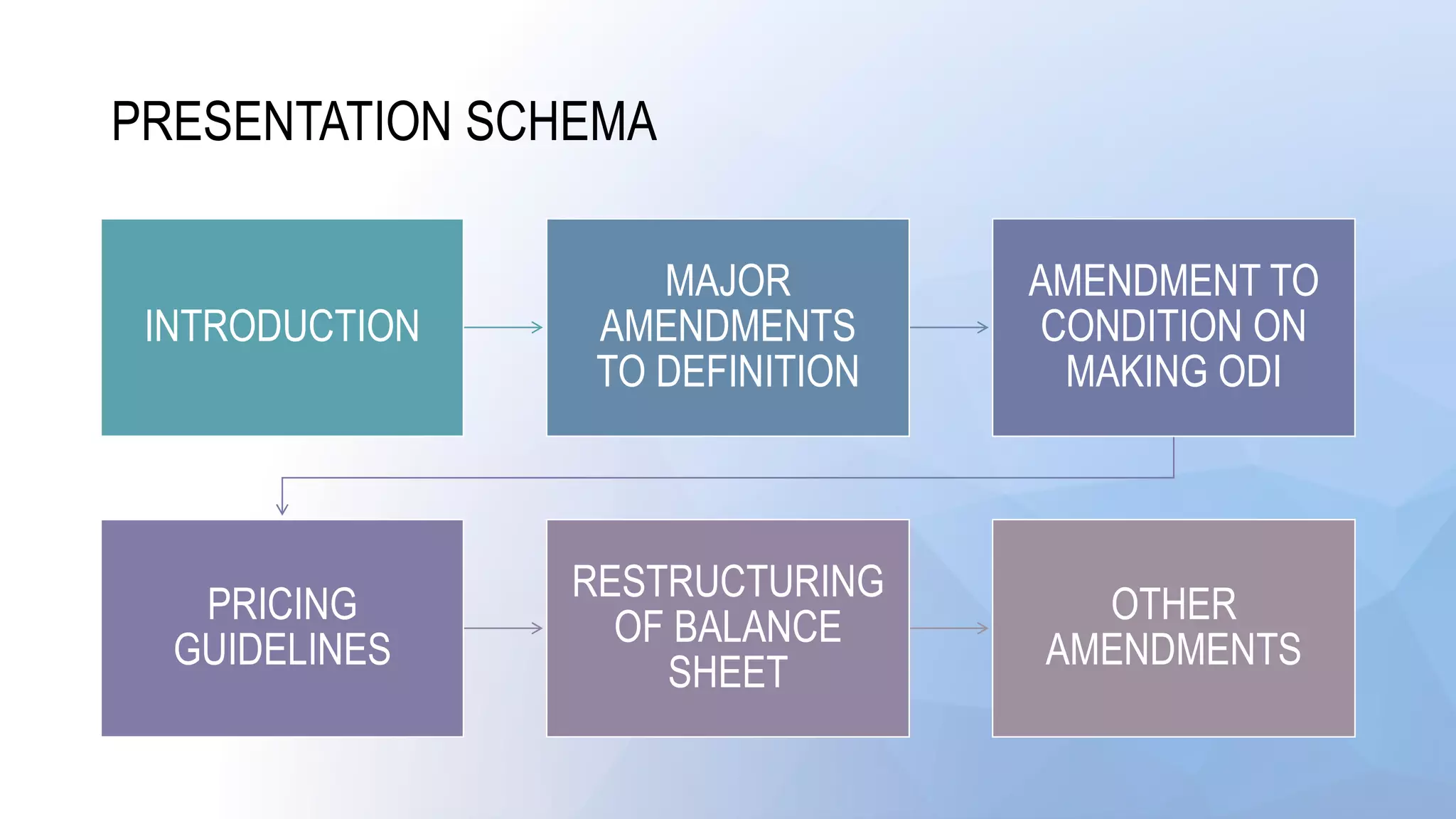

The document outlines the major amendments to the Foreign Exchange Management Act, specifically regarding overseas direct investment (ODI) and overseas portfolio investment (OPI) regulations. Key changes include updated definitions for ODI and OPI, adjustments to disinvestment conditions, and new pricing guidelines to enhance clarity and ease of doing business. The proposed regulations also impose requirements for obtaining a No Objection Certificate in certain circumstances and allow for restructuring of the balance sheets of foreign entities with Indian investments.