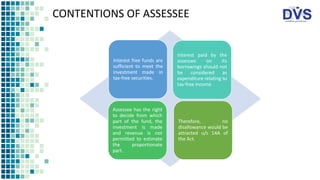

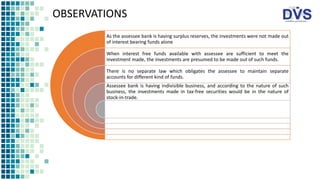

The Supreme Court ruled in the case of South Indian Bank Ltd. v. Commissioner of Income-Tax that Section 14A does not permit disallowance of expenses related to earning tax-free income when separate accounts for such investments are not maintained. The Court determined that when sufficient interest-free funds are available, it is presumed that investments in tax-free securities are made from these funds, negating the need for disallowance. Consequently, the appeals were decided in favor of the assessee, reinforcing the idea that tax planning should not be based on presumption.

![DISALLOWANCE U/S 14A

SOUTH INDIAN BANK LTD.

V.

COMMISSIONER OF INCOME-TAX

[2021] 130 TAXMANN.COM 178 (SC)

.](https://image.slidesharecdn.com/southindianbankltdvscit-211023110748/85/DISALLOWANCE-U-S-14A-1-320.jpg)