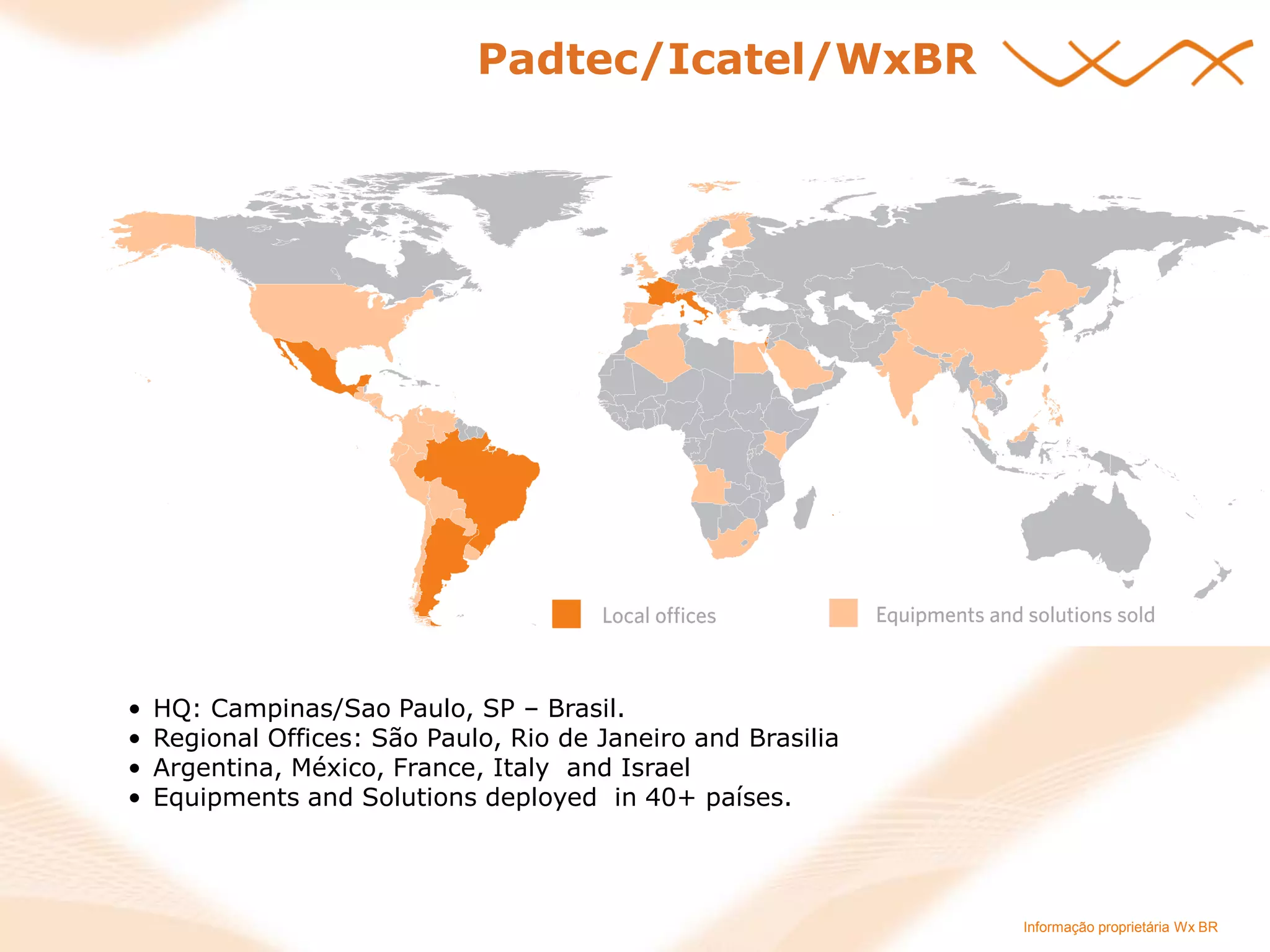

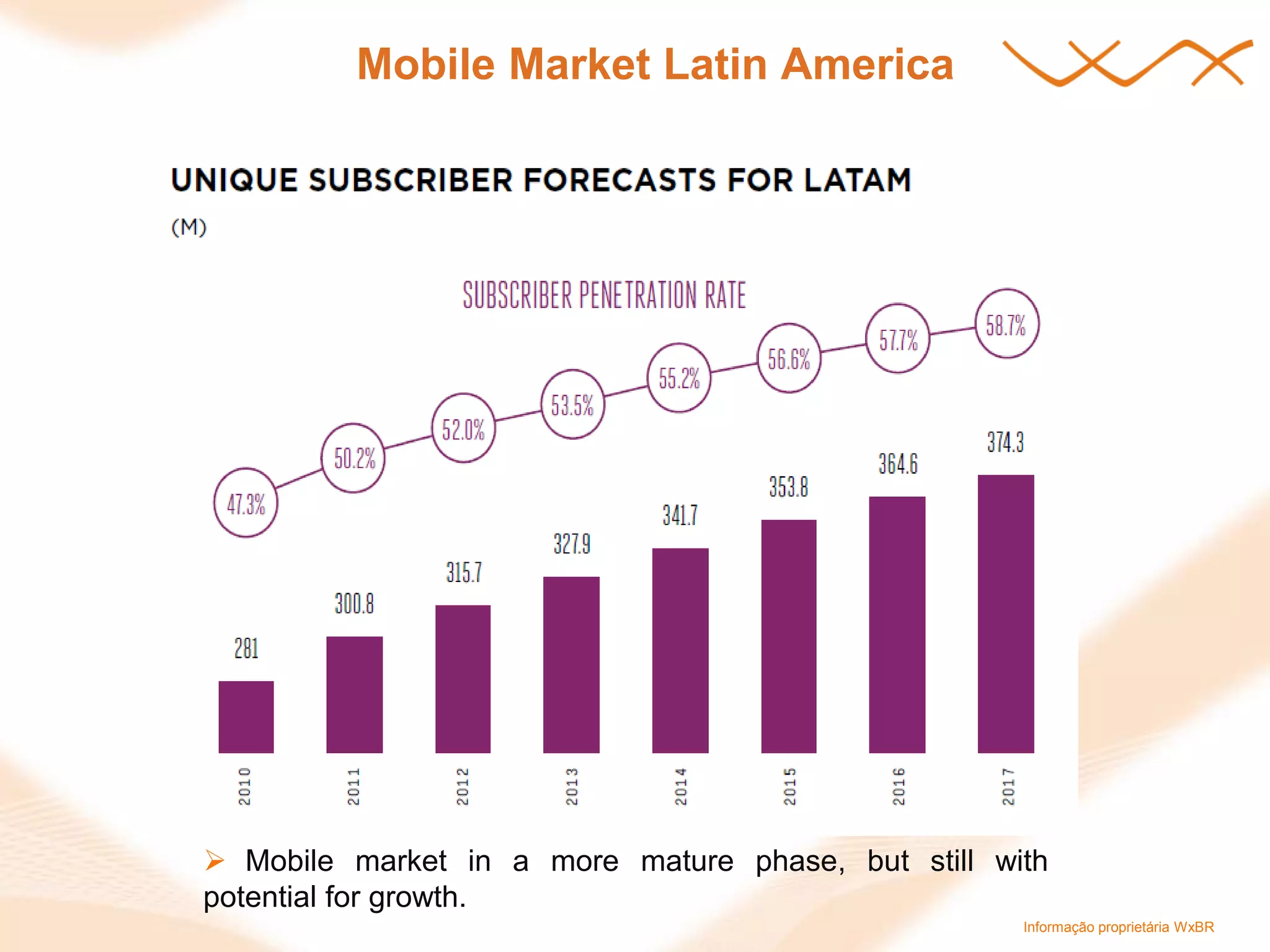

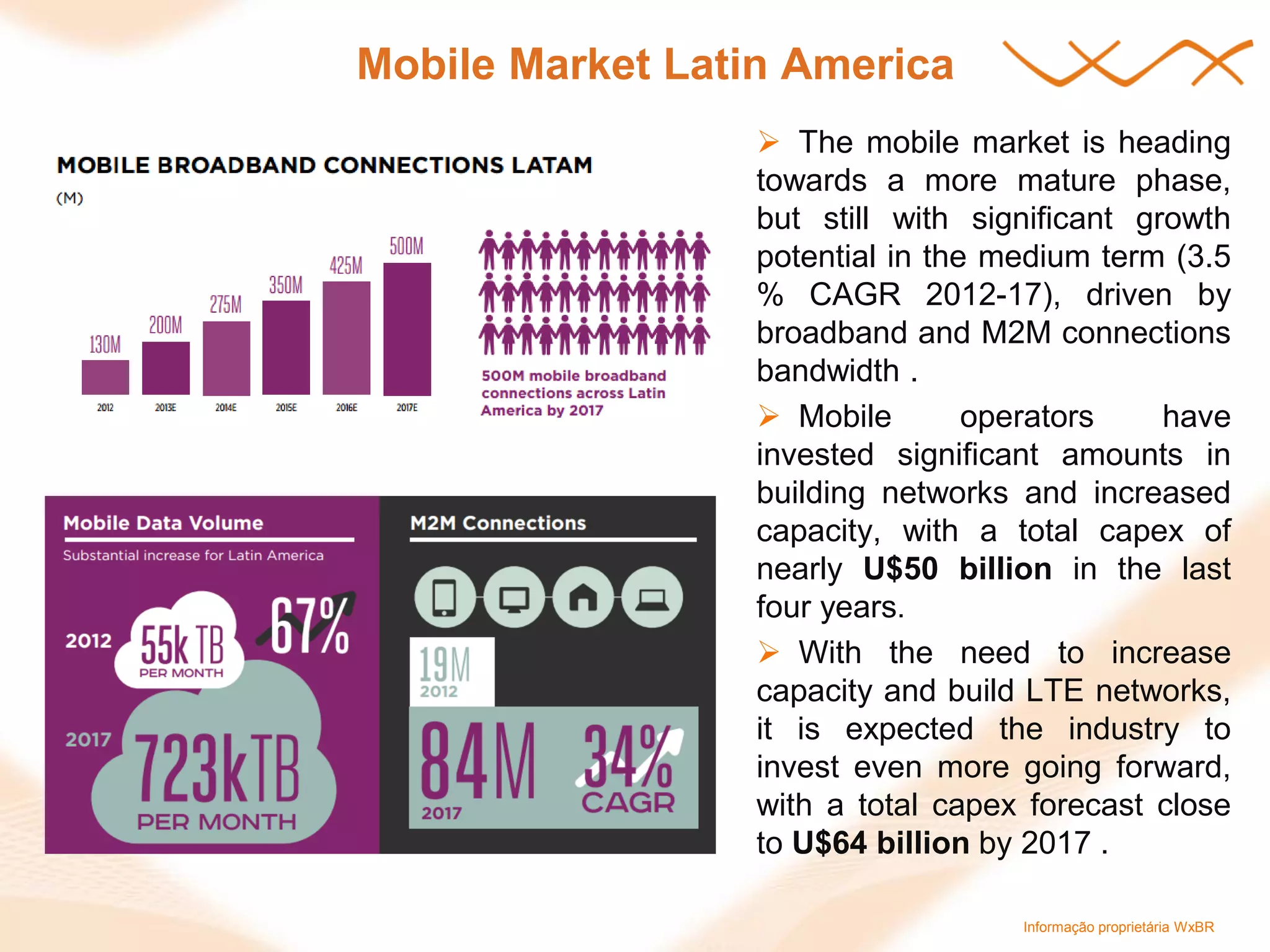

