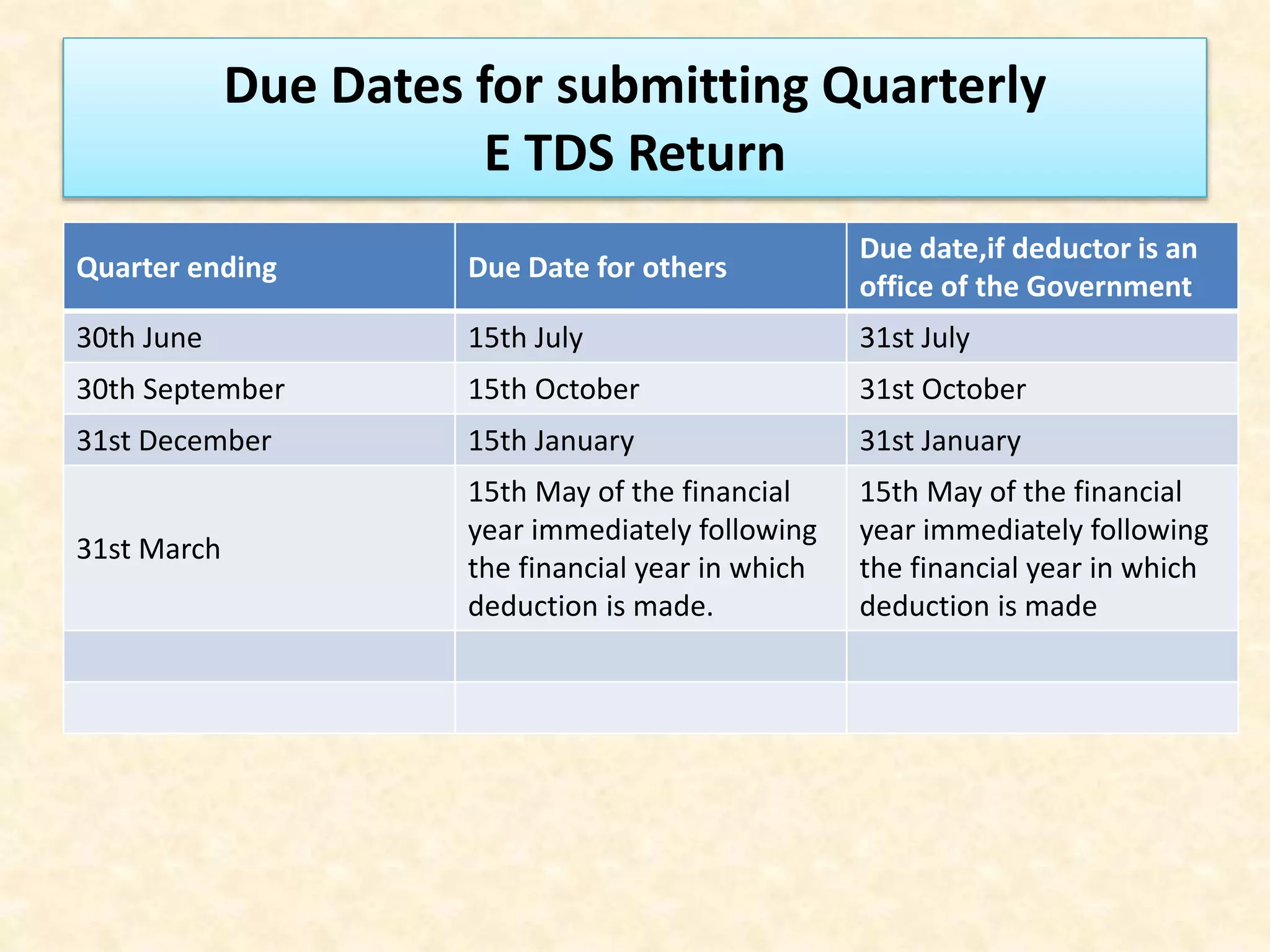

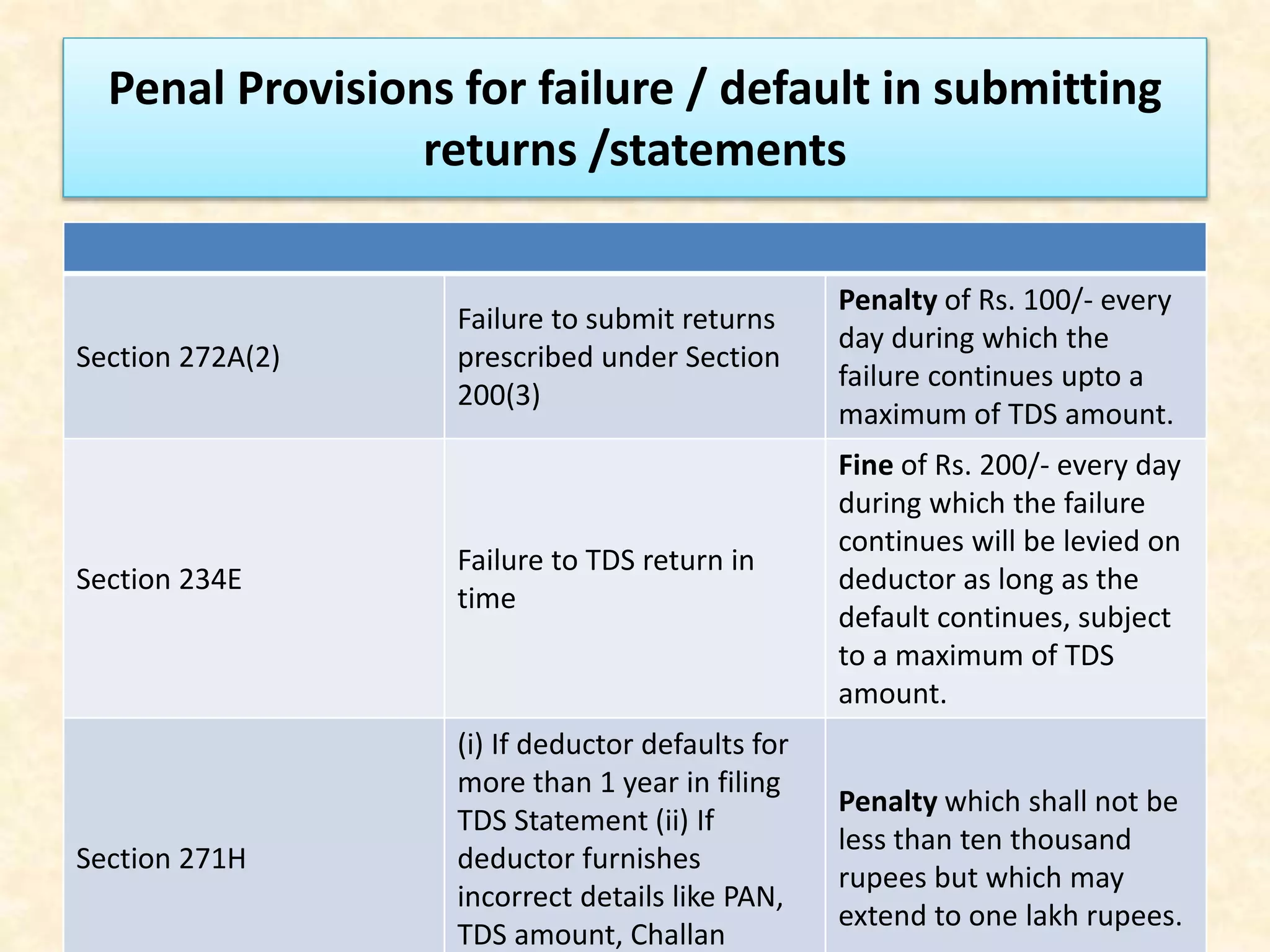

This document outlines the tax deduction at source (TDS) compliance process in India. It applies to all corporate and government deductors who are required to get their accounts audited. The key steps are: 1) apply for and obtain a TAN number; 2) deduct tax from applicable payments like salaries, interest, rent, etc. at the time of payment or credit; 3) deposit the deducted tax with the government treasury by the due dates; 4) file quarterly electronic TDS returns; and 5) issue TDS certificates to deductees. Failure to comply can result in penalties like interest charges, fines, and in severe cases, imprisonment.