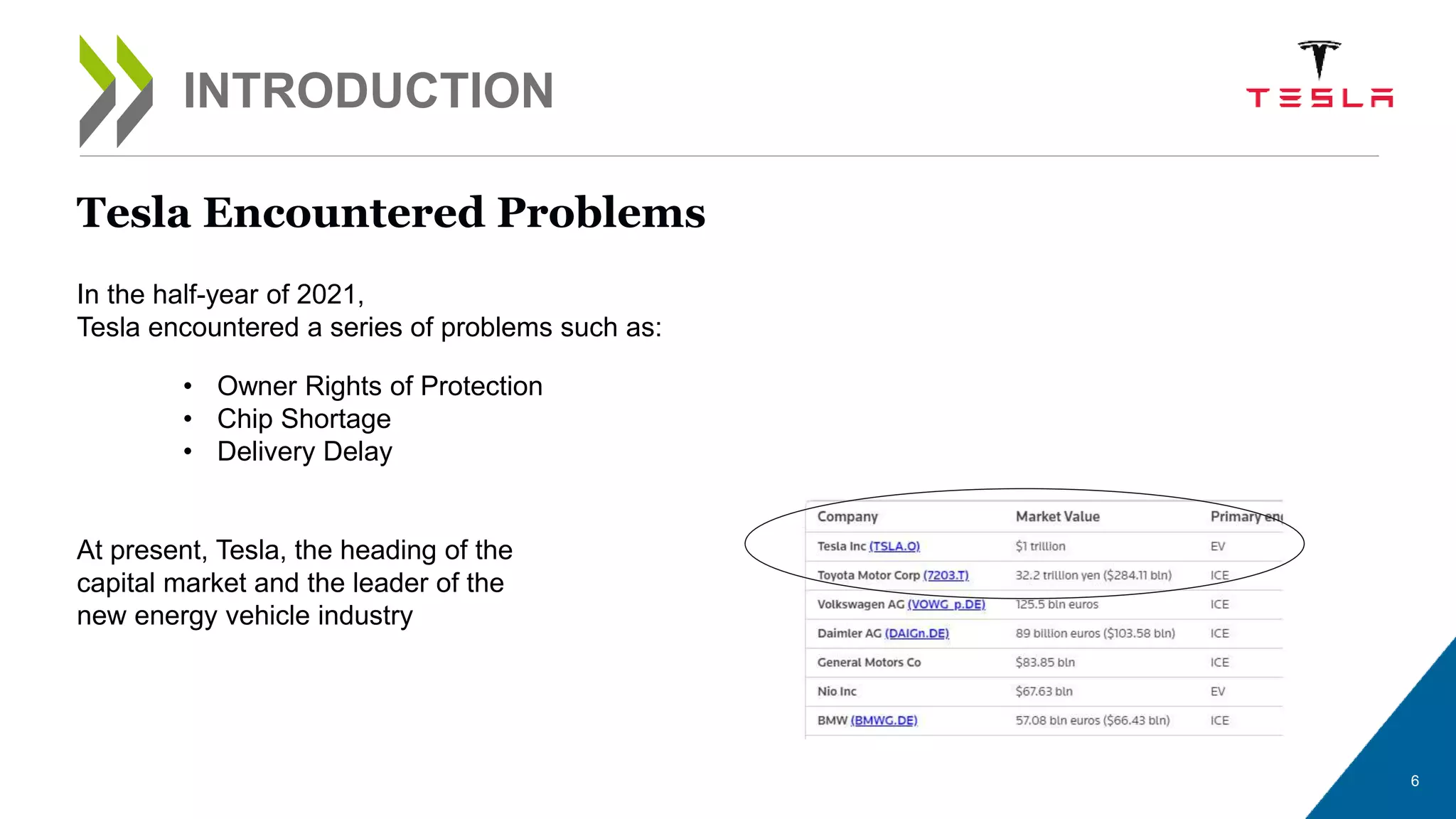

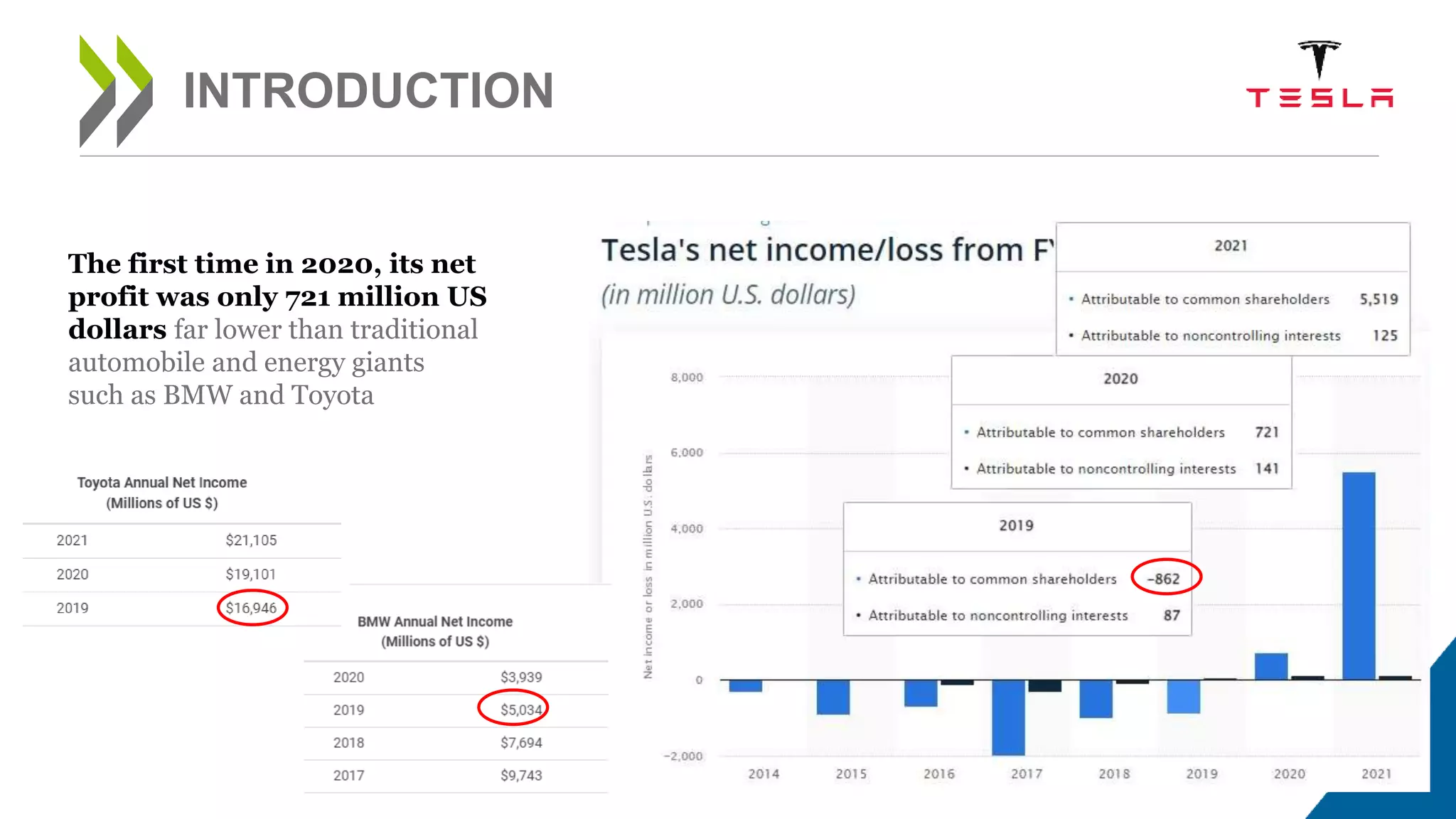

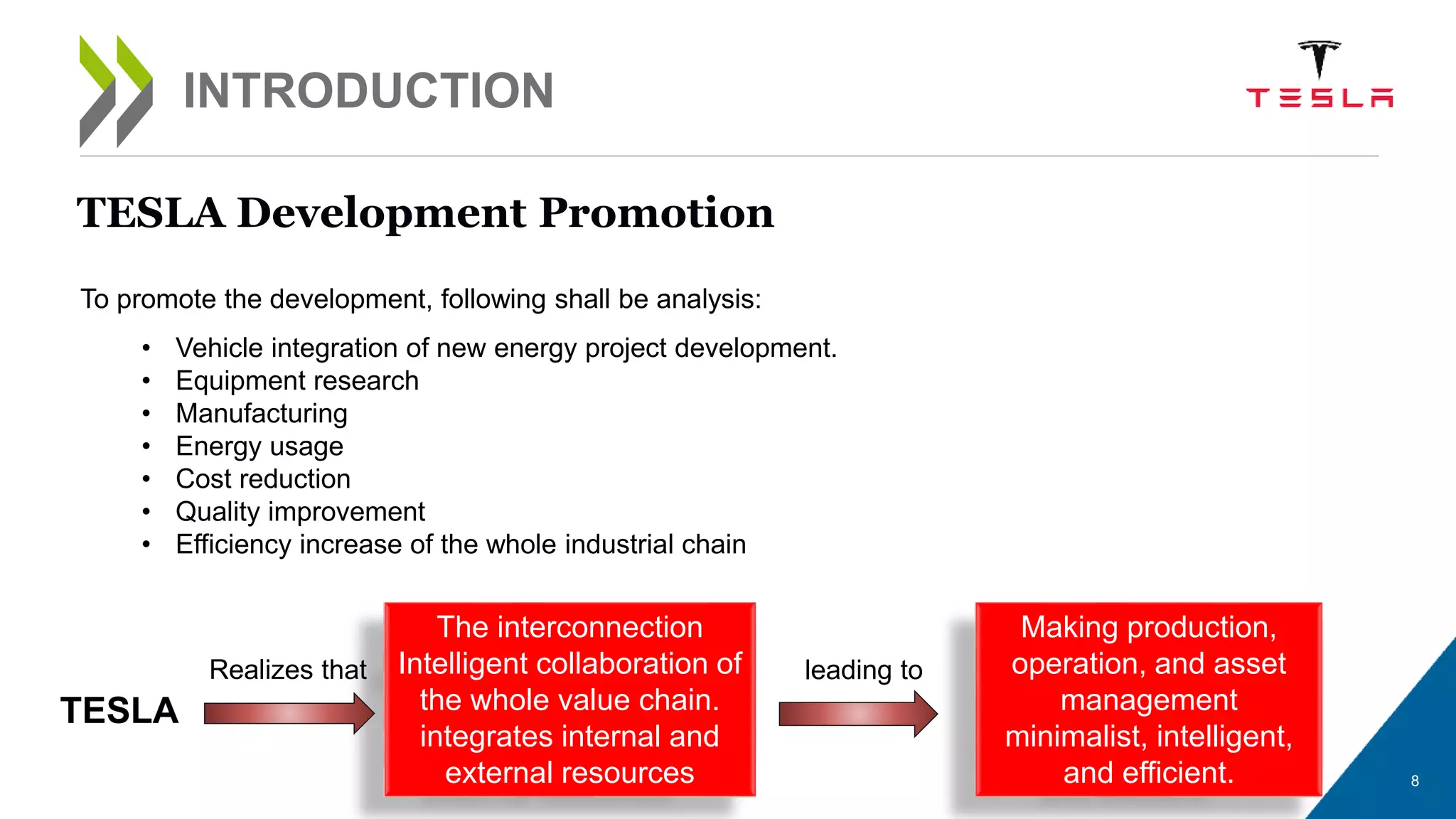

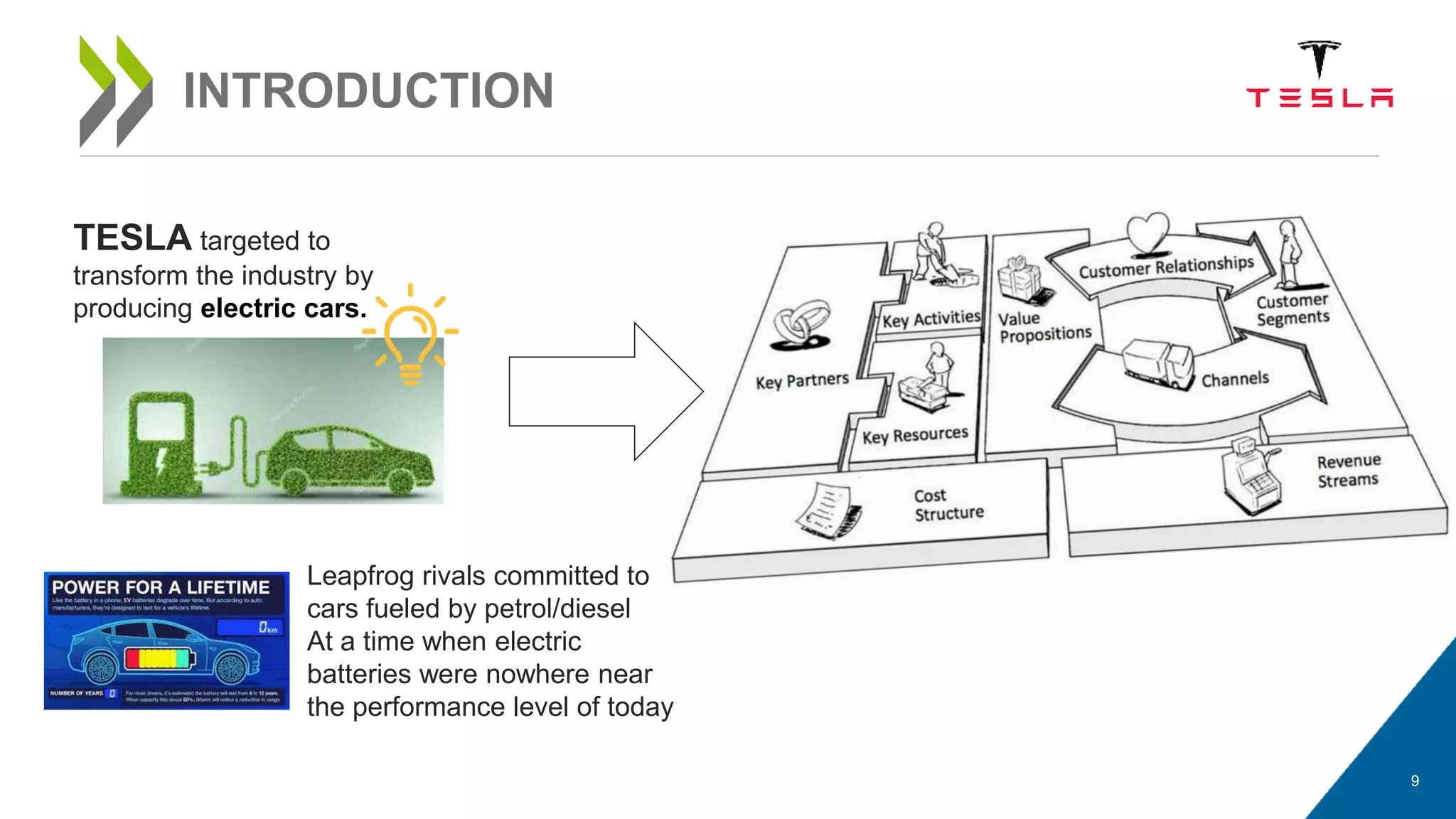