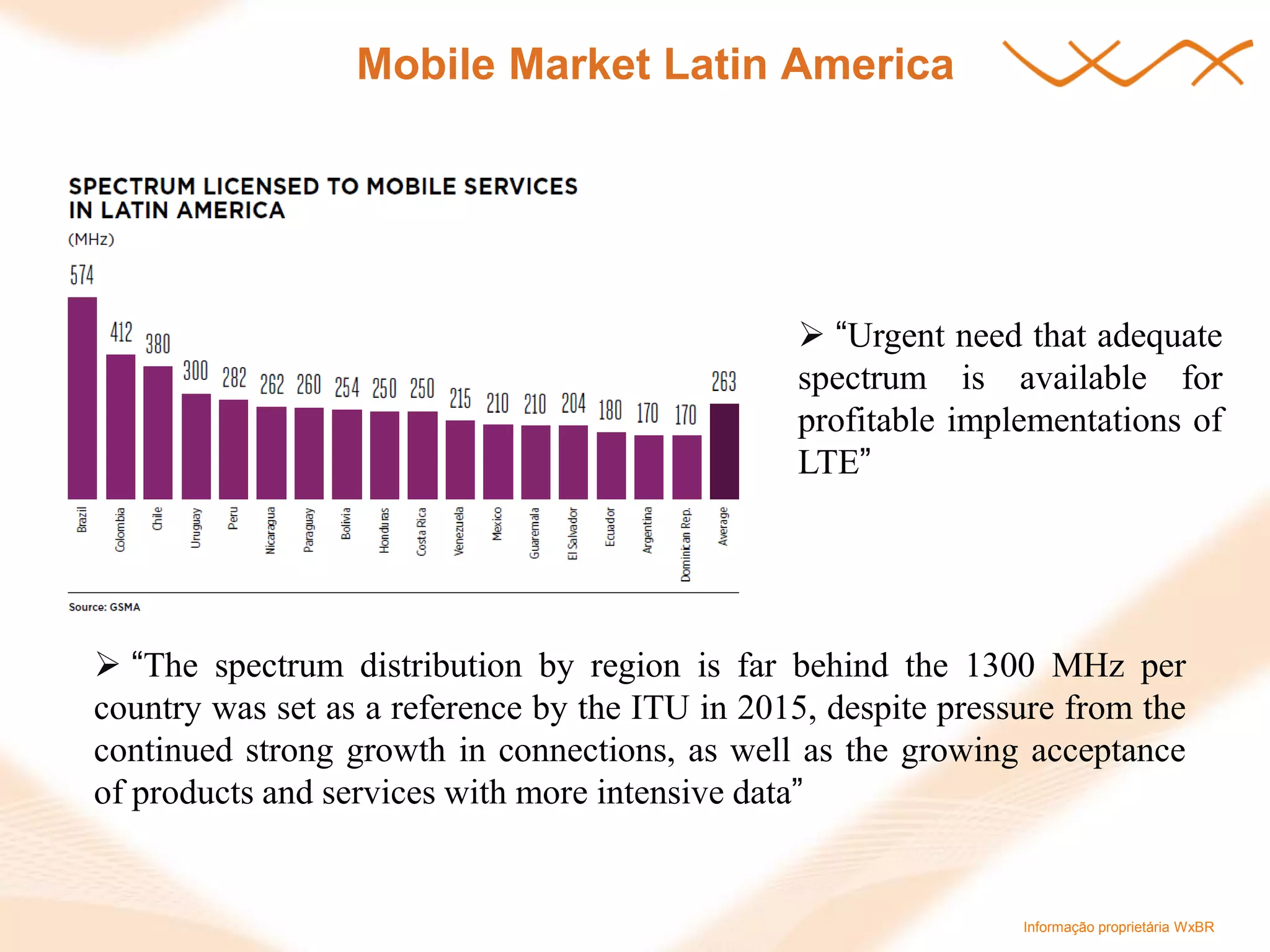

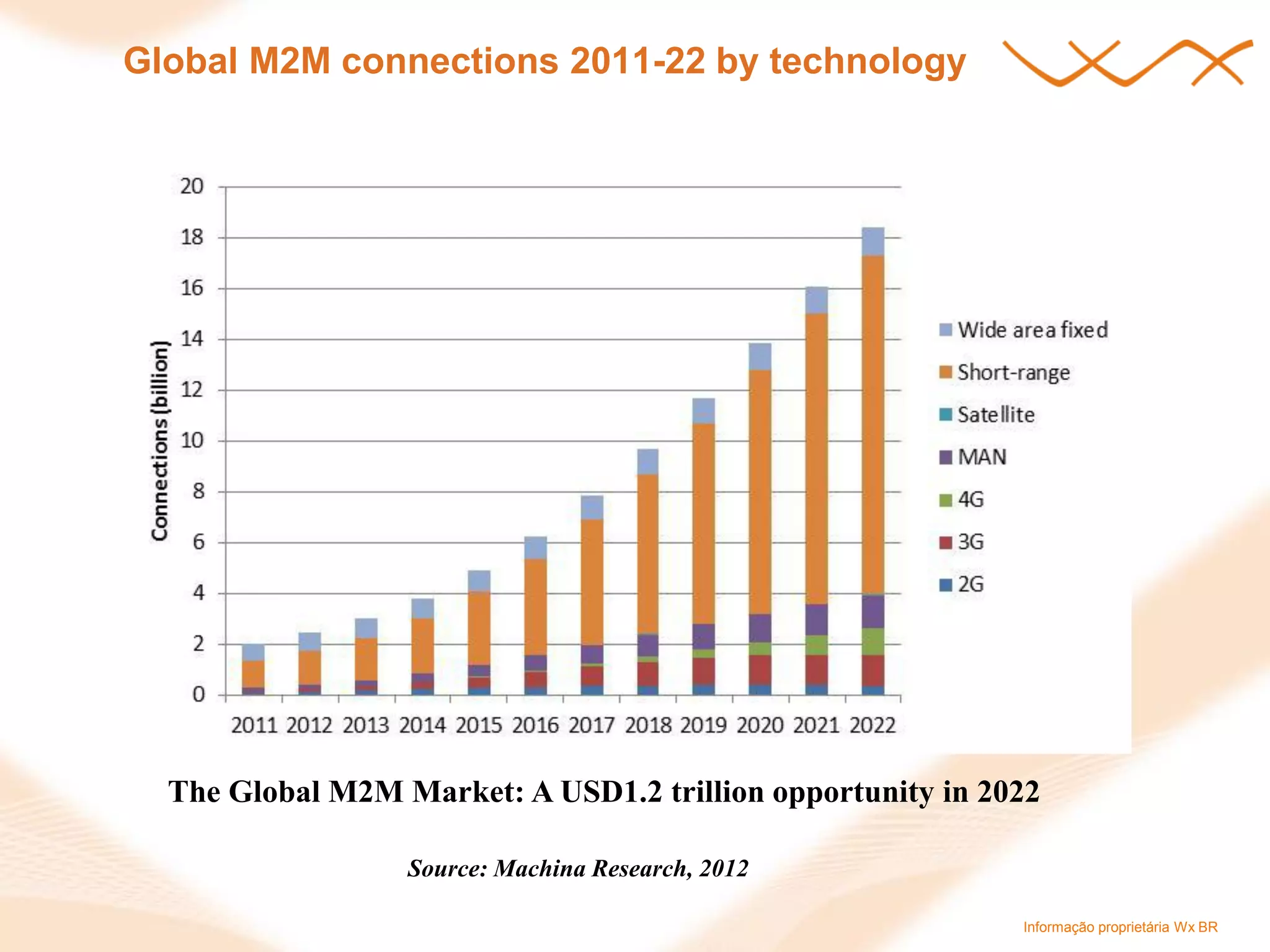

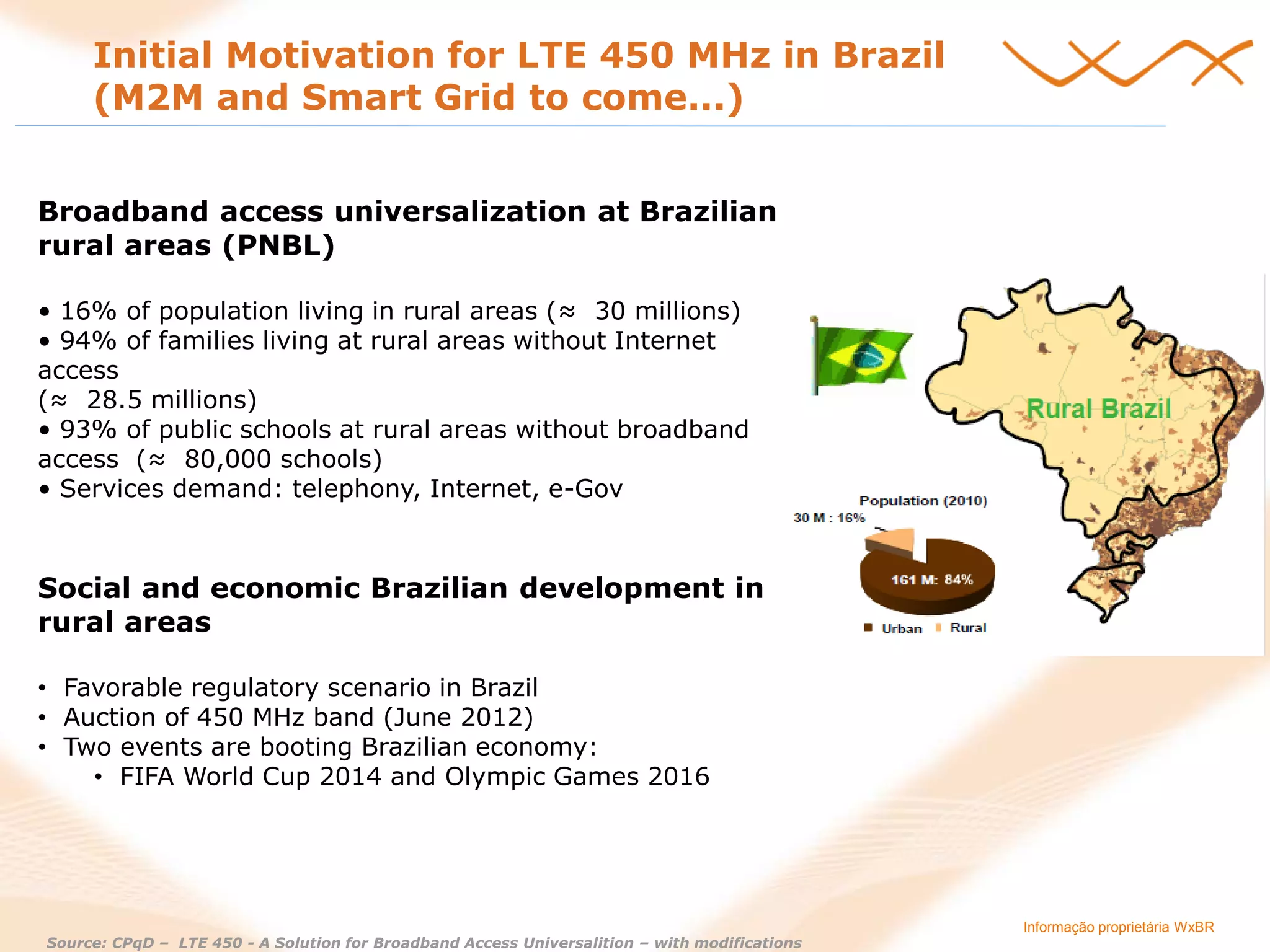

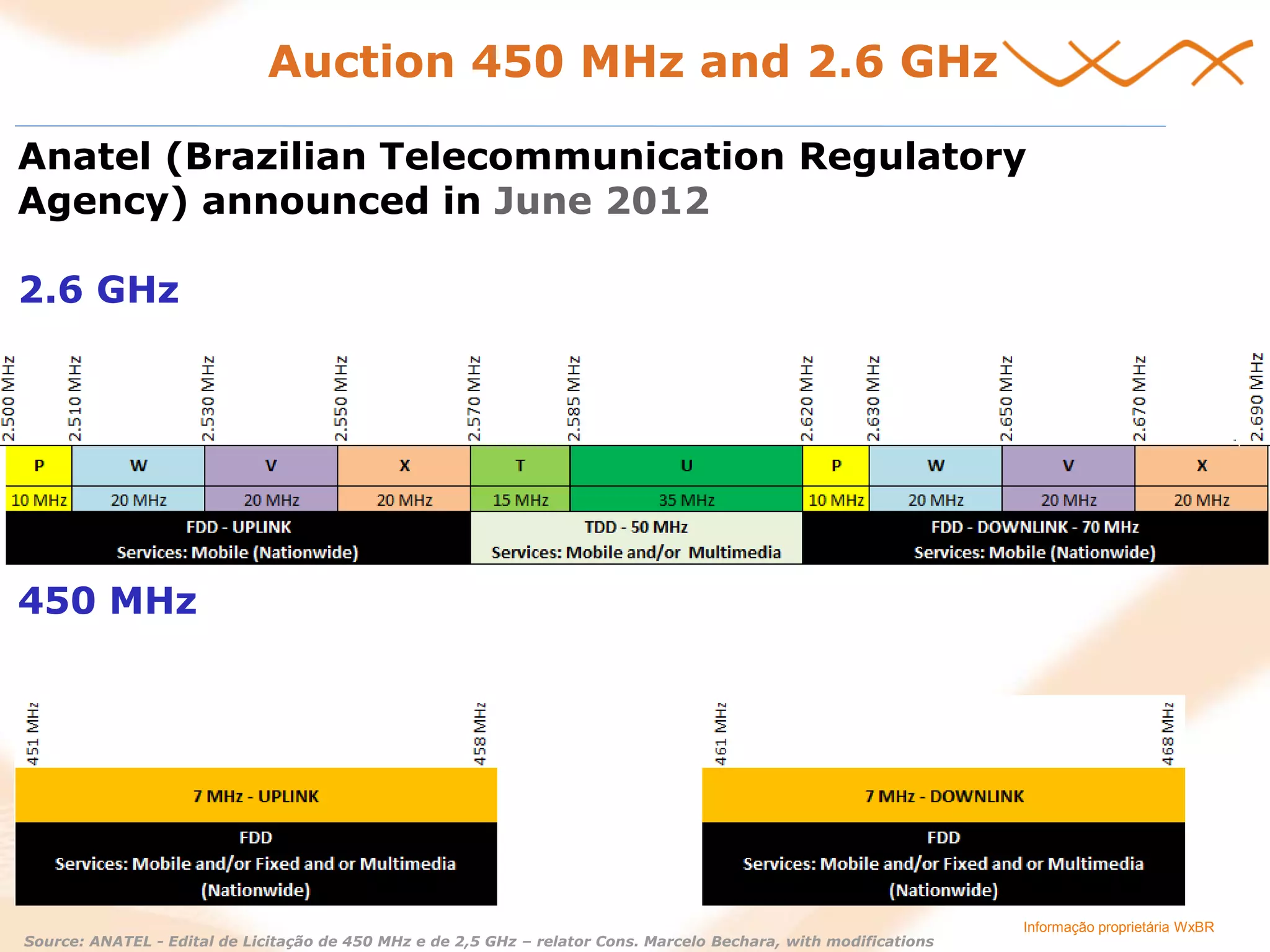

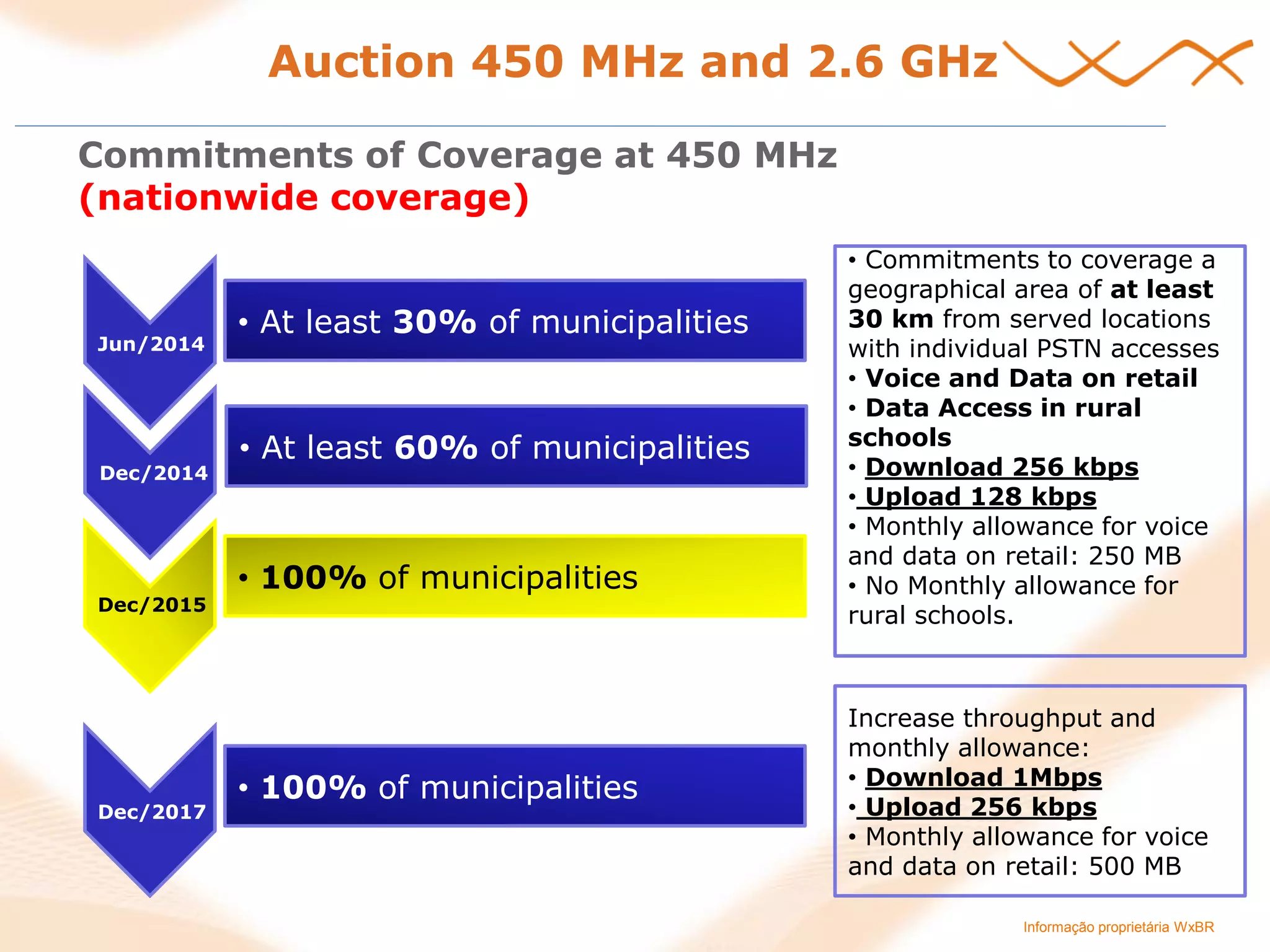

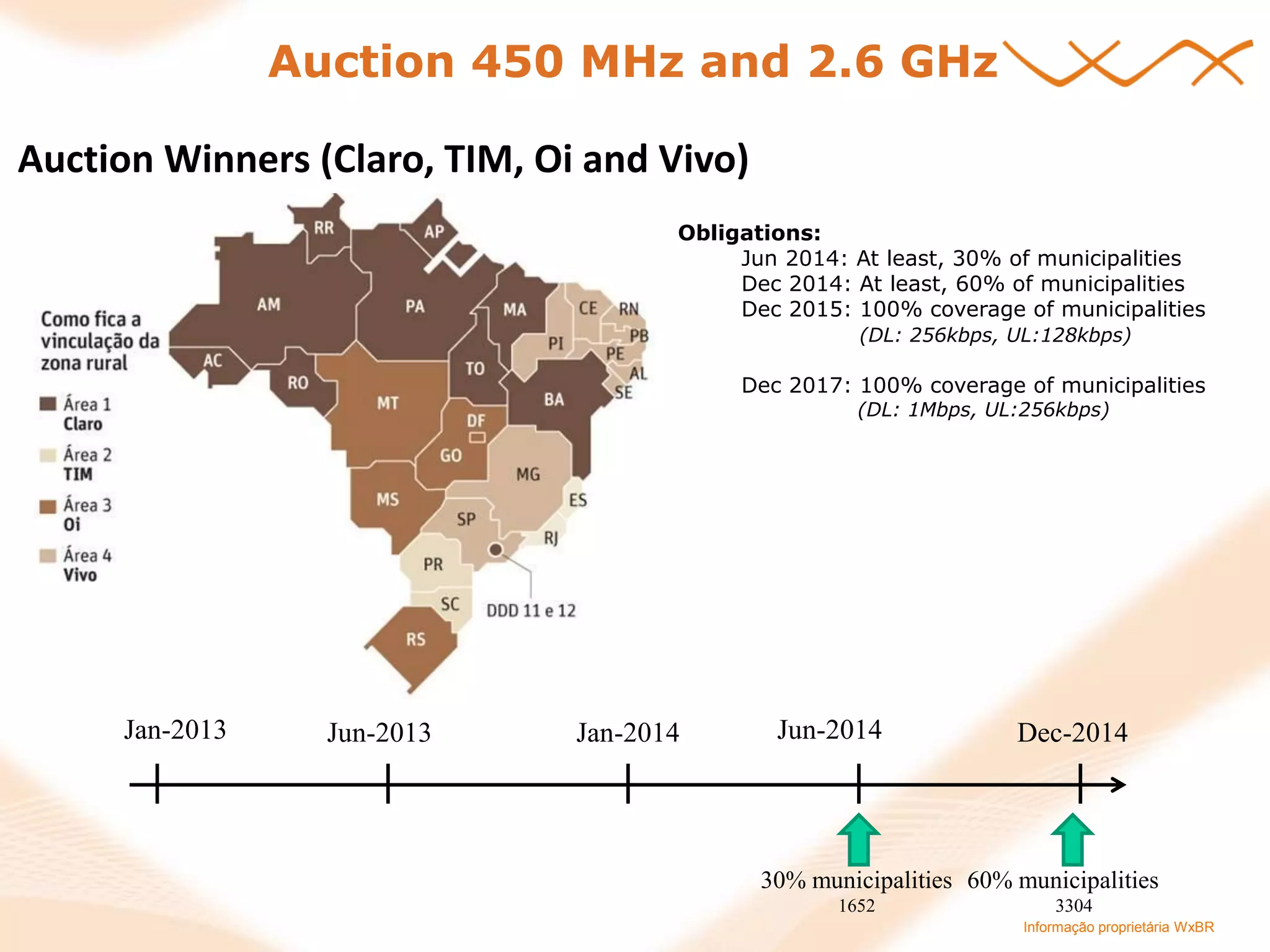

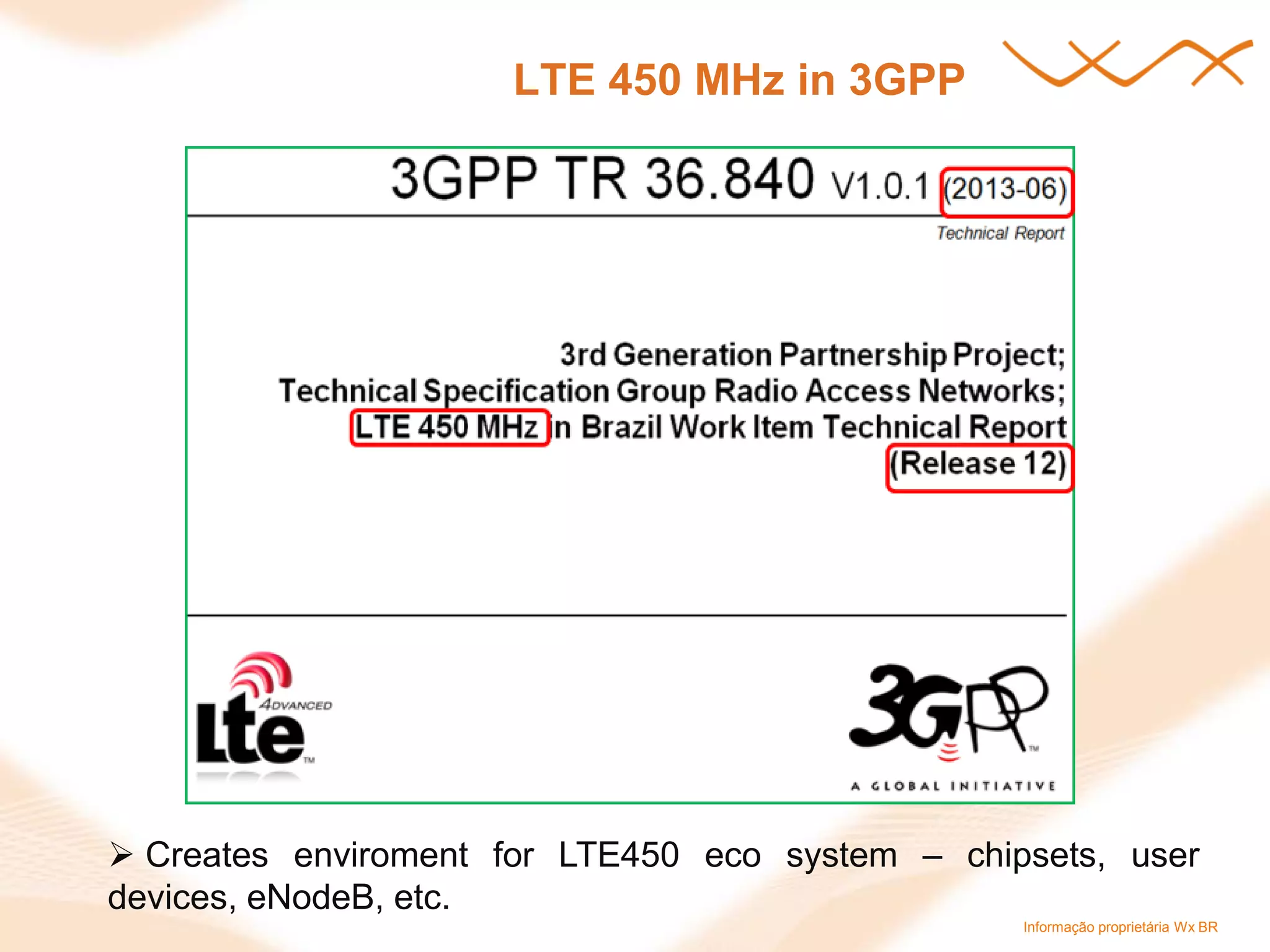

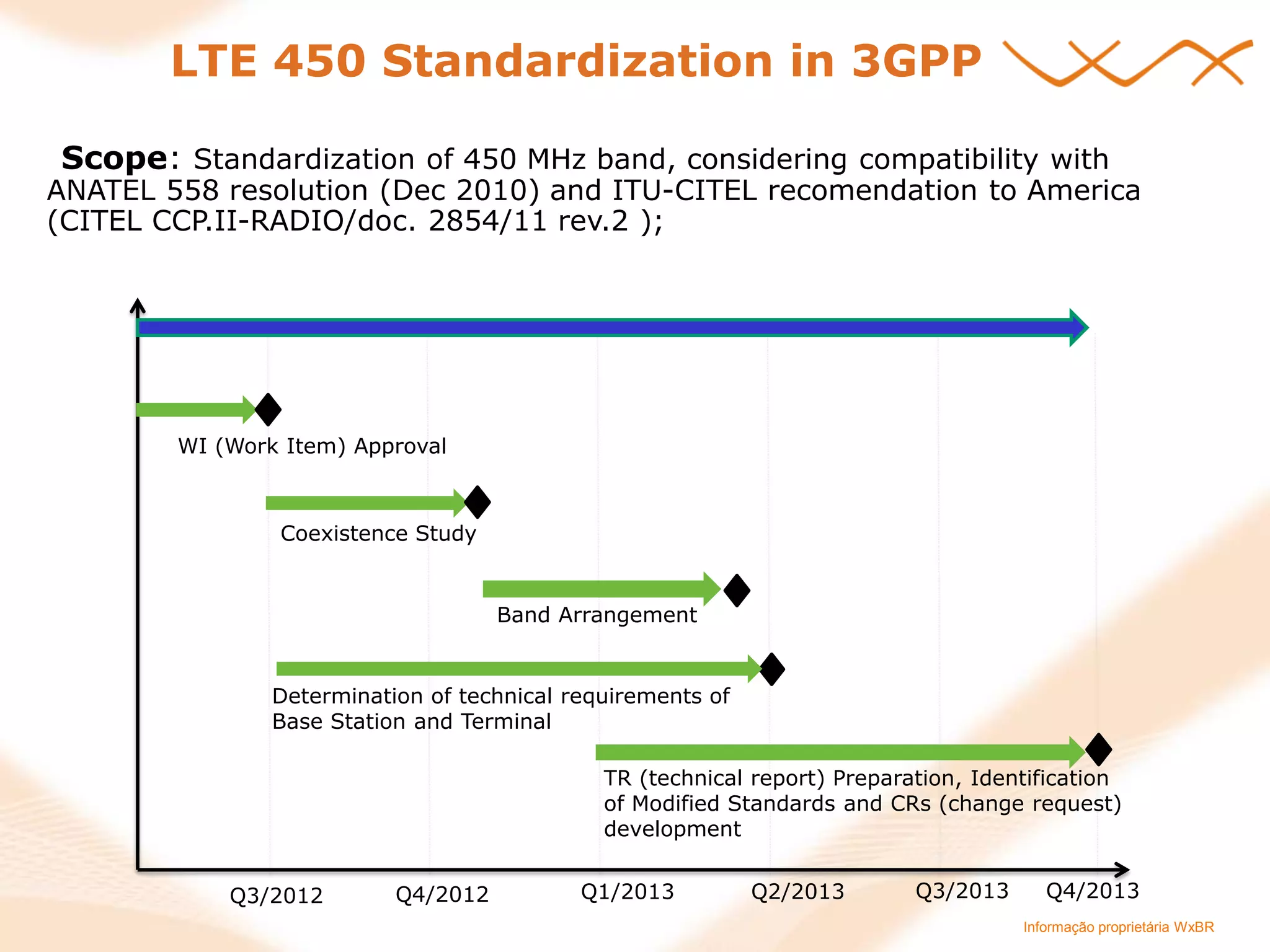

WXBR, founded in 2008 and specialized in broadband wireless access technologies, operates in high-technology markets with a strong emphasis on R&D and innovative solutions. The Latin American mobile market is evolving, showing growth potential driven by broadband, M2M connections, and investments in network capacity, despite existing challenges in spectrum availability. Additionally, the document highlights the urgency for infrastructure improvements in rural areas to meet the growing demand for connectivity and new applications.