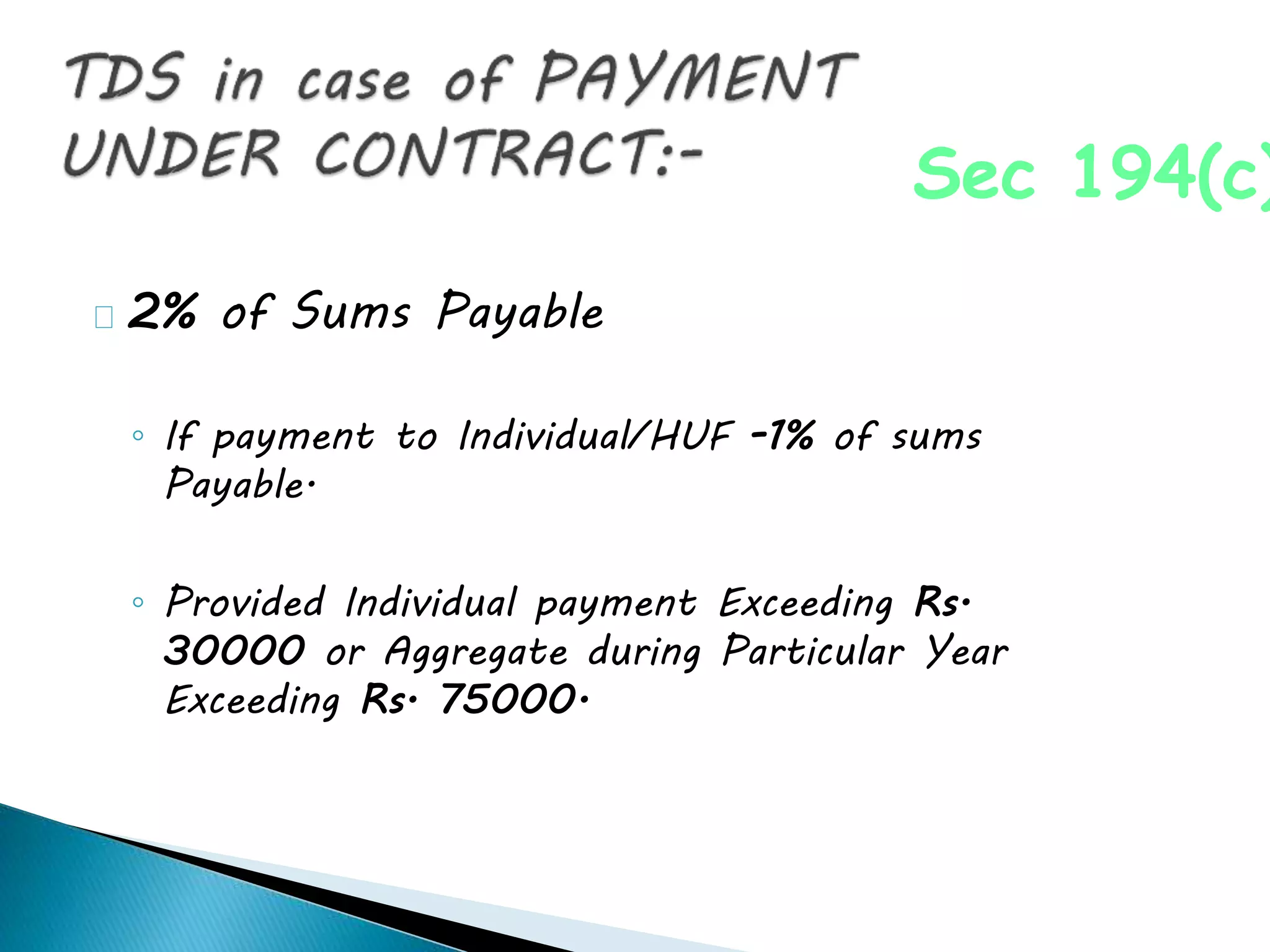

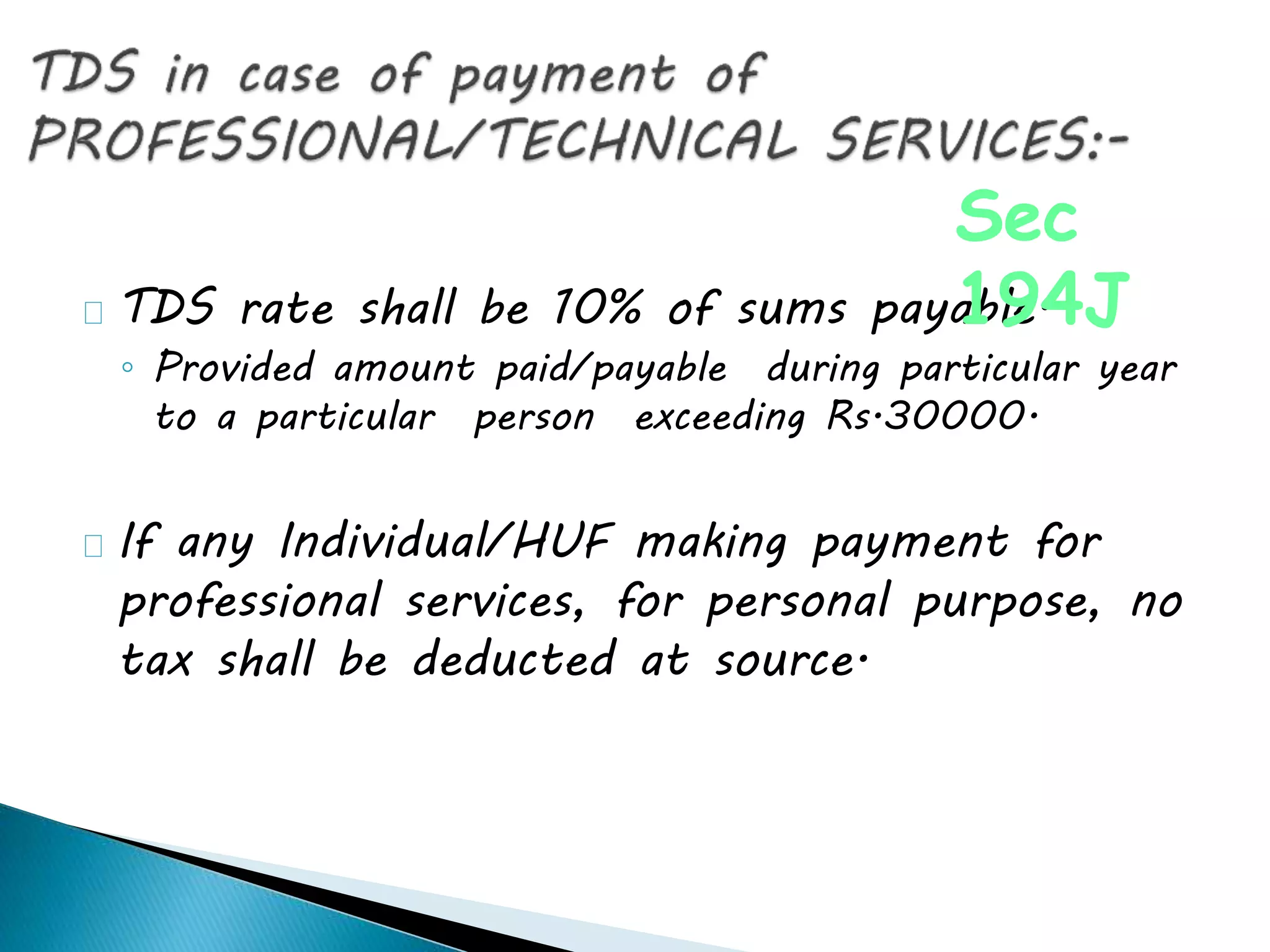

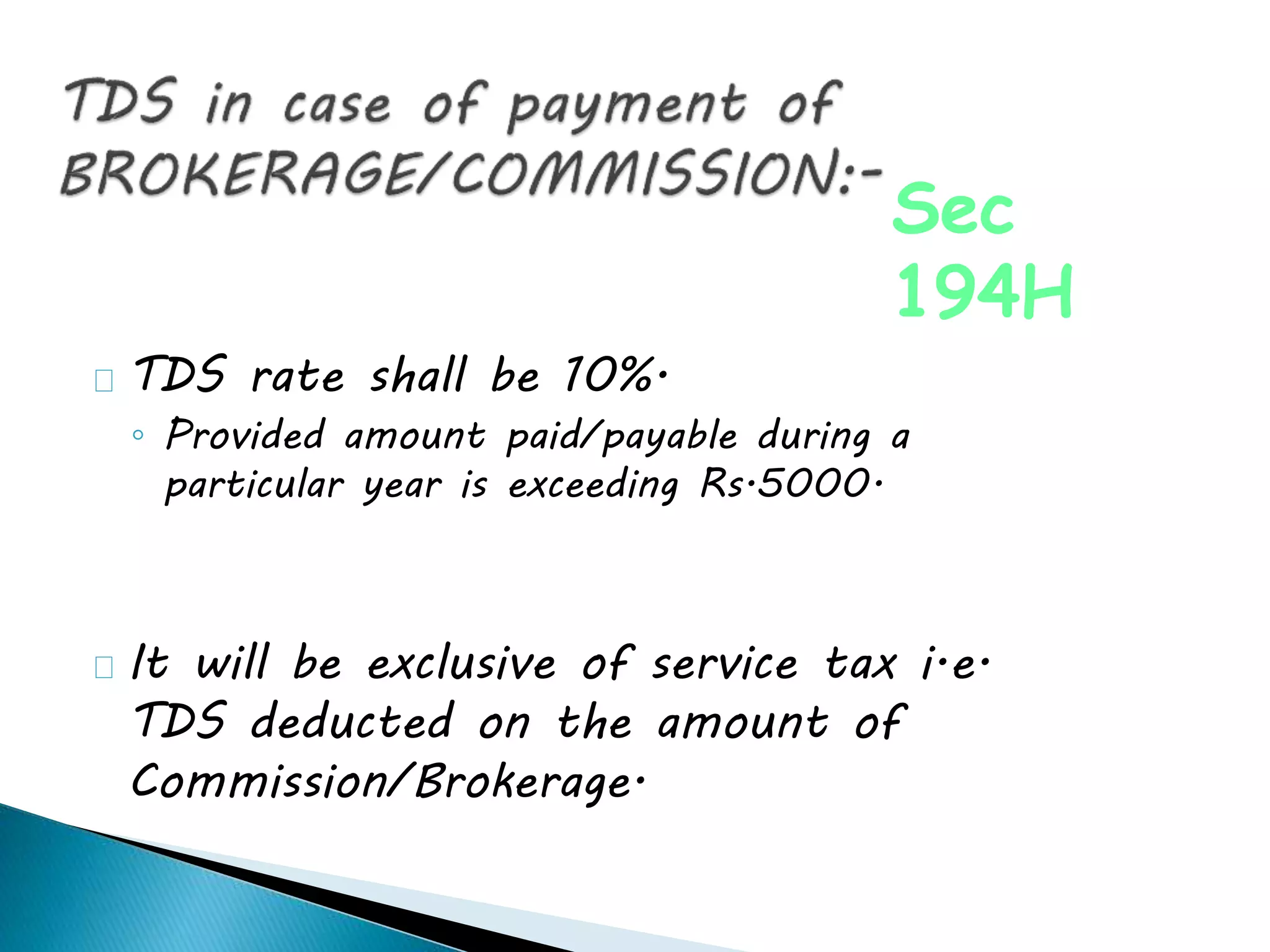

