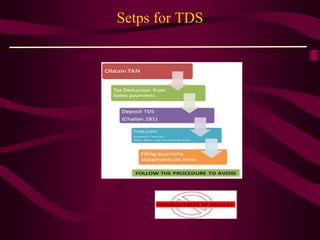

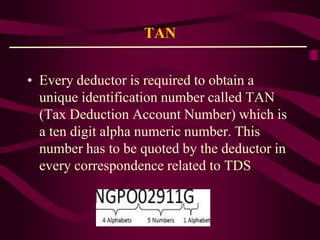

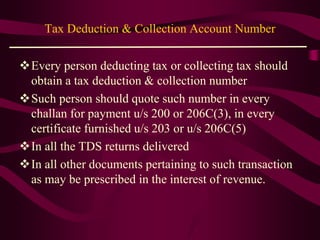

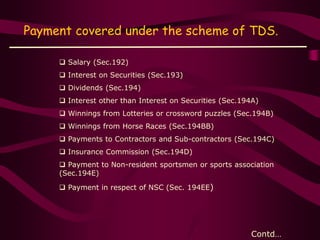

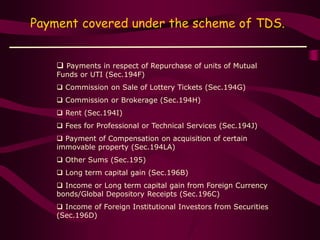

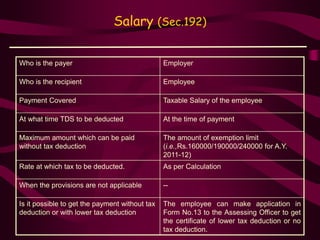

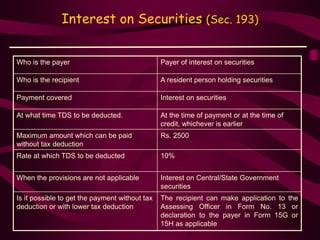

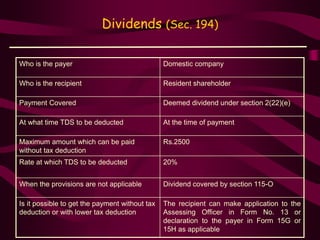

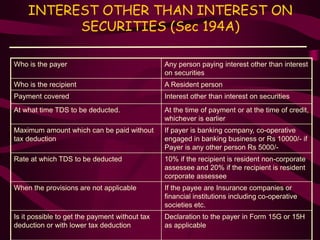

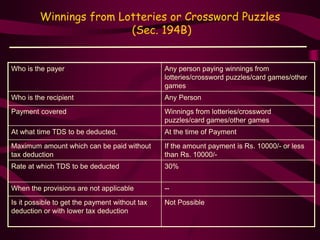

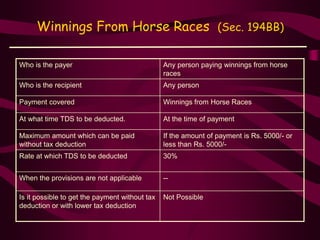

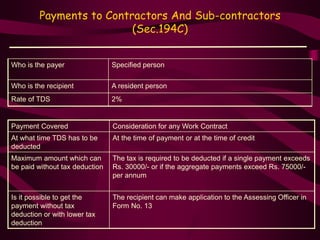

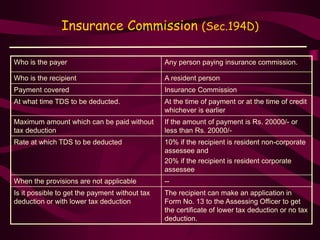

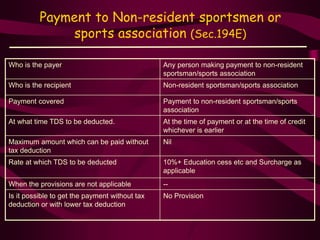

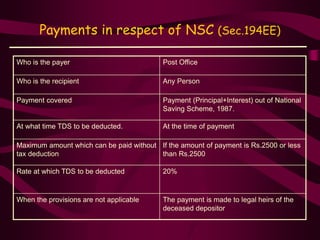

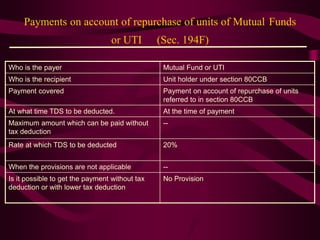

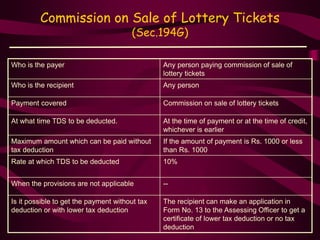

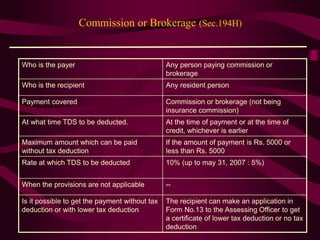

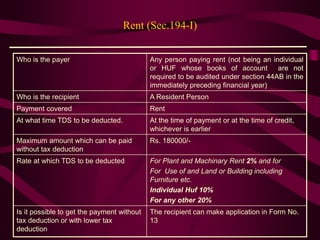

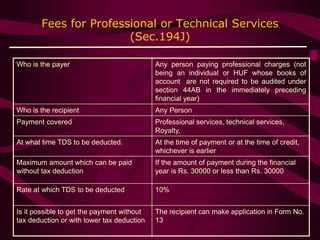

