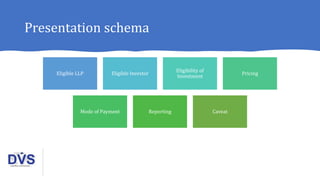

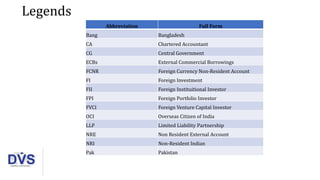

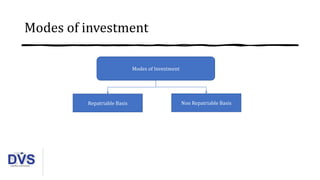

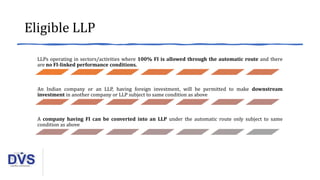

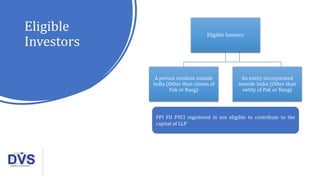

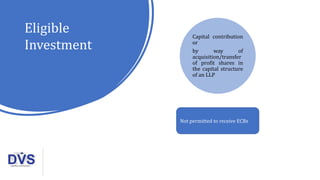

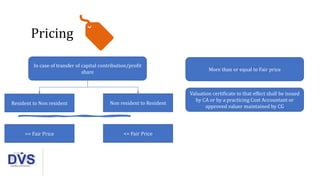

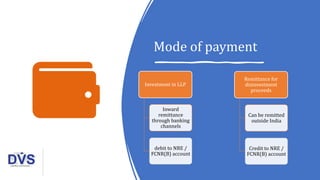

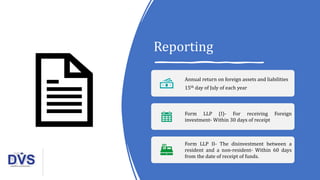

The document outlines the regulations regarding foreign investments in Limited Liability Partnerships (LLPs) in India, highlighting eligibility criteria, modes of investment, and reporting requirements. It specifies that foreign investments are permitted in sectors where 100% foreign investment is allowed and details the modes of payment and disinvestment processes. Additionally, it notes the restrictions on certain foreign institutional investors and the conditions for investments on a non-repatriable basis.