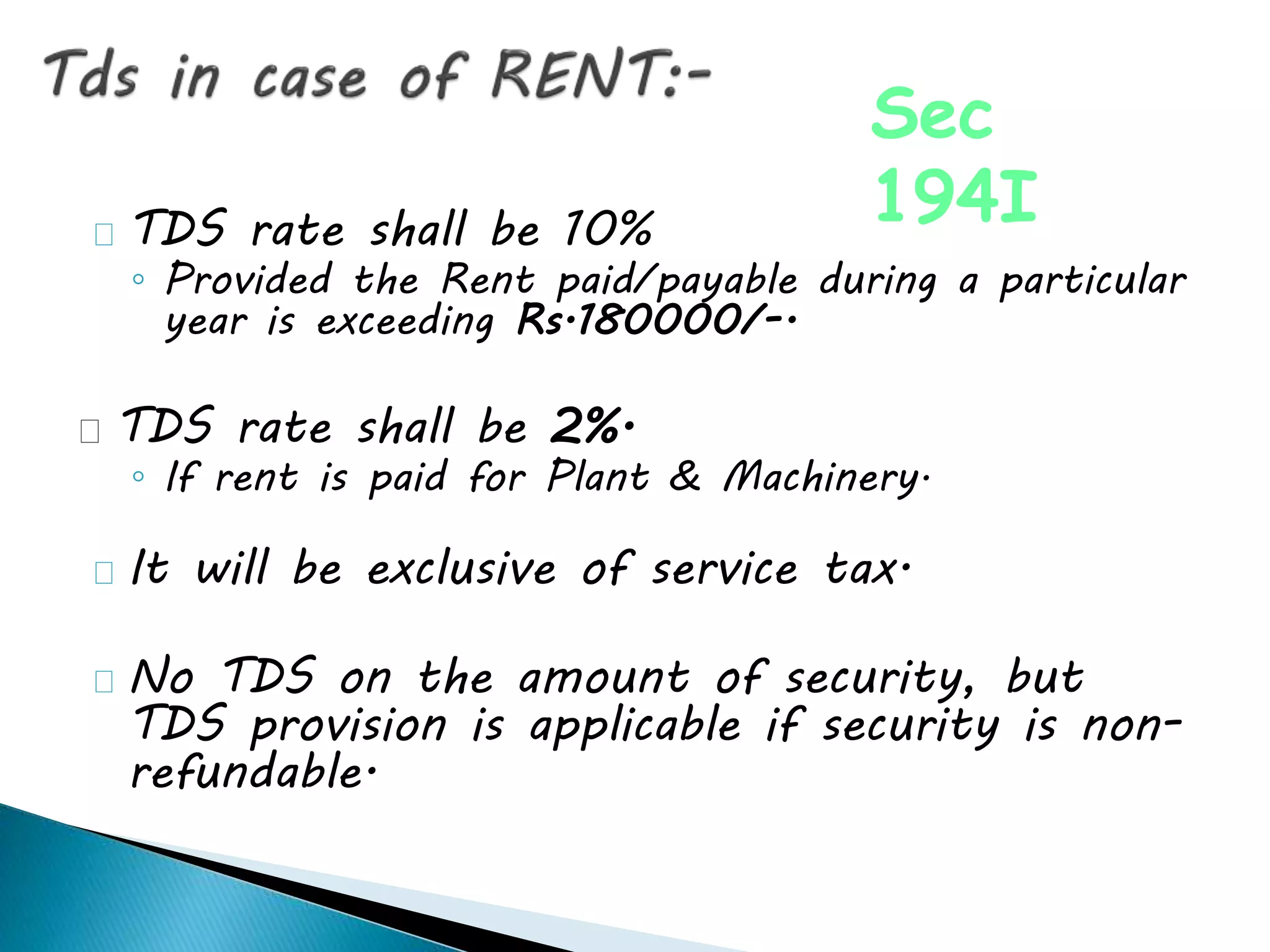

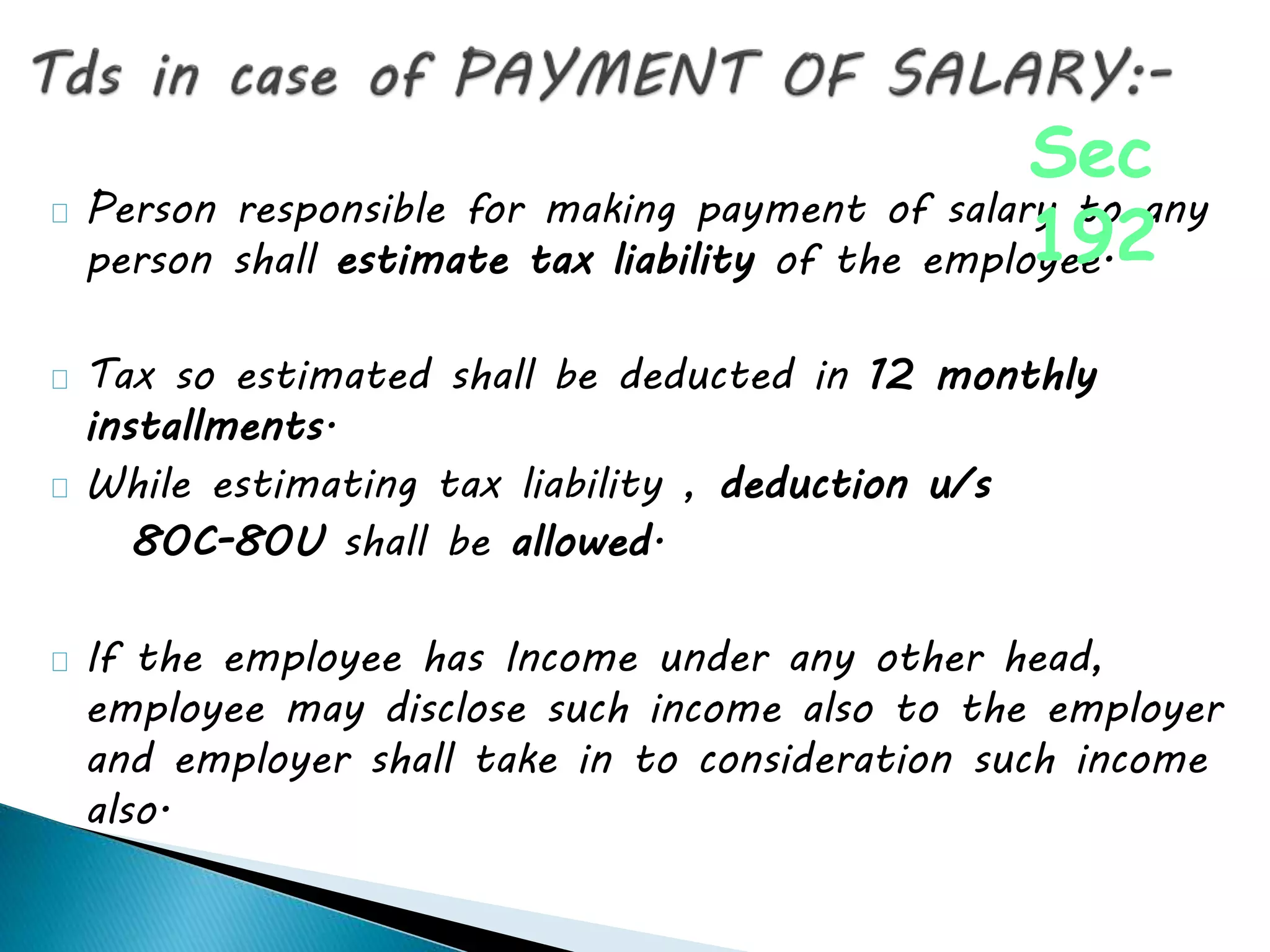

