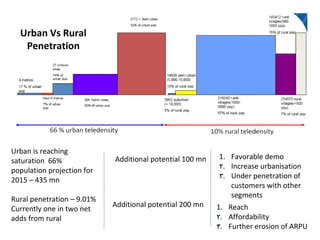

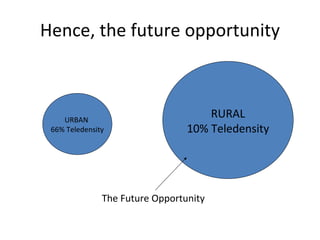

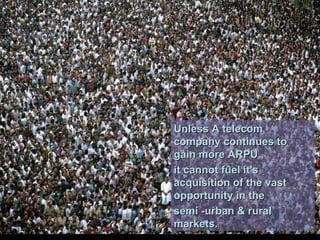

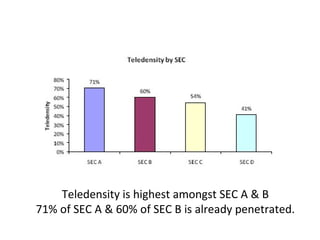

1. The telecom industry is reaching saturation in urban areas but rural penetration remains low, representing a major growth opportunity.

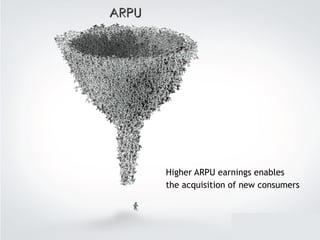

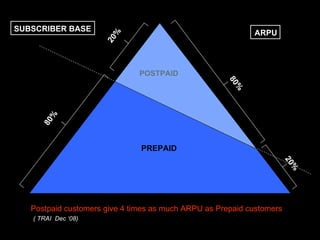

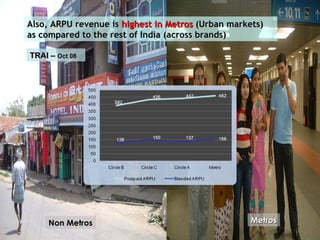

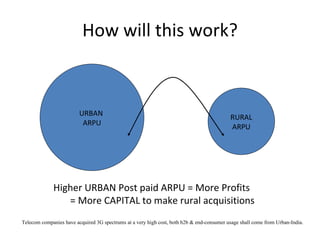

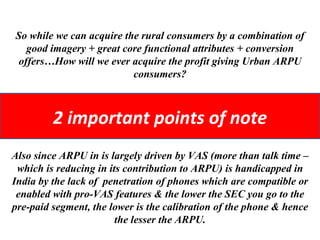

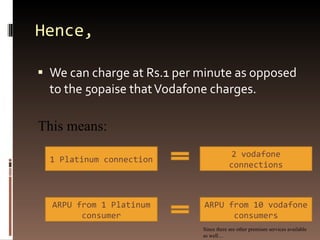

2. However, acquiring new rural customers requires generating higher Average Revenue Per User (ARPU) which currently comes mainly from urban postpaid subscribers.

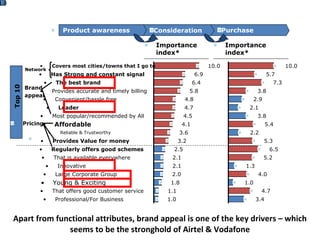

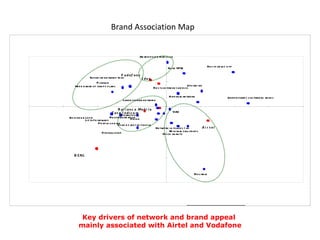

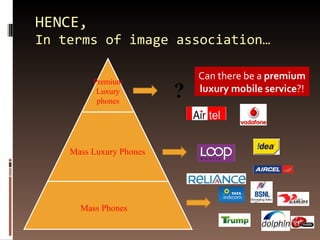

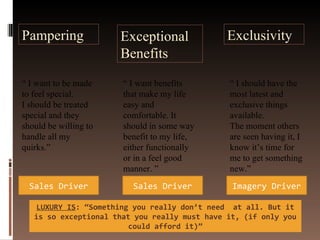

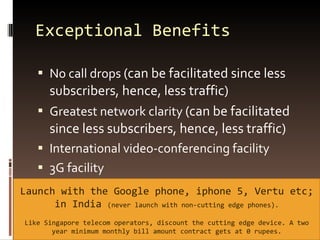

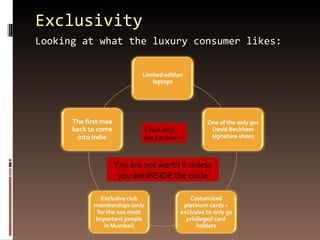

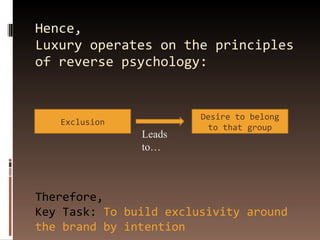

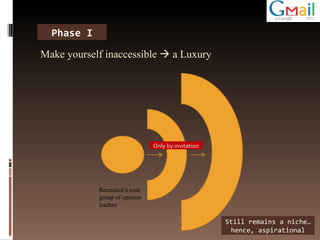

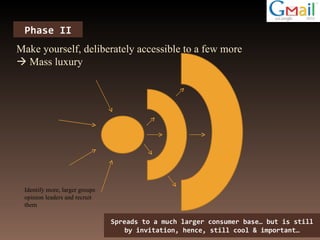

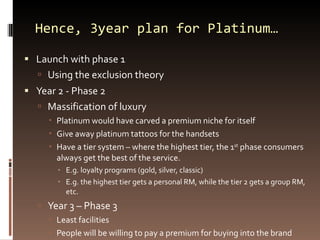

3. The document proposes launching an exclusive "premium luxury" mobile service brand targeting high ARPU urban customers to fund rural expansion, using social diffusion and exclusivity to build the brand.