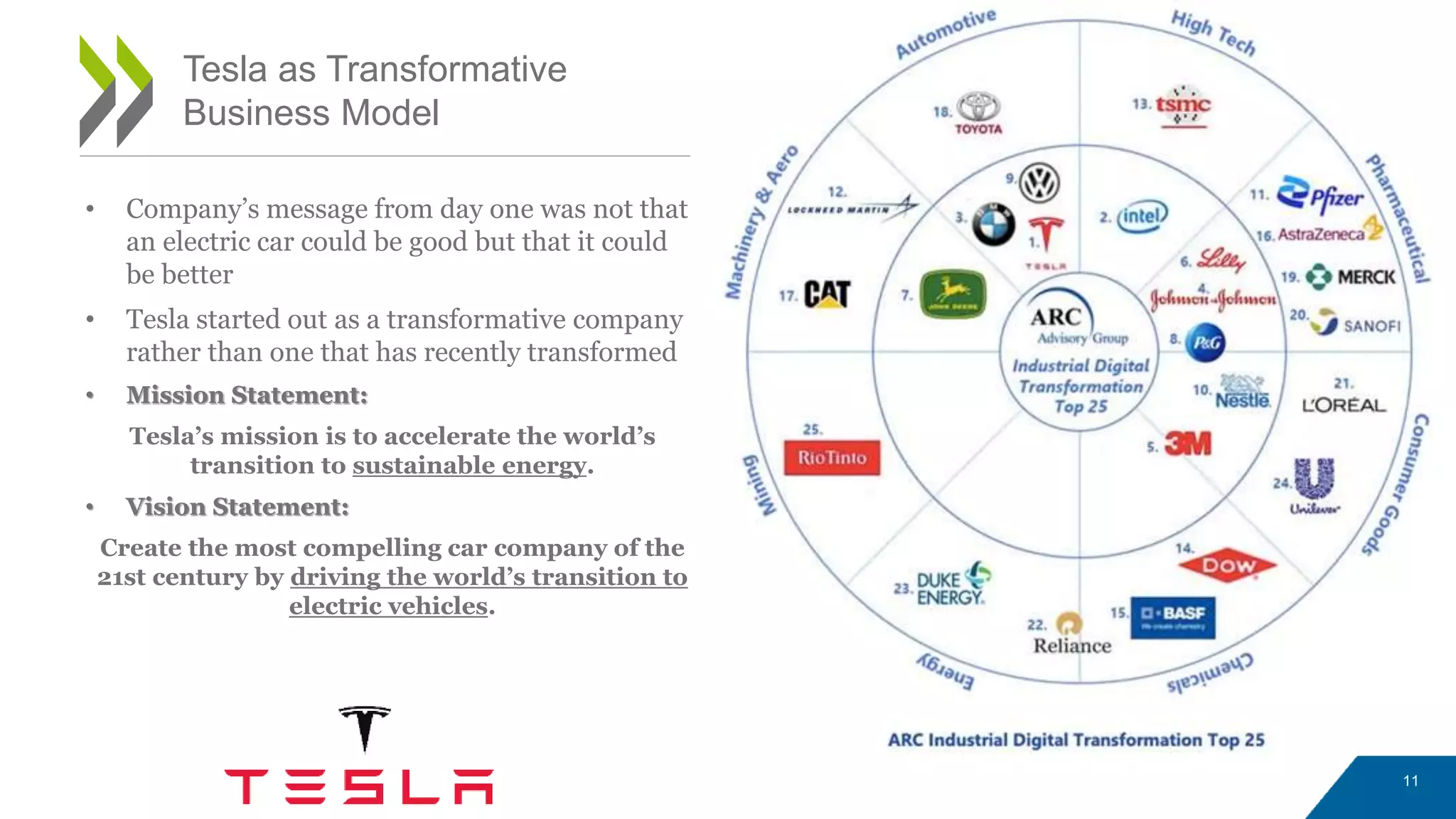

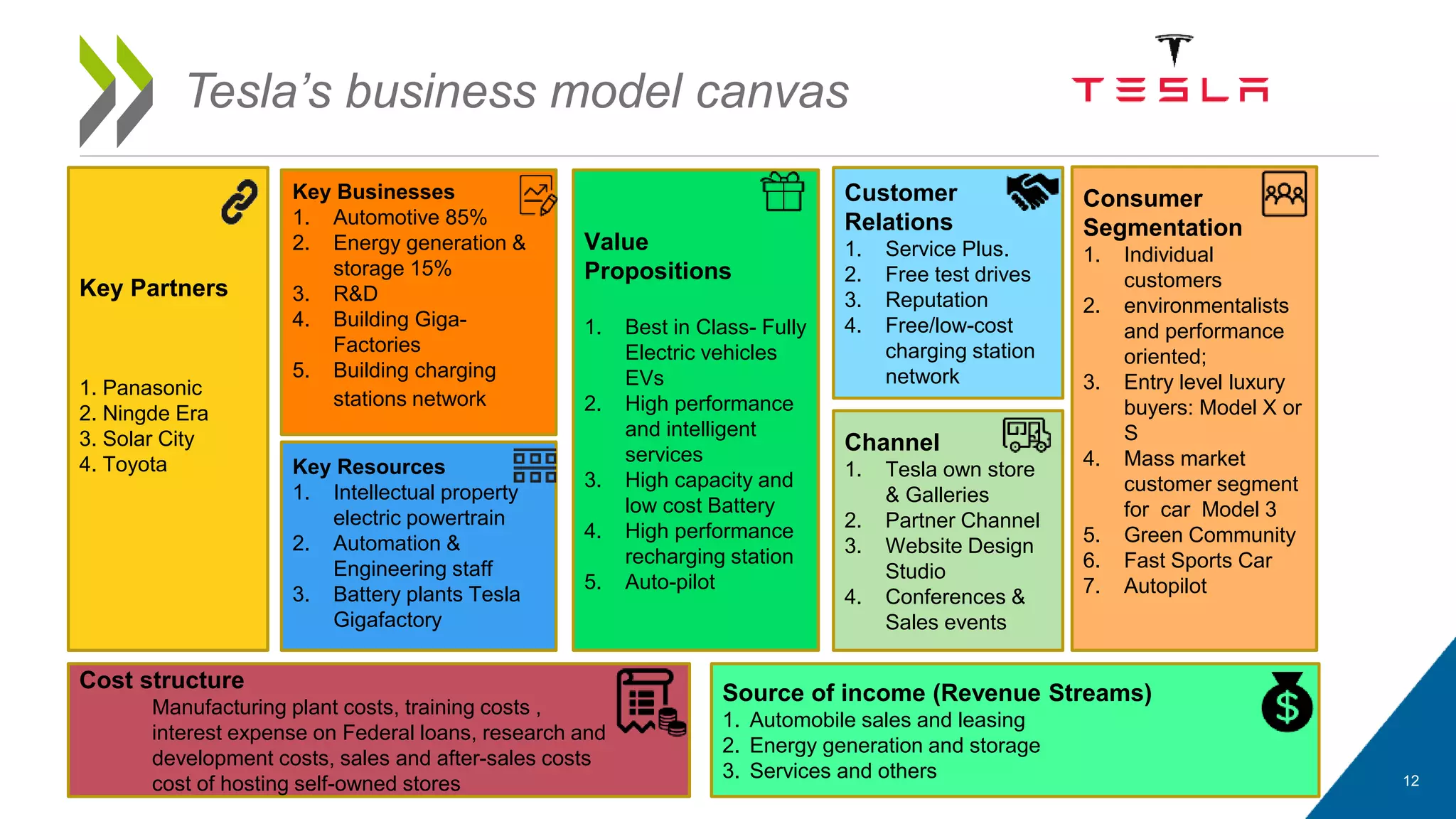

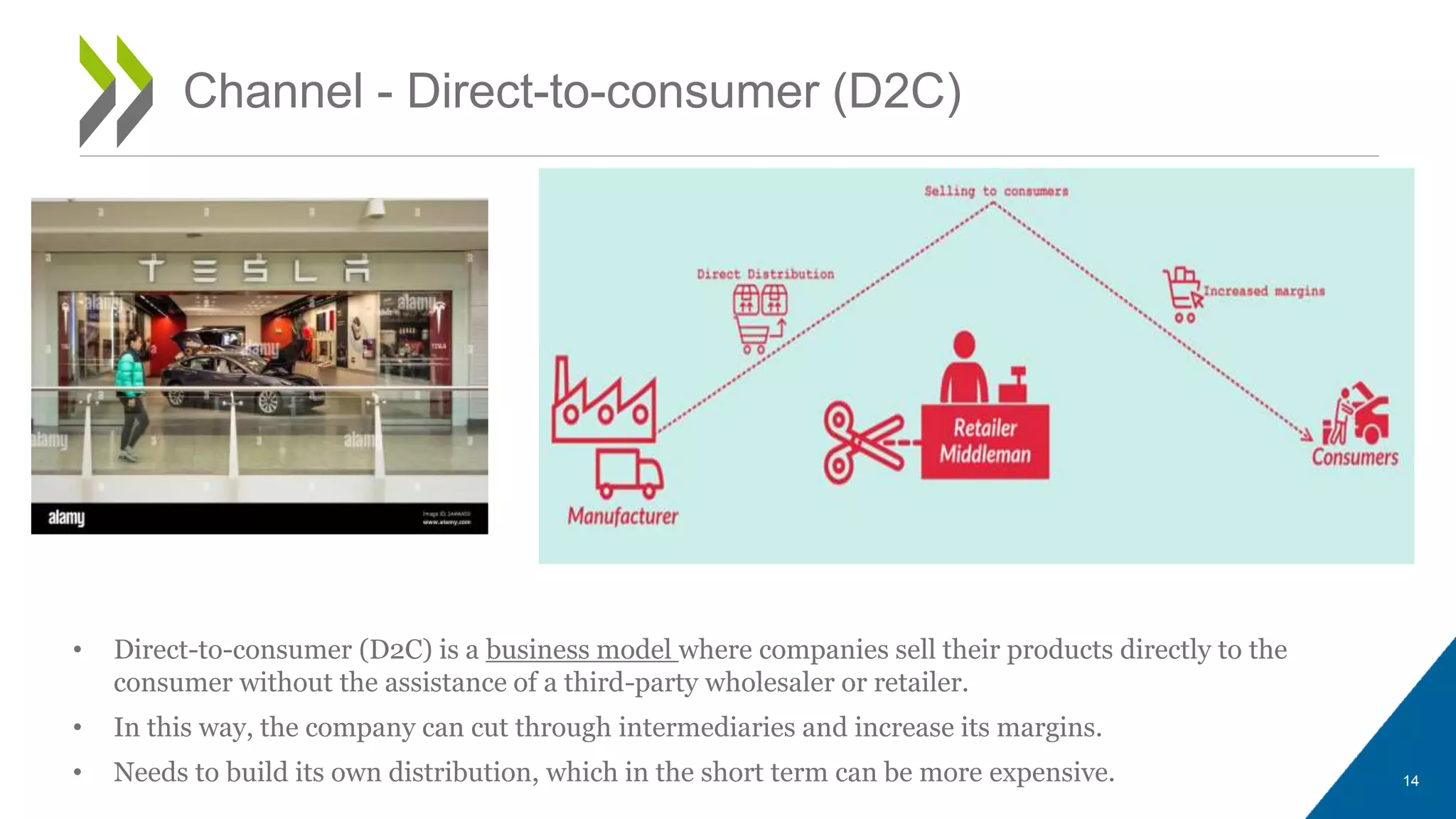