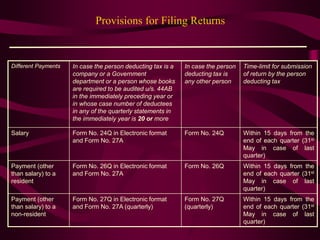

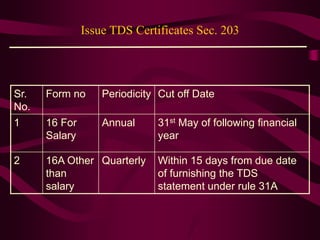

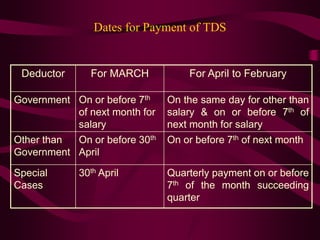

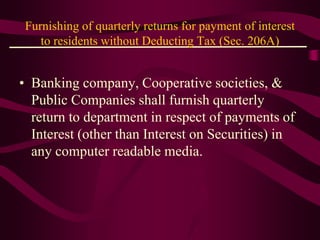

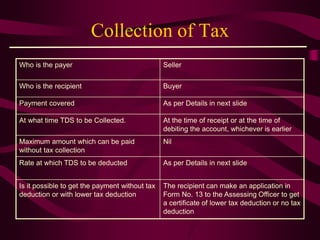

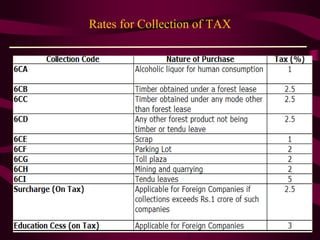

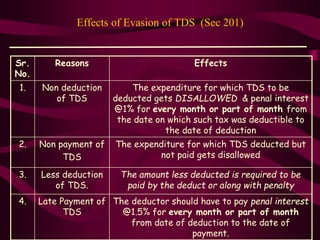

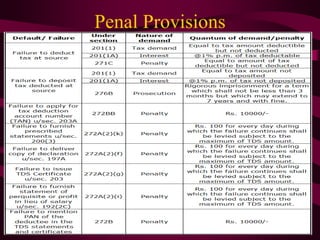

The document discusses the provisions for tax deducted at source (TDS) in India. It provides details on the types of payments that are covered under TDS, including salary, interest, dividends, rent, professional fees, etc. It explains the rate of tax deduction for different payments and the requirements for deductors to obtain a Tax Deduction Account Number (TAN) and file quarterly returns. The purpose of TDS is to collect tax on income at the time it accrues to avoid tax evasion.