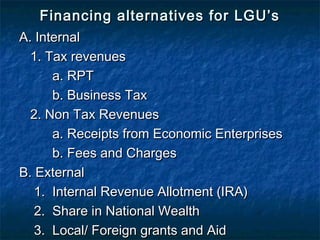

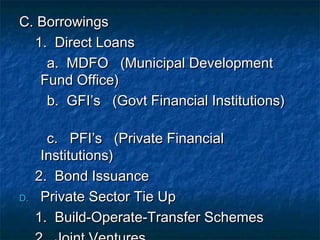

The document discusses external sources of revenue for Local Government Units (LGUs) in the Philippines. The major external sources discussed are: 1) Internal Revenue Allotment (IRA), which allocates 40% of national tax revenues to LGUs, 2) Shares of national wealth such as mining and forestry revenues, 3) Shares from government agencies and corporations operating in their jurisdictions, and 4) Credit financing options such as loans from domestic banks and bonds. LGUs have increased financing power under the Local Government Code of 1991 to fund infrastructure and services.