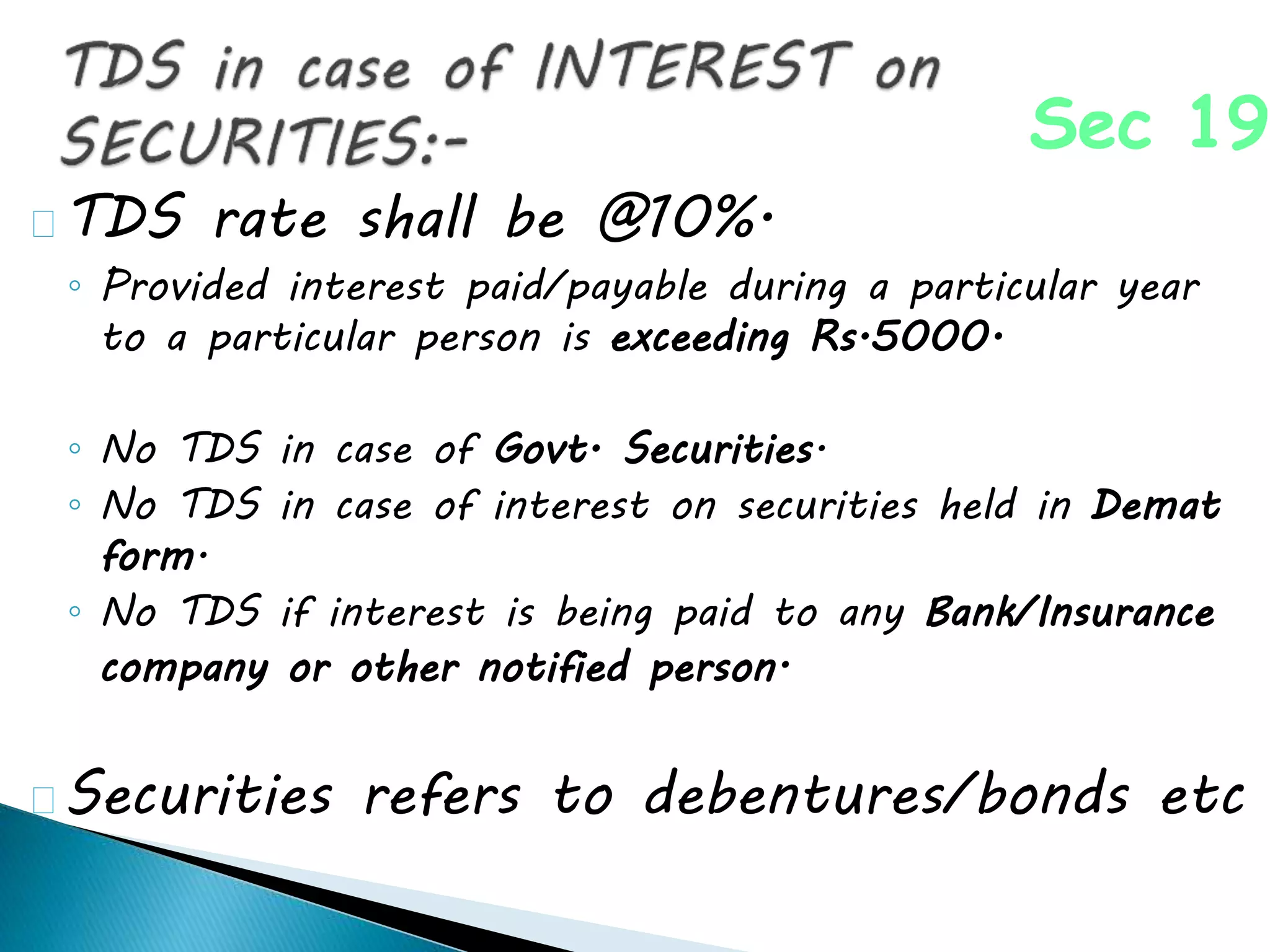

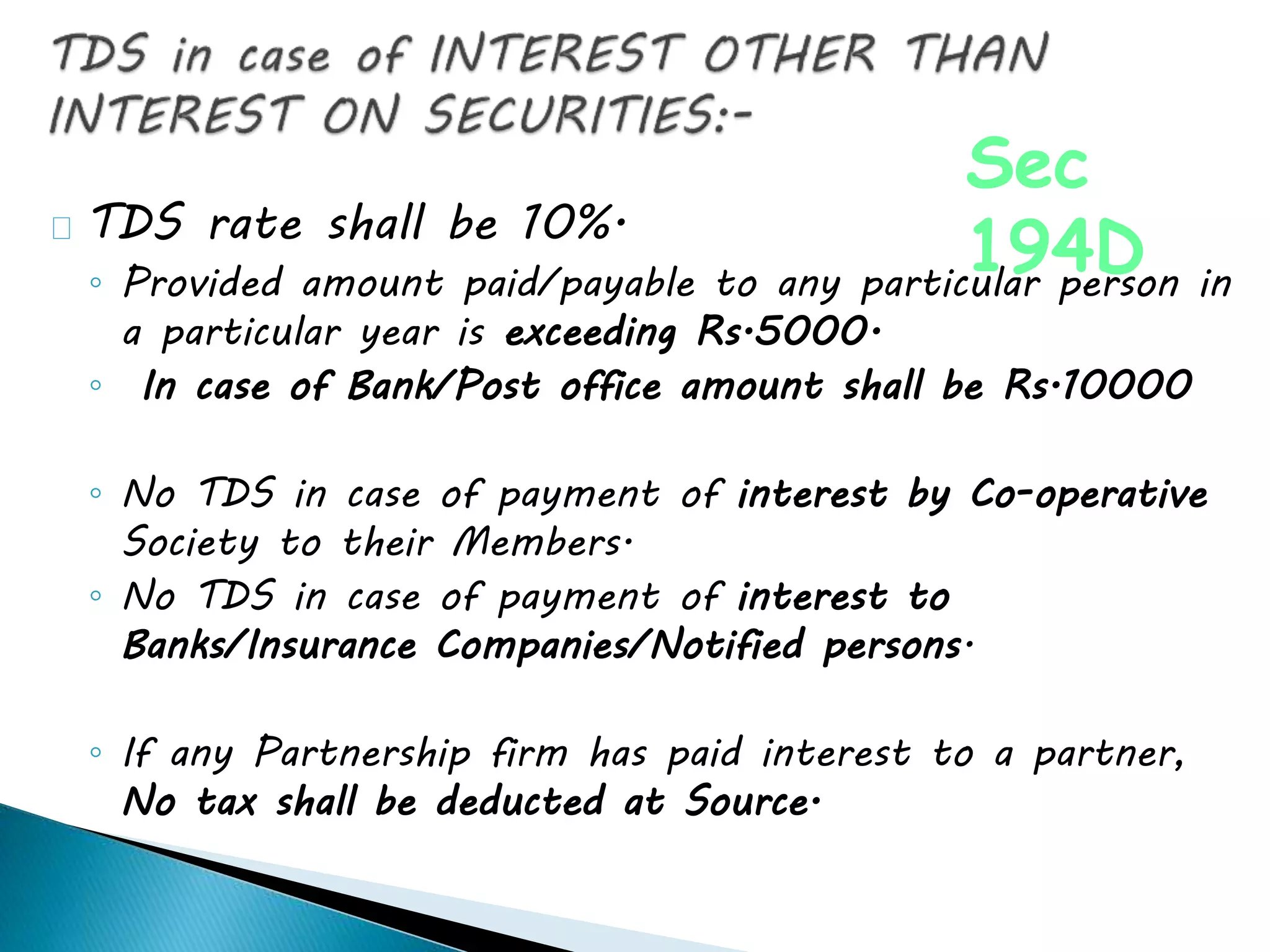

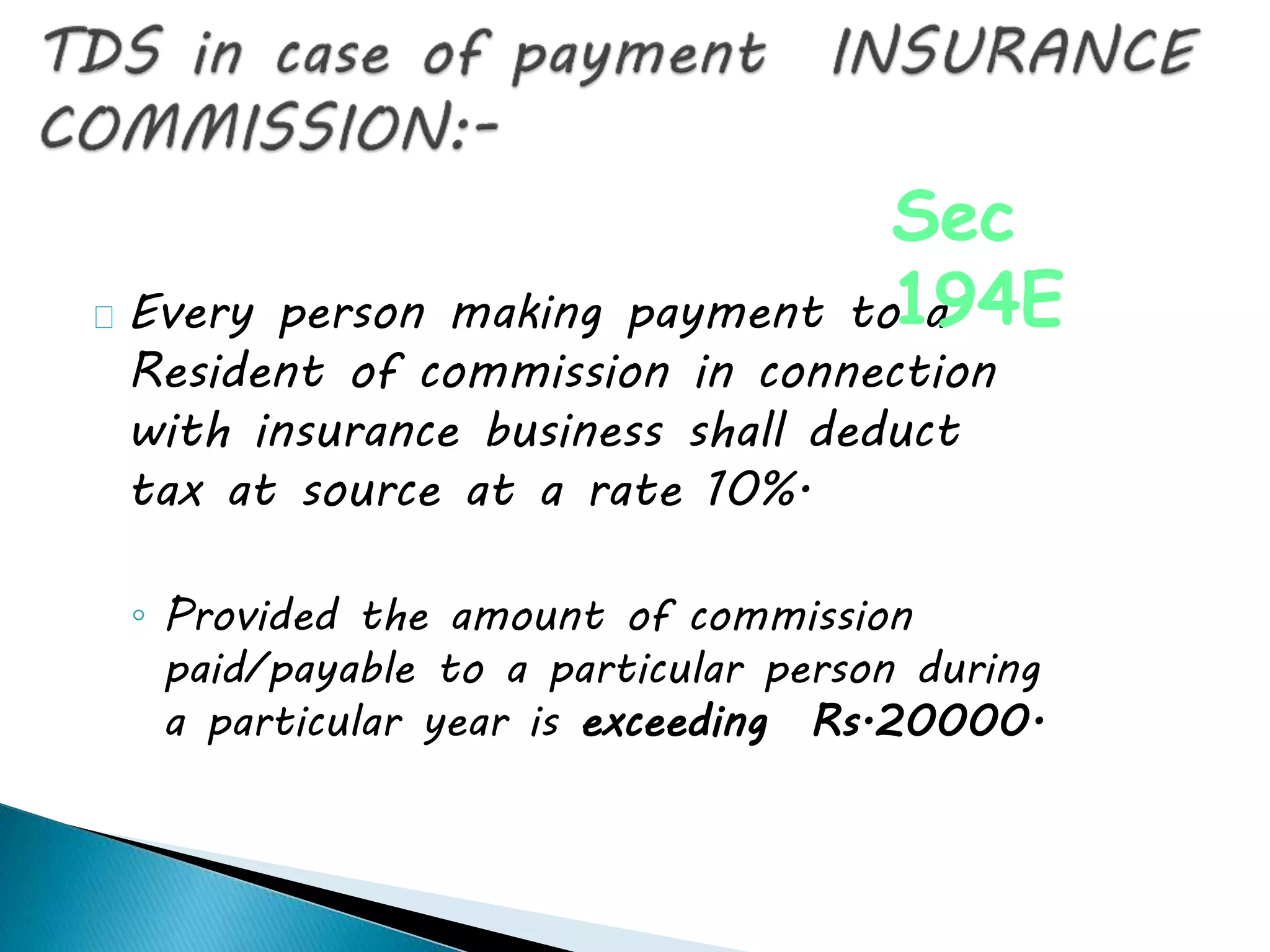

This document summarizes tax deduction at source requirements in India. It states that any person responsible for making income payments covered by the tax scheme must deduct tax at prescribed rates and deposit the amounts by the 7th of the following month. It also outlines requirements for obtaining a TAN number, issuing TDS certificates, submitting quarterly statements, and penalties for non-compliance. Various sections are cited that specify TDS rates for different types of payments like salary, rent, interest, dividends, and commission.