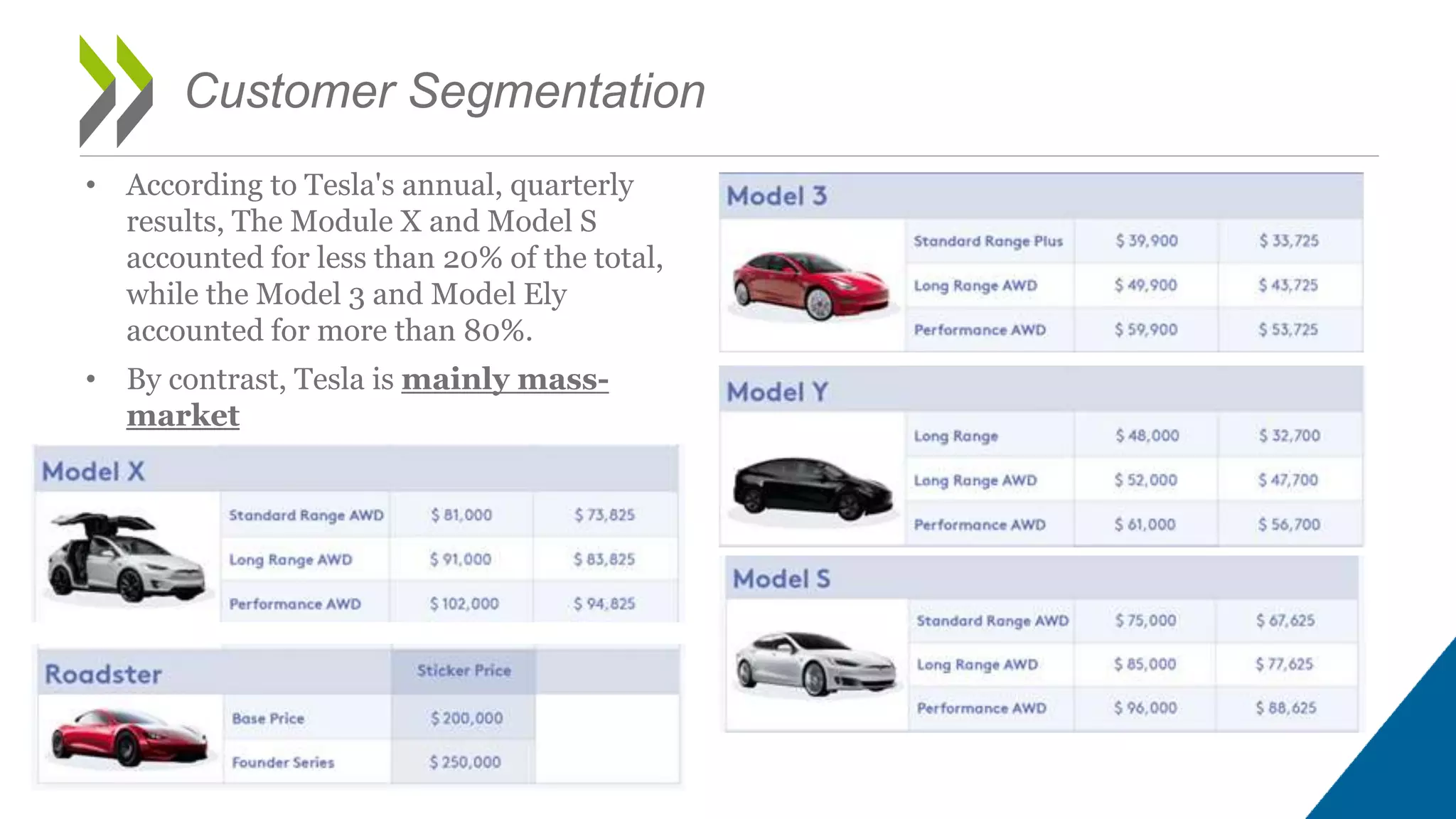

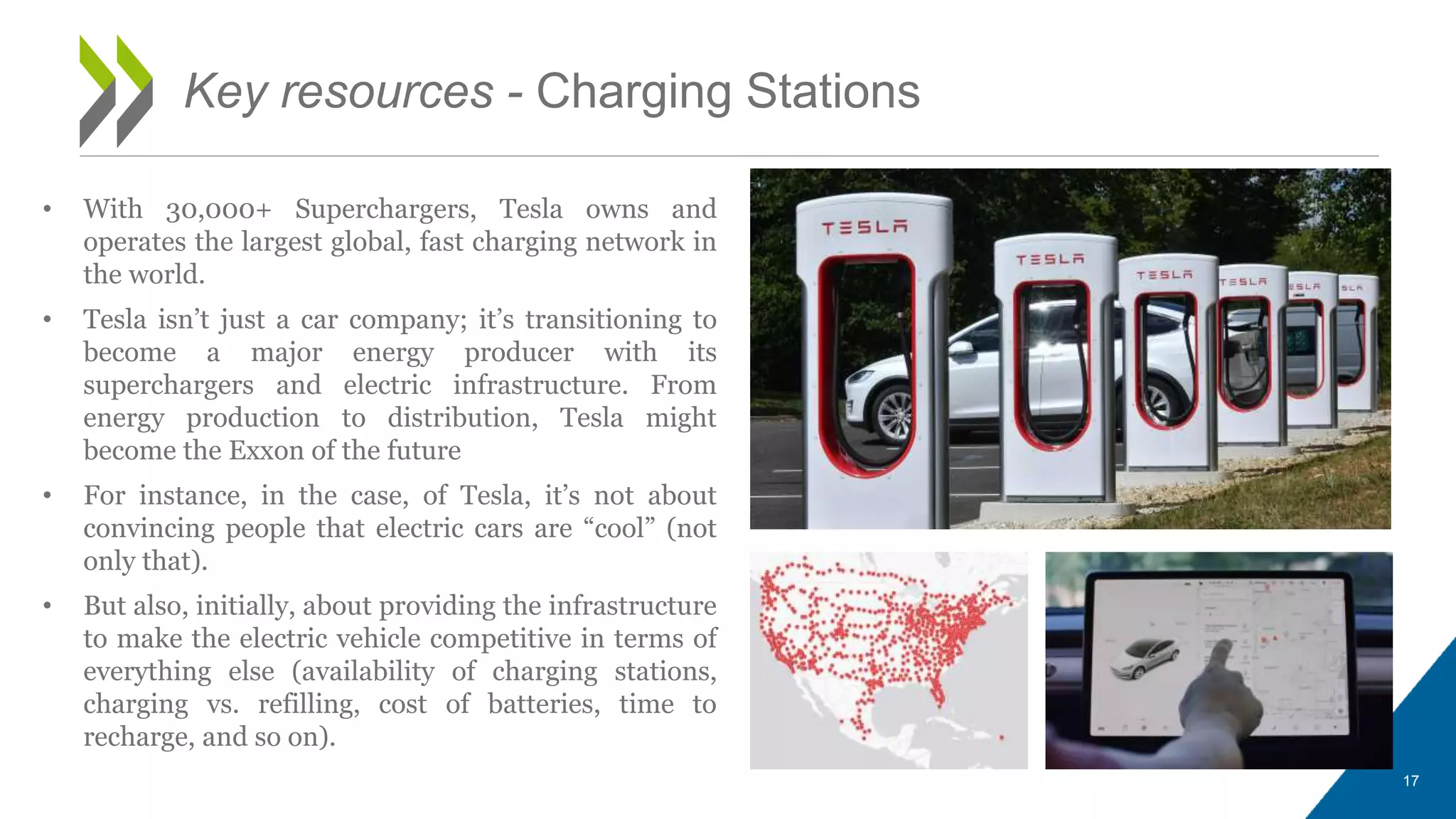

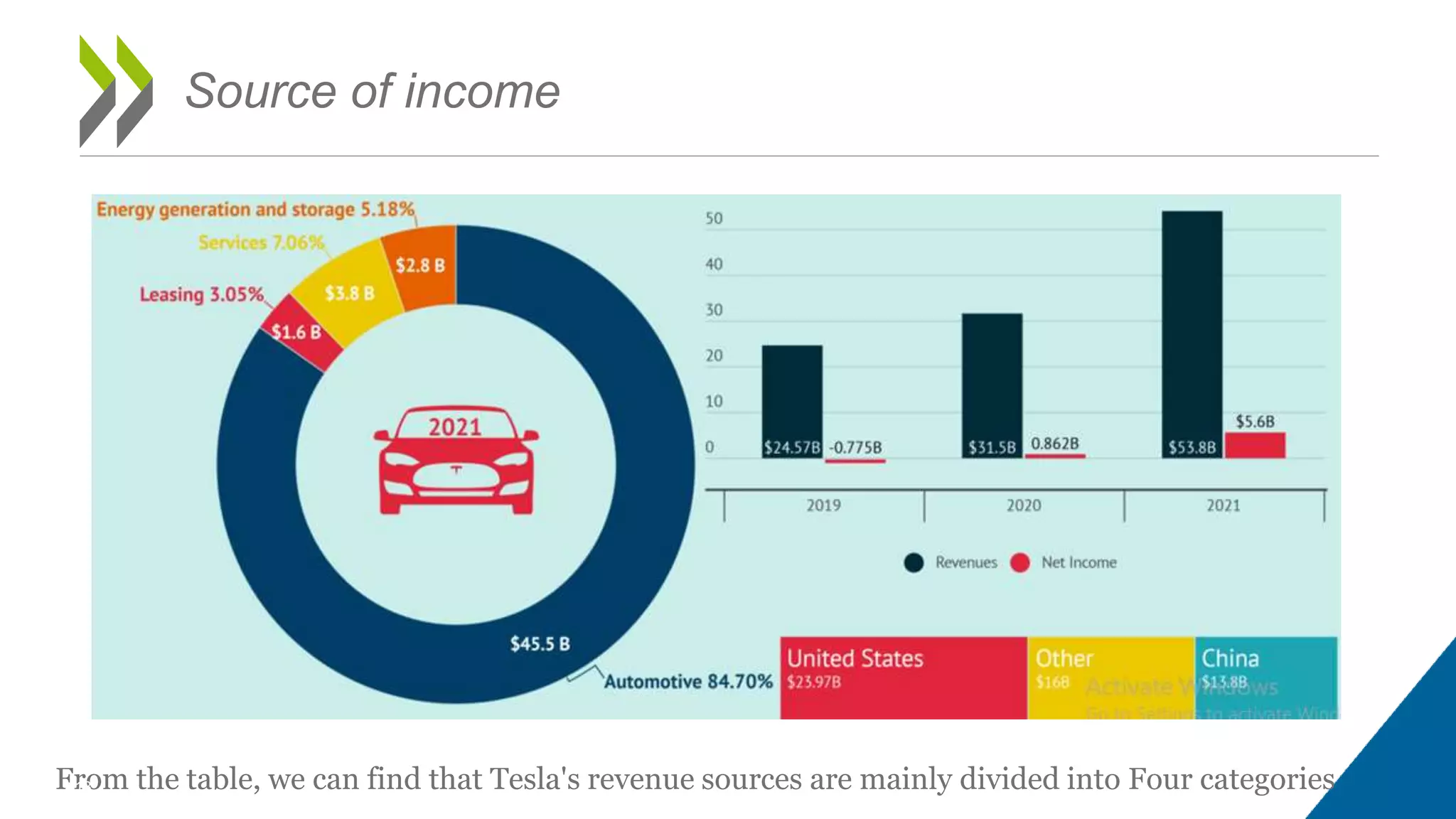

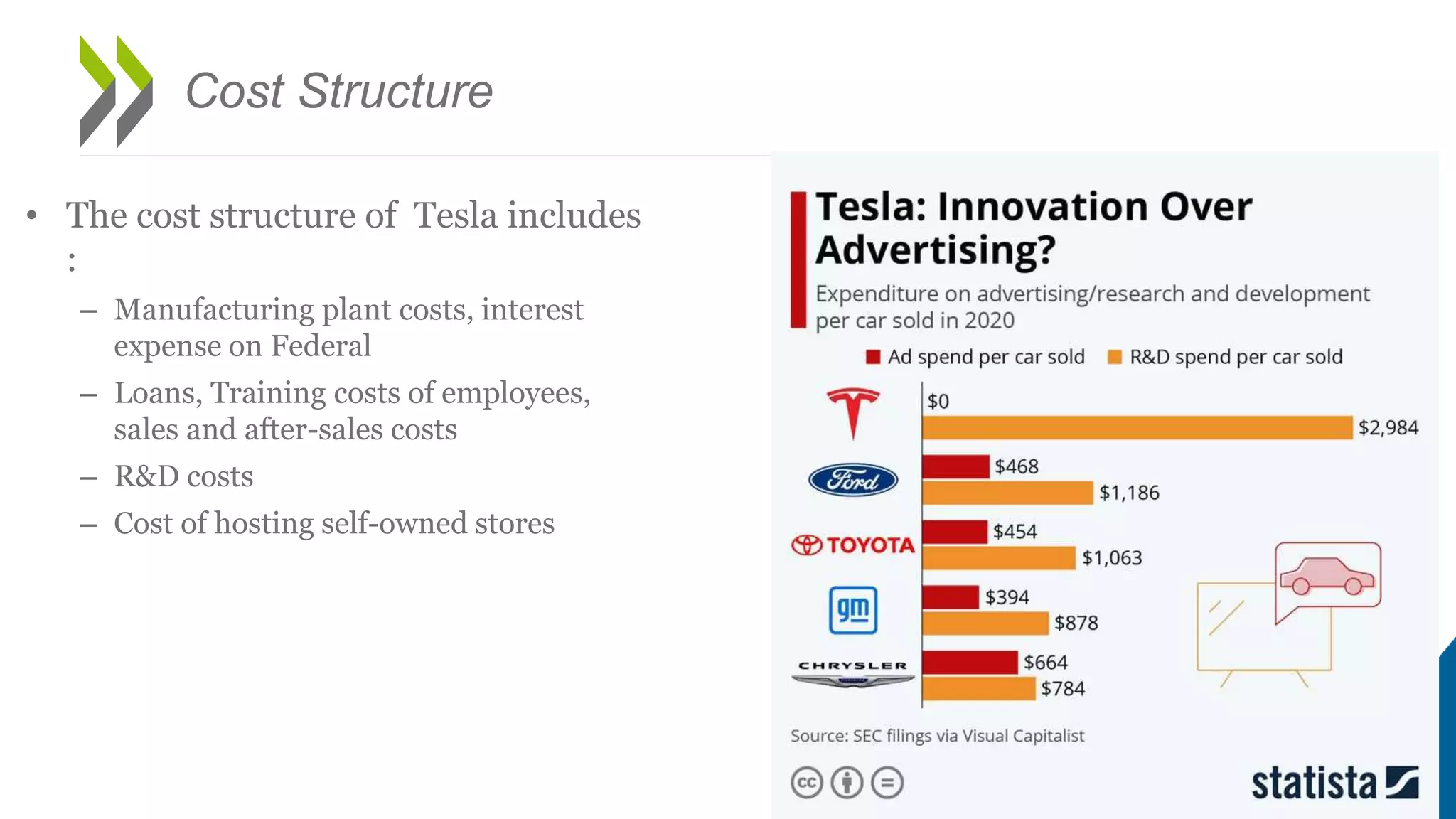

