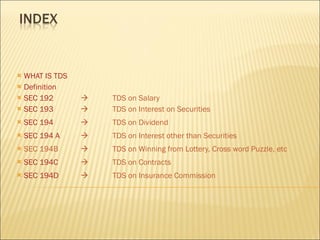

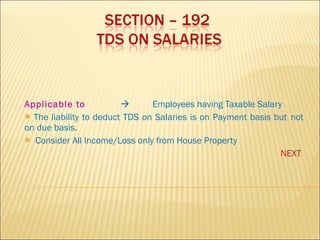

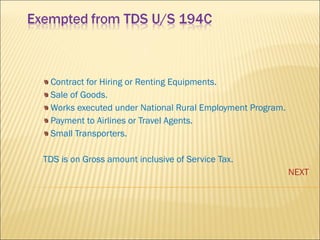

This document defines various sections under the Indian Income Tax Act that specify tax to be deducted at source (TDS) for different types of payments. It outlines TDS rates and thresholds for salary (Section 192), interest (Section 193, 194), dividends (Section 194), lottery winnings (Section 194B), contracts (Section 194C), rent (Section 194I), professional fees (Section 194J), and payments to non-residents (Section 195). It also discusses due dates for remitting TDS, interest charged on late payments, and penalties for non-compliance.