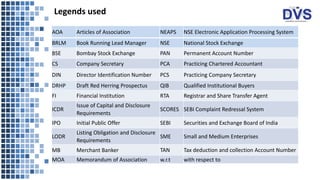

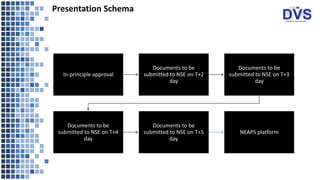

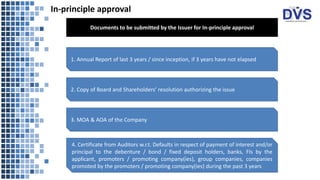

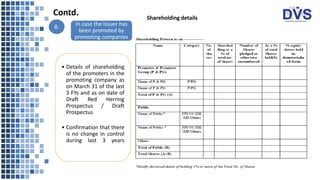

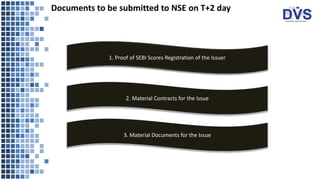

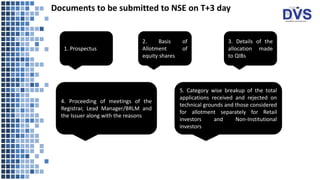

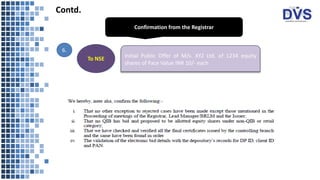

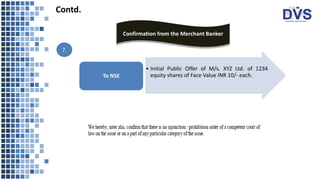

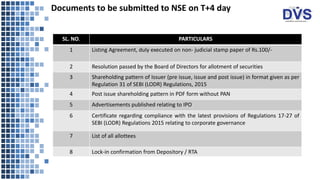

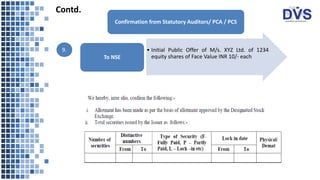

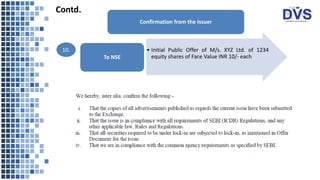

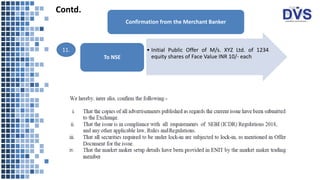

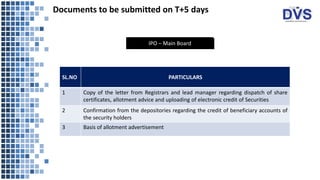

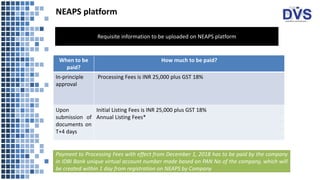

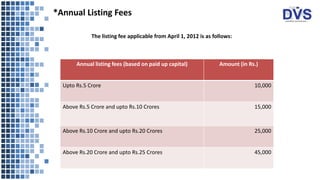

This document outlines the process and documentation required for an SME to obtain an in-principle approval for an initial public offering (IPO) listing on the National Stock Exchange of India (NSE). It details the documents required to be submitted on T+2, T+3, T+4, and T+5 days from the date of in-principle approval to finalize the listing. These include annual reports, board resolutions, shareholding details, basis of allotment, post-issue shareholding pattern, and confirmation from issuers, merchant bankers, and statutory auditors. It also provides information on NEAPS platform registration and payment of processing and annual listing fees.