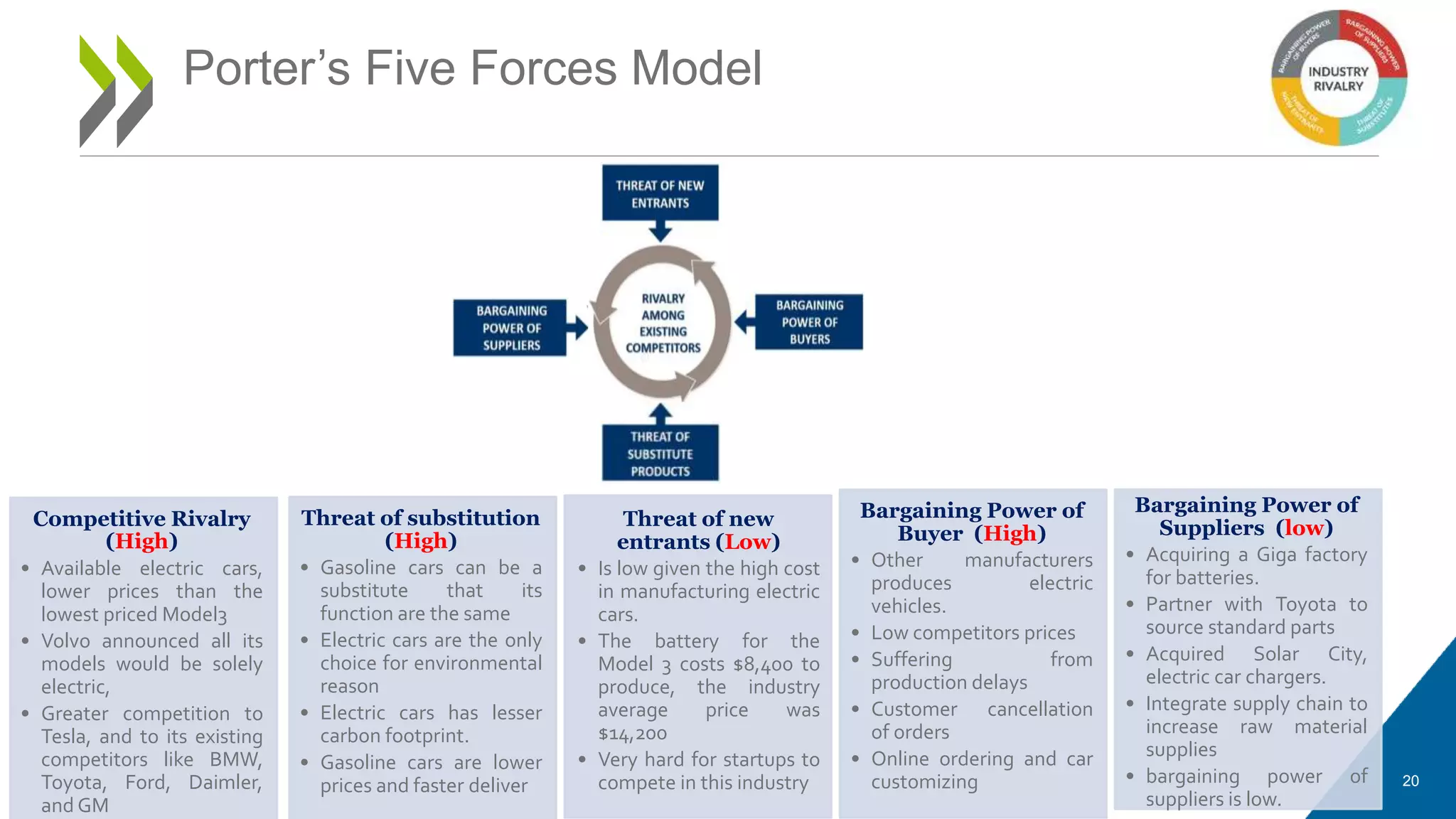

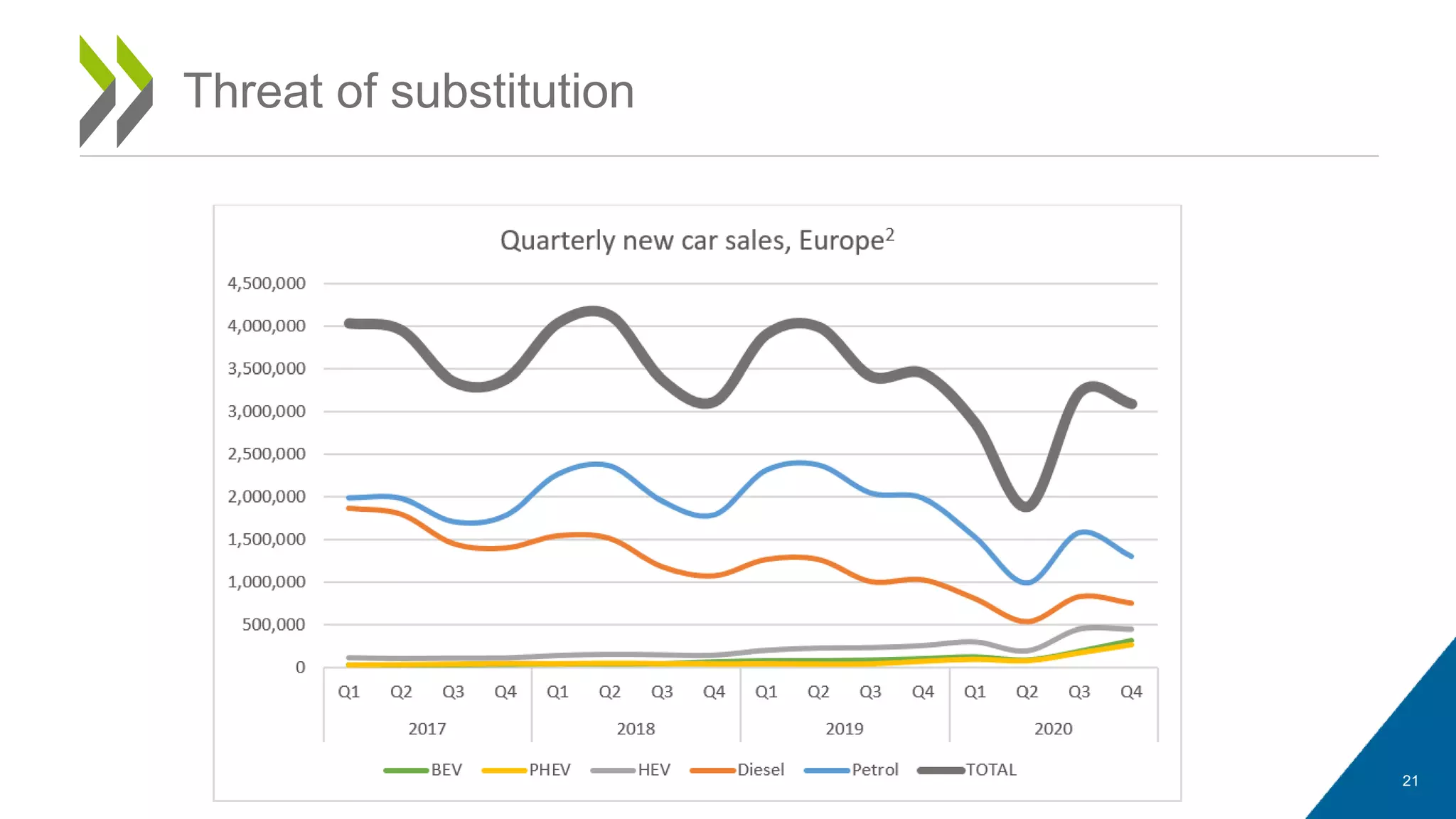

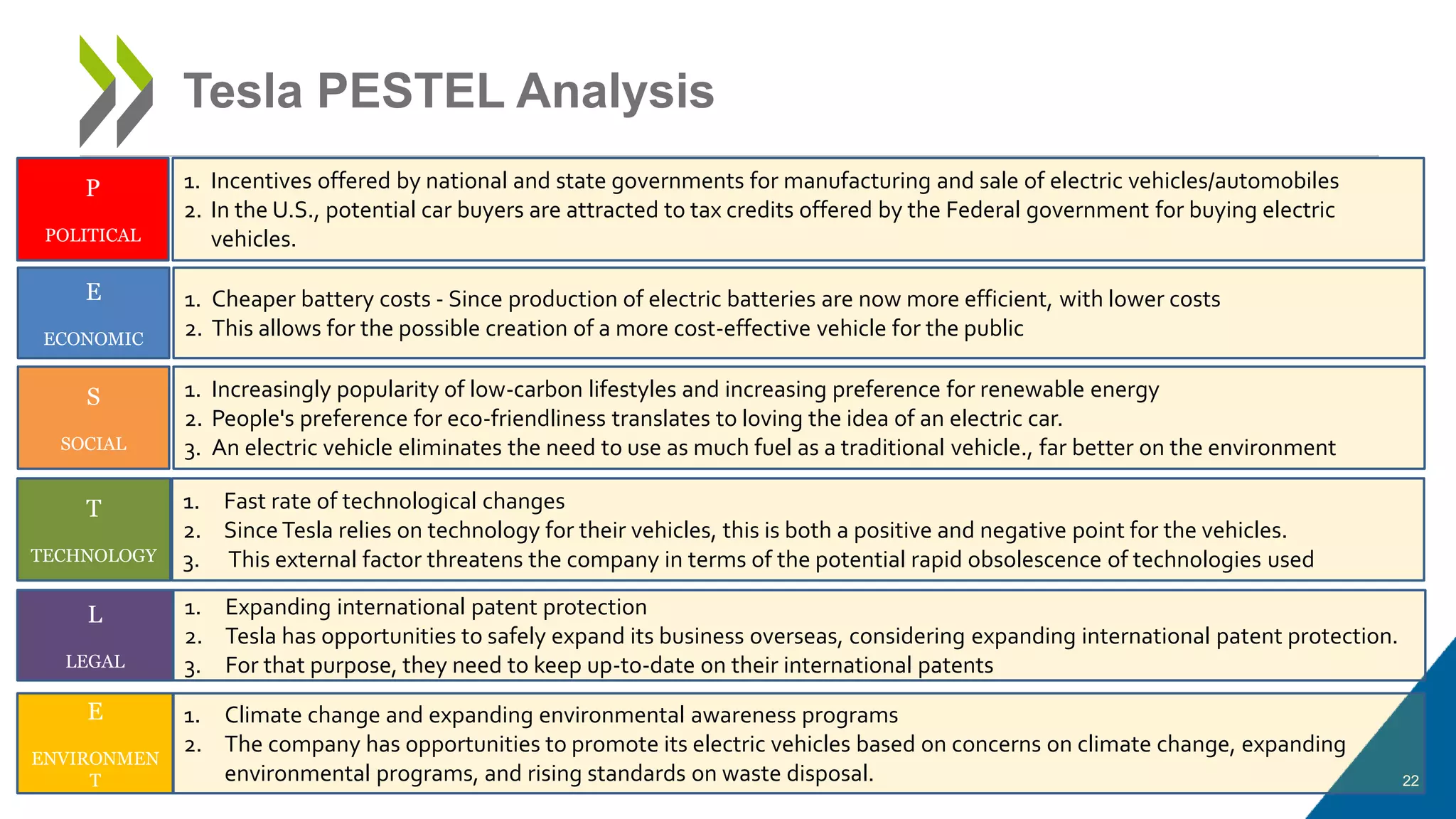

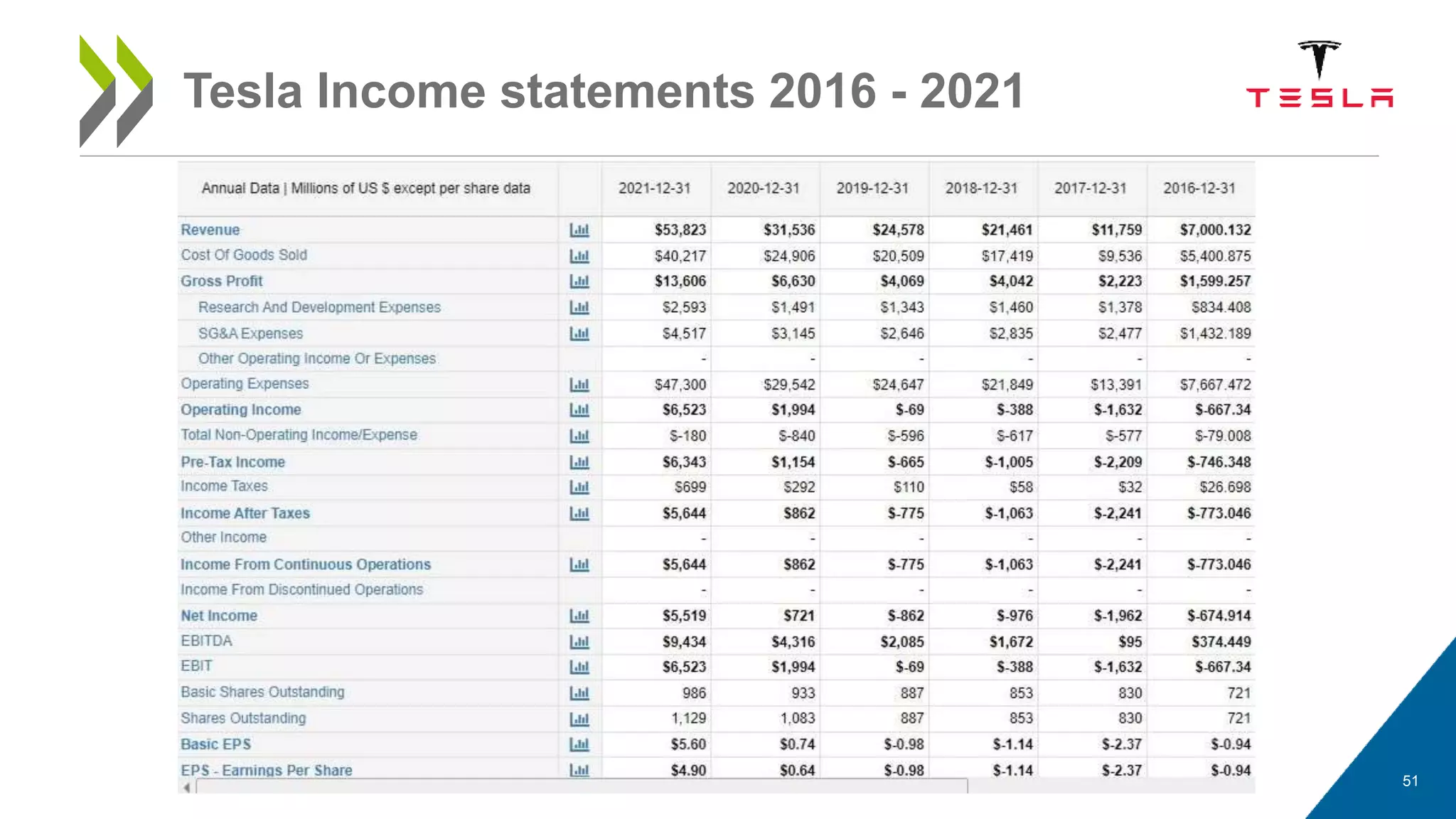

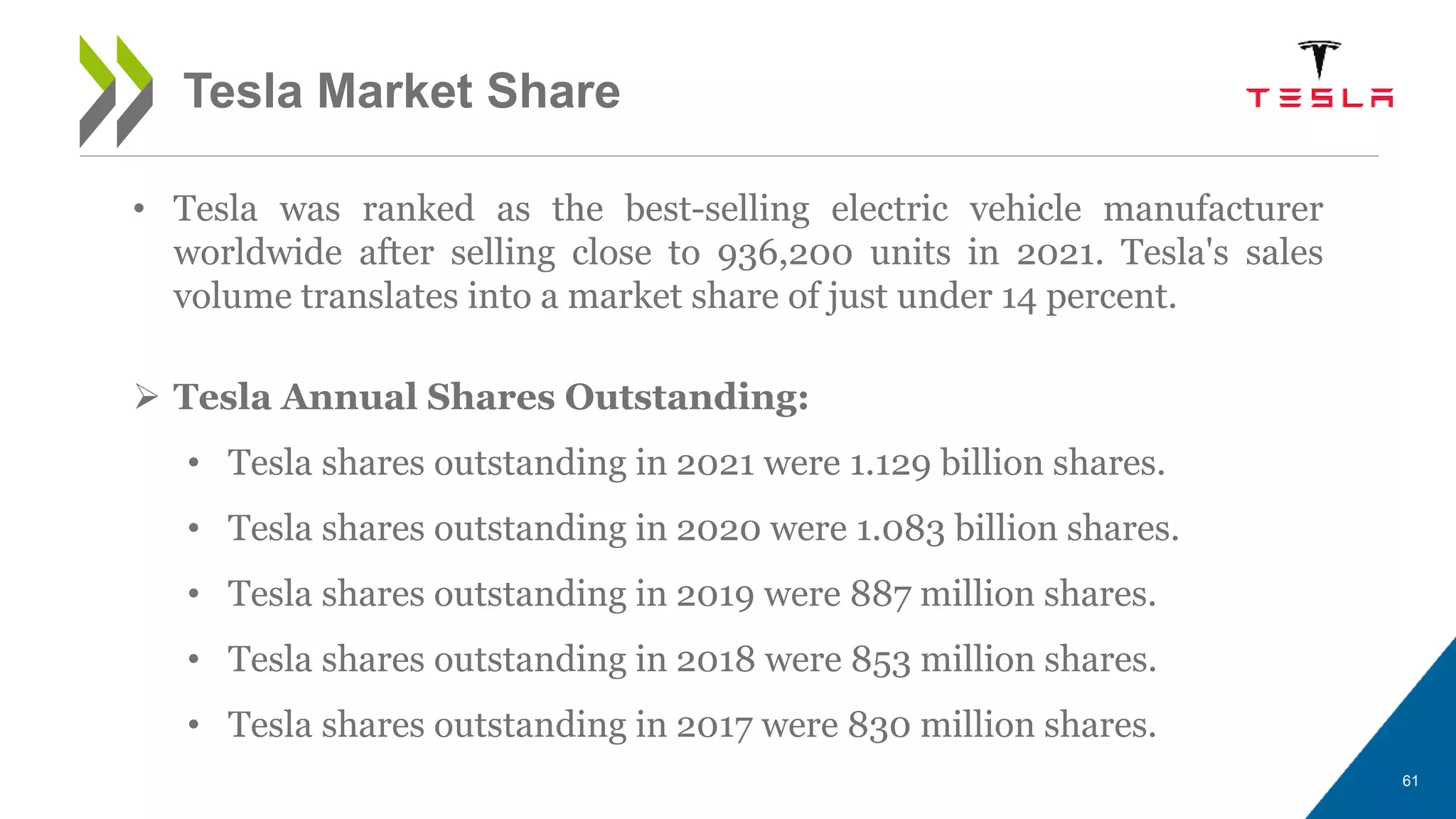

Tesla is an American electric vehicle and clean energy company that designs, manufactures, and sells electric vehicles and solar panels. It was founded in 2003 and is now a leader in the electric vehicle industry. The document provides an analysis of Tesla's business model, including its key partners like Panasonic for batteries, revenue sources from vehicle sales and energy generation, resources like the Gigafactory for battery production, and challenges from high competition in the automotive industry and potential substitution with gasoline vehicles.