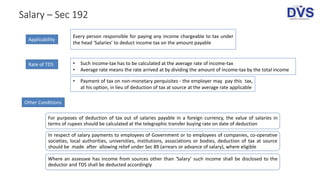

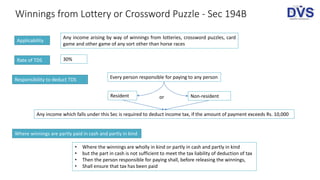

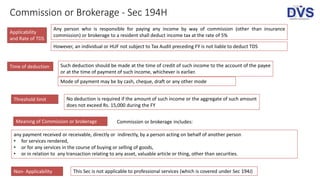

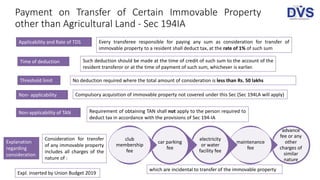

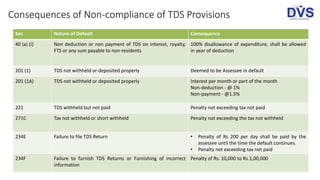

The document provides an extensive overview of Tax Deducted at Source (TDS) and Tax Collected at Source (TCS) guidelines under various sections of the Income Tax Act. It details the types of income subject to TDS, the applicable rates, and the responsibilities of deductors in terms of deductions, thresholds, and conditions for various payments like salary, interest, and winnings. Additionally, it covers specific provisions for payments to non-residents, contractors, and other income categories, aiming to minimize tax evasion and streamline